Facts About Tax-Deferred Investing: Grow Your Money, Reduce Your Tax Bill

As a CERTIFIED FINANCIAL PLANNER™ in Dallas, I see it all the time—clients eager to invest but unsure how to do it tax-smart. One of the most common questions I hear is:

“How do I grow my wealth and pay less in taxes—without jeopardizing my future?”

Here’s the thing: Building wealth isn’t just about picking the right investments. It’s about constructing the right structure around those investments—your financial house.

And tax-deferred accounts? They’re one of the strongest structural tools available.

Whether it’s a Traditional 401(k), IRA, or small business retirement plan, tax-deferred investing gives you the chance to:

- Lower your taxable income now

- Let your money grow without yearly tax drag

- Delay the IRS bill until retirement (when it may cost you less)

But don’t stop there. Many people confuse tax-deferred with tax-free—and that’s where Roth accounts come in.

If you're asking yourself, “Wait… aren’t Roths tax-deferred too?”—you’re asking the right question.

Let’s walk through the real differences, the strategic advantages, and how you can use both to build a financial house that’s strong, tax-efficient, and designed to serve you long-term.

What Is Tax-Deferred Investing?

Tax-deferred investing means you postpone paying taxes on investment gains, dividends, and interest until you withdraw the money. This creates more opportunity for compound growth and reduces current-year tax obligations.

Key Benefits:

- Delays income taxes

- Allows investments to compound without annual tax drag

- Potentially lowers current taxable income

- Improves eligibility for tax credits and benefits

Tax-deferred = grow now, pay later.

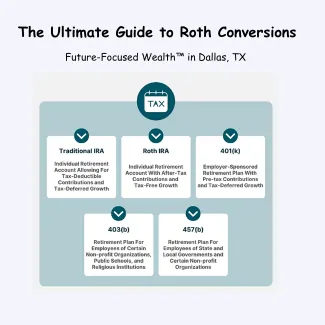

Common Tax-Deferred Accounts

Traditional 401(k)

What it is: An employer-sponsored retirement plan that allows employees to contribute a portion of their pre-tax salary.

Tax Benefit: Contributions reduce current taxable income, deferring taxes until withdrawals in retirement. This lowers your annual tax bill now while compounding tax-deferred growth over decades.

Contribution Limits (2025): $23,000 under age 50; $30,500 for age 50+; $37,500 at age 60+.

Employer Match: Many companies match a percentage of employee contributions—essentially free money that accelerates retirement savings.

Investment Options: Typically includes mutual funds, index funds, target-date funds, and company stock. Some plans offer self-directed brokerage windows for additional flexibility.

Withdrawals & Penalties: Withdrawals before age 59½ incur a 10% penalty plus ordinary income tax unless an exception applies. Required Minimum Distributions (RMDs) begin at age 73.

Best For: Employees in higher income brackets who expect to be in a lower tax bracket during retirement, or who want to defer taxes and take full advantage of employer matching.

Traditional IRA

What it is: An Individual Retirement Account available to anyone with earned income.

Tax Benefit: Contributions may be tax-deductible depending on income and access to employer plans. Investments grow tax-deferred until withdrawal.

Contribution Limits (2025): $7,000 under age 50; $8,000 for age 50+.

Income Limits: Deductibility phases out for higher-income earners if covered by a workplace retirement plan (e.g., phase-out begins at $77,000 for single filers in 2025).

Investment Options: Broad investment flexibility—stocks, bonds, ETFs, mutual funds, and alternative assets (e.g., real estate or precious metals through self-directed IRAs).

Withdrawals & Penalties: Early withdrawals before age 59½ incur a 10% penalty and income tax unless an exception applies. RMDs begin at age 73.

Best For: Individuals not covered by a workplace plan, those seeking additional retirement savings, or those in a higher tax bracket now than they expect to be in retirement.

SIMPLE IRA (Savings Incentive Match Plan for Employees)

What it is: A retirement savings plan designed for small businesses with 100 or fewer employees.

Tax Benefit: Contributions are made pre-tax, reducing current taxable income. Investments grow tax-deferred until withdrawal.

