Creating a Family Budget That Works

As a Certified Financial Planner™ and a mom raising two girls in Dallas, I know how chaotic family life can feel—school schedules, grocery bills, sports, birthdays, summer camps, and those “surprise” expenses that never seem to stop.

In my book Future-Focused Wealth, the chapters on family finances came straight from experience. Creating a working family budget didn’t just help me support my goals—it brought peace of mind to our daily life.

I believe budgeting isn’t about restriction—it’s about intention. When you know where your money is going, you gain confidence, control, and clarity. This blog is your step-by-step guide to building a realistic family budget that fits your life (not someone else’s spreadsheet).

Why Most Budgets Fail (and How to Fix Yours)

Most families don’t fail at budgeting because they lack discipline—they fail because the method doesn’t fit their life.

A budgeting plan that works for your friend, neighbor, or favorite finance influencer may fall flat for your unique family structure, income, and values. That’s where most budgeting frustrations begin.

Common reasons why budgets fail:

-

Too complicated – If your budget takes hours a week to maintain, you won’t stick with it.

-

Too rigid – Life happens. If there’s no flexibility built in, your budget becomes a stressor.

-

Not personalized – You’re using someone else’s structure without considering your family’s priorities, income rhythm, or goals.

Dallas Budgeting Insight: The #1 mistake I see as a Dallas Certified Financial Planner™ is families trying to force a budgeting method that doesn’t match their real-life cash flow.

Budgeting works when it’s customized. That’s why I help families create flexible, realistic systems that evolve with them—not rigid blueprints that lead to guilt, confusion, or burnout.

Whether you're living on a single income, managing childcare expenses, or trying to balance debt payoff with college savings, the right plan is the one that fits your family—not a template from social media.

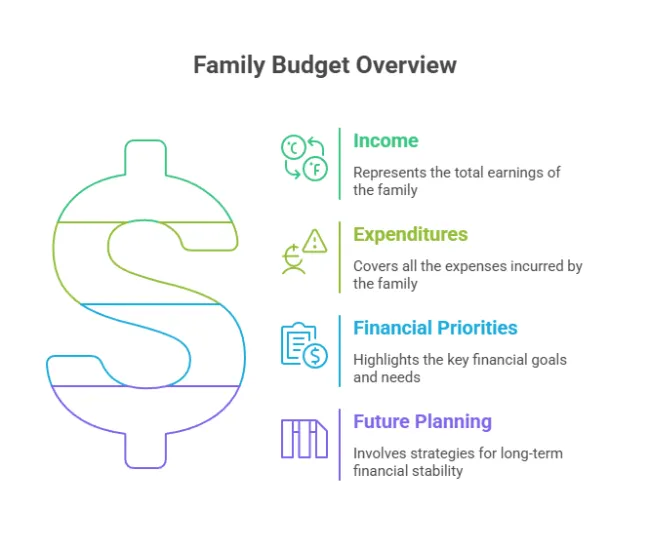

Step 1: Define Your Family’s Financial Values

Budgeting doesn’t begin with numbers—it starts with meaning. Before you dive into spreadsheets or apps, take time to define your family’s core financial values. This is especially important for families juggling multiple priorities in a fast-paced environment like Dallas.

Ask yourselves:

-

What are we truly saving for—short-term peace of mind or long-term legacy?

-

What kind of life are we trying to build, and what does financial freedom mean to us?

-

Are we prioritizing travel, faith-based giving, private education, home upgrades, college for the kids, or early retirement?

Whether you're a dual-income household in the suburbs or a growing family balancing childcare and careers in the city, your budget should reflect your real-life goals—not a generic online template.

📌 Dallas Planning Tip: Sit down as a family and create a “values hierarchy.” Rank your priorities in order of importance—this becomes the backbone of your budget categories and ensures your spending supports what matters most.

💡 Why This Matters:

One of the most common reasons family budgets fail is because they’re based on someone else’s version of success. If you're using a budgeting method that doesn't reflect your lifestyle, values, or income rhythm, it won’t stick—no matter how well it's designed. As a Dallas Certified Financial Planner™, I always begin budget planning by aligning with what you care about most.

