Saving on College vs. Saving FOR College: What’s the Real Difference?

As a Dallas-based Certified Financial Planner™ (and parent), I’ve sat on both sides of the college table—helping families save smartly for college, and coaching students on how to save on the cost of attending. The rising cost of higher education isn't just stressful—it's strategic. If you're feeling overwhelmed by tuition price tags, student loan headlines, or the pressure to "do everything right," you’re not alone.

But here's the good news: there’s more than one way to make college affordable—and understanding the difference between saving on college vs. saving for college can dramatically reduce your family's financial burden.

In this guide, I’ll show you how to:

- Prepare early with smart college savings tools like 529 plans

- Cut tuition and housing costs while your student is in school

- Use the College Pre-Approval™ process to prevent overborrowing

If you want a college plan that supports your future—not sabotages it—you're in the right place.

The Cost of College and Why It Matters

The cost of college is skyrocketing, with student loan debt surpassing $1.7 trillion in the U.S. Parents and students alike are searching for ways to reduce costs and avoid crushing debt. The good news? There are practical ways to save on college without sacrificing quality education. This guide will break down the key difference between saving on college (cutting costs while in school) and saving for college (financial planning before enrollment)—and how to make the best decisions for your future.

What is Saving FOR College?

Saving for college refers to the preparation and financial planning done before a student enrolls in college. This includes:

- 529 College Savings Plans – Tax-advantaged accounts to save for future tuition.

- Education Savings Accounts (ESAs) – Another tax-friendly option for school expenses.

- Prepaid Tuition Plans – Locking in today’s tuition rates for future use.

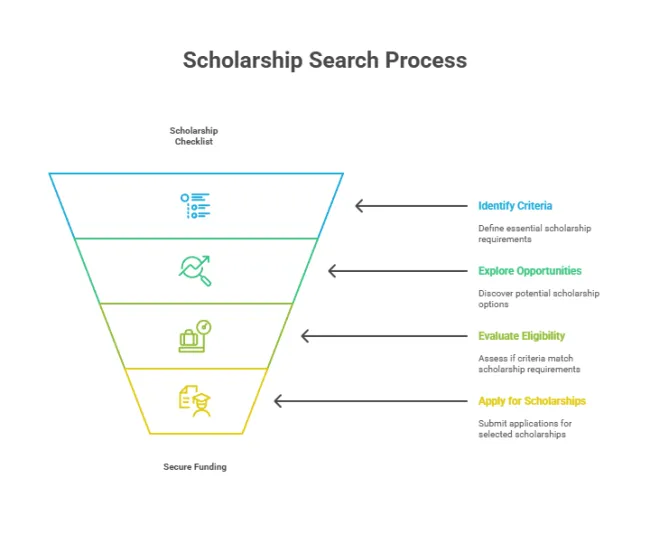

- Scholarship & Grant Research – Applying early for financial aid opportunities.

Pros of Saving FOR College:

✔️ Reduces reliance on student loans.

✔️ Allows for long-term investment growth.

✔️ Creates financial security before college starts.

Cons of Saving FOR College:

❌ Requires early financial planning.

❌ Not all families have the ability to set aside significant savings.

What is Saving ON College?

Saving on college refers to strategies that lower tuition and college-related expenses while attending school. This includes:

- Choosing an Affordable College Option – Community colleges, in-state schools, and institutions with generous aid.

- Applying for Scholarships & Grants – Free money that reduces out-of-pocket costs.

- Work-Study & Part-Time Jobs – Earning income while in school to offset expenses.

- Minimizing Student Loan Borrowing – Only borrowing what is absolutely necessary.

Pros of Saving ON College:

✔️ Immediate cost reduction while attending school.

✔️ Helps avoid excessive student loan debt.

✔️ Provides financial flexibility after graduation.

Cons of Saving ON College:

❌ Requires more effort and research.

❌ Not all students qualify for substantial aid.

How to Combine Both Approaches for Maximum Savings

The best strategy is to combine saving for college and saving on college for maximum financial benefit. Here’s how:

Before College (Saving FOR College):

- Start a 529 Plan early to maximize tax-free growth.