Contribution Limits (2025):

- Employee deferral: $16,000

- Catch-up for age 50+: $3,500

- Employer match: up to 3% of compensation OR a 2% non-elective contribution to all eligible employees

Employer Role: Must either match employee contributions dollar-for-dollar (up to 3%) or contribute 2% of each eligible employee’s salary whether the employee contributes or not.

Investment Options: Broad flexibility depending on provider; can include mutual funds, ETFs, and more.

Withdrawals & Penalties: Early withdrawals before age 59½ are subject to a 25% penalty if made within the first 2 years of participation (10% penalty afterward), plus income tax.

Best For: Small business owners seeking a low-cost, simple plan with minimal administrative overhead. Great for employers wanting to support employee retirement without the complexity of 401(k)s.

SEP IRA (Simplified Employee Pension)

What it is: A retirement plan designed primarily for self-employed individuals and small business owners.

Tax Benefit: Employer-only contributions are made pre-tax and grow tax-deferred until withdrawal. Contributions are deductible as a business expense.

Contribution Limits (2025): Up to 25% of compensation or $69,000 (whichever is less).

Employer Role: Only employers contribute; they must contribute the same percentage of salary for all eligible employees.

Flexibility: No annual filing required for employers; contributions can vary by year.

Investment Options: Very flexible—can be invested in mutual funds, ETFs, stocks, bonds, or self-directed assets.

Withdrawals & Penalties: Subject to the same 10% early withdrawal penalty and income tax before age 59½. RMDs apply at age 73.

Best For: Solopreneurs or small business owners with few or no employees. SEP IRAs allow for high contribution limits with administrative ease.

Health Savings Account (HSA)

What it is: An HSA is a tax-advantaged savings and investment account designed for individuals with a high-deductible health plan (HDHP). It's the only account type that offers a triple tax advantage: pre-tax contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Triple Tax Advantage

- Contributions are tax-deductible.

- Reduce your taxable income in the year you contribute—even if you don’t itemize deductions.

- Reduce your taxable income in the year you contribute—even if you don’t itemize deductions.

- Investment growth is tax-free.

- Like a Roth or Traditional account, your money grows without annual tax drag.

- Like a Roth or Traditional account, your money grows without annual tax drag.

- Withdrawals for qualified medical expenses are tax-free.

- You’ll never owe taxes if funds are used for eligible expenses like doctor visits, prescriptions, dental, vision, or even Medicare premiums in retirement.

2025 Contribution Limits

- Individual Coverage: $4,150

- Family Coverage: $8,300

- Catch-Up (Age 55+): Additional $1,000

Note: These limits apply to total contributions from you and your employer.

HSA Eligibility

To qualify for an HSA, you must:

- Be enrolled in a high-deductible health plan (HDHP) (2025 minimums: $1,650 individual / $3,300 family deductible).

- Not be enrolled in Medicare.

- Not be claimed as a dependent on someone else’s tax return.

HSA as a Retirement Tool

Most people think of HSAs as “spending” accounts, but savvy investors use them for long-term retirement planning:

- Invest unused funds in mutual funds, ETFs, or stocks once the account reaches a minimum threshold.

- Pay out-of-pocket for medical expenses now, save the receipts, and withdraw the equivalent tax-free later, even years down the road.

- In retirement, HSA funds can be used for:

- Medicare premiums

- Long-term care

- Prescription drugs

- COBRA insurance

- Any medical costs tax-free

- And after age 65, withdrawals for non-medical expenses are only taxed as ordinary income (like a Traditional IRA)—no penalty.

Planning Tip

Think of your HSA like a stealth retirement account. Prioritize maxing it out after your emergency fund and Roth/401(k) contributions. It bridges healthcare and wealth-building in one efficient, tax-advantaged package.

Best For:

- Individuals with low annual healthcare expenses and HDHPs

- People looking to maximize tax efficiency

- Retirees who want flexibility for medical costs

- Long-term investors seeking another layer of retirement funding

Deferred Annuities: Long-Term Growth with Income Security

What it is: A deferred annuity is a tax-deferred insurance contract designed to accumulate wealth now and generate guaranteed income later. It's issued by an insurance company and acts as a powerful tool for retirement income planning—especially for those concerned about longevity risk.