Step 2: Track Your Spending (Without Judgment)

You can’t build a plan if you don’t know where your money is going. Step two in creating a realistic family budget is getting clear on your current spending habits. That means looking at 3–6 months of your household’s actual expenses, across:

-

Bank accounts

-

Credit cards

-

Auto-pay subscriptions

-

Cash purchases and Venmo-type transfers

This isn’t about guilt or “gotchas”—it’s about building awareness. Every family has spending blind spots (even mine!), and the goal here is to bring them into the light so we can plan better, not feel worse.

🧠 Use these updated tools for tracking:

📥 Free Download:

👉 Family Budget Tracker Template

📌 Dallas Financial Planning Tip: Many of my clients are surprised by how much “leaks” out through drive-thrus, impulse Amazon purchases, and kids’ activities. Once we categorize it all, we can decide what’s worth it—and what’s just noise in the budget.

Step 3: Use a Flexible, Bucket-Based System

Once you know where your money is going, it’s time to put your spending into a framework that works—not just one that looks good in a spreadsheet. I recommend the “bucket method” because it gives your budget breathing room and aligns with how real families live.

This approach divides your take-home income into three major categories:

📌 Dallas Family Tip: For growing families in North Texas—especially those juggling daycare, rising home costs, and school expenses—“Essentials” may creep higher. That’s okay. The key is to adjust based on your life stage and shift as your financial picture evolves.

🛠️ Customize Your Buckets Based on Season of Life:

-

New parents? You might need to allocate more toward childcare or baby supplies.

-

Teens at home? Add line items for driving expenses, extracurriculars, and college prep.

-

Dual-income household with irregular bonuses or commissions? Use “Savings & Debt” as a buffer to absorb fluctuations and boost longer-term goals.

📌 Pro Insight: As a Dallas Certified Financial Planner™, I often recommend clients use buckets per paycheck, not just per month. This helps manage cash flow more precisely and keeps things from falling through the cracks.

💬 Remember: Flexibility = sustainability. Budgets that are too rigid are the first to break. Give yourself permission to adjust as needed—your budget should serve your life, not the other way around.

Step 4: Budget Based on Paychecks—Not Just the Calendar

Here’s one of the biggest mistakes I see families make when trying to budget:

They plan by the month, but they get paid by the paycheck.

Whether your income arrives biweekly, semi-monthly, or even irregularly, your budgeting system should match your income flow—not force you to squeeze your life into monthly boxes that don’t reflect reality.

💡 Why This Matters:

When you align your budget with your pay cycle, you gain control over timing. You know when bills are due, which paycheck will cover them, and how much is left to allocate toward savings or flexible spending.

✅ Try the “Paycheck Budget” Method:

Instead of one monthly budget, split your plan by paycheck:

-

Paycheck #1: Mortgage, utilities, groceries

-

Paycheck #2: Car payment, gas, savings contribution, dining out

🔁 Use your bucket system from Step 3 within each pay cycle to cover:

-

Essentials

-

Wants

-

Savings/Debt

🧮 Dallas Planning Insight:

In my practice, I often work with teachers, healthcare workers, and tech professionals whose pay schedules vary. We build paycheck-by-paycheck spending plans to ensure big expenses like childcare, tuition, or annual insurance premiums don’t catch them off guard.

📌 Pro Tip: Set recurring calendar reminders around payday to:

-

Transfer savings immediately

-

Pay key bills on time

-

Review remaining discretionary funds

🧠 This rhythm builds financial discipline—and it minimizes the stress of mid-month surprises.

Schedule a 1-on-1 Call With Melissa

Step 5: Automate Everything You Can (Because Life Is Busy)

As a Dallas-based financial planner and mom, I’ll be the first to say it—life gets chaotic. Between school pickups, dinner prep, work deadlines, and all the “extras” that come with raising a family, it’s easy to forget a bill or skip a savings deposit.

That’s why automation is the secret weapon of successful family budgets.

When you automate your financial systems, you stop relying on willpower and start relying on structure. You make progress by default, even when life gets hectic.

🔁 What You Should Automate:

-

✅ Bill payments (utilities, subscriptions, insurance)

-

✅ Emergency fund contributions

-

✅ Roth IRA deposits

-

✅ 529 Plan or college savings contributions

-

✅ Credit card minimum payments (at minimum!)

