Everything You Need to Know About Annuities: The Ultimate Guide for Dallas Investors

When it comes to retirement planning, few financial tools are as misunderstood—or as misused—as annuities.

As a Dallas-based Certified Financial Planner™, I regularly sit down with individuals and families who have heard about annuities from salespeople, dinner seminars, or flashy commercials promising “guaranteed income for life.” But they’re left with more questions than answers.

Are annuities a smart investment or just high-fee insurance products?

Can they actually provide lifetime income—or is that just marketing?

When do annuities actually make sense in a retirement strategy?

This Comprehensive Financial Planning guide is here to answer those questions and more. If you’re searching for real answers about annuities—from someone who isn't trying to sell you one—you’re in the right place.

In this deep-dive, we’ll cover:

- What annuities are (in plain English)

- How they work

- The major types of annuities (and how they differ)

- The pros, cons, and hidden fees no one tells you about

- When annuities make sense—and when they don’t

- How can they complement a diversified retirement strategy?

- What Dallas investors need to know when considering annuities

Whether you're just starting to explore retirement income options or you’ve already been pitched an annuity and want a second opinion, this guide will give you the clarity you need.

Let’s start at the beginning.

What Is an Annuity? (Plain-language explanation)

At its core, an annuity is a contract between you and an insurance company. You give the insurer money—either all at once (a lump sum) or over time—and in exchange, they promise to pay you income, either immediately or in the future.

Annuities are designed to solve one primary problem:

Outliving your money in retirement.

Unlike traditional investments that rise and fall with the market, annuities can offer guaranteed income for life. They’re often used by retirees to create a personal pension stream—especially as fewer people have employer-provided pensions today.

But not all annuities are created equal. Some are simple. Some are incredibly complex. Some are good. Some are…not.

That’s why understanding how annuities actually work is so important before making a decision.

Why Are Annuities So Popular?

Despite their complexity—and controversy—annuities remain one of the most widely purchased retirement products in the U.S.

But why?

Because they offer something most other investments can’t:

✅ Predictable, guaranteed income for life.

✅ Tax-deferred growth.

✅ Peace of mind.

For retirees and pre-retirees in Dallas and across the country, annuities are appealing for several key reasons:

1. They Create Personal Pensions

With pensions becoming increasingly rare in private-sector jobs, many investors use annuities to recreate that guaranteed income stream—giving them the confidence to spend in retirement without running out.

2. They Help Satisfy RMDs

Certain types of annuities—like Qualified Longevity Annuity Contracts (QLACs)—can delay or manage Required Minimum Distributions (RMDs) from IRAs, which can be a useful tax return strategy when coordinated correctly.

3. They Reduce Market Anxiety

Some investors aren’t comfortable riding the ups and downs of the stock market. Fixed and indexed annuities offer downside protection or guaranteed returns with none (or less) of the volatility.

4. They Offer Behavioral Benefits

Structured payouts can help prevent overspending in early retirement and provide a sense of structure many retirees find comforting.

Dallas Insight:

In a city with high real estate wealth and rising living costs, many Dallas retirees use annuities to convert assets into income—especially if they're already drawing from rental property, pensions, or Social Security.

Why Annuities Are So “Hot” Right Now — And What It Has to Do With Interest Rates

If you’ve been hearing nonstop radio ads, dinner seminar invitations, or online pitches about annuities lately, you’re not alone. In fact, 2023 and 2024 saw record-breaking annuity sales, and 2025 is continuing that trend.

But why the sudden popularity?

The answer is simple: Interest rates are high.

And that directly affects the value proposition of annuities.

How Annuities Are Tied to Interest Rates

When you buy an annuity, you’re essentially giving an insurance company money in exchange for future income. The insurer invests that money—often in bonds or other interest-bearing instruments.

So when interest rates rise:

- Insurers earn more on your money

- They can offer better income payouts

- Fixed annuity crediting rates go up

- Income riders may grow faster than in low-rate environments

In other words, the higher the rate environment, the more favorable the annuity terms can be.