How Deferred Annuities Work

You invest a lump sum or make a series of contributions. The funds grow tax-deferred until you begin withdrawals, usually during retirement. When the payout phase begins, you receive:

- A lump sum, or

- A guaranteed income stream for a specific time period or for life

Types of Deferred Annuities

There are three primary categories:

- Fixed Deferred Annuities

- Earn a guaranteed interest rate for a set period

- Ideal for conservative investors seeking predictable growth

- Variable Deferred Annuities

- Invested in sub-accounts similar to mutual funds

- Returns fluctuate based on market performance

- Higher growth potential, higher risk

- Indexed Deferred Annuities

- Returns linked to a market index (e.g., S&P 500)

- Downside protection with limited upside participation

- Middle ground between fixed and variable

Tax Advantages

- Contributions grow tax-deferred until withdrawn

- No annual contribution limits (unlike IRAs or 401(k)s)

- Taxes only apply when you start receiving distributions

- Withdrawals taxed as ordinary income, not capital gains

Withdrawal Rules

- Withdrawals before age 59½ may incur a 10% early withdrawal penalty, similar to IRAs

- Surrender charges often apply if funds are withdrawn within the first 5–10 years

- RMDs do not apply unless held within a qualified retirement account

Planning Tips

- Use deferred annuities to fill income gaps: They're especially helpful if you're delaying Social Security or lack a pension.

- Pair with longevity planning: Helps ensure you don’t outlive your income.

- Avoid unnecessary fees: Many annuities have high costs, so due diligence is critical—review surrender periods, admin fees, and rider costs.

Best For:

- Individuals nearing or in retirement seeking guaranteed lifetime income

- Those concerned about outliving savings

- High earners who’ve maxed out 401(k) and IRA contributions and need additional tax-deferred vehicles

- Conservative investors seeking principal protection (via fixed/indexed annuities)

Watch Out For:

- Long surrender periods (5–10 years is common)

- High fees (mortality & expense, admin, investment management)

- Complexity of riders (e.g., guaranteed income or death benefits)

Real-Life Scenario:

Imagine a 60-year-old investor who’s maxed out their IRA and 401(k). They invest $200,000 into a fixed indexed annuity. The funds grow tax-deferred until age 70, when they trigger guaranteed income of $1,200/month for life. Even if they live to 100, the checks keep coming.

Wait… What About Roth IRAs and Roth 401(k)s?

That’s a fantastic question—and one that deserves a clear explanation.

While Roth accounts are often mentioned alongside tax-deferred investing, they actually belong in a slightly different (but equally powerful) tax category: tax-exempt investing.

Unlike traditional 401(k)s and IRAs, which defer taxes until withdrawal, Roth accounts work in reverse:

How Roth Accounts Work:

- Contributions are made with after-tax dollars.

You’ve already paid taxes on the money before it goes in. - Investments grow completely tax-free.

No annual taxes on dividends, interest, or capital gains. - Withdrawals in retirement are 100% tax-free.

As long as you follow qualified distribution rules (typically age 59½ and the account must be open for 5+ years), you’ll never pay taxes again on that money.

🔍 Key Differences: Tax-Deferred vs. Roth

*Roth 401(k)s must be rolled to a Roth IRA to avoid RMDs

Why Roth Accounts Still Belong in the Conversation

Even though Roth accounts aren’t technically tax-deferred, they play a crucial role in a well-rounded retirement strategy. That’s because they offer:

Tax-Free Retirement Income

If tax rates rise in the future (as many experts predict), having a pool of tax-free income could dramatically improve your after-tax retirement lifestyle.

Flexibility in Withdrawal Planning

A mix of taxable, tax-deferred, and Roth accounts allows you to control your taxable income in retirement—minimizing Medicare premiums, capital gains taxes, and Social Security taxation.

Estate Planning Benefits

Roth IRAs are not subject to RMDs during your lifetime, and heirs can generally inherit the account tax-free—making them a powerful intergenerational wealth transfer tool.

