Scholarship Strategies That Work: Finding Free Money for College

Strategic Planning = Smarter Funding

At Future-Focused Wealth™, I help families navigate one of the most emotionally charged financial goals they’ll ever face: paying for college without compromising their future.

Whether you're earning $90K or $900K, the truth is the same—college is a major investment, and most families are underprepared for the rising cost, the hidden aid rules, and the myth that smart kids automatically get free money.

As a CERTIFIED FINANCIAL PLANNER™ (CFP®) and a College Funding and Student Loan Advisor (CFSLA), I bring a coordinated, tax-aware, and goal-based approach to college planning—integrating aid strategy, financial aid forms, retirement projections, and real family budgets.

And here’s what I’ve seen year after year:

You can have a straight-A student with a perfect SAT score...

You can save diligently in a 529…

You can even have grandparents pitching in…

And still miss out on thousands in scholarships because your timing was off, your FAFSA wasn’t filed, or your strategy didn’t match your student’s school list.

Scholarships aren’t about luck. They’re about leverage.

And that leverage comes from early planning, proper positioning, and knowing how schools—especially private ones—use aid to shape their class. You don’t have to be an expert on financial aid… but you do need one in your corner.

This blog breaks down the real scholarship ecosystem—why some students get overlooked, how to build a winning strategy, and what tools Dallas families can use to pay less for college without sabotaging their retirement or financial independence.

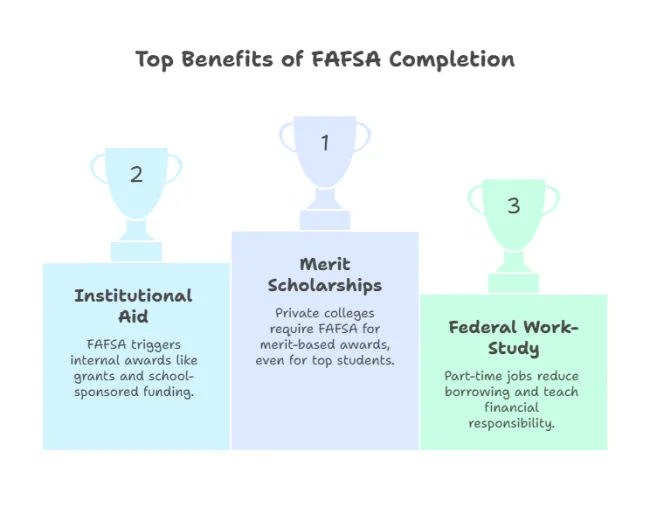

FAFSA First: The Golden Key to Unlocking Aid

f your student skips the Free Application for Federal Student Aid (FAFSA), they’re not just opting out of federal grants—they’re potentially shutting the door on tens of thousands of dollars in scholarships, work-study opportunities, and low-interest loans.

FAFSA isn’t just about need-based aid—it’s the gateway to nearly all forms of college funding.

Whether your family is middle-income, high-income, or ultra-high-net-worth, most colleges—especially private institutions—use FAFSA data to determine eligibility for both merit and institutional aid. And yes, that includes students who don't “need” federal aid.

What Families Lose by Skipping FAFSA:

- Merit Scholarships

Many private colleges require a completed FAFSA before offering merit-based awards—even if the student ranks in the top 5% of their class.

- Institutional Aid from Public and Private Schools

FAFSA data is often used to trigger internal awards, including grants, discounts, and school-sponsored funding that don’t appear on public scholarship lists.

- Federal Work-Study and On-Campus Employment Opportunities

These part-time jobs offer more than a paycheck—they help reduce borrowing and teach financial responsibility.

- Unsubsidized Federal Student Loans

Even if you don’t qualify for Pell Grants, unsubsidized loans are available to most students—but only if they’ve filed the FAFSA.

FAFSA Stats Every Parent Should Know

- $3.75 billion in free federal aid goes unclaimed each year—largely due to families not filing the FAFSA.

(Source: National College Attainment Network)

- FAFSA now pulls income from the prior-prior year—meaning your student’s sophomore year of high school is what determines freshman year aid eligibility.

(Example: Class of 2026 uses 2024 tax data.)

- Over 92% of undergraduate students receive some form of aid—and that includes students from families earning well into the six figures.

(Source: National Center for Education Statistics)

Dallas Planning Insight:

Even if your income puts you outside traditional need-based aid brackets, skipping the FAFSA can still hurt you. Many Dallas-area families lose out on merit scholarships at top private universities like SMU, Rice, or TCU simply because they didn’t file.