Why Annuities Are Getting So Much Attention Right Now

Let’s break it down:

1. Higher Payouts from Fixed and Immediate Annuities

- SPIAs are offering the best guaranteed income in over a decade

- Fixed annuity rates are competing with CDs and Treasuries

2. Indexed Annuities Offering More Competitive Caps

- Insurers can afford to give investors more participation in the market

- Cap rates and spreads have improved significantly since 2020–2021

3. A Volatile Market Has Driven Investors Toward “Safety with Growth”

- The market has been unpredictable

- Annuities give a middle ground: some growth + some protection

4. High Interest Rates Make Cash Look Good—but Annuities Look Better

- Instead of 5% in a money market account, clients want income for life at 6–7% guaranteed

- It feels like a “bond alternative” without the interest rate risk of bond prices falling

Dallas Insight: Many of my clients are hearing about annuities on local radio or from friends, and for the first time, the numbers actually make sense—but that doesn’t mean every annuity is worth buying.

Important Note

While higher rates do make annuities more attractive, remember:

- Not all annuities pass through the full benefit

- Some firms still push old contracts with lower caps

- You need to compare multiple quotes and consider contract design, not just headline rates

Planning Tip from Melissa Cox, CFP®:

If you were offered an annuity a few years ago and passed—good news:

Today’s higher-rate environment may make revisiting the strategy worth it.

But don’t respond to the ad.

Respond to a plan—and let that plan determine if an annuity fits.

📅 Want to know how today’s rate environment affects your retirement income potential?

How Do Annuities Work?

Annuities have two basic phases:

1. Accumulation Phase

This is when you're paying into the annuity—either as a lump sum or through ongoing contributions. The money inside the annuity grows tax-deferred, which means you won’t pay taxes on the gains until you start withdrawing income.

During this phase, your annuity might:

- Earn a fixed interest rate (fixed annuity)

- Be tied to market performance (indexed or variable)

- Offer bonuses or income riders (optional add-ons)

2. Distribution (or Annuitization) Phase

This is when you start receiving payments from the annuity.

You might:

- Turn the balance into lifetime income

- Take flexible withdrawals over time

- Use a guaranteed income rider without fully annuitizing the contract

Payments can begin immediately (with immediate annuities) or be deferred to a future date (with deferred annuities).

Here’s the key:

Annuities are not just investments—they are insurance products.

That means they’re regulated differently, and your “returns” are based on contract terms, not market rates.

Now, let’s break down the different types of annuities so you can start to understand which ones might be worth your attention—and which to avoid.

Types of Annuities

Fixed Annuities

What They Are:

A fixed annuity offers a guaranteed rate of interest over a specific period and then provides fixed periodic payments.

Key Benefits:

- Predictable returns

- Guaranteed principal (backed by the insurer)

- Often used as a CD alternative for longer horizons

Ideal For:

- Conservative investors

- Those who want a guaranteed income without market risk

Considerations:

- Returns may not keep pace with inflation

- Not designed for growth

- Liquidity restrictions if you need the money early

📝 Tip: Many Dallas-area retirees use fixed annuities to lock in income during the early years of retirement, when predictability matters most.

Indexed Annuities

What They Are:

Indexed annuities are tied to a market index, like the S&P 500, but with limited upside and no downside risk to principal.

Key Benefits:

- Growth potential with downside protection

- Tax-deferred accumulation

- Income riders can provide guaranteed payouts

Ideal For:

- Moderate investors looking for market participation with safety nets

Considerations:

- Gains are subject to caps, spreads, and participation rates

- Contracts are complex and can be difficult to understand

- Watch for long surrender periods

🧠 Pro Insight: Indexed annuities are widely sold in Texas—but many are misunderstood. Always review the participation rate, cap rate, and fees before considering one.

Variable Annuities

What They Are:

Variable annuities let you invest in a selection of mutual fund-like subaccounts. Your account grows based on market performance, but it can also shrink.

Key Benefits:

- Unlimited upside potential (no cap on gains)

- Optional guaranteed income riders

- Tax-deferred growth

Ideal For:

- Investors with a higher risk tolerance

- Those looking for growth plus lifetime income potential

Considerations:

- High fees, often over 2–3% annually

- Investment risk—your principal can lose value

- Complexity makes comparisons difficult

⚠️ Warning: Many variable annuities come with layers of fees—mortality & expense, admin, rider costs, and fund expenses. Always ask for a fee breakdown in writing.

Immediate Annuities

What They Are:

An Immediate Annuity (also called a Single Premium Immediate Annuity, or SPIA) starts paying income right after you fund it—usually within 30 days.