Smart Strategy for Younger Investors

If you're early in your career and in a lower tax bracket, Roth accounts may offer greater lifetime benefits than traditional accounts—because you’re paying taxes on a smaller income today in exchange for decades of tax-free growth.

Planning Tip: Use Both for Tax Diversification

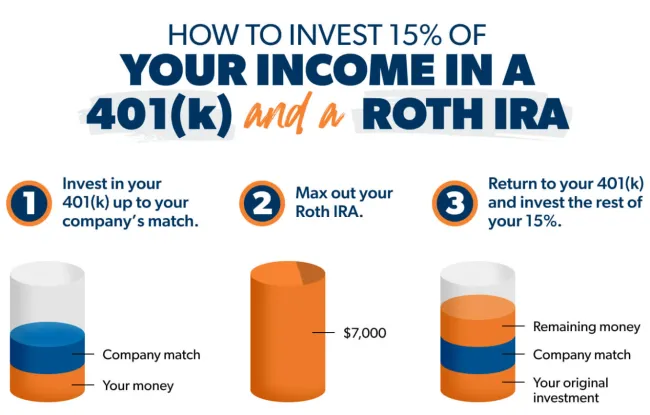

Instead of trying to “pick a winner,” consider building both:

- Use tax-deferred accounts to reduce current income and compound pre-tax dollars.

- Use Roth accounts to secure future tax-free income and hedge against future rate hikes.

This approach is known as tax diversification—and it’s one of the smartest long-term strategies for building financial flexibility.

Why Tax-Deferred Accounts Matter for Long-Term Wealth

Tax-deferred investment accounts are more than just retirement vehicles—they're strategic financial tools that offer powerful tax advantages and long-term growth potential. Here’s why every investor should understand how and when to use them.

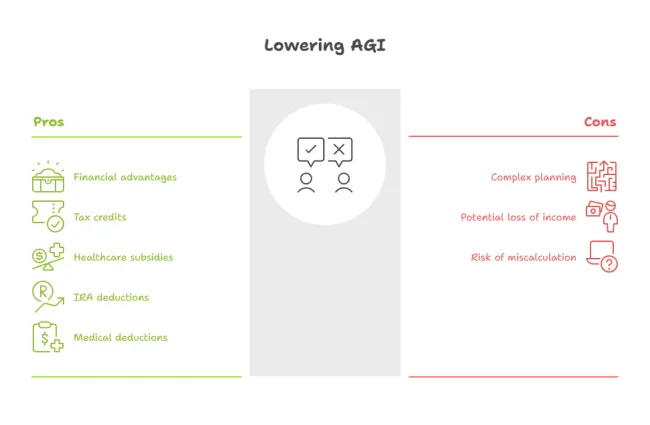

1. Lower Your Taxable Income Now

When you contribute to a Traditional 401(k), Traditional IRA, SIMPLE IRA, or SEP IRA, those contributions are typically pre-tax, which means they reduce your adjusted gross income (AGI) for the year.

💡 Example:

If you contribute $23,000 to your 401(k) in 2025, your taxable income is reduced by the same amount.

- This could move you into a lower tax bracket

- Reduce your overall tax liability

- Make you eligible for additional deductions or credits

These benefits are especially valuable for high earners looking to optimize their current tax strategy while preparing for retirement.

2. Maximize Compounding Growth

Inside a tax-deferred account, your investments grow without annual tax drag. That means you don't pay capital gains tax or income tax on dividends or interest every year.

Why it matters:

More of your money stays invested → more compounding → exponential long-term growth

Let’s compare:

- Taxable account: Gains are taxed yearly

- Tax-deferred account: Gains are untouched until withdrawal

This difference can add tens of thousands of dollars (or more) to your portfolio over time.

3. Control When You Pay Taxes

Tax-deferred investing gives you control over the timing of your tax bill.

Instead of paying taxes now—at potentially high rates—you defer them until retirement, when:

- You may be in a lower tax bracket

- Your income needs are more predictable

- You can strategically manage withdrawals to optimize tax impact

This is especially effective for professionals who are currently in their peak earning years.

