How to Save for College: Tips for Parents at Every Income Level

As a Dallas-based CERTIFIED FINANCIAL PLANNER™—and a mom—I understand the pressure parents feel when it comes to saving for college. Whether you’re bringing in a modest income or navigating six figures, the question is the same:

“How do I save for my child’s future without sacrificing my own?”

The good news: You don’t need to have it all figured out today. But you do need a plan. And that plan should reflect your income, your priorities, and your family’s values—not someone else’s idea of “success.”

Let’s explore how families at every income level can start saving smarter—without burning out or derailing retirement.

Why Saving for College Matters—Even If You’re Not Wealthy

It’s easy to put off college savings, especially when today’s expenses already feel tight. But here’s the truth I share with every Dallas client:

“You can borrow for college. You can’t borrow for retirement.”

Saving something—even a small amount—sets your family up for more options later. It reduces the future loan burden, increases eligibility for scholarships and grants, and shows your child that their future matters to you today.

Related: Saving on vs. Saving FOR College: What’s the Real Difference? (Understand how cost-cutting and saving strategies work together.)

The Real Cost of College (And Why You Need to Start Now)

Saving for college isn’t just emotionally charged—it’s mathematically urgent. According to the College Board’s Trends in College Pricing 2024, here’s what families are up against:

- Average annual cost of attendance (2023–2024):

- Public in-state: $28,840/year

- Public out-of-state: $46,730/year

- Private non-profit: $60,420/year

- Public in-state: $28,840/year

Multiply that by four years—and you’re looking at $115K to $240K+ per child, depending on the institution.

And that’s before inflation.

Here’s the kicker: College costs have grown at roughly 5%–6% per year over the past two decades—outpacing both inflation and wage growth. If trends continue, the cost of a 4-year public university in 2038 could top $180,000 for today’s newborns.

Dallas Insight: Even “affordable” state schools can feel out of reach if you’re trying to fund everything last-minute. That’s why early, consistent savings—even in small amounts—can have a massive impact.

College Cost & Inflation Fast Facts to Include:

What FAFSA Really Looks At—And Why Timing Matters

College isn’t just expensive—it’s also complicated. One of the biggest mistakes I see families make is assuming they’ll get more financial aid than they actually do. That’s where the FAFSA and Student Aid Index (SAI) come in.

FAFSA 101: What Is It?

The Free Application for Federal Student Aid (FAFSA) is the government’s tool for assessing how much your family is expected to contribute toward college costs. It’s used by most colleges to calculate need-based financial aid.

As of the FAFSA Simplification Act, your Student Aid Index (SAI) has replaced the old EFC (Expected Family Contribution). The lower your SAI, the more aid you’re eligible for.

But here’s the part families often miss:

FAFSA looks at your income from two years prior.

That means your child’s junior year of high school is the financial year that will determine freshman-year aid eligibility.

FAFSA Timing Example:

So if your child is currently a high school sophomore, their aid eligibility is already being shaped by the income you’ll report next year.

This makes strategic income planning, Roth conversions, asset positioning, and gifting decisions especially important during those key years.

Why Saving Early Still Helps (Even if You Might Get Aid)

Some families hold off on saving, hoping their income will qualify them for need-based aid. But that’s risky. Not only are most middle- and upper-middle-income families ineligible for substantial aid, but the aid they do get often includes loans—not free money.

And remember:

Parent-owned 529 plans have only a small impact on aid formulas (up to 5.64% of the account value).

But student-owned accounts (like UGMA/UTMAs) can count far more heavily (up to 20%).

Dallas Strategy Insight: I help clients restructure accounts before those key FAFSA years to optimize aid eligibility without sacrificing smart savings growth

Why Your Brilliant Kid Might Not Get a Scholarship (and What Parents Need to Know)

Every parent dreams of the full-ride scholarship—and if you’ve got a high-achieving student, that hope might feel realistic. But here’s the tough truth I share with Dallas families all the time:

“Your student’s academic performance matters—but so does where they apply, how your finances line up, and what that school can afford to offer.”

Not All Schools Are Financially Equal

It’s a common misconception that public state universities are always the most affordable option. While tuition may be lower on paper, state schools often have limited aid budgets, especially for middle- and upper-income families.