At Future-Focused Wealth™, I help Dallas families file early, file correctly, and use FAFSA as a strategic tool—not a guessing game.

Why Smart Kids Don’t Always Get Scholarships

One of the biggest misconceptions I hear from families—especially those with high-achieving students—is:

“My kid is in the top 10% of their class. Scholarships won’t be a problem.”

Unfortunately, that’s not how the system works.

Straight A’s and stellar test scores don’t guarantee free money. Where your student applies often matters more than how smart they are.

Let’s break down why.

Public Colleges = Limited Merit Aid

While public state universities appear more affordable on paper, they often have smaller aid budgets and less flexibility with merit awards—especially for middle- and high-income families.

Here’s what that typically looks like:

- Tight scholarship caps driven by legislative budgets and state funding priorities

- Fewer merit awards, and those that exist are often reserved for lower-income or in-state students

- Less aid for out-of-state students, regardless of academic performance

- Minimal flexibility in pricing—you pay what’s listed, even if your student excels

Dallas Example: UT Austin and Texas A&M offer great in-state rates, but merit aid is limited and highly competitive. Many top-tier Dallas students receive little to no merit-based help, even with 4.0+ GPAs and test scores.

Private Colleges = Larger, More Flexible Scholarships

Here’s where families are often surprised: Private colleges—yes, the ones with the $60K+ sticker price—can actually be more affordable.

Why?

Private institutions typically have:

- Large endowments that fund generous aid packages

- Substantial merit scholarships based on academics, leadership, or extracurricular excellence

- More flexibility to “discount” tuition to attract top students—regardless of family income

- The ability to meet a higher percentage of “need”—even when your SAI is high

Case in Point: A $75,000/year private college offering your student a $40,000 scholarship results in a net cost of $35,000/year. That’s cheaper than a $25,000/year public school offering no aid or only federal loans.

Planning Insight:

Families often overlook elite private schools assuming they’re “out of reach.” In reality, many Dallas-area families pay less out-of-pocket at private universities like SMU, Trinity, or Baylor than they would at flagship public institutions—simply because the aid structures are built differently.

At Future-Focused Wealth™, I help you:

- Identify schools that are generous with merit and need-based aid

- Compare true net price, not just sticker price

- Create application strategies that align your student’s strengths with colleges that reward them

Understanding the SAI: What Determines Aid Now

As of 2024, the Student Aid Index (SAI) has officially replaced the outdated Expected Family Contribution (EFC). But while the name has changed, the stakes have only grown higher.

The SAI is the single most important number in your student’s college funding journey. It determines how much financial aid your family qualifies for—both from the federal government and from most colleges themselves.

And here’s the key: you don’t get to negotiate it. You plan for it.

Let’s break down what drives your SAI—and what you can do about it.

What Counts Toward the Student Aid Index

Parent Income — From Two Years Prior

- FAFSA uses the “prior-prior year” income, meaning if your child is entering college in 2026, your 2024 tax return is what matters.

- That means your income during their sophomore year of high school determines freshman-year aid.

- Wages, bonuses, business income, and even certain capital gains are all factored in.

- FAFSA uses the “prior-prior year” income, meaning if your child is entering college in 2026, your 2024 tax return is what matters.

Student Income and Assets

- Student earnings over $7,600 (approx.) can count heavily against aid eligibility.

- Assets in the student’s name—like UGMA/UTMA accounts—are assessed at a 20% rate, compared to 5.64% for parent assets.

- Scholarship funds left over from previous years can also raise red flags if not structured properly.

- Student earnings over $7,600 (approx.) can count heavily against aid eligibility.

Parent Assets (But NOT Retirement Accounts)

- 529 plans, savings, and brokerage accounts in the parent’s name are assessed lightly (up to 5.64%), but they still count.

- Retirement accounts (401(k)s, IRAs, Roths) are not included in the formula—though distributions may be.

- 529 plans, savings, and brokerage accounts in the parent’s name are assessed lightly (up to 5.64%), but they still count.

Family Size Matters (But Not College Count Anymore)

- FAFSA now accounts for the total number of people in the household.

- BUT: Starting with the FAFSA Simplification Act, the number of kids in college no longer lowers your SAI—a major change that hurts families with multiple college-bound children.

- FAFSA now accounts for the total number of people in the household.

Strategic FAFSA Timing Insight

If your child is in 10th grade right now, your 2024 income and assets are what colleges will use to determine their 2026 freshman aid package.

