Why Income Planning Is the Missing Link in Your Financial Strategy

The Most Overlooked Power Tool in Your Financial Plan

As a Dallas CERTIFIED FINANCIAL PLANNER™, I work with high-achieving professionals, driven families, and entrepreneurs building their future with intention. Most come to me with clear goals—save more, retire smarter, minimize taxes—but there’s one critical piece many haven’t considered: income planning.

And here’s the truth: Income is the engine of your entire financial life. Without a plan for how your money comes in, it’s nearly impossible to make smart decisions about how it goes out—into savings, into investments, or into your future.

In a fast-paced city like Dallas—where careers evolve quickly, side hustles flourish, and entrepreneurship is thriving—your income potential is exciting, but also unpredictable. That makes income planning not just important, but absolutely essential.

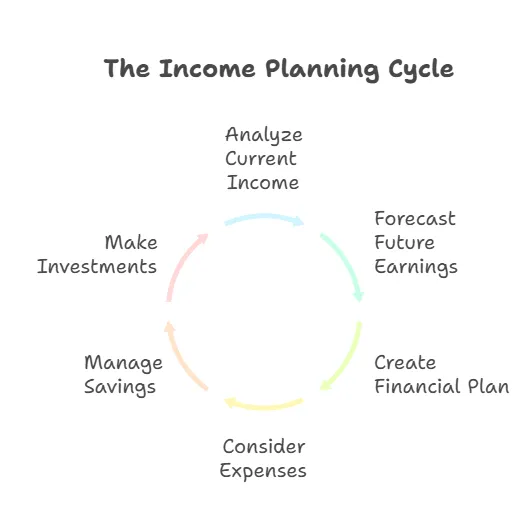

What Is Income Planning? (And Why It’s More Than Budgeting)

Think of income planning as a strategy for how your money enters your life—not just this year, but five, ten, or twenty years from now.

It’s about more than just tracking paychecks or setting a budget. It means:

- Understanding where your income comes from—salaries, side gigs, rental properties, business profits

- Anticipating shifts in your earnings over time

- Designing a system that aligns your income with your goals, taxes, savings, and spending priorities

At Future-Focused Wealth, income planning is the foundation. It’s where your investment strategy, tax plan, and retirement roadmap all begin. Because if you don’t know what’s coming in—or what could come in—how can you confidently plan for what’s going out?

Why Dallas Residents Can’t Afford to Skip This Step

Dallas is booming—but that growth comes with complexity. Real estate costs swing between neighborhoods. Property taxes bite into monthly budgets. And many professionals earn income from multiple, sometimes inconsistent, sources.

That’s why Dallas financial advisors like me are laser-focused on:

- Structuring income for tax efficiency

- Creating flexible income plans for retirement

- Navigating volatility for entrepreneurs and commission earners

- Ensuring every dollar works harder—not just for today, but for decades to come

Why Income Planning Should Lead Your Financial Plan

Here’s something I tell nearly every client: If you’ve ever asked, “How much do I need to save?”—you’re really asking an income question.

Because the answer depends entirely on how much income you need… and how much you expect to have.

Most financial planning starts with assets. I take a different approach—starting with income—because:

- Income drives your savings power

- Income determines your lifestyle expectations

- Income continuity in retirement is the goal we’re reverse-engineering toward

By building a financial plan that starts with income, we make sure your strategy isn’t just technically correct—it’s real-life resilient

From Paycheck to Portfolio: How Income Shapes Retirement

Most people think retirement planning begins with investments. In reality, it begins with understanding income—how much you’ll need, where it will come from, and how long it will last.

Here’s how we help Dallas clients bridge the gap between working income and retirement income:

1. Track and Understand Your Spending

You can’t design a retirement income plan if you don’t know how much life costs. At Future-Focused Wealth, we help clients separate core expenses (mortgage, healthcare, insurance) from discretionary expenses (travel, hobbies, dining). This clarity tells us what income must be guaranteed—and where we can build in flexibility.

2. Calculate the Retirement Income Gap

Subtract your projected guaranteed income—like Social Security or pensions—from your estimated future spending. The difference is your retirement income gap—the amount your savings and investments must cover. That number becomes your income target.

