The Ultimate Guide to Roth Conversions

As a Dallas-based Certified Financial Planner™, I’ve seen how one strategy—used at the right time—can radically shift someone’s long-term financial picture. That strategy? The Roth conversion.

Whether you’re building retirement income, managing future tax exposure, or planning a legacy, understanding how (and when) to convert pre-tax dollars into a Roth IRA can save you thousands in taxes and give you flexibility others don’t have.

But a Roth conversion isn’t a one-size-fits-all decision.

It’s a strategic tool—and like all tools, it needs to be used with precision.

This guide will walk you through everything you need to know: What it is. Who it’s for. When it works. And how to do it right.

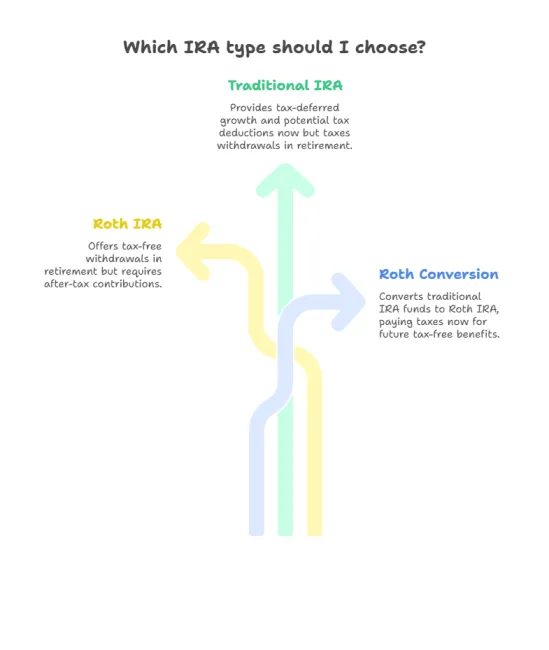

What Is a Roth Conversion?

A Roth conversion moves money from a tax-deferred account (like a Traditional IRA or 401(k)) into a Roth IRA, where it can grow tax-free—forever.

When you convert, you:

- Pay taxes now (on the converted amount)

- Avoid taxes later (no tax on growth or withdrawals, if qualified)

Once inside a Roth, that money:

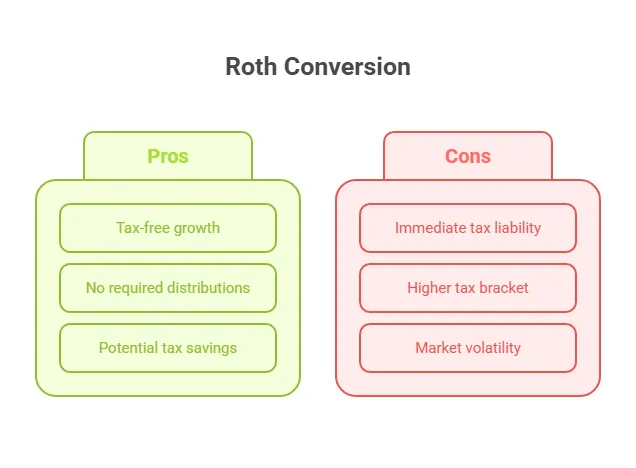

✅ Grows tax-free

✅ Isn’t subject to required minimum distributions (RMDs)

✅ Can be passed to heirs tax-free

Why Consider a Roth Conversion?

Roth conversions are especially valuable if you want to:

- Lower future taxable income in retirement

- Avoid higher RMDs down the road

- Take advantage of a low-income year (e.g., retirement gap years)

- Plan around upcoming tax increases

- Build a tax-free income bucket for flexibility

- Leave a tax-efficient legacy to heirs

When Does a Roth Conversion Make Sense?

Roth conversions make the most sense when:

- You’re in a lower-than-usual tax bracket

- You expect taxes to rise in the future

- You want to reduce your Traditional IRA balance before RMDs start

- You can pay the conversion tax without using retirement funds

- You have high pre-tax balances and want more income control in retirement

How to Time Your Roth Conversion by Tax Bracket

This is where planning gets powerful. Your marginal tax bracket determines how much a Roth conversion will cost in taxes.

We often look at:

- How much space you have left in your current tax bracket

- If converting more would bump you into the next bracket

- Whether to spread the conversion over multiple years

📘 This is why I now review tax returns for all clients—so we can model these decisions accurately.

Roth Conversions & Their Impact on Social Security, Medicare, and More

A Roth conversion increases your adjusted gross income (AGI), which can:

- Make more of your Social Security taxable

- Trigger IRMAA surcharges (higher Medicare Part B & D premiums)

- Affect eligibility for tax credits

We run side-by-side scenarios to evaluate the ripple effects before executing a conversion.

Backdoor Roth IRA: What It Is and Who It’s For

A Backdoor Roth IRA is a strategy for high-income earners who make too much to contribute directly to a Roth IRA.

Here’s how it works:

- Contribute to a Traditional IRA (non-deductible)

- Convert it to a Roth IRA

- Pay tax only on the growth (if any)

⚠️ Important: If you already have pre-tax IRAs, the pro-rata rule applies—and could increase your tax bill. This is why working with a planner is key.

Best for:

- High earners who want Roth access

- Individuals with minimal existing IRA balances

- Long-term savers looking to create future tax-free income

Common Roth Conversion Mistakes

❌ Converting too much and triggering a higher tax bracket

❌ Using retirement emergency funds to pay the tax bill

❌ Ignoring the impact on Medicare premiums

❌ Failing to model long-term tax savings vs. short-term cost

❌ Overlooking the five-year rule for tax-free withdrawals

These mistakes are why a conversion should be strategically planned, not rushed.

Who Is a Good Candidate for a Roth Conversion?

- Retirees in a low-income window before RMDs

- Business owners with a low-income year

- Young professionals expecting higher future income

- Families doing legacy planning

- Anyone who wants tax diversification in retirement

Use Our Free Roth Conversion Planning Checklist

Want to know if this is the right year to convert?

📥 Download the Roth Conversion Planning Checklist PDF

It includes:

- Bracket review prompts

- Timing questions

- Medicare considerations

- Estate planning insights

Use it to prepare for your strategy session with me.

Final Thoughts: A Strategy, Not a Guess

Roth conversions are one of the most powerful tools in modern retirement planning—but only when they’re done with insight, timing, and precision.

At Future-Focused Wealth, we help you:

- Analyze your tax return

- Model various conversion strategies

- Plan around Medicare, Social Security, and income timing

- Build a tax-smart retirement income plan you can trust

📅 Want to find out if this is your Roth conversion year?

FAQs About Roth Conversions

Q. Do I pay taxes when I convert?

Yes. You pay income tax on the amount you convert—but never again on that money once it’s in the Roth.

Q. Can I convert just part of my IRA?

Absolutely. Partial conversions are often best for tax efficiency.

Q. Does this affect my Medicare premiums?

It can. If your AGI rises above certain thresholds, you may pay IRMAA surcharges. We model that in advance.

Q. Is a Roth conversion the same as a Roth contribution?

No. Contributions are subject to income limits. Conversions are not.

Q. Is there a limit on how much I can convert?

No dollar limit exists—but tax consequences grow with the amount.