- Research scholarship opportunities in middle and high school.

- Set realistic expectations with a College Pre-Approval™ process.

During College (Saving ON College):

- Use work-study programs to offset tuition costs.

- Choose an affordable school based on financial aid packages.

- Live at home or minimize living expenses whenever possible.

The College Pre-Approval™ Process

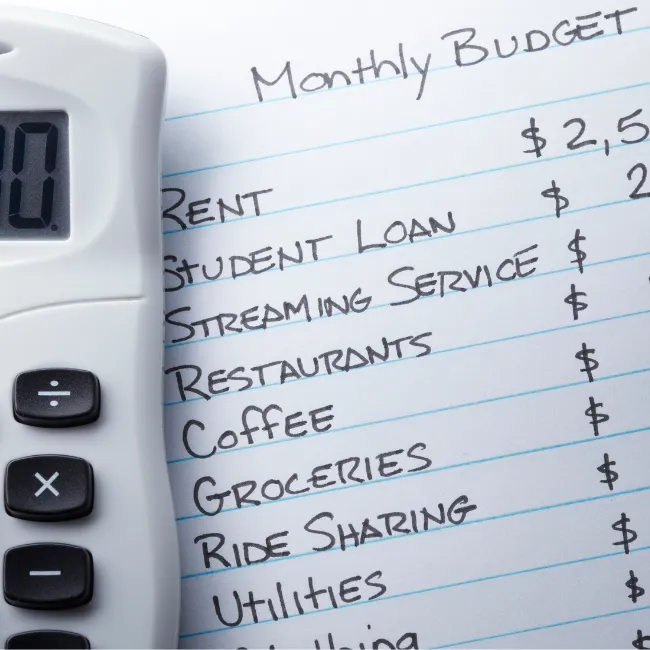

The College Pre-Approval™ process helps families plan their budget before choosing a school, ensuring students graduate with manageable debt.

- Set a realistic college budget.

- Compare schools based on affordability and financial aid packages.

- Plan how to cover all four years of college without surprises.

📢 Get Your Free College Money Report™

Before making college decisions, get a fully customized College Money Report™ to demystify your student’s financial aid outlook.

👉 Get Your Free Report Now

Making College Affordable for Your Family

A college degree is valuable, but it doesn’t have to come at the cost of a lifetime of debt. By being proactive and strategic, you can significantly cut costs and still receive a quality education.

As a Certified Financial Planner™ (CFP®), I specialize in helping families navigate the complexities of college financial planning. I work with parents and students to develop customized strategies that minimize costs, maximize financial aid, and prevent excessive student loan debt. Through the College Pre-Approval™ process, I ensure families make informed decisions about college affordability and long-term financial stability. Whether it's creating a savings plan, evaluating financial aid options, or optimizing loan strategies, my goal is to help families make smart financial choices while preserving their financial future.

💡 What strategies are you using to save on or for college? Schedule a call with Melissa Cox CFP® to help your family build a college plan that works for you!

FAQs About Saving on vs. Saving FOR College

Q. What is the best way to save money on college tuition?

A. Attending community college first, applying for scholarships, and choosing in-state public universities are some of the best ways to cut tuition costs.

Q. How can I avoid student loans altogether?

- Apply for grants and scholarships.

- Take part in work-study programs.

- Choose affordable schools with strong financial aid programs.

Q. How do I apply for college financial aid?

A. Fill out the FAFSA (Free Application for Federal Student Aid) as early as possible to qualify for grants, work-study, and student loans.

Q. Are private student loans a good option?

A. Private loans should be a last resort, as they often have higher interest rates and fewer repayment options than federal loans.

Q. Can I negotiate financial aid with colleges?

A. Yes! If you receive multiple offers, some colleges may match or improve their financial aid packages if you show them a better offer from another school.

Q. How do I calculate my actual cost of college?

A. Use the school’s Net Price Calculator to estimate your out-of-pocket cost after financial aid and scholarships.

Q. Should I take a gap year to save money?

A. A gap year can be beneficial if you use the time to work and save money, improving your financial situation before starting college