3. Build the Income Engine

Once we know the gap, we create an income engine using a mix of:

- Tax-deferred account withdrawals (like 401(k)s and Traditional IRAs)

- Roth conversions to lower future tax liabilities

- Income-producing assets such as dividend stocks, annuities, or a bond ladder

- Taxable brokerage accounts for liquidity and tax management

This structure allows you to draw income efficiently, preserve capital, and reduce the chances of outliving your money.

4. Account for Taxes

Texas doesn’t have a state income tax—but don’t get too comfortable. Federal taxes still matter. And your Medicare premiums, Social Security taxation, and future tax brackets are all influenced by your income in retirement.

Through smart income planning, we help clients in Dallas avoid common tax pitfalls, including:

- Triggering unexpected tax brackets

- Paying Medicare IRMAA surcharges

Causing Social Security income to become taxable

How to Build an Income Plan That Lasts

Building a smart income plan is like designing a GPS for your financial journey—it doesn’t just tell you where you are, it shows you where you’re going and how to get there efficiently.

Here’s how we do it:

Step 1: Identify All Income Sources

Catalog your current and potential income:

- W-2 or 1099 income

- Business earnings

- Rental properties

- Investment interest and dividends

- Spousal or child support

- Government benefits or pensions

Step 2: Estimate Your Lifestyle Costs

Use real data. Separate:

- Essentials: housing, food, healthcare, insurance

- Discretionary: travel, entertainment, gifting

Create both a monthly and annual spending target. This tells you how much income you’ll need.

Step 3: Set Short- and Long-Term Income Goals

Short-term: building cash reserves, paying off debt

Long-term: financial independence, business exits, retirement

Each phase of life needs a different income approach.

Step 4: Evaluate Income Stability and Risk

Assess how reliable each income stream is. Salaries may be stable, but gig income or commissions aren’t. This affects:

- Emergency fund size

- Insurance needs

- How much income can you count on

Step 5: Optimize for Tax Efficiency

A Dallas financial advisor can help you:

- Leverage pre-tax retirement accounts (401(k), SEP, SIMPLE)

- Time Roth conversions during low-income years

- Use business deductions for self-employed income

- Reduce tax drag on your investment portfolio

Step 6: Use Tools to Stay on Track

Our Personal Financial Portal lets you:

- Track spending and savings

- Monitor cash flow from multiple sources

- Store tax documents and financial goals

- View your financial life in real time

Step 7: Review Regularly

Check in every 6 to 12 months—or when your life changes. Income planning is not “set it and forget it.” It evolves with your career, family, business, and goals.

Final Thoughts: Income Planning Is Your Financial Foundation

You’ve worked hard to build wealth. Income planning ensures that wealth supports your life—not just now, but in every season ahead.

At Future-Focused Wealth, we don’t chase trends or build cookie-cutter portfolios. We help Dallas families and professionals build financial plans rooted in income clarity, tax efficiency, and long-term resilience.

Whether you’re navigating a complex career path, growing a business, or planning for a vibrant retirement, your income is your power source—and we’ll help you make the most of it.

Let’s map out your income strategy together. Schedule a free session with Melissa Anne Cox, CFP®.

Frequently Asked Questions - Retirement Income Planning

Q: What exactly is income planning?

Income planning involves mapping out how much and from where your money will come—from now until retirement. It accounts for salary, side gigs, business earnings, investment income, and government benefits. It’s the anchor of your financial house, guiding how much you save, invest, and withdraw.

Q: Is it more important than budgeting?

It’s complementary. Budgeting sets the foundation (expenses), while income planning builds the structure (income sources). You need both: budgeting tells you what your money needs to do, and income planning tells you how it gets there.

Q: How often should I revisit my income plan?

At least every 6–12 months—or after major life events such as a job change, business success, family growth, or market shifts. As your income evolves, so must your plan.

Q: Does this work if I have side hustles?

Absolutely. Income planning thrives when you have multiple income streams. We help you assess stability, tax implications, and how much of each stream can safely fund your plan without burnout.

Q: How do I avoid paying too much tax in retirement?

By incorporating tax-efficient tools like:

- Pre-tax accounts (401(k), SEP IRA)

- Roth conversions in low-income years

- Taxable accounts for flexibility

We design your income mix to minimize tax burdens and maximize after-tax retirement income.

Q: Do I need a financial advisor to build an income plan?

You don’t have to—but a Dallas-based CFP® like me brings experience in structuring income, managing tax strategies, and adapting plans during life changes. It can mean the difference between a plan that works on paper and one that works in real life.