Do Student Loans Make Cents?

As a Dallas-based Certified Financial Planner™, I’ve had more than a few conversations with clients—especially young professionals and parents—who feel overwhelmed by the weight of student loans. For some, those loans opened doors to higher income and career advancement. For others, they’ve become a source of financial stress, regret, and delayed goals. So, the real question becomes: Do student loans actually make sense—or just cents?

In this guide, we’ll break down the true cost of borrowing, dispel common myths, and walk through smarter strategies to manage—or avoid—student debt entirely. If you're trying to make confident, informed decisions about higher education and financial freedom, you're in the right place.

The True Cost of Student Loans

Student loans are often considered a necessary step toward higher education. But are they always a good financial decision? While a college degree can increase lifetime earnings, student loans can also lead to long-term debt struggles if not managed wisely.

In this guide, we’ll break down how student loans work, repayment strategies, and whether taking on student debt makes financial sense for you.

🔹 Related Read: The Ultimate Guide to Financial Planning

Fact or Fiction? Common Myths About Student Loans

🚫 Fiction: “Student loans are free money.”

✅ Fact: Student loans must be repaid—with interest. Borrow only what you need.

🚫 Fiction: “All student loans are the same.”

✅ Fact: Federal and private loans have different interest rates, repayment options, and forgiveness programs.

🚫 Fiction: “Student loan forgiveness is guaranteed.”

✅ Fact: Public Service Loan Forgiveness (PSLF) has strict eligibility requirements and isn’t guaranteed.

🚫 Fiction: “I should always extend my repayment term to lower my monthly payment.”

✅ Fact: Longer repayment terms mean paying more in interest over time.

How Student Loans Work

Understanding student loans is essential before taking on debt. Here are key terms you should know:

- Principal: The amount borrowed.

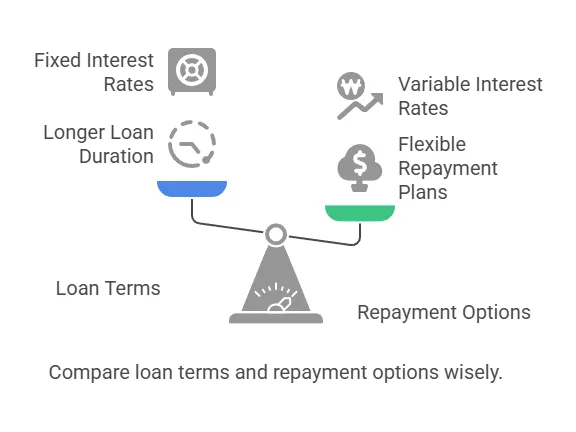

- Interest Rate (APR): The cost of borrowing money, either fixed or variable.

- Loan Term: The number of years to repay the loan.

- Federal vs. Private Loans: Federal loans offer lower interest rates and income-driven repayment options, while private loans often depend on credit history.

📌 Rule of Thumb: Expect to repay $100 per month for every $10,000 borrowed over a 10-year term.

🔹 Related Read: Understanding Your Credit Report

How Loan Term Affects Total Cost

Extending your repayment term lowers your monthly payment but increases your total repayment amount. Here’s an example:

📌 Takeaway: Choosing a longer repayment term may seem affordable month-to-month, but you’ll pay significantly more over time.

🔹 Related Read: 5 Budgeting Methods Compared

How to Pay Off Student Loans Faster

If you want to minimize interest payments, consider these strategies:

✅ Make Extra Payments: Even $50 more per month can shorten your loan term and save thousands in interest.

✅ Automate Payments: Many lenders offer interest rate discounts for autopay enrollment.

✅ Use Windfalls Wisely: Tax refunds, bonuses, and financial gifts can go toward principal reduction.

✅ Avoid Lifestyle Inflation: Keep your expenses low after graduation and allocate extra income to loan repayment.

📌 Pro Tip: Tell your lender to apply extra payments toward the principal, not future interest!

🔹 Related Read: Growing Your Savings Rate in Your Financial Plan

When Extra Loan Payments Don’t Make Sense

For borrowers pursuing Public Service Loan Forgiveness (PSLF) or income-driven repayment, extra payments may not be beneficial. Instead, focus on:

✅ Ensuring PSLF-eligible payments count

✅ Maximizing retirement savings

✅ Building an emergency fund before aggressive repayment

🔹 Related Read: How to Build an Emergency Fund

Final Thoughts: Let’s Make Student Loans Work for You—Not Against You

Student loans aren’t inherently good or bad—they’re just tools. The real power lies in how you use them, plan around them, and ultimately manage them within your broader financial picture. Whether you're navigating repayment, deciding how much to borrow, or figuring out how loans fit into your long-term goals, you don’t have to figure it all out alone.

As a fiduciary financial planner, I help individuals and families build smart, student-loan-aware strategies that support real life—not just financial theory. If you're ready to take control of your debt, design a plan that works for your future, and stop second-guessing your decisions...

📅 Let’s connect and build a plan that makes cents.

👉 Schedule a strategy session with Melissa Cox, CFP®

FAQs: Student Loan Essentials

Q. How do I know if I should take out student loans?

A. Consider the return on investment—the expected salary in your field vs. the total cost of your degree.

Q. What’s the best way to lower student loan interest?

A. Make extra principal payments, set up autopay, and explore refinancing options.

Q. Is student loan refinancing a good idea?

A. It depends! Federal loans lose access to income-driven repayment and forgiveness when refinanced privately.

Q. Should I pay off student loans or invest?

A. If your loan interest rate is above 6%, prioritize repayment. If it's lower, consider investing alongside paying loans.

Q. What’s the biggest mistake people make with student loans?

A. Borrowing more than needed and failing to explore grants, scholarships, and work-study options.