You hand over a lump sum to an insurance company, and they pay you a fixed amount monthly for:

- Life

- A set number of years

- Or both (life with period certain)

Key Benefits:

- Simple structure

- Immediate income stream

- Payments can be guaranteed for life

Ideal For:

- Retirees needing income now

- Individuals without pension income

- Those looking to replace a paycheck post-retirement

Considerations:

- Irrevocable: Once you annuitize, you can’t access your principal

- No market upside or inflation protection unless added via rider

- Death before full payout could mean forfeited funds (unless a rider is added)

Dallas Tip: SPIAs can work well for those retiring without employer pensions, especially if Social Security alone won’t meet monthly income needs.

Deferred Annuities

What They Are:

A Deferred Annuity delays income payouts until a later date, allowing the invested funds to grow tax-deferred in the meantime.

You can choose:

- Fixed (guaranteed growth)

- Variable (market-linked)

- Indexed (market-tied with protection)

Key Benefits:

- Flexibility: Choose your income start date

- Tax-deferred growth

- Income planning with control

Ideal For:

- Investors 5+ years from retirement

- Those who want to grow funds before activating income

- People looking to bridge the gap to RMDs or delay Social Security

Considerations:

- Early withdrawals may face surrender charges and a 10% IRS penalty

- Potentially complex contract riders

💬 Financial Planning Insight: Deferred annuities can be a useful “income bucket” for clients in their late 50s or early 60s planning for age 70+ retirement income.

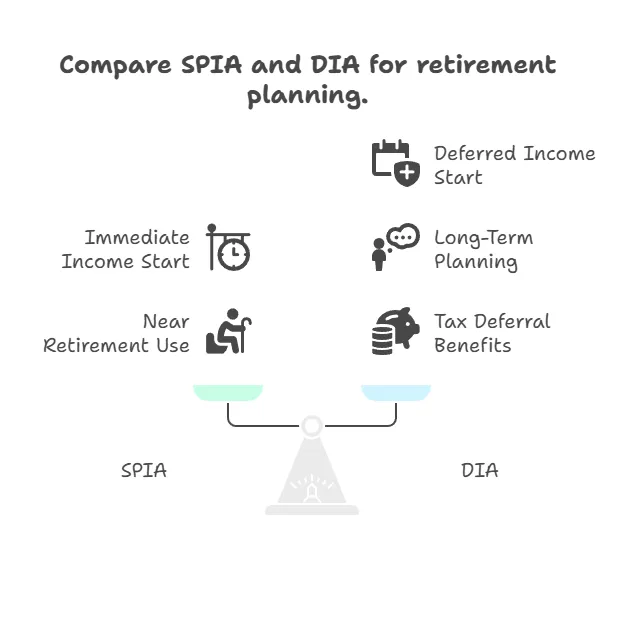

SPIAs vs. DIAs (Deferred Income Annuities)

Let’s differentiate:

SPIA – Single Premium Immediate Annuity

- Income starts right away

- Commonly used at or near retirement

DIA – Deferred Income Annuity

- Fund it now, income starts later (e.g. 10–15 years out)

- Can create longevity insurance for older age

DIA Benefits:

- Allows planning far ahead

- Can defer Required Minimum Distributions (if structured as a QLAC)

- Lowers immediate taxable income

Considerations:

- Long lock-up period

- No access to funds once annuitized

- Not right for those needing liquidity

Dallas Use Case: A 60-year-old exec might buy a DIA to begin payments at 80—ensuring income if they live long enough to need extended care.

Hybrid Annuities

What They Are:

“Hybrid” annuities combine elements of other annuities with built-in riders, often focused on long-term care, lifetime income, or market participation.

Common types include:

- Fixed Indexed Annuities with Income Riders

- Long-Term Care Annuity Hybrids

Key Benefits:

- Lifetime income without full annuitization

- Enhanced access to funds for qualified care needs

- Market growth potential with downside protection

Ideal For:

- Clients looking for both income and flexibility

- People concerned about outliving assets or needing care

- High-net-worth families doing multigenerational planning

Considerations:

- Rider fees can be high (1–2% annually)

- Returns may be capped

- Must read the fine print

⚠️ Caution: “Hybrid” is a marketing term, not a regulated product class. Not all hybrids are created equal—some offer value, others just add fees.