4. Increase Eligibility for Tax Credits & Benefits

Lowering your AGI can also improve access to other financial advantages, such as:

- Child tax credits

- Student aid eligibility

- Premium subsidies for healthcare (ACA)

- Deductions for IRA contributions or medical expenses

For families, parents, or those applying for student aid, tax-deferred accounts can provide hidden boosts by reducing your reportable income.

Real-World Example: Emily’s Strategic Move

Emily earns $110,000 annually. She contributes $20,500 to her Traditional 401(k) for the 2025 tax year.

Here’s what happens:

- Her taxable income drops to $89,500

- She moves into a lower federal tax bracket

- She reduces her income taxes by several thousand dollars

- She still enjoys full compounding in her retirement plan

Meanwhile, her portfolio grows tax-deferred, setting her up for a stronger retirement with a smaller tax bill today.

Tax-Deferred vs. Roth: Which Is Better?

There’s no one-size-fits-all solution—but here's how I guide my clients at Future-Focused Wealth:

Planning Tip: Use Both to Maximize Tax Flexibility

Having both Roth and tax-deferred accounts gives you the ability to "choose your own tax adventure" in retirement:

- Pull from Roth accounts when you want to avoid taxes

- Use tax-deferred withdrawals in low-income years

- Reduce RMD burdens by converting to Roth over time

The Catch: Required Minimum Distributions (RMDs)

While tax-deferred accounts offer excellent upfront benefits, they come with a critical caveat: you can’t defer taxes forever. The IRS requires that you eventually begin taking Required Minimum Distributions (RMDs)—and paying taxes on them.

When Do RMDs Start?

- For most individuals, RMDs begin at age 73 (as of 2025).

- The amount you’re required to withdraw is calculated annually based on your account balance and life expectancy.

- Applies to Traditional IRAs, 401(k)s, 403(b)s, and SEP & SIMPLE IRAs.

What If You Miss an RMD?

Missing an RMD triggers one of the harshest penalties in the tax code:

- A 25% excise tax on the amount you failed to withdraw (recently reduced from 50% under SECURE 2.0).

- If corrected in time, the penalty may be reduced to 10%—but it’s a costly mistake either way.

RMDs and Roth Accounts

- Roth IRAs do not require RMDs during the original account holder’s lifetime.

- This makes Roth IRAs a powerful estate planning tool—allowing tax-free growth for your lifetime and your heirs.

- Roth 401(k)s, however, do require RMDs unless rolled into a Roth IRA.

Strategy Tip: Use Roth Conversions to Lower Future Tax Burdens

One of the smartest ways to reduce the long-term tax bite of RMDs is through Roth conversions. This strategy involves moving money from a Traditional IRA into a Roth IRA, and paying taxes on the amount converted today.

Why Would You Do This?

- You expect higher taxes later: Converting now locks in today’s lower tax rates.

- You’re in a lower-income year: Retired early, career sabbatical, or reduced work = ideal time to convert.

- Markets are down: Converting while values are lower means you pay tax on less—then capture the rebound inside a tax-free Roth.

Benefits of Roth Conversions:

- Tax-free growth forever after conversion

- No RMDs, which gives you more control over retirement income

- Better estate planning—your heirs can inherit Roth IRAs tax-free (though with a 10-year distribution window)

Conversion Caveats:

- The amount converted is treated as ordinary income in the year of conversion

- It could bump you into a higher tax bracket—so planning is critical

- You can no longer “recharacterize” or undo a Roth conversion (rule change in 2018)

When Does a Roth Conversion Make Sense?

Planning Tip:

Spread conversions over multiple years to stay in a favorable tax bracket. This approach is often called “filling the bracket” and is best done with the help of a financial planner and tax professional.

Final Thoughts: Building Wealth with Purpose and Precision

Tax-deferred investing isn’t just a tactic—it’s a cornerstone of a resilient, future-focused financial plan. When used intentionally, it becomes a strategic asset that protects your income today, fuels your growth tomorrow, and creates breathing room for the financial future you truly want.