📌 Dallas Planning Tip: I recommend automating savings to happen right after payday—before you’re tempted to spend it. “Pay yourself first” isn’t just good advice—it’s a proven strategy.

🧠 Why Automation Works (Backed by Behavioral Finance)

Financial psychology shows that removing friction (like having to log in, make a decision, or move money manually) dramatically increases your chances of sticking to a financial plan.

In other words:

If you set it and forget it, your money will work harder—even when you’re not thinking about it.

📥 Free Resource:

👉 Download the Future Focused Emergency Fund Tracker

Automation doesn’t mean giving up control—it means creating a baseline of financial success that works while you live your life. And when paired with intentional reviews (see Step 7), you stay flexible without falling behind.

Step 6: Plan for Irregular Expenses (Because Surprises Aren’t Really Surprises)

Most family budgets don’t fail because of overspending on groceries or streaming services.

They fail because of irregular—but completely predictable—expenses that weren’t accounted for.

Think about it… holidays, summer camps, back-to-school shopping, birthday parties, vet visits—these happen every year. Yet most families treat them like emergencies when they pop up.

🎯 The Budgeting Fix? Sinking Funds.

A sinking fund is a separate savings bucket where you set aside money each month for known future costs.

Here are a few smart sinking fund categories I often build into Dallas family budgets:

-

🎁 Holidays & gifts (Christmas, birthdays, teacher gifts)

-

🏖️ Vacations & travel

-

🎒 Back-to-school shopping

-

☀️ Summer camps or childcare

-

🚗 Car maintenance

-

🐶 Pet care & vet bills

-

🧾 Annual insurance premiums

📌 Dallas Planning Tip: Multiply each expense by 12 and divide by the number of months until it's due. For example:

If you want to spend $1,200 on the holidays, save $100/month starting in January.

How to Set Up Sinking Funds

-

🏦 Use labeled sub-savings accounts at your bank or credit union.

-

📲 Use apps like Qube, YNAB, or even an old-school spreadsheet.

-

🔄 Automate transfers on payday—treat it like any other bill.

🧠 Behavioral Finance Insight: When money is mentally and physically separated for a purpose, you're less likely to raid it for impulse spending. That means fewer financial “oops” moments.

Why Irregularity Matters

Irregular expenses are not emergencies—they’re just poorly planned regular expenses.

When your budget accounts for the ebb and flow of real life, you build stability, confidence, and peace of mind.

📥 Free Resource Reminder:

👉 Download the Family Budget Tracker

Hover text: “Track fixed, variable, and seasonal expenses with ease.”

Step 7: Review Monthly & Adjust Quarterly

A static budget is a broken budget.

One of the biggest reasons budgets fail is because they don’t evolve with your life. Your expenses, priorities, and income shift over time—and your budget needs to keep up.

🗓️ Monthly Budget Check-In

Once a month, take 20–30 minutes to sit down (as a couple, or solo if you manage finances) and:

-

Review your actual spending against your plan

-

Look for categories that consistently go over or under

-

Adjust upcoming expenses based on changes (e.g., new childcare, increased gas, or subscription costs)

💬 Dallas Financial Planner Tip: Don’t aim for perfection—aim for awareness. Even messy data is better than no data.

📅 Quarterly Budget Tune-Up

Every 3 months—or after major life changes—review your entire budgeting system:

-

Are your sinking funds on track?

-

Has your income changed?

-

Are your savings goals still aligned with your values?

-

Has your family hit a new stage (starting daycare, new school year, job change)?

📌 If the answer to any of these is "yes," it's time to realign your budget.

What Triggers a Full Budget Refresh?

Here are a few life events that warrant a full rework of your budget:

-

🍼 New baby or childcare shift

-

🏡 Move to a new home or city

-

💼 Job change or income change

-

🏥 Medical bills or health-related changes

-

🎓 Kids entering a new school phase

- 🧾 Debt payoff or refinancing

By creating a dynamic budget that adapts to your life, you avoid the all-or-nothing trap that causes most people to give up. That means:

-

Less stress during life transitions

-

Better progress toward long-term goals

-

And a budgeting system you’ll actually stick with

💬 As a Dallas-based Certified Financial Planner™, I help families design flexible budgeting frameworks that evolve with them—not against them. Whether you're a new parent or navigating the teen years, your budget should grow with you.