Summary Table: Types of Annuities at a Glance

Understanding Annuity Fees & Costs: What You Really Pay

Annuities are often marketed as “no-fee” or low-fee” products. But let’s be honest:

If you don’t see the fee up front, it’s baked in somewhere else.

As a fiduciary financial planner in Dallas, one of the first things I do when reviewing an annuity contract is break down the real costs, because annuities can be loaded with layers of hidden fees that erode returns over time.

Here’s what you need to know.

1. Surrender Charges

Most annuities have a surrender period—a span of 5 to 10 years (or longer) during which withdrawing your money triggers a penalty.

- Starts at 7–10% typically and reduces each year

- Some contracts offer 10% free withdrawals annually (read the fine print)

Tip: Always ask, “What is the surrender schedule?” and get it in writing.

2. Mortality and Expense Risk Charges (M&E Fees)

This is common with variable annuities and typically ranges from 0.9% to 1.5% annually.

It covers the insurance company’s risk of providing you with income guarantees—but it’s essentially a fee just for owning the annuity.

3. Administrative Fees

These fees cover servicing, statements, and account maintenance.

- Usually range from 0.1% to 0.3%

- May be waived on larger contracts or after surrender periods

4. Investment Management Fees

If your annuity is variable, the subaccounts you invest in are often mutual fund clones that carry their own internal expense ratios:

- Average range: 0.5% to 1.25%

These are in addition to M&E fees

5. Rider Fees

Optional riders can add flexibility or guarantees—but they’re not free. Examples:

- Guaranteed Lifetime Withdrawal Benefit (GLWB)

- Long-Term Care or Enhanced Income Riders

- Death Benefit Riders

These can cost anywhere from 0.75% to 2.0% annually, depending on the features included.

Combined rider and M&E fees in some contracts can exceed 4% per year—without ever being clearly disclosed in marketing materials.

The Bottom Line on Annuity Costs

Total cost in some variable annuities can exceed 4–5% annually, which significantly reduces your long-term performance.

Dallas Planning Perspective

In my practice, I help clients determine if the benefit of the annuity justifies the cost. Sometimes it does—especially when clients need:

- Income guarantees

- Tax deferral

- Behavioral guardrails

But I’ll also say this plainly:

If you don’t fully understand the cost structure of the annuity, don’t buy it.

Taxation of Annuities: What You Need to Know Before You Withdraw

One of the biggest misconceptions I hear from clients in Dallas is:

“Annuities are tax-free, right?”

Not exactly.

While annuities do offer tax-deferred growth, you will eventually pay taxes when you take the money out—and how much you pay depends on the type of annuity, the source of the funds used to buy it, and how the withdrawals are structured.

Let’s break down exactly how annuities are taxed.

1. Tax Deferral: The Upside

Annuities grow tax-deferred, which means:

- You don’t pay taxes on interest, dividends, or capital gains while funds stay inside the annuity

- You only pay taxes when you withdraw money

This can be helpful for high-earning investors who want to delay taxes until retirement, when they may be in a lower bracket.

2. Taxation on Withdrawals

If You Funded the Annuity with After-Tax Money (non-qualified annuity):

- Only the gains are taxed when you withdraw

- Withdrawals are taxed as ordinary income, not capital gains

- Withdrawals follow LIFO (Last In, First Out) rules—interest comes out first

Example:

You invest $100,000. It grows to $150,000.

If you withdraw $10,000, the first $50,000 is taxable (as interest), and only after that will your original principal come out tax-free.

If You Funded the Annuity with Pre-Tax Money (qualified annuity, like IRA rollover):

- The entire withdrawal is taxable as ordinary income

- Treated just like traditional IRA or 401(k) withdrawals

⚠️ Note: Annuities do not provide any additional tax benefit when held inside a tax-advantaged account like an IRA. In fact, they can create redundant tax deferral and limit investment flexibility.

3. Early Withdrawal Penalties

If you’re under age 59½ and you take money out of a deferred annuity:

- You’ll pay a 10% IRS penalty on the taxable portion

- Plus ordinary income tax

Some contracts allow penalty-free withdrawals, but IRS rules still apply.

4. Annuitized Income vs. Withdrawals

If you annuitize your contract into income payments, the IRS may apply an exclusion ratio to determine how much of each payment is taxable.

