QCD Strategy: How to Give to Charity and Reduce Your Taxes in Retirement

Giving back shouldn’t come at the cost of a larger tax bill—especially in retirement.

As a Dallas-based Certified Financial Planner™, I work with many clients who are charitably inclined but frustrated by how their donations impact their tax return—especially once Required Minimum Distributions (RMDs) kick in.

That’s where Qualified Charitable Distributions (QCDs) come in.

With a QCD, you can give directly from your IRA, reduce your taxable income, and satisfy your RMD—all in one charitable, tax-smart move.

Let’s explore how QCDs work, who can use them, and how to make the most of this powerful planning strategy.

What Is a Qualified Charitable Distribution (QCD)?

A QCD allows you to transfer money directly from your IRA to a qualified charity, up to $100,000 per year, without the distribution counting as taxable income.

It satisfies your Required Minimum Distribution (RMD) but doesn’t increase your adjusted gross income (AGI).

💡 This is especially helpful for retirees who:

- Don’t need their full RMD for income

- Want to reduce Medicare IRMAA surcharges

- Are subject to Social Security taxation

- Aren’t benefiting from itemized deductions anymore

Who Is Eligible for a QCD?

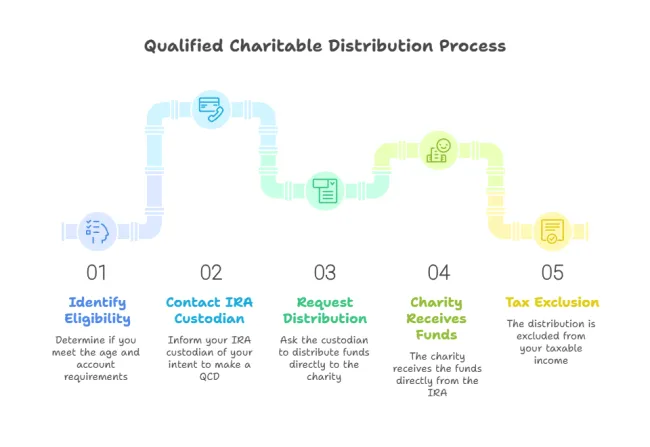

To use a QCD:

- You must be age 70½ or older

- The funds must come from an IRA (not a 401(k) or other plan unless rolled into an IRA)

- The charity must be a 501(c)(3) eligible nonprofit

- The money must go directly from the IRA custodian to the charity

👉 You can’t take a distribution yourself and then donate—it must be direct transfer only.

What’s the Maximum You Can Donate via QCD?

- Up to $100,000 per person, per year

- Married couples can each donate $100,000 from their respective IRAs if both are eligible

And yes—it counts toward your RMD, which can dramatically reduce your taxable income if planned right.

Why QCDs Are So Powerful

Here’s what sets QCDs apart from traditional giving strategies:

Lower AGI = Lower Tax Risk

QCDs reduce your adjusted gross income (AGI)—which affects:

- Tax brackets

- Medicare premium brackets

- Social Security taxation thresholds

- Eligibility for other deductions or credits

Doesn’t Require Itemizing Deductions

Many retirees no longer itemize due to the higher standard deduction. QCDs allow you to get a tax benefit from charitable giving anyway, regardless of whether you itemize.

Better Than Donating Cash

If you simply withdraw your RMD, pay tax on it, and then donate cash, you’ve already paid taxes. With a QCD, you skip that step entirely.

Real-Life Example

Sarah is 74. Her RMD for the year is $25,000.

She donates $10,000 directly to her favorite charity via a QCD from her IRA. That $10,000:

- Satisfies part of her RMD

- Is not included in her taxable income

- Doesn’t increase her Medicare premiums

- Still supports a cause she cares about

She takes the remaining $15,000 RMD as cash and pays taxes only on that portion.

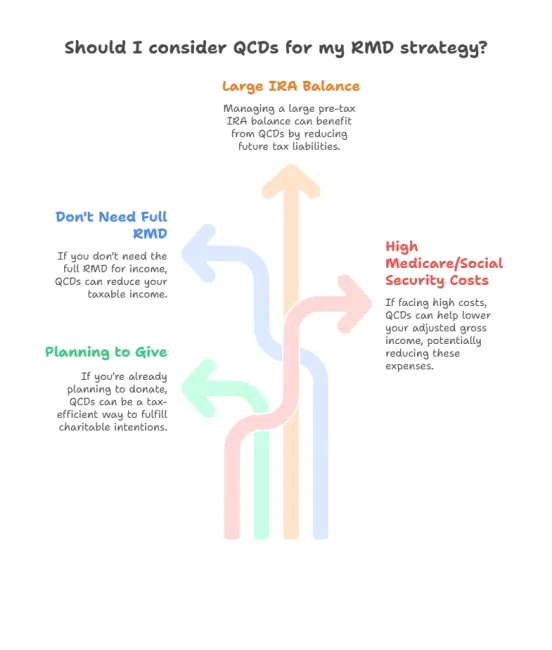

Coordinating QCDs with Your RMD Strategy

QCDs are especially helpful if:

- You’re already planning to give

- You don’t need your full RMD for income

- You’re managing a large pre-tax IRA balance

You’re already facing high Medicare costs or Social Security taxes

And since QCDs must be processed by December 31 of each year, they require intentional timing.

Final Thoughts: Give With Heart—And With Strategy

At Future-Focused Wealth, we believe in giving with both purpose and precision. A QCD allows you to:

- Meet your RMD obligation

- Reduce your taxable income

- Control your Medicare and Social Security tax impact

- Support causes that matter to you

📅 Ready to coordinate your QCD strategy for this year’s RMD?

Let’s build your plan together:

Frequently Asked Questions (FAQs) About QCDs

Q. Can I use my 401(k) for a QCD?

No, but you can roll funds into an IRA first, then use the IRA for QCDs.

Q. Does the QCD have to be the full RMD amount?

No. You can use QCDs to satisfy all or part of your RMD.

Q. Can I do a QCD if I’m under 70½?

No. You must be 70½ or older on the date of the transfer.

Q. Can I give to any charity?

Only IRS-approved 501(c)(3) charities qualify. Private foundations and donor-advised funds do not.