The True Cost of Raising Kids: What to Expect at Each Stage

When I wrote the “Kids” chapter of Future-Focused Wealth, it struck a personal chord. As a mom to two young girls—ages 4 and 7—it made me reflect not only on the financial choices we’ve made as a family, but on how each new season of parenting has brought new challenges (and expenses).

We haven’t hit driving lessons or college visits yet—but writing that section made me imagine what my daughters will be like as teenagers and adults. It reminded me that raising kids is one of the most joyful and financially layered experiences in life. If you're a parent in Dallas wondering how to build a plan that grows alongside your kids—you’re in the right place.

In this blog, I’ll break down the real (and sometimes surprising) costs of raising children—from cradle to college—and how to prepare for each phase with clarity, confidence, and compassion.

Why This Blog Matters (Especially in Dallas)

- Local Cost of Living: Dallas families face unique financial pressures, from rising daycare rates to competitive college tuition.

- Long-Term Planning: The earlier you plan, the more freedom and flexibility you gain later on.

- Real Talk from a CFP® Who’s Living It: I’m not just a financial planner—I’m a mom navigating these same decisions right alongside you.

Stage 1: Infants and Toddlers (Ages 0–3)

Key Expenses:

- Diapers, formula, clothing (lots of it!)

- Childcare or stay-at-home income adjustments

- Baby gear: cribs, car seats, strollers

- Medical costs and insurance planning

Dallas Insight:

In the Dallas metro area, full-time daycare costs can range from $1,000–$1,800/month for infants. Planning ahead with flexible spending accounts (FSAs) or dependent care credits can reduce out-of-pocket strain.

Planning Tip:

Start a 529 college savings plan now. Even $50/month can compound over time—and you’ll thank yourself later.

Stage 2: Early Childhood (Ages 4–7)

Key Expenses:

- Preschool or private school tuition

- Extracurriculars: gymnastics, dance, soccer

- Summer camps and enrichment programs

- Clothes (again!), birthday parties, and holiday gifts

This is the stage I’m currently in with my girls. It’s busy, beautiful—and deceptively expensive. Little things add up fast.

Planning Tip:

Build a family budget with clear “kid categories” to track enrichment vs. essentials. Consider setting limits on holiday and birthday spending to avoid overextending.

Stage 3: Tweens and Middle Schoolers (Ages 8–12)

Key Expenses:

- School supplies, uniforms, tech devices

- Camp tuition or tutoring

- Travel teams, clubs, instruments

- Early orthodontics or medical needs

Dallas Planning Insight:

Middle school is when families often begin exploring private education or ramping up enrichment. This can double or triple monthly costs.

Planning Tip:

Use this stage to teach financial literacy to your kids: savings jars, allowance systems, or chore-based “income.”

Stage 4: Teenagers (Ages 13–18)

Key Expenses:

- Car insurance and gas (if they’re driving)

- High school activity fees and senior-year costs

- ACT/SAT prep, college application fees

- Increasing grocery bills (!)

Even though I haven’t reached this stage personally, I help many Dallas families plan for it—and the jump in cost can be dramatic. From tech to transportation, teens require a deeper pool of resources.

Planning Tip:

Start college cost projections early. Use tools like the College Money Report™ to compare aid packages and avoid student loan overreach.

Stage 5: Young Adults and College Years (Ages 18+)

Key Expenses:

- Tuition, room and board

- Textbooks, transportation, travel

- Parent support (cell phones, car insurance, etc.)

- Emergencies or gap-year adventures

Dallas College Strategy Tip:

Use the College Pre-Approval™ approach to evaluate what you can afford, what aid is available, and how to avoid over-borrowing. Just because your child gets into a school doesn’t mean it’s the right financial fit.