For example:

- Part of each payment is considered a return of your original principal (not taxed)

- The rest is taxable income (interest/gain)

Once you’ve received all your original investment back, the rest of the payments are fully taxable.

Dallas Planning Insight

Smart tax planning with annuities often includes:

- Timing withdrawals in low-income years

- Coordinating with Roth conversions to manage bracket creep

- Using non-qualified annuities for tax deferral without impacting AGI

- Avoiding annuities in IRAs unless using them for income guarantees

✅ This is where working with a planner—not just a product rep—can save you real money over time.

When Annuities Make Sense — And When They Don’t

Annuities aren’t good or bad. They’re simply tools—and like any tool, they need to match the job.

As a Dallas-based financial planner, I’ve helped clients use annuities intentionally—not because someone “sold” them one, but because it made sense within a broader, goals-based financial plan.

Here’s how to determine if an annuity fits your needs

When Annuities Make Sense

1. You Need Guaranteed Income for Life

If you’re worried about outliving your money—or want a predictable monthly income to cover fixed expenses—an annuity can act as a personal pension.

Great for:

- Retirees without pensions

- Single-income households

- Individuals who value security over growth

2. You Want to Create a “Floor” for Essential Expenses

We often design income “buckets” where a fixed or indexed annuity covers:

- Mortgage or rent

- Insurance premiums

- Groceries & utilities

That gives clients the confidence to let their investment portfolio grow, knowing their core expenses are covered.

3. You’re in a High Tax Bracket Pre-Retirement

Deferred annuities can be a tax-management strategy, allowing:

- Tax-deferred growth

- Delayed income until a lower-tax bracket in retirement

Possible Roth conversion pairing opportunities

4. You’re Planning for Long-Term Care Needs

Hybrid annuities with long-term care riders offer:

- Enhanced payouts if you need home care or assisted living

- Return of premium or death benefit features

- Less underwriting than standalone LTC insurance

This can be ideal for:

- Pre-retirees concerned about future medical costs

- People who want to self-fund care with leverage

5. You Want Behavioral Guardrails

Let’s be honest: Not everyone is comfortable managing a large lump sum.

Annuities can help:

- Structure predictable withdrawals

- Prevent overspending

- Provide peace of mind

This is especially useful for:

- Recent retirees

- Widows or widowers

People who “panic sell” during market drops

When Annuities Don’t Make Sense

1. You Need Liquidity or Access to Funds

Most annuities have surrender charges, income riders, and contract lock-ins.

If you need flexibility or access to your money, an annuity is likely not your best choice.

2. You Don’t Understand the Product

Annuities can be shockingly complex, especially indexed and variable contracts with riders.

If you don’t:

- Know the fees

- Understand the guarantees

- Know the tradeoffs

…you shouldn’t sign anything. Period.

3. You’re Already Inside a Tax-Deferred Account

Putting an annuity inside an IRA or 401(k) often duplicates tax deferral, while adding layers of fees and limiting investment flexibility.

There are exceptions—but most of the time, this strategy benefits the insurance rep more than the client.

4. You’re Comfortable With Market Risk

If you're a growth-focused investor with a long time horizon, locking money into an annuity could limit your upside and tie up capital you could grow elsewhere.

5. You’re Being Sold One at a Free Dinner

If the first time you hear about an annuity is over filet mignon and someone says “guaranteed income with no downside,” you need to hit pause.

Always get a second opinion—ideally from a fee-based fiduciary who isn’t earning a commission from the product.

How Annuities Fit Into a Diversified Retirement Plan

Annuities aren’t meant to replace your portfolio. They’re meant to complement it—filling in specific gaps or risks that other investment vehicles can’t always solve.

Here’s how we strategically use annuities in retirement planning for our clients:

1. Income Layering: Building a Retirement Paycheck

Think of retirement income as layers:

- Social Security Retirement Planner – fixed income, inflation-adjusted

- Pensions – if available

- Annuities – guaranteed income for what’s missing

- IRAs, 401(k)s, Roths – flexible income/tax buckets

- Brokerage accounts – taxable but highly liquid

- Real estate or business income – if applicable

Annuities are often used to secure the “floor” income needed for basic living expenses.