That gives you a limited window to plan strategically, including:

- Roth conversions (timed correctly to avoid FAFSA-year income spikes)

- Managing bonuses or business income deferments

- Repositioning assets from student-owned to parent-owned accounts

- Reducing cash-heavy holdings that count more than retirement assets

Dallas Financial Strategy Tip:

High-earning families often assume they’re “too wealthy” to qualify for aid—but smart income and asset planning can reduce your SAI by thousands, unlocking need-based aid at private schools and positioning your student for institutional merit.

Bottom line? The SAI isn’t just a number—it’s a strategy target. And the sooner we align your finances with that target, the more options your student will have when it matters most.

Where the Money Is: Types of Scholarships (and How to Get Them)

One of the biggest misconceptions in college planning? That scholarships only come from outside sources like private companies or essay contests. In reality, most scholarship money comes directly from the colleges themselves—but only if you know how to find it, apply for it, and position your student correctly.

Here’s a breakdown of the three major types of scholarship opportunities available—and how to maximize each:

Institutional Scholarships

These are scholarships awarded directly by the colleges your student applies to. In fact, they represent the largest pool of available “free money”—often far exceeding anything you’ll find from private searches.

What to Know:

- Based on GPA, SAT/ACT scores, extracurriculars, and leadership

- Often automatically awarded during the admissions process (but may require FAFSA submission)

- Frequently renewable for all 4 years—with GPA or enrollment requirements

- Can be stacked with state or outside aid, depending on the school

Dallas Insight: Private colleges—especially those with large endowments—use institutional scholarships aggressively to attract strong students, even from high-income families.

Private Scholarships

These include national, regional, and local awards from corporations, non-profits, civic groups, religious organizations, and community foundations. They’re usually competitive and essay-based, and many are tailored to specific niches.

Where to Search:

- Fastweb

- Scholarships.com

- CollegeBoard’s Scholarship Search

- Local school district and library scholarship boards

- Parent employers, alumni associations, religious or cultural groups

What to Expect:

- Deadlines range from fall of junior year through senior year

- Essays, recommendation letters, and interviews are often required

- Many are single-year awards (but some can be renewable)

Pro Tip: Treat scholarship hunting like a part-time job. A $500 scholarship for one afternoon of writing is a better hourly rate than most adult jobs.

State-Based Scholarships (Texas-Specific Programs)

While Texas doesn’t offer generous merit aid across the board, there are key programs available to eligible students:

- TEXAS Grant: For students who graduated from an eligible Texas high school and demonstrate financial need

- Tuition Equalization Grant (TEG): For Texas residents attending approved private Texas colleges

- Top 10% Scholarship: For Texas high school seniors graduating in the top 10% of their class who enroll in public colleges

Texas Strategy Tip: These awards often require both the FAFSA and a clear record of residency and academic achievement—submit documentation early.

Strategic Scholarship Planning: What Works (and What Doesn’t)

Winning scholarships isn’t just about applying to more—it’s about applying smarter. Here’s what I recommend to every Future-Focused family:

Start Early

- Begin tracking deadlines and requirements by sophomore year

- Build a “scholarship calendar” to avoid missing windows for essays or applications

Cast a Wide Net

- Don’t ignore smaller local scholarships—$500 here and $1,000 there adds up

- Many local awards have less competition and simpler applications

Test Scores Still Matter

- Even schools that are test-optional for admissions may require SAT/ACT scores for merit aid

- Retake the exam if your student is on the cusp of a scholarship cutoff

Essay Excellence Wins

- A compelling personal story will always beat a generic essay

- Encourage students to highlight overcoming adversity, leadership, and growth

Position Your Assets Wisely

Not all college savings accounts affect FAFSA equally. Here's what matters:

Melissa’s Advice: Use Roth IRAs as stealth college accounts—especially if the parent is over 59½ and can access funds tax-free. And always keep student assets to a minimum if aid is a priority.

CFP® + CFSLA Perspective: How I Help Dallas Families Maximize Aid and Minimize Stress

Scholarship planning isn’t just about crossing your fingers and hoping your kid gets lucky. It’s not a Google search. It’s not a one-time essay.

Real planning requires precision. Timing. Coordination. And knowing how today’s decisions affect tomorrow’s aid.

As a CERTIFIED FINANCIAL PLANNER™ (CFP®) and a College Funding and Student Loan Advisor (CFSLA), I bring more than just investment expertise—I bring a holistic, strategic approach designed to help Dallas families pay for college without sabotaging retirement or building debt.

Here’s what that looks like in practice:

FAFSA Timing & Income Optimization

- Your student’s sophomore year family income can make or break their aid eligibility.

