The Ultimate Guide to IRAs, Roth IRAs, 401(k)s, and Small Business Retirement Plans

Retirement Planning: The Money Round of Life

As a CERTIFIED FINANCIAL PLANNER™, I view retirement planning as one of the most vital elements of a comprehensive financial strategy. I often tell clients this is the money round—and yes, it’s a pun, but it’s also true. Retirement is the biggest financial challenge most people will ever prepare for, and it requires smart, forward-thinking strategies that begin well before you stop working.

Why is it so important? Because retirement isn’t just a dream—it’s a financial reality that could last 20 to 40 years. Social Security helps, but it was never designed to carry the full load. The average monthly benefit in 2024 is about $1,800. That’s not enough to maintain the lifestyle most people envision.

That’s why we zero in on building tax-advantaged retirement plans tailored to long-term goals. Tax-deferred accounts like 401(k)s and Traditional IRAs let your money grow without being taxed today. Roth accounts flip the script—pay tax now, enjoy tax-free withdrawals later.

Contributions also reduce your adjusted gross income (AGI), which may drop you into a lower tax bracket and unlock other deductions or credits. Catch-up contributions for those 50+ (and enhanced limits at 60+) give you more firepower to catch up or stay ahead.

Diversifying between Traditional and Roth accounts is a key tactic. If the market drops, withdrawing from a Roth may preserve your tax-deferred accounts. If you’re in a lower tax bracket during an up year, it might make sense to tap into Traditional IRAs or 401(k)s instead.

Roth conversions? We love those in the right context. They can be powerful in low-income years or when markets are down—convert now, grow tax-free later.

Fees Matter

Retirement accounts often come with:

- Administrative fees (especially in employer plans)

- Investment management fees (expense ratios)

- Custodial or advisory fees

We help clients understand who’s getting paid and how fees impact long-term returns.

Common investment options include:

- Mutual Funds

- Exchange-Traded Funds (ETFs)

- Target-Date Funds

- Individual Stocks and Bonds (more common in IRAs and Solo 401(k)s)

Retirement Stats & Surprising Facts

- Average retirement savings for Americans age 50–59 in 2023: $189,800

- Recommended savings by age 60: 6–8x your annual salary

- 37% of Americans think they’ll outlive their savings

401(k) participation rose 22% post-2020 thanks to online access and awareness

Retirement Myths vs. Reality

Myth: “I can just live off Social Security.”

Fact: It replaces only about 40% of your pre-retirement income.

Myth: “I’ll spend less in retirement.”

Fact: Health care, travel, and long-term care often increase spending.

Myth: “I’ll borrow from my 401(k) if I need to.”

Fact: It slows your growth, and penalties loom if not repaid.

How Retirement Planning Has Evolved Across Generations

Retirement planning has changed dramatically over the decades. Previous generations often relied on pensions and Social Security to carry them through retirement. Many baby boomers had access to employer-sponsored pension plans, offering guaranteed income for life. But those traditional pensions are becoming increasingly rare.

Today’s workforce must be more self-reliant. With the shift from pensions to defined-contribution plans like 401(k)s, the responsibility for retirement savings has largely shifted to individuals. Millennials and Gen Z must not only save consistently, but also make wise investment and tax-planning decisions along the way.

Thankfully, recent legislation like the SECURE 2.0 Act has introduced several new tools and benefits to make saving more accessible:

- Automatic enrollment in retirement plans is now encouraged.

- Increased catch-up contributions starting at age 60.

- Emergency savings features built into 401(k) plans.

Student loan matching contributions for those who prioritize debt payments over savings.

These changes represent a growing recognition that saving for retirement is both a national priority and a personal necessity. Staying informed about these evolving tools helps ensure you’re maximizing every opportunity to build a secure and fulfilling retirement.

Schedule a consultation!

Breaking Down Retirement Plan Types

Now, let’s break down each plan type and how it fits into your strategy.

Why We Use Tax-Deferred Retirement Accounts

One of the greatest benefits of retirement accounts is that many are tax-deferred, meaning you don’t pay taxes on your contributions now—you pay them when you withdraw money in retirement. This allows your investments to grow without being reduced by annual taxes, giving them the full advantage of compound interest over time.

Other accounts, like Roth IRAs and Roth 401(k)s, are tax-free in retirement because you pay taxes upfront. Choosing between tax-deferred vs. tax-free growth depends on your current tax rate and what you expect in the future.

Another major tax-saving strategy is that contributing to pre-tax accounts like Traditional 401(k)s and Traditional IRAs can reduce your taxable income today. If you’re in a high tax bracket, this could mean thousands of dollars in annual savings!

