Lifestyle Creep: The Hidden Wealth Killer You Didn’t See Coming

As a Dallas-based Certified Financial Planner™, I work with people who’ve earned promotions, bonuses, and pay raises—only to wonder why they’re still living paycheck to paycheck.

Sound familiar?

That frustrating disconnect is usually caused by something most people don’t even realize is happening: lifestyle creep.

It’s subtle. It’s sneaky. And left unchecked, it quietly eats away at your financial future.

What Is Lifestyle Creep?

Lifestyle creep (also known as lifestyle inflation) happens when your spending increases as your income does.

You:

- Get a raise → upgrade your car

- Pay off debt → increase dining out

- Move up in your career → move up in wardrobe, housing, gadgets

It doesn’t feel excessive. After all, you “earned it.” But over time, these upgrades become your new normal—and savings never increase with income.

How to Know If You're Experiencing Lifestyle Creep

Ask yourself:

- Has your savings rate increased with your income?

- Are your monthly subscriptions and spending categories expanding?

- Do you still feel broke even with a higher income?

If your lifestyle costs rise with (or faster than) your income, you may be unknowingly sabotaging your long-term financial goals.

The Mindset Behind Lifestyle Creep

Lifestyle creep isn’t just about spending—it’s about identity and validation.

It’s the “I deserve this” reflex, the pressure to keep up, and the dopamine hit of new and shiny things.

It’s also often fueled by:

- Financial FOMO

- Comparison culture (“They went to Tulum, why not us?”)

- Money myths like “I can always save later” or “I work hard—I deserve to enjoy it.”

But here's the truth:

"Just because you can afford it doesn’t mean it’s building your future."

How to Stop Lifestyle Creep Before It Kills Your Goals

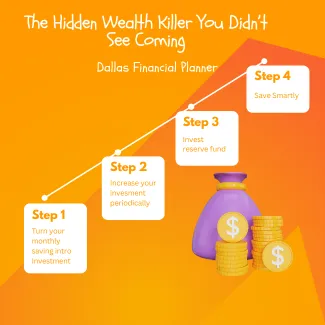

1. Lock in a Savings Percentage — Not a Dollar Amount

Commit to saving 20–30% of every new raise or bonus. That way, your wealth grows with your income.

2. Use Guardrails

Automate transfers to savings or investment accounts before the money hits your spending account.

🧾 Emergency Fund Tracker – Download

3. Upgrade Intentionally

Want to upgrade something? Awesome. Just ask:

“Does this align with my values or am I just upgrading by default?”

Real Client Moment

One couple I worked with had nearly doubled their household income over 5 years—but they felt more stressed than ever. Why?

They’d upgraded:

- Homes

- Cars

- Streaming services

- Dining habits

But hadn’t upgraded their savings rate. Once we reset their spending priorities and automated saving, they recaptured over $1,200/month—without feeling deprived.

Planning + Coaching: A Tag-Team Approach to Lifestyle Management

At Future-Focused Wealth, we don’t just help you build a plan. We help you stick to it—even when lifestyle creep threatens to derail progress.

👩💼 [Work with Melissa Cox, CFP®]

👨💼 Work with Jason Lackey, Financial Coach

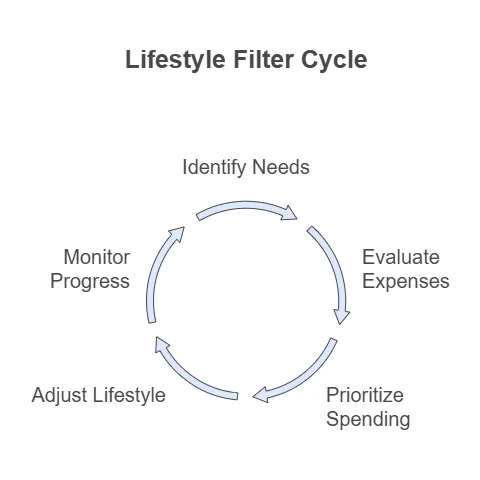

Red Light, Green Light: Lifestyle Upgrade Decision Filter

Ask these 3 questions before every new expense:

- Is this upgrade permanent or temporary?

- Will it still matter to me in 12 months?

- Will this purchase delay or derail my financial goals?

If any answer gives you pause—it might be lifestyle creep in disguise.

Final Thoughts: Keep the Lifestyle. Upgrade the Mindset.

You don’t have to live on rice and beans to build wealth—but you do have to be intentional.

Lifestyle creep isn’t a spending problem. It’s a mindset drift—from conscious choice to emotional auto-pilot.

If you’ve found yourself earning more but saving less, it’s time to pause and realign your spending with your values. Whether you need a financial plan that scales with your success or a coach to help rewire habits, we’re here to help you move from overwhelmed to in control.

📅 Let’s make your money work harder than your lifestyle ever will. Book a call today.

FAQs About Lifestyle Creep

What causes lifestyle creep?

Increased income, social pressure, emotional spending, and lack of awareness all contribute to this common trap.

Can you reverse lifestyle creep?

Yes—with habit tracking, intentional budgeting, and automated saving. Working with a planner or coach makes it even easier.

Is it bad to enjoy your income?

Not at all. The goal is balance. Celebrate wins—but also protect your future.