Meanwhile, many private colleges and universities—especially those with large endowments—can offer generous need-based or merit-based aid packages, even if their sticker price is higher.

Public vs. Private: An Unexpected Financial Aid Twist

Dallas Insight: I’ve seen Dallas-area families pay less out-of-pocket at elite private schools like SMU, Rice, or Trinity than at large state schools like UT or Texas A&M—purely because of how aid was structured.

The Role of the Student Aid Index (SAI)

This is where your Student Aid Index (SAI) becomes the deciding factor. Schools look at your SAI and decide:

- Whether you qualify for need-based aid

- How much of your “need” they can meet

- What type of aid you’ll receive (grants vs. loans vs. work-study)

Some schools (especially elite private institutions) pledge to meet 100% of demonstrated need—others meet only a fraction.

So even if your student is a valedictorian with a 35 ACT score, their scholarship offer might look very different depending on the school’s resources and policies.

Real Talk: Merit ≠ Money

Just because your child is brilliant doesn’t mean a school has the budget to reward them. And just because a school can offer big aid doesn’t mean it will—if your SAI is high, they may assume you can afford more.

That’s why college selection is just as much a financial decision as an academic one.

College Savings Tips by Income Level

If You’re Earning Less than $75K/year

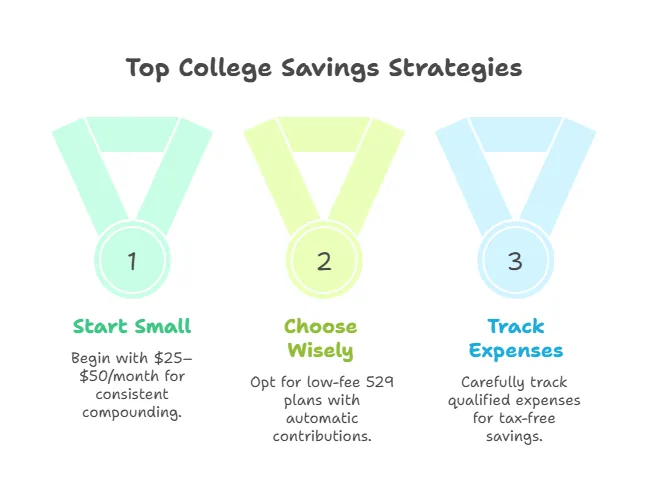

Don’t let modest income scare you away from saving. The key is consistency.

- Start with $25–$50/month. Every bit compounds.

- Open a direct-sold 529 plan with low fees and automatic contributions.

- Track qualified expenses carefully so every dollar stays tax-free.

- Explore grant-based colleges with high aid ratios.

Fiduciary Tip: You may qualify for middle-income aid programs or need-based scholarships. Saving small now can still save thousands later.

If You’re in the $75K–$150K Range

You’re likely juggling multiple priorities—retirement, mortgage, maybe even aging parents. Strategic planning matters more than brute force saving.

- Set up a monthly savings goal (e.g., $300–$500/month).

- Layer savings vehicles—start with a 529, then supplement with taxable investments if needed.

- Time your gifts to maximize FAFSA impact.

- Consider super funding if grandparents want to contribute.

Related: Do Student Loans Make Cents? (Learn when borrowing may be helpful—or harmful.)

If You’re Earning $150K+

You may face fewer aid options—but more planning complexity.

- Use Roth IRAs strategically. You can withdraw contributions for education.

- Be wary of overfunding one child. Work with a planner to avoid financial aid penalties or unused balances.

- Plan for taxes on gains in non-529 accounts.

- Look at estate planning: Large 529s can become legacy tools.

Dallas Insight: Texas doesn’t offer state tax deductions—but that also means you’re free to shop for the best 529 plans nationwide.

What If College Isn’t the Path?

Worried your child might skip college? You still have smart options.

- Use 529 funds for trade school, graduate school, or even K–12 tuition

- Change the beneficiary to a sibling or future grandchild

- Roll unused funds into a Roth IRA (up to $35,000) under SECURE Act 2.0 rules

Your plan should support your child’s future—even if that looks different than expected.

How Much Should You Save?

Here’s a ballpark based on public in-state tuition:

Even $50/month counts. Automate contributions and increase them as your income grows.

