When Your Financial Plan Stops Working: How to Reset Without Shame

“I had a plan. I was doing everything right… until I wasn’t.”

Sound familiar?

Whether it's a job loss, unexpected expense, market dip, medical event, or just burnout—you’re not broken. But your financial plan may need a reboot. And you’re not alone.

As a Dallas-based Certified Financial Planner™, I’ve walked clients through every version of this moment: when the numbers don’t add up, the stress is high, and the motivation is gone.

But I’ve also seen what happens when people get back in the driver’s seat—with clarity, compassion, and a new strategy.

5 Real Reasons Financial Plans Break Down

- They were too rigid.

Life changed, but your plan didn’t—and now it no longer fits.

- You were in survival mode.

You made it work during a crisis… but never rebuilt the foundation.

- You experienced lifestyle creep.

➤ Understand how rising income can silently derail your savings.

- You never addressed the mindset.

➤ Discover how scarcity thinking can sabotage even the best plan.

- You hit emotional burnout.

➤ Learn how stress can shut down your decision-making and progress.

Step One: Ditch the Shame. Pick Up the Pencil.

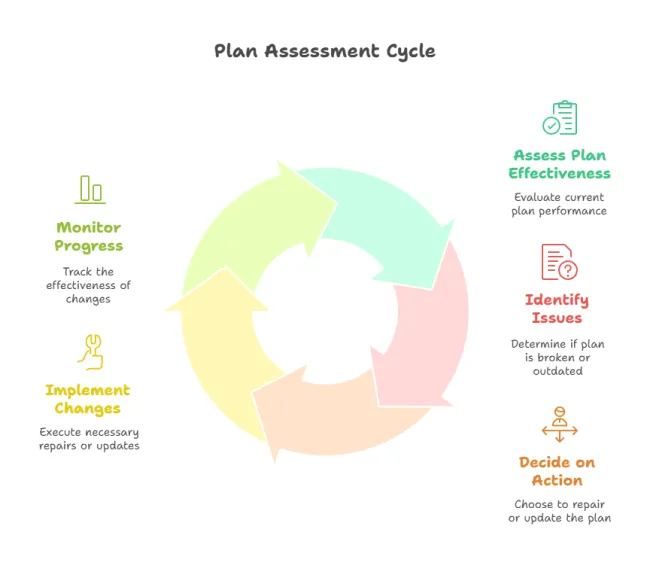

Financial planning is not a one-and-done deal.

It’s a living system that must evolve with your life.

“If the plan doesn’t work anymore, the problem isn’t you—it’s the plan.”

So let’s stop beating ourselves up… and start building something that fits who you are now.

Step Two: Ask the Right Questions

Instead of “What’s wrong with me?”

Try asking:

- What’s changed in my life since I made this plan?

- What’s still working… and what feels heavy or forced?

- What financial decision am I avoiding out of fear or fatigue?

These questions are often best tackled with support from a coach or planner—so you can separate emotion from strategy and get unstuck faster.

Step Three: Rebuild Smarter, Not Harder

You don’t need to scrap everything. You just need a reset.

Here’s what that could look like:

- Update your goals. What’s the priority now? What can wait?

- Realign your cash flow. Is your spending tracking with what matters today

- Re-check your risk. Are your investments still appropriate for this season of life?

Work with Melissa Cox, CFP®

Connect with Jason Lackey, Financial Coach

Real Client Story

A teacher in Fort Worth came to us after draining her emergency fund to care for a parent. Her old plan was toast—but her values hadn’t changed.

We:

- Rebuilt her budget around new medical expenses

- Increased her savings rate with small but frequent transfers

- Created a timeline for rebuilding her fund without guilt

Today, her plan fits again—and she sleeps better at night.

Bonus Tool: The Financial Reset Starter Checklist

Want a fresh starting point?

Review 3 months of spending

Check your emergency fund status

Revisit 2–3 goals and adjust timelines

Final Thoughts: You Haven’t Failed—You’ve Evolved. Now Let’s Plan for That.

Your financial plan isn’t broken—it’s just out of sync with your life.

And that’s completely normal. Because life evolves. Careers shift. Families grow. Priorities change. And your plan should be able to grow with you—not trap you in yesterday’s version of success.

That’s where working with a financial planner makes the difference between feeling stuck and feeling empowered.

As a Certified Financial Planner™, my job isn’t just to run numbers or manage investments. It’s to:

- Help you reassess your goals with clarity

- Adjust your plan to fit your current life—not punish your past decisions

- Create proactive strategies to keep you moving—even when life gets messy

But we don’t stop at spreadsheets. At Future-Focused Wealth, you also get access to a full financial support team:

- Planner Melissa: for strategy, structure, and future vision

- Coach Jason: for habits, mindset, and daily decision-making

- Additional experts (tax, estate, college) as needed

Because a real financial plan doesn’t live in a drawer—it lives with you.

It adapts when things change. It grows with your values. And most importantly, it reminds you that you’re not alone.

📅 Let’s take what’s working, fix what’s not, and plan what’s next—together.

FAQs About Broken Financial Plans

How do I know if my financial plan isn’t working anymore?

If you’re avoiding it, feeling overwhelmed, or not making progress—it’s time to review and adjust.

Can I fix it myself?

Yes—but working with a planner or coach speeds up clarity and ensures you’re not missing blind spots.

Do I need to start over?

Usually not. Most “broken” plans need tweaks, not a total rebuild.