Understanding the Different Types of Retirement Accounts

1. 401(k) Plans (Employer-Sponsored)

- Contribution Limits (2025): $23,000 (under 50); $30,500 (50+); $37,500 (60+)

- Employer Matching: Many employers offer matching contributions.

- Tax Treatment: Choose Traditional (tax-deferred) or Roth (tax-free withdrawals).

- Fees: Administrative, management, and advisor fees may apply.

- Investment Options: Mutual funds, ETFs, target-date funds.

2. Roth 401(k) vs. Traditional 401(k)

- Roth 401(k): Contributions are after-tax; withdrawals are tax-free.

- Traditional 401(k): Contributions reduce taxable income; withdrawals are taxed.

3. 403(b) and 457 Plans (Public Sector Options)

403(b) Plans

- Designed for public school, nonprofit, and certain religious employees.

- Contribution Limits (2025): Same as 401(k).

- Extra Catch-Up: Employees with 15+ years may contribute an additional $3,000/year.

457(b) Plans

- Available to state/local government employees.

- No Early Withdrawal Penalty: Funds accessible before 59½ without penalty.

- Contribution Limits: Same as 401(k), plus optional double-up contributions in final 3 years before retirement.

Loans from Retirement Accounts: Pros, Cons & Considerations

Some retirement accounts allow participants to take loans from their balances—primarily 401(k) and 403(b) plans. However, IRAs and Roth IRAs do not permit loans under IRS rules.

Key Details:

- Loan Amount: Up to 50% of your vested balance, capped at $50,000

- Repayment Terms: Typically must be repaid within 5 years with interest

- Loan Fees: Origination and administrative fees may apply, typically $50–$100 or more

Why I Rarely Recommend Loans

As a financial planner, I rarely recommend borrowing from retirement accounts because:

- You’re removing invested funds from the market, limiting long-term growth

- If you default, the loan becomes a taxable distribution and may incur penalties

- You repay with after-tax dollars, which are taxed again upon withdrawal

That said, loans can be a practical short-term solution in rare cases—such as avoiding high-interest credit card debt or foreclosure—if there’s a clear repayment strategy.

A Real-World Example

Let’s say Jordan, age 45, has $100,000 in a 401(k) and needs $20,000 to cover medical expenses. They take a loan with a 5-year term at 6% interest. Jordan repays roughly $387/month. While this seems manageable, the $20,000 missed out on market growth, potentially costing tens of thousands in compounded earnings over 20 years. If Jordan leaves their job, the outstanding balance becomes due immediately or is treated as a distribution.

Emergency Withdrawals vs Loans

Many people confuse hardship withdrawals with loans. Here’s how they differ:

- Loans must be repaid with interest

- Hardship withdrawals are permanent and may be subject to income tax and penalties unless qualified

Always consult a financial professional before tapping into your retirement accounts.

Emergency Savings Accounts Under SECURE 2.0

Starting in 2024, the SECURE 2.0 Act allows employers to offer emergency savings accounts linked to retirement plans. Employees can contribute up to $2,500 to these Roth-style accounts and make penalty- and tax-free withdrawals, encouraging both short-term and long-term financial security.

Taking Money Out: Withdrawals, Penalties, and Age Rules

Understanding the rules around retirement withdrawals is essential to avoid taxes and penalties and to make your money last.

General Withdrawal Guidelines by Account Type

Key Considerations

- Traditional accounts (IRA, 401(k), 403(b)) are taxed upon withdrawal; early withdrawals incur penalties.

- Roth IRAs provide the most flexibility—your contributions (not earnings) can be withdrawn tax- and penalty-free at any time.

- 457(b) plans have a unique advantage of no early withdrawal penalty.

- RMDs must begin at age 73 for most traditional accounts; Roth IRAs have no RMDs for original account holders.

Additional Strategies and Considerations

Roth Conversions: A Powerful Tax Strategy

Roth conversions involve transferring funds from a Traditional IRA or 401(k) into a Roth IRA. You’ll pay taxes on the converted amount now, but benefit from tax-free withdrawals in the future. This can be particularly advantageous in years when your income is temporarily lower—such as between jobs, early retirement, or following business losses.

Additionally, when markets are down, converting assets at lower valuations means more long-term tax-free growth potential.

Tax Diversification in Retirement

We often advise clients to maintain a mix of tax-deferred and tax-free accounts. This strategy provides critical flexibility in retirement. For example:

- Withdraw from Roth IRAs in high-income or high-tax years

- Tap Traditional IRAs/401(k)s when your income (and tax bracket) is lower

Having both options lets you better manage your taxable income year by year.

