Building Your Financial House with Purpose

Most People Light the Fire Before They Build the House

As a CERTIFIED FINANCIAL PLANNER™, I’ve worked with clients across every income level, life stage, and business phase. And yet, one pattern remains strikingly consistent:

We're taught to chase returns.

Track performance.

Obsess over allocation.

We’re taught to light the fire first — to focus on growth without building the structure needed to support it.

But here’s the truth: if you light the fire before you build the house, and without ensuring the proper structure is in place, that fire doesn’t warm you.

It burns everything down.

Building wealth is not just about growth. It’s about resilience, protection, and purpose.

When you build your financial house with intention, the fire — your investments and growth — becomes a sustainable source of warmth, energy, and comfort, not a force of destruction.

What a Real Financial House Looks Like

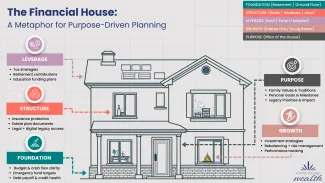

Imagine your financial life as a real house:

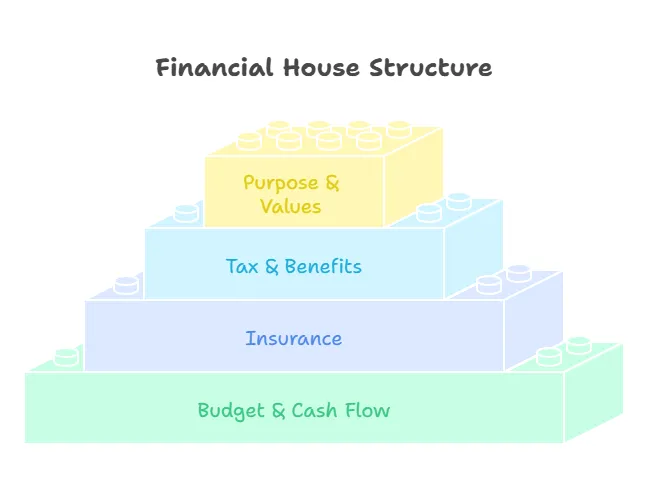

- Foundation: Your budget, cash flow management, emergency savings, and debt payoff — the solid ground that holds everything up.

- Walls: Your insurance coverage, estate planning, and legal protections — shielding you from life's inevitable storms.

- Roof: Your tax strategies, employer benefits, and retirement savings — the overhead structure that keeps wealth from leaking away.

- Interior: Your deeply personal family values, future goals, and legacy priorities — the reason you built the house in the first place.

- Fireplace: Your investments and financial growth — designed to sustain, not destroy.

The Fire: Long-term wealth accumulation, meant to warm your future with security and opportunity.

If you only focus on starting a big fire — and ignore the house itself — you risk everything. An unprotected fire either burns out too soon, leaving you cold and vulnerable, or grows too wildly and consumes everything you’ve built.

Why Building a Structured Financial House Matters

The foundation, walls, and roof aren't luxuries. They are necessities.

Without a budget and cash flow system, you can't survive financial emergencies.

Without proper insurance, a single unexpected event could wipe out decades of progress.

Without a smart tax and benefits strategy, your hard-earned money can leak away year after year.

Without strong purpose and values guiding you, even a big fire of investment success can feel empty, aimless, or unstable.

A properly built financial house gives you:

- Stability when markets shake.

- Protection when life surprises you.

- Comfort when you reach major life milestones.

- Confidence that your wealth is aligned with your deepest goals.

Volatility Feels Different When Your House is Built

Without a house, financial storms are devastating:

- You panic sell during market dips.

- You make fear-driven decisions.

- You second-guess your every financial move.

But when your house is built intentionally?

- Your emergency fund bridges tough seasons.

- Your insurance and estate plans protect what matters most.

Your investment strategy rides out volatility without fear.

A strong financial house transforms crises into manageable moments.

The Wealth on Purpose™ Framework: How We Build Your Financial House

At Future-Focused Wealth, we don’t build bonfires. We build resilient, purposeful homes for your wealth.

Phase 1: Foundation

Cash Flow Management, Emergency Savings, Debt Optimization

Every house needs a solid ground floor. Before you can build upward, you must:

- Understand income and expenses.

- Build an emergency fund (3-6 months minimum).

- Eliminate toxic, high-interest debt.

Create a budget that supports growth without strangling flexibility.

You can't build wealth if your foundation is cracked.

