Mastering Required Minimum Distributions (RMDs): Strategies for Tax-Efficient Retirement Planning

As a Dallas-based Certified Financial Planner™, one of the most frequent questions I get is:

“What’s the best way to handle RMDs without wrecking my taxes?”

RMDs—Required Minimum Distributions—are mandatory withdrawals the IRS makes you take from retirement accounts starting in your 70s. And if you’re not planning ahead, they can lead to:

- Tax bracket spikes

- Medicare premium increases

- Surprise taxes on Social Security

- Lost opportunities for smart legacy planning

But here’s the truth:

With the right strategy, RMDs don’t have to be a burden—they can be an opportunity.

Let’s break down everything you need to know to make them work for you.

What Are Required Minimum Distributions?

RMDs are IRS-mandated withdrawals from tax-deferred retirement accounts like:

- Traditional IRAs

- SEP and SIMPLE IRAs

- 401(k), 403(b), and 457(b) accounts

Why? Because the government wants to ensure it collects taxes on money you deferred.

When Do RMDs Begin?

- If you turn 73 in 2024, your first RMD must be taken by April 1, 2025

- After that, RMDs must be taken annually by December 31

⚠️ Caution: If you delay your first RMD until April, you’ll take two distributions in one year—possibly pushing you into a higher tax bracket or triggering IRMAA surcharges for Medicare.

➡️ By 2033, the RMD age increases to 75 for those born in 1960 or later.

How Are RMDs Calculated?

RMDs = Your prior year’s account balance ÷ IRS life expectancy factor

You use the Uniform Lifetime Table unless you qualify for a special rule (see below).

Example:

If your Traditional IRA balance was $500,000 and your factor is 26.5, your RMD is about $18,867.92.

Special Rule: Spouse More Than 10 Years Younger?

If:

- Your sole primary beneficiary is your spouse, and

- Your spouse is 10+ years younger,

You get to use the Joint Life Expectancy Table—which reduces your required withdrawal.

This lowers your tax bill and helps your money last longer.

What If You Don’t Need the RMD?

This is a common frustration. You’ve saved well, don’t need the income, and now the IRS RMD is forcing withdrawals. But just because you have to take the money doesn’t mean you have to spend it.

Here’s how to put your RMD to work intentionally:

Reinvest It in a Taxable Account

Let the money continue growing in a diversified investment portfolio—just outside of your IRA.

Fund Education or Legacy Goals

Use your RMDs to:

- Contribute to a 529 plan for grandchildren

- Gift money to family (under the annual gift tax exclusion)

- Open custodial investment accounts to build family wealth

Fund Life Insurance or Long-Term Care

Your RMD could:

- Pay premiums on permanent life insurance to enhance your estate

- Fund a hybrid LTC policy for future care protection

- Reduce IRA size to lower future taxes for heirs

RMDs don’t have to be waste—they can be wealth in disguise.

Tax Impacts of RMDs

RMDs are:

- Taxed as ordinary income

- Can push you into a higher bracket

- May increase the taxable portion of your Social Security

- Can trigger Medicare IRMAA surcharges

That’s why timing and strategy matter just as much as the withdrawal itself.

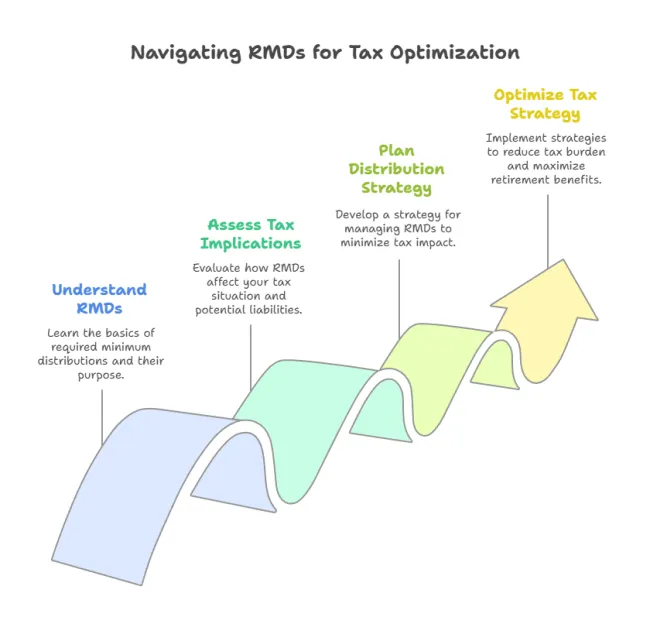

RMD Strategies That Save You Money

1. Roth Conversions Before RMD Age

Converting IRA dollars to Roth accounts in lower-income years can dramatically reduce future RMDs.

2. Qualified Charitable Distributions (QCDs)

After age 70½, you can donate up to $100,000/year directly to charity from your IRA—and it counts as your RMD (but is not taxable).

3. Strategic Early Withdrawals

Use “gap years” (post-retirement, pre-RMD) to pull money out at lower tax rates.

4. Rebalance Your Asset Location

Position higher-yield assets in Roth or taxable accounts to reduce growth in RMD-triggered accounts.

5. Aggregate IRAs

If you own multiple Traditional IRAs, you can take one total RMD from any combination. This does not apply to 401(k)s or employer-sponsored accounts.

Inherited IRAs and the 10-Year Rule

If you inherit an IRA:

- Spouses can roll it into their own IRA or treat it as inherited

- Non-spouses (in most cases) must empty the account within 10 years

New rules: Some beneficiaries are still required to take annual RMDs within the 10-year window.

More info: Segal 10-Year Rule Relief

Penalties for Missing an RMD

- 25% penalty on any missed amount

- Can be reduced to 10% if corrected quickly

Avoid penalties by:

- Automating your withdrawals

- Working with a financial planner who tracks RMD deadlines

Final Thoughts: Plan Around RMDs—Don’t Just React to Them

At Future-Focused Wealth, RMDs aren’t an afterthought. They’re part of a full strategy:

- Tax modeling with your return

- Roth conversion analysis

- Charitable giving integration

- Legacy and long-term care planning

- Smart withdrawal sequencing

Let’s make your RMDs intentional—not just required.

📅 Book a strategy session today:

Frequently Asked Question (FAQs) about RMDs

Q. Do Roth IRAs have RMDs?

Not for the original owner. Inherited Roth IRAs do have RMD requirements.

Q. Can I reinvest my RMD?

Yes—into a taxable investment account.

Q. Do QCDs count toward my RMD?

Yes, if done properly. And they’re not counted as income.

Q. Can I reduce or avoid RMDs?

You can’t skip them, but you can reduce them through Roth strategies, QCDs, and proactive withdrawals.