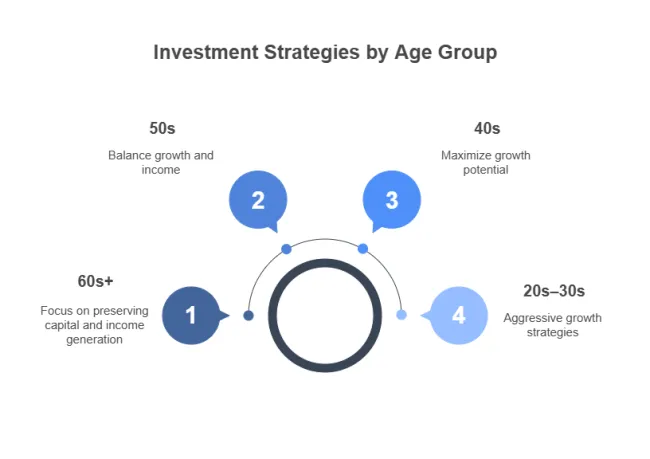

Retirement Planning by Life Stage

- In Your 20s–30s: Focus on Roth IRAs and aggressive growth investments. Compounding over time is your biggest asset.

- In Your 40s: Maximize your contributions, assess your retirement age, and balance your portfolio.

- In Your 50s: Leverage catch-up contributions, track progress, and model your retirement income.

- In Your 60s–70s: Refine withdrawal strategies, consider Social Security timing, and plan for RMDs.

Retirement and Inflation

Inflation is a silent threat to long-term retirement success. Even a 3% annual inflation rate cuts your purchasing power in half in 24 years. Your plan must include growth strategies—even in retirement—to keep pace.

Growth-oriented investments, strategic withdrawals, and planning for healthcare inflation are essential.

Final Thoughts about Retirement

Retirement planning isn’t just about saving money—it’s about building a roadmap that allows you to enjoy your future with confidence, clarity, and purpose. With so many types of accounts, contribution limits, tax considerations, and investment options available, it’s no wonder people feel overwhelmed.

But here’s the good news: you don’t have to figure it out alone.

As a CERTIFIED FINANCIAL PLANNER™, I specialize in helping clients understand how all the moving parts of their financial lives fit together. Whether you're decades away from retirement or just a few years out, there’s always something we can do to enhance your strategy.

We take the time to tailor each plan to your goals, your lifestyle, and your personal timeline. And when markets are uncertain or tax laws change, we adapt together—so you always feel prepared, not panicked.

You’ve worked hard for your money. Now let’s make your money work hard for you!

📩 Schedule your free consultation today and Boost your savings strategy for a stronger retirement

Let’s design a future where your retirement is more than just possible—it’s something you look forward to with excitement and peace of mind.

FAQs About Retirement Accounts

Q: When should I start saving for retirement?

A: The earlier, the better. Starting in your 20s or 30s gives your money decades to grow through compounding, but it’s never too late to begin.

Q: What’s the difference between a Traditional and Roth account?

A: Traditional accounts let you contribute pre-tax and pay taxes in retirement. Roth accounts are funded with after-tax dollars, but withdrawals in retirement are tax-free.

Q: Can I contribute to both a 401(k) and an IRA?

A: Yes! Many people contribute to both to diversify tax advantages. Be mindful of income limits for Roth IRAs and deductibility rules for Traditional IRAs.

Q: What are the 2025 contribution limits?

A: For 401(k)s and similar plans: $23,000 under age 50, $30,500 for 50+, and $37,500 for 60+. For IRAs: $7,000 under 50, $8,000 for 50+.

Q: Are there penalties for withdrawing early?

A: Yes. Most retirement plans charge a 10% penalty plus taxes if you withdraw before age 59½, unless you meet a qualified exception.

Q: Can I borrow from my IRA?

A: No. IRAs and Roth IRAs do not allow loans. Some employer-sponsored plans like 401(k)s and 403(b)s may offer loan options.

Q: How do catch-up contributions work?

A: Once you turn 50, you can contribute extra to your retirement accounts. Starting at 60, new legislation allows even higher catch-up limits for some plans.

Q: What happens to my retirement account if I change jobs?

A: You can roll your old 401(k) into your new employer’s plan or into an IRA to maintain tax-advantaged growth and simplify your accounts.

Q: Do I need a financial advisor to plan for retirement?

A: While not required, working with a CFP® can provide personalized strategies, tax planning insights, and peace of mind knowing your plan is on track.