Phase 2: Structure

Insurance Planning, Estate Organization, Legal Protections

Walls and doors don’t just make a house beautiful — they make it livable and safe.

- Life, disability, and liability insurance for income protection.

- Wills, trusts, and powers of attorney to protect your wishes.

- Digital legacy plans for online accounts and family continuity.

Structure protects what you’re building—from the outside in.

Phase 3: Leverage

Tax Strategy, Employer Benefits, Education Planning

The roof shields your progress from slow, invisible losses like inefficient taxes or missed savings opportunities.

- Max out retirement contributions.

- Leverage employer benefits.

- Plan for future education expenses.

Build tax-advantaged strategies for every life stage.

Leverage helps your financial structure work smarter.

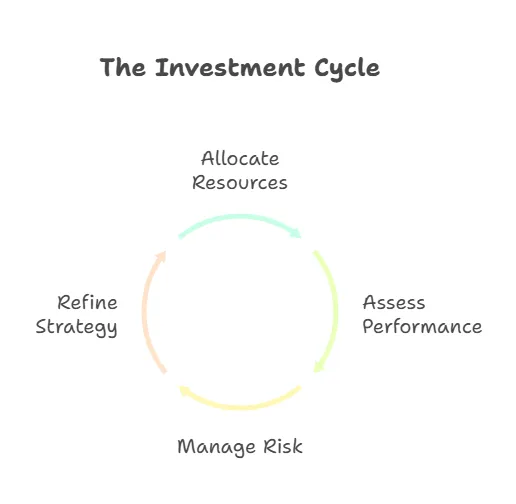

Phase 4: Growth

Investments, Performance, Risk Management

We don’t wait until the entire house is complete to light the fire. We begin early, carefully tending it while simultaneously strengthening the foundation, erecting the walls, and building the roof.

The key is proportional growth:

- Tailored investment portfolios based on real goals.

- Diversification to protect against market risk.

- Regular rebalancing to maintain proper alignment.

Emotional resilience to withstand volatility.

Investments are the fire—but they must be built intentionally, proportionally, and protected by the growing structure of your financial house.

Purpose: The Central Pillar That Holds It All Together

Running through the center of your financial house is your Purpose.

Without purpose, even a beautiful house can feel hollow. With it, every room has meaning, and every financial decision feels aligned.

Purpose answers:

- Why are you building wealth?

- Who do you want to protect?

What legacy do you want to leave?

Purpose transforms wealth into meaning. It turns assets into a life story.

Visual Wealth on Purpose™

Visualize a house blueprint:

- Foundation Layer: Budget, savings, debt management

- Walls Layer: Insurance, estate planning, legal protection

- Roof Layer: Tax efficiency, retirement savings, education planning

- Interior and Fireplace: Investments fueling future dreams

- Center Pillar: Core life values and purpose

The result? A home ready to face storms, shelter growth, and nurture generations.

Build the House As You Tend the Fire

At Future-Focused Wealth, we don’t rush to chase investment returns without building the structure first. We nurture growth in tandem with strength and security.

We believe your financial house should:

- Comfort you in uncertainty.

- Protect you from risks.

- Sustain your dreams for decades.

- Leave a legacy of purpose.

Your fire — your investments — should be a source of warmth, not risk.

Ready to Build Your Financial House — One Smart Brick at a Time?

Whether you're laying the foundation or remodeling an outdated plan, your financial house should be designed around your values, lifestyle, and long-term goals. Let’s take the first step together.

📅 Schedule a complimentary strategy session today and start building a plan that’s as solid and future-focused as you are.

👉 Book Your Call with Melissa Cox, CFP®

FAQs About Building Your Financial House

Can I start investing even if I don't have a full emergency fund?

Yes, but cautiously. It's important to balance early investments with emergency savings to avoid pulling out investments during unexpected hardships.

Why do I need insurance if I have good investments?

Insurance protects your financial foundation from catastrophic loss. Without it, even the best investment strategy can be wiped out by one accident or illness.

How much should I have saved before focusing on retirement planning?

Ideally, you should have at least 3-6 months of living expenses saved in an emergency fund before aggressively contributing to retirement plans.

What happens if my 'financial fire' grows too fast without structure?

Rapid, unprotected growth can create major risks, including tax inefficiency, emotional decision-making, and susceptibility to major losses in downturns.

How often should I "rebalance" my financial house?

We recommend a full review at least annually — and anytime you experience a major life change such as marriage, a new job, the birth of a child, or nearing retirement.