Then, your investment accounts can be used more flexibly—for travel, healthcare, or gifting.

2. Risk Reduction and Behavioral Support

When the market is volatile, having a steady annuity income stream can reduce panic selling or overreacting.

This is especially useful for:

- Risk-averse retirees

- Spouses who may not manage investments actively

- Clients transitioning from “accumulation” to “distribution”

Dallas Insight: Many of our clients like the idea of knowing a certain portion of their income is secured, regardless of what’s happening in the market or economy.

3. Tax Diversification

In a retirement plan, it’s smart to diversify not just by asset class—but by tax treatment:

Annuities allow you to delay taxes and strategically manage your income levels—especially when coordinated with Roth conversions or to avoid Medicare IRMAA brackets.

4. Longevity Planning & Legacy Considerations

We also use annuities to:

- Guarantee income into your 80s and 90s (DIA or longevity annuity)

- Structure spousal continuation benefits

- Pair with life insurance or charitable giving strategies

- Create legacy plans with specific timelines or triggers

Dallas Planning Example:

Let’s say you're 62, married, and planning to retire at 67.

- You want $7,000/month in income.

- Social Security and pension will cover $4,000.

- You’ll need to generate $3,000/month from investments.

We might use:

- A fixed annuity to cover $2,000/month of income securely

- A Roth conversion strategy between 62–70 to reduce future RMDs

- A tax-efficient drawdown strategy using IRAs and brokerage funds

- Your remaining portfolio for long-term growth and liquidity

That’s not just retirement planning. That’s intentional income architecture.

Common Annuity Red Flags & Scams to Avoid

Unfortunately, not every annuity is sold with your best interest in mind. Here are some of the most common pitfalls to watch for:

1. High Commissions with No Disclosure

Many annuity contracts pay agents 6–10% commission upfront, which creates misaligned incentives. Always ask:

“How are you being compensated?”

2. “No Fees” or “Free Money” Language

If someone tells you an annuity has “no fees,” they may be hiding:

- Rider costs

- Embedded surrender charges

- Reduced returns via participation caps or spreads

3. Surrender Periods Longer Than 10 Years

Most reputable annuities have a 5–10 year surrender period. Anything longer may be too restrictive unless there’s a strong reason.

4. Guaranteed Income With Strings Attached

Lifetime income riders often sound great—until you realize:

- The “guaranteed rate” isn’t a real return

- Income values can’t be accessed as a lump sum

- Riders may cost 1–2% annually

5. Complex, 80-Page Contracts with No Explanation

If the person selling the annuity can’t explain:

- How the product works

- What the caps, fees, and riders actually do

- What your exit options are

Then walk away.

How to Vet an Insurance Company

Annuities are only as safe as the insurer issuing them. Look for:

Financial Strength Ratings

Use independent rating agencies:

Stick with insurers rated A or higher.

Confirm Regulatory Oversight

In Texas, annuity sales are regulated by:

- The Texas Department of Insurance

- The Financial Industry Regulatory Authority (FINRA) for variable annuities

Check licenses at: Texas Department of Insurance

In Texas, the Texas Life and Health Insurance Guaranty Association provides limited protection if an insurer fails.

But this is not a substitute for working with highly rated carriers.

Who Should You Buy an Annuity From? Why a Fiduciary Matters More Than Ever

With so many ads, agents, and “retirement specialists” out there promoting annuities, the real question becomes:

“How do I know I’m buying the right annuity… from the right person?”

Here’s the truth that most consumers don’t realize:

Anyone with an insurance license can legally sell you an annuity.

But that doesn’t mean they understand your full financial picture—or are required to act in your best interest.

The Difference Between a Fiduciary and a Commission-Based Salesperson

- A fiduciary financial planner is legally required to act in your best interest.

- An insurance-only agent is typically held to a suitability standard—they can sell you something that isn’t technically “bad,” even if it’s not optimal.

Many annuities are sold for high commissions (6–10%) with no obligation to compare alternatives or explain fees.

If someone’s only solution is an annuity—every time—you should walk away.

How a Fiduciary Helps You Choose the Right Annuity (or Avoid One)

As a CFP® and fiduciary, my role is to:

- Assess whether you even need an annuity in the first place

- Analyze multiple carriers and contracts, not just one company

- Help you understand the fees, surrender charges, riders, and tax impact

- Coordinate how the annuity fits with your Social Security, investments, RMDs, and estate plan

- Structure it for your goals, not for commissions

Questions to Ask Before You Buy An Annuity

- “Are you a fiduciary?”