👉 Want a custom-built system tailored to your life? Schedule a free strategy call today

Bonus: Common Budgeting Pitfalls (and How to Fix Them)

Even the most well-intentioned family budgets can fall apart without the right systems in place. As a Dallas financial planner, I’ve seen time and again that it’s not the math—it’s the method that breaks things down. Below are some of the most common budgeting fails Dallas families encounter, along with real-world strategies to fix them.

📌 Dallas Planning Tip: Your budget should evolve as your life changes. A growing family, a new job, or shifting priorities all require regular budget checkups—just like your financial plan.

Sample Budget Template for a Dallas Family

Every household is different, but here’s a realistic starting point for a middle-income family of four living in Dallas. This breakdown reflects typical expenses based on regional cost of living and the values of intentional, goal-oriented budgeting.

🔍 Dallas Family Insight: Whether you’re saving for college, funding private school, or managing extracurricular chaos, flexible categories allow you to adapt your budget as your kids grow and your priorities shift.

📥 Get the Editable Version: Wealth Tracker

Budgeting for Dual-Income Families

If you and your partner both earn incomes, you have a powerful opportunity—but also an increased risk of “lifestyle creep.” Here’s the strategy I use with many of my Dallas-based dual-income clients:

💡 Base your core budget on ONE income.

Build your essentials—housing, food, transportation, insurance—around the lower of the two incomes. This gives you breathing room and resilience in case of job loss, maternity/paternity leave, or a career change.

Use the second income for strategic goals like:

-

Emergency fund growth

-

Family vacations (without credit card debt!)

-

College savings (like 529 plans)

-

Retirement contributions

-

Paying off debt faster

📌 Dallas Planning Tip: If you want to transition to one parent staying home, starting a business, or scaling back hours, this strategy gives you options without upending your entire financial life.

What Readers Are Saying About Future-Focused Wealth

My approach to family budgeting—and financial planning in general—isn’t based on theory. It’s grounded in real-world experience, both as a Certified Financial Planner™ and as a mom managing money in the chaos of real life. That’s why I wrote Future Focused Wealth—to give families a practical roadmap they can follow with confidence.

Here’s what readers have said:

🗣️ “This is an amazing book with so much important information to help anyone at any age get their finances in shape... from stress to confidence.”

– Janis, Verified Amazon Reviewer

🗣️ “With unusual clarity (and even a fun sense of humor), Melissa Cox covers just about every money topic anyone from 16–96 should know about.”

– Christine Nicolette-Gonzalez, Author of My Mother’s Curse

🗣️ “Enjoyable and easy to read.”

– Fahad A., Verified Amazon Review

📘 Want to explore the full book?

👉 Grab your copy of Future-Focused Wealth

Final Thoughts: Budgeting Isn’t About Deprivation—It’s About Direction

You don’t have to track every penny, sacrifice your family’s joy, or feel like you’re failing to manage your money. What you do need is a budgeting system built around your real life, your family values, and your evolving goals.

As a Dallas-based Certified Financial Planner™—and a mom who’s lived through the budgeting chaos—I help families just like yours turn confusion into clarity. Whether you're trying to make room for college savings, tackle debt, or simply gain more control over everyday expenses, we’ll build a budget that actually works for your household.

This isn’t about restriction. It’s about building a financial future with purpose, flexibility, and peace of mind.

📅 Ready to take control of your family’s finances and create a budget that fits your life—not someone else’s spreadsheet?

👉 Schedule a 1-on-1 planning call with me today

FAQs: Family Budgeting in Dallas

Q: What’s the best budgeting method for families?

A: The one you’ll stick with—zero-based, 50/30/20, or envelope systems are all valid.

Q: Should I use budgeting apps or spreadsheets?

A: Whichever suits your personality. Apps automate; spreadsheets customize.

Q: How do I budget with irregular income?

A: Budget from your lowest reliable income. Save extra during high-income months.

Q: Can kids be involved in budgeting?

A: Yes! Teens can help with categories, savings goals, and even grocery planning.

Q: What if we’re always over our grocery budget?

A: Track it for two months. Then tweak: meal plan, use reward apps, or adjust the budget.