- I help families coordinate Roth conversions, capital gains, and bonuses to reduce aid-disqualifying spikes in income.

Smart 529 Withdrawals and Grandparent Gifting

- I’ll show you how to structure distributions from parent- or grandparent-owned 529s to maximize aid eligibility.

- Under the new FAFSA rules, grandparent 529s no longer hurt aid—but they still need to be timed strategically.

Multi-Student, Multi-Year Planning

- Have more than one kid heading to college? I build multi-year roadmaps that anticipate when aid will shift and how to position resources across siblings.

- We factor in FAFSA, CSS Profile (if applicable), merit deadlines, and real-life budgeting.

Asset Structuring That Works with—Not Against—FAFSA

- Not all savings vehicles are FAFSA-friendly. I help you:

- Reposition taxable accounts into parent-owned 529s when appropriate

- Avoid student-owned accounts (UTMA/UGMA) that can reduce aid drastically

- Use Roth IRAs to protect aid while growing retirement funds

- Reposition taxable accounts into parent-owned 529s when appropriate

- I also help entrepreneurs and small business owners minimize FAFSA exposure from business assets.

Legacy Gifting Without Financial Aid Fallout

- Many families want to use trusts or grandparent gifts to support education—but done incorrectly, these can backfire.

- I create aid-sensitive gifting strategies using:

- Annual exclusion gifts

- Strategic 529 contributions

- Trust distributions timed for after graduation

- Annual exclusion gifts

Planning Around the OBBB Act

The One Borrower, One Loan, Better Budgeting Act (OBBB) now limits how much parents can borrow through Parent PLUS loans.

No more:

- Borrowing well beyond the cost of attendance

- Using PLUS loans to fund family lifestyle gaps

- Relying on loans to “figure it out later”

That’s why planning scholarships, savings, and FAFSA strategy up front is more important than ever. You can’t borrow your way out of poor planning anymore.

Bottom Line: Your student’s academic achievements deserve more than last-minute aid scrambling. I help families turn good students into great scholarship candidates—and great plans into confident decisions.

Ready to take the guesswork out of financial aid?

Schedule a College Aid Strategy Session

Final Thoughts: Scholarships Aren’t Lucky—They’re Strategized

Winning scholarships isn’t a matter of chance—it’s the result of intentional planning, early action, and understanding how the financial aid game is really played.

At Future-Focused Wealth™, I work with families who don’t want to just “hope it works out.” They want a clear, step-by-step roadmap that connects the dots between:

- FAFSA strategy and income timing

- Smart asset positioning

- College selection that aligns with merit potential

- Scholarships that go beyond the obvious and into the strategic

Whether your student is a rising sophomore or already filling out college applications, there’s still time to shape a funding strategy that avoids unnecessary debt, protects your retirement, and empowers your student to thrive—without the financial pressure.

Let’s make college affordable—and stress-free—with a scholarship strategy that actually works.

👉 Schedule a College Aid Strategy Session

FAQs - Scholarship Planning

Q: Do straight-A students automatically get scholarships?

A: Not always. Academic excellence helps, but most scholarships—especially from private colleges—depend on where your student applies, what kind of aid the school offers, and how well their strengths align with the school’s priorities.

Q: Should we file the FAFSA if we make too much to qualify for federal aid?

A: Yes. Many colleges, especially private ones, require the FAFSA to award merit and institutional aid—even for families earning well into the six figures.

Q: Are private colleges actually more affordable than public ones?

A: In many cases, yes. Despite their high sticker price, private colleges often offer more generous aid packages that can make them more affordable than public universities offering little to no aid.

Q: When should we start applying for scholarships?

A: Ideally, during your student’s sophomore or junior year. Many deadlines fall in the fall of senior year, and some competitive scholarships open even earlier.

Q: Are SAT or ACT scores still important for scholarships?

A: Yes. Even at test-optional schools, merit scholarships often require test scores. A strong SAT/ACT score can unlock thousands in aid.

Q: How do student-owned accounts affect aid?

A: Accounts in the student’s name (like UTMA/UGMA) are weighed much more heavily in the aid formula—up to 20%—compared to parent assets. Strategic repositioning can help.

Q: What’s the Student Aid Index (SAI), and how does it impact aid?

A: The SAI replaced the Expected Family Contribution (EFC) and determines your eligibility for need-based aid. It’s calculated using income from two years prior, plus assets—so early planning is key.

Q: Where can we find trustworthy private scholarships?

A: Start with sites like Fastweb, Scholarships.com, and CollegeBoard’s Scholarship Search. Also check local school districts, community groups, and your employer.