- “How are you compensated for this recommendation?”

- “What are the all-in annual fees?”

- “What surrender schedule am I agreeing to?”

- “How does this annuity complement my other retirement income sources?”

If they can’t clearly and confidently answer every question—or dodge them altogether—that’s your red flag.

Dallas Insight:

Texas is a hotspot for high-commission annuity marketing. I’ve reviewed contracts from clients that were:

- Too expensive

- Unnecessarily complex

- Structured in ways that benefited the agent, not the retiree

That’s why who you buy from is just as important as what you buy.

📅 Want a second opinion on an annuity you’ve been pitched—or guidance on structuring one properly?

Book a strategy session here:

Final Thoughts from Melissa Cox, CFP®: Should You Own an Annuity?

Annuities can be a powerful tool—or a financial trap—depending on how they’re used. And that’s why your decision shouldn’t start with a product pitch… it should start with a plan.

As a Dallas-based Certified Financial Planner™, I’m not here to sell you an annuity—I’m here to show you when, where, and if it makes sense for your life, your legacy, and your goals.

Because smart retirement planning means:

- Securing income

- Managing taxes

- Preserving flexibility

- Aligning your values and vision with your money

If an annuity can help us do that, I’ll help you find the right one and structure it properly. If not, I’ll tell you that too.

📅 Let’s make sure your retirement income plan is intentional, diversified, and clear:

Schedule a retirement income strategy session with Melissa Cox, CFP®.

Annuity FAQs: What Clients Ask Me Most

Q: What happens to my annuity when I die?

It depends on your contract. Some allow for beneficiary payouts; others stop payments. Choose wisely.

Q: Can I cancel an annuity after I buy it?

Yes, but you may face surrender charges unless you’re within the “free look” period (typically 10–30 days).

Q: Are annuity payments taxed like regular income?

Yes. Withdrawals are taxed as ordinary income, not capital gains.

Q: Are annuities insured by the government?

No. They are insured by the issuing company—not the FDIC.

Q: How do I know if I’m getting a good deal on an annuity?

Compare annuity payout rates across multiple carriers, review the internal fees and surrender schedule, and make sure the product aligns with your goals. A fiduciary planner can help you evaluate side-by-side quotes objectively.

Q: Do annuities count as part of my taxable estate?

Yes. Unless owned inside a trust, the death benefit of an annuity typically counts toward your estate for tax purposes.

Q: Can I own an annuity in my IRA or 401(k)?

You can, but it’s often unnecessary. These accounts already grow tax-deferred, and layering an annuity on top may just add fees without providing additional benefit, unless income guarantees are essential.

Q: What’s a Qualified Longevity Annuity Contract (QLAC)?

A QLAC is a special type of deferred income annuity purchased with retirement funds (like from an IRA) that defers RMDs strategy and provides guaranteed income starting later in life, often at age 80 or 85.

Q: Are there inflation-adjusted annuities?

Yes—some annuities offer optional cost-of-living adjustments (COLAs) or income that increases over time. But these benefits usually reduce the starting payout, so they must be weighed carefully.

Q: What happens if my annuity company goes bankrupt?

You could lose benefits not protected by your state’s guaranty association. That’s why it's critical to buy from A-rated or higher insurers and diversify if you’re allocating a large sum.

Q: Can I access my money in an emergency?

Most annuities limit liquidity, especially during the surrender period. Some allow 10% annual penalty-free withdrawals, and certain riders offer enhanced access during long-term care needs.

Q: Can annuity income affect my Medicare premiums?

Yes. Annuity withdrawals increase your modified adjusted gross income (MAGI), which can push you into a higher IRMAA bracket, leading to increased Medicare Part B and D premiums.

Q: Can I ladder annuities like bonds?

Absolutely. Annuity laddering—buying contracts with staggered start dates—can offer income flexibility, interest rate diversification, and long-term inflation mitigation.

Q: Should I buy an annuity if I already have rental income or a pension?

It depends. If your income is already secure and exceeds your fixed expenses, you may not need an annuity. But it could still be a behavioral or longevity planning tool when used intentionally.