Scarcity vs. Abundance: How Your Money Mindset Shapes Your Financial Future

As a Certified Financial Planner™ and the author of Future-Focused Wealth, my mission isn't just to help you plan your finances—it's to empower you to think differently about money. I've seen firsthand how deeply rooted beliefs around scarcity can sabotage even the best financial strategies. Mindset isn't fluff. It's foundational. Because no matter how perfect your budget is, how carefully crafted your investment portfolio might be, if you're approaching money from a place of fear, lack, or "not enoughness," you'll stay stuck. True wealth-building starts in the mind. And that's why understanding the difference between a scarcity mindset and an abundance mindset could be the most transformational financial decision you ever make.

Quick Reflection: Where Are You Starting From?

- Do you constantly worry there won’t be enough?

- Do you compare your financial progress to others?

- Are you afraid to invest or spend—even when you have the money?

Your answers may reveal which mindset is shaping your financial journey. This guide will help you shift it.

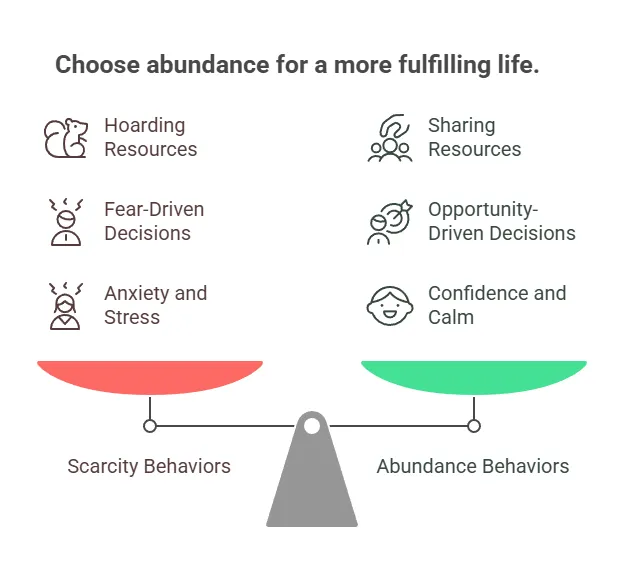

What is a Scarcity Mindset?

A scarcity mindset is a belief system rooted in the idea that there is never enough—not enough money, not enough time, not enough opportunity. It's that inner voice whispering, "I can't afford that," even when you technically can. This mindset often:

- Encourages hoarding money instead of investing

- Triggers anxiety around spending or saving

- Causes guilt when treating yourself

Promotes comparison to others

This emotional stress loop prevents long-term planning. It keeps people reacting, not leading. And in my experience, clients with this mindset rarely feel financially safe—no matter their income bracket.

Scarcity Belief to Challenge: "If I spend now, I won’t have enough later."

✅ Abundance Reframe: "I can spend wisely and still plan confidently for my future."

What is an Abundance Mindset?

In contrast, an abundance mindset views money as a tool, not a threat. It's grounded in confidence, strategy, and growth. People with this mindset:

- View setbacks as temporary, not permanent

- Make proactive investment decisions

- Align spending with their values

- Seek growth opportunities instead of cutting corners

Abundance isn't about excess—it's about intention. It's the cornerstone of long-term financial freedom.

💡 Pro Tip: Research from the CFA Institute shows that mindset-driven investors are more consistent over time.

Why Mindset is More Important Than Math

While budgets, balance sheets, and spreadsheets matter, your financial mindset dictates your consistency, resilience, and discipline. I've worked with high-net-worth clients who still lived paycheck to paycheck in their minds. I've also seen single parents with modest incomes build robust investment portfolios simply because they refused to operate from fear.

This isn't magic. It's mindset.

"Your mindset fuels your behavior. Your behavior fuels your results."

And when you shift from scarcity to abundance, everything changes—from your credit score to your confidence.

Action Plan: Steps to Shift into Abundance

- Audit Your Language

→ Replace "I can't afford that" with "How can I afford that responsibly?" - Identify Money Scripts

→ Reflect on beliefs passed down from your family. Use this money scripts guide - Create a Values-Based Spending Plan

→ Use your financial goals—not fear—as your roadmap. - Celebrate Small Wins

→ Write down every progress point, even paying $25 toward debt. - Invest in Education

→ Read, listen, and ask. Start with Future-Focused Wealth:

✅ Download the Emergency Fund Tracker to put this mindset into motion.

Financial Planning with an Abundance Lens

Working with a financial planner trained in behavioral finance can help you reframe limiting beliefs and build a strategy rooted in clarity, not fear. If you're ready to shift your mindset, here are a few actions to take:

- Book a clarity session with Melissa Cox CFP®

- Download your Future-Focused Wealth Emergency Fund Tracker:

Reframing Wealth: A Mindset-Driven Approach to Financial Planning

If you've been feeling like you're doing everything "right" financially but still aren't making the progress you want, it's time to look beyond numbers. Your mindset might be the missing link. As a Dallas-based financial planner, I combine strategic planning with mindset coaching to help individuals and families unlock their full financial potential. This isn't just about wealth—it's about peace of mind, confidence, and control. Let me help you shift your mindset, optimize your money behaviors, and design a plan that supports your best life. Because building wealth is personal, and your journey deserves a guide who sees both your balance sheet and your belief system.

Let’s move you from scarcity to security—one empowered decision at a time.

FAQs About Scarcity vs. Abundance Mindset

What causes a scarcity mindset around money?

Scarcity mindsets are often rooted in childhood experiences, generational beliefs, or financial trauma. They can develop regardless of income level.

Can an abundance mindset help with debt repayment?

Absolutely. It reframes debt from being a punishment to being a solvable challenge, and helps you act strategically instead of emotionally.

How long does it take to shift to an abundance mindset?

It's a process, not an event. But even small steps (like changing your money language or automating savings) create lasting change.