Why Work with a CFP® and a CFSLA?

Setting up a 529 account is one thing. Designing a flexible, tax-smart, and aid-aware college plan that supports your entire financial picture—that’s where specialized guidance makes all the difference.

As a Dallas-based CERTIFIED FINANCIAL PLANNER™ (CFP®) and College Funding and Student Loan Advisor (CFSLA), I help families do more than save. I help them strategize. Optimize. And protect.

Here’s what that looks like:

Strategic Coordination Across Your Whole Financial Life

College funding doesn’t happen in a vacuum. Every dollar you save (or spend) affects your retirement timeline, tax strategy, and even estate plan. I bring your college planning into full alignment with:

- Long-term retirement goals

- Multi-child and legacy planning

- Tax-aware saving and withdrawal strategies

Dallas Planning Insight: Some families are unknowingly overfunding 529s—while undercutting their retirement. We fix that with smart balance and tailored projections.

FAFSA, SAI & Aid Optimization You Can’t Google

As a CFSLA, I specialize in the nuances of financial aid, the Student Aid Index (SAI), and what really impacts your chances of getting grants or scholarships.

I help you:

- Time income and asset shifts to maximize aid eligibility

- Avoid financial moves that can hurt your FAFSA (like ill-timed withdrawals)

- Understand how colleges actually calculate what you can afford

Real Talk: The year that counts most for FAFSA is often your child’s sophomore year of high school. If you wait until senior year to start planning, you’ve already missed the window.

A Dynamic Plan That Adjusts With Your Child’s Journey

What if your child gets a full ride? Chooses trade school? Decides not to go at all?

That’s why we build education strategies with maximum flexibility—including:

- Repurposing unused 529 funds

- Layering in Roth IRAs, custodial accounts, or taxable brokerage strategies

- Planning for grad school, career changes, or sibling transfers

With the SECURE Act 2.0, we can even roll unused 529 funds into a Roth IRA (with specific rules). As a CFP® and CFSLA, I help you navigate those options without penalty or guesswork.

Why Families Choose Me

I don’t just offer education advice—I live it. As a parent and fiduciary advisor, I know that your college plan isn’t just about saving for school. It’s about giving your child a future that’s debt-conscious, opportunity-rich, and values-based.

Let’s build a plan that does more than check the boxes. Let’s build one that truly fits your life.

Schedule a College Strategy Session

Final Thoughts: Start Where You Are

There’s no magic number when it comes to college savings. No perfect formula. No universal benchmark. What matters most is that you start—intentionally and strategically—based on your reality.

Maybe you’re just now thinking about college, or perhaps you’re playing catch-up after years of focusing on other goals like paying down debt or buying a home. That’s not a failure—it’s life. The best college savings plan isn’t the biggest one. It’s the one that:

- Fits your budge

- Respects your timeline

- And stays flexible as your child’s journey evolves

At Future-Focused Wealth™, I help Dallas parents and grandparents build education savings strategies that are both realistic and resilient. That means:

- Choosing the right 529 plan for your needs (not just what’s popular)

- Strategically coordinating with your retirement and tax planning

- Optimizing for FAFSA, student aid, scholarships, and legacy goals

- Making sure your plan can adapt—if your child’s plans change

As a CERTIFIED FINANCIAL PLANNER™ and College Funding and Student Loan Advisor (CFSLA), I’ve helped dozens of families go from overwhelmed to empowered—often with small, consistent steps that made a huge long-term difference.

You don’t need to be perfect. You don’t need to have it all figured out.

You just need to start—and I’ll help you from there.

Schedule your free education planning consultation today

FAQs: College Savings for Every Budget

Can I still get financial aid if I save in a 529?

Yes. Parent-owned 529s have a minimal impact on FAFSA. They’re one of the most aid-friendly tools available.

What if I have more than one child?

You can open multiple 529s or shift beneficiaries as needed. A planner can help you keep it fair—and flexible.

Can I open a 529 if I live in Texas?

Absolutely. Texas residents can open plans in any state—and many out-of-state plans offer lower fees or better investments.

Is a Roth IRA a better option?

For some families, yes—especially if you want dual-purpose savings for retirement and education. But it comes with limitations and should be planned carefully.