Financial Anxiety Is Real: How to Calm Your Mind and Build Wealth

“I can’t sleep—I just keep thinking about my credit card balance.”

“Every time a bill hits my inbox, I feel sick.”

“I make good money… so why do I feel broke and panicked?”

These are real quotes from real clients—and they all point to one powerful truth:

Financial anxiety is real, and it affects more than just your wallet.

As a Dallas-based CFP® and the author of Future-Focused Wealth, I’ve helped people facing six-figure incomes and six-figure stress. Because when it comes to your relationship with money, the numbers never tell the full story.

What Is Financial Anxiety?

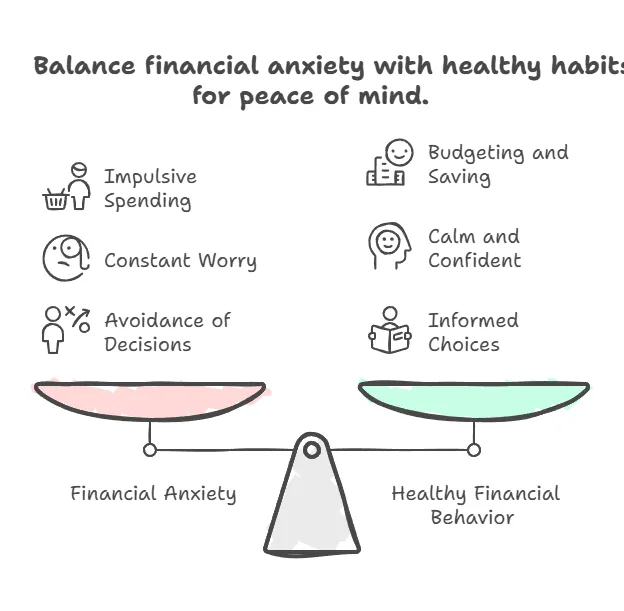

Financial anxiety is more than worry. It’s a chronic emotional and physical stress response tied to money:

- You avoid checking accounts or statements

- You lose sleep over bills or spending

- You feel shame when talking about finances

- You’re triggered by spending—even on necessities

And here’s the kicker:

Financial anxiety doesn’t always come from being “broke.” It often comes from being overwhelmed, under-supported, or living in fear of financial failure.

The Mental + Physical Toll of Financial Stress

65% of Americans say money is their #1 source of stress

- Financial anxiety can trigger:

- Insomnia

- Panic attacks

- Digestive issues

- Impulse spending

- Relationship strain

💡 Source: APA – Stress & Money

Why Traditional Budgeting Often Makes Anxiety Worse

When you’re anxious, you want control. So many people try to “budget their way out” of financial stress—but:

- They create overly rigid plans

- They set unrealistic savings goals

- They beat themselves up over every “mistake”

This creates a cycle of guilt and failure—which only deepens the anxiety.

That’s why we take a different approach at Future-Focused Wealth.

The Power of Planning + Coaching for Financial Peace

We combine:

- Melissa Cox, CFP®: Strategic, non-judgmental financial planning

- Jason Lackey, Financial Coach: Daily accountability and mindset support

Together, we guide you from panic → plan → peace of mind.

5 Ways to Manage Financial Anxiety Right Now

1. Create a “Worry Budget”

Write down everything you’re anxious about. Categorize it:

- Controllable (like subscriptions, food spending)

- Uncontrollable (inflation, taxes, economic cycles)

Now: Focus energy ONLY on what you can control.

2. Build a Safety Net

An emergency fund = emotional insulation.

Even $500–$1,000 reduces panic-driven choices.

Download the Emergency Fund Tracker

3. Set Micro Goals

Instead of “I’ll pay off $20k,” start with:

- “I’ll pay $100 more this month”

- “I’ll check my balance on Fridays”

- “I’ll automate one payment”

These small wins rebuild confidence—fast.

4. Replace Shame With Structure

Your past money mistakes don’t define you. A smart structure can:

- Prevent emotional overspending

- Guide your choices during stress

- Automate what you used to avoid

📘 [Why Budgets Are Essential in Financial Planning]

5. Ask for Support

Financial anxiety thrives in silence. But you don’t have to go it alone.

That’s what coaching and planning were made for.

📞 Book a call with Melissa or Jason today

When Your Brain Says “Panic,” Let Your Plan Say “You’ve Got This.”

Anxiety doesn’t mean you’ve failed—it means you care.

But you deserve a financial life that feels empowered, not exhausting.

That’s what we build here. Whether it’s panic around debt, shame around spending, or fear around the future—we help you turn chaos into clarity. One mindset shift, one habit, one financial decision at a time.

📅 Ready to calm your financial stress with confidence and support?

Let’s build the plan—and peace—you deserve.

FAQs About Financial Anxiety

What causes financial anxiety?

It can stem from trauma, upbringing, uncertainty, debt, or fear of failure. Even people with high incomes can feel it.

Can therapy or coaching help with money stress?

Absolutely. Coaching offers practical support. Therapy offers emotional tools. Many clients do both.

What’s the fastest way to reduce anxiety about money?

Track what you can control. Automate one win. Talk to someone trained to help.