At Future-Focused Wealth™, we don’t just plug numbers into a calculator—we architect your entire financial house. That means aligning your investments with:

- Tax-deferred growth that builds long-term momentum

- Tax-free Roth strategies for ultimate flexibility

- Taxable accounts for liquidity, control, and opportunity

No single account can do it all. But the right combination—designed around your life stage, goals, values, and tax realities—can build wealth that’s not just bigger… but smarter, safer, and stronger.

🔗 Let’s build your financial house together—and give every dollar a job, a mission, and a future.

Frequently Asked Questions About Tax-Deferred Investing

Q. What is tax-deferred investing, and how does it work?

Tax-deferred investing allows you to postpone paying taxes on your investment earnings—such as interest, dividends, and capital gains—until you withdraw funds in retirement. This means your money can compound faster because it isn’t reduced by annual taxes.

Q. Which accounts are considered tax-deferred?

The most common tax-deferred accounts include:

- Traditional 401(k)

- Traditional IRA

- SIMPLE IRA

- SEP IRA

- Deferred annuities

- Health Savings Accounts (HSAs) – for qualified expenses

Each account has unique eligibility rules, contribution limits, and tax advantages.

Q. Are Roth IRAs tax-deferred?

Technically, Roth IRAs are not tax-deferred—they are tax-exempt. You pay taxes on contributions upfront, but all growth and withdrawals are tax-free in retirement (if qualified). Roth accounts complement tax-deferred accounts in a tax-diversified strategy.

Q. What’s better: Roth or tax-deferred?

It depends on your tax bracket, income level, and long-term goals:

There’s no one-size-fits-all answer. That’s why we build custom strategies at Future-Focused Wealth™.

Q. What are the tax advantages of tax-deferred investing?

- Reduces your taxable income now

- No annual taxes on dividends or capital gains

- Lowers AGI, potentially qualifying you for:

- Student aid

- Tax credits

- Healthcare subsidies

- Delays your tax bill until retirement, when you may be in a lower bracket

Q. When do I have to start taking money out (RMDs)?

Required Minimum Distributions (RMDs) begin at age 73 (as of 2025) for:

- Traditional IRAs

- 401(k)s

- 403(b)s

- SEP & SIMPLE IRAs

Failing to take an RMD can result in a 25% IRS penalty. Roth IRAs do not require RMDs during your lifetime, which makes them a powerful estate planning tool

Q. What if I over-contribute to a tax-deferred account?

Exceeding contribution limits can result in IRS penalties and require you to remove the excess plus any earnings. You may also face double taxation if not corrected promptly. It’s important to monitor your limits each year, especially if contributing to multiple plans.

Q. Can I access my money early if I need it?

Yes, but with penalties. Most tax-deferred accounts assess:

- 10% penalty for early withdrawal before age 59½

Income tax on the amount withdrawn

Exceptions may apply for:- First-time home purchase (IRAs)

- Qualified education expenses (IRAs)

- Substantially Equal Periodic Payments (SEPPs)

- Certain medical or disability expenses

Q How do tax-deferred accounts fit into my “financial house”?

Think of tax-deferred accounts as the roof of your financial house, providing protection and long-term planning power. They sit on a solid foundation of budgeting, cash flow, and emergency savings, and surround your fire of investment growth.

They help:

- Lower risk from rising tax rates

- Delay forced taxable events

- Provide lifetime income when paired with annuities

Reduce income volatility in retirement

Q: What’s a Roth conversion—and should I do one?

A Roth conversion moves funds from a Traditional IRA to a Roth IRA. You pay taxes now, but avoid them forever afterward. It’s smart if:

- You’re in a low-income year

- You believe tax rates will rise in the future

- Your portfolio temporarily dropped in value

You want no RMDs and tax-free growth

Q How do I decide which account is best for me?

A. That depends on:

- Your current tax bracket

- Your expected income in retirement

- Your goals for liquidity, estate planning, and income

- Whether you’re self-employed or W-2

Your timeline until retirement

📅 Schedule a free consultation with Melissa Anne Cox, CFP® to create your personalized tax-deferred investing strategy.