The Lifetime Cost of Raising a Child (and Why It’s Not All About the Math)

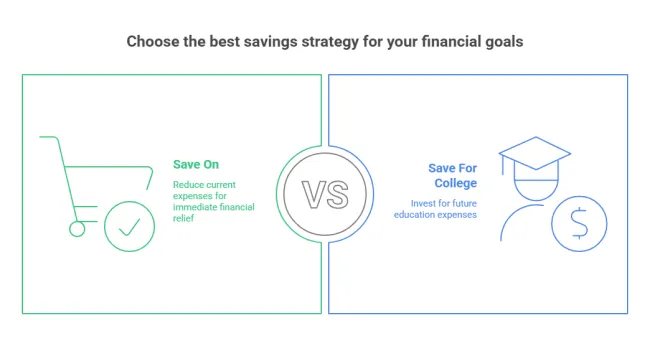

According to the USDA, the average cost of raising a child through age 18 exceeds $310,000—and that doesn’t include college. But for most families, the real concern isn’t the total number—it’s how to plan month by month, year by year.

As a Dallas CFP®, I help families create customized cash flow plans that:

- Account for seasonal expenses (like summer camps or school fees)

- Build emergency savings for the unexpected

- Automate education savings and insurance planning

When you treat parenting as part of your financial identity, everything becomes more manageable.

Financial Planning Is Family Planning

Raising children isn’t just emotional—it’s financial. And your money choices today have ripple effects across generations.

Whether your kids are in diapers or prepping for college, I help Dallas families:

- Build stage-based budgets that grow with your children

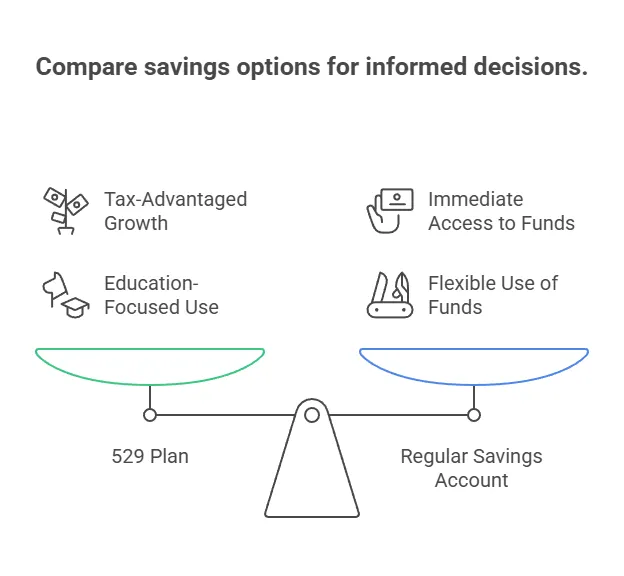

- Design tax-efficient education savings strategies

- Plan insurance and estate coverage that protects what matters most

Because at the end of the day, we’re not just planning for college… we’re planning for the life you want for your kids—and the future you want for yourself.

Raising kids is one of life’s greatest joys—and also one of its biggest financial commitments. As a Certified Financial Planner™ in Dallas, I’ve helped countless families navigate the real costs of parenting, from diapers to diplomas and everything in between. But more than the numbers, I love the conversations, the shared hopes, and the opportunity to help parents build a future that reflects what matters most. Whether you're budgeting for a toddler or planning for college, I'm here to support your journey with empathy, clarity, and strategies that truly fit your family.

📅 Ready to build a financial plan designed for real life—and real families?

👉 Schedule a call today

Ready to Create a Family-Focused Financial Plan?

Let’s build a future that grows with your family—without sacrificing today’s joy.

👉 Schedule your 1:1 strategy session

Frequently Asked Questions About Finances and Raising Children

Q: When should I start saving for my child’s education?

A: As soon as possible. Even small monthly contributions to a 529 plan compound significantly over 15+ years.

Q: How do I budget for extracurriculars and school costs?

A: Build a monthly “kid budget” with seasonal adjustments and automatic savings buckets for events like summer camps or back-to-school shopping.

Q: What if I didn’t start saving early enough?

A: It’s never too late to plan smarter. We can layer strategies that reduce student debt and make the most of current income.

Q: Are private schools worth the cost in Dallas?

A: That depends on your values, your child’s needs, and your total financial picture. We can model scenarios and compare total impact before you commit.