Tax Return Reviews: Why Your Financial Planner Needs to See Your Taxes

As a Dallas-based Certified Financial Planner™, I’ve always believed in the power of financial planning to bring clarity, security, and confidence. But I’ll be honest...for years, I didn’t emphasize the tax side of the equation. After all, I’m not a CPA.

But here’s what I’ve realized:

Too many CPAs focus on tax preparation, not proactive planning.

Many clients assume their CPA is looking out for Roth conversion timing, tax bracket optimization, or stealth tax drag. But that’s often not the case. And in some unfortunate scenarios, I’ve seen people steered toward annuities or tax strategies that benefit someone else more than they benefit the client.

That’s why I now review tax returns as a standard part of financial planning. Not to replace your CPA—but to bring powerful insight into how your income, investments, and goals interact. This lets us plan with purpose, not just assumptions.

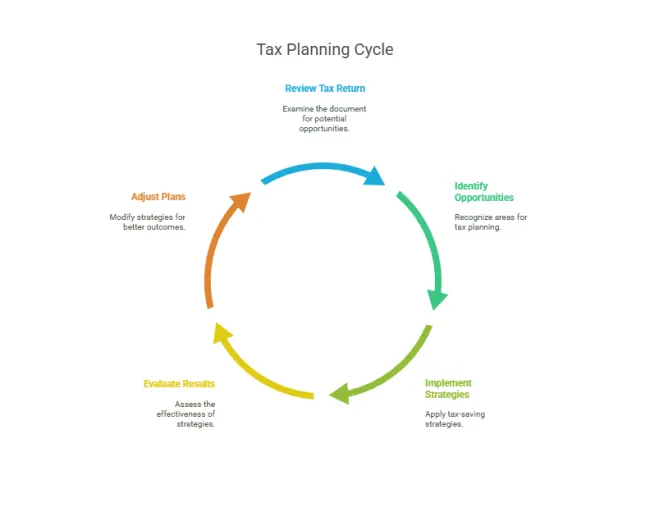

Why Tax Return Reviews Are a Game-Changer

Your tax return isn’t just for the IRS Tax Return Basics. It’s a roadmap full of insights that can:

✅ Identify underused tax credits or bracket gaps

✅ Surface Roth conversion opportunities

✅ Reduce Medicare surcharges and stealth tax drag

✅ Reveal inefficient investment income

✅ Highlight charitable strategies or income timing options

✅ Help structure retirement withdrawals wisely

Tax analysis gives us a smarter, more strategic way to guide your plan.

What We’re Looking At (And Why It Matters)

We use professional-grade tax planning tools (including software like Holistiplan) to scan and interpret your return. With it, we can pinpoint areas of opportunity with clarity and speed.

Adjusted Gross Income (AGI)

Your AGI affects:

- Your tax bracket

- Capital gains thresholds

- Eligibility for deductions or credits

- Medicare premium brackets

We look for ways to intentionally manage AGI—whether through charitable giving, tax-efficient withdrawals, or pre-tax savings.

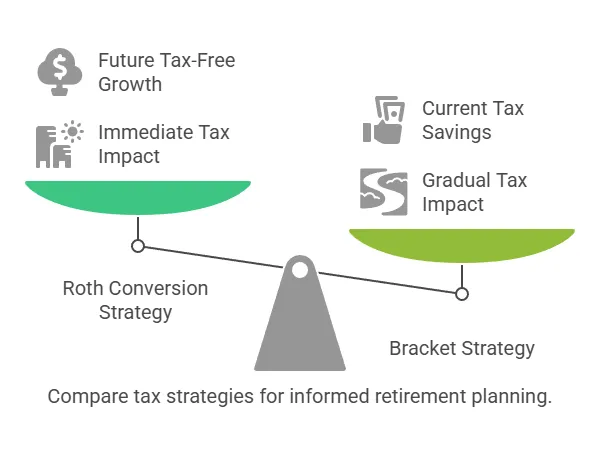

Roth Conversion Opportunities

This is one of the most powerful levers in tax-smart planning.

Using your return and tax bracket data, we can:

- Identify underutilized income space (like within the 12% or 22% brackets)

- Convert just the right amount from traditional IRA to Roth

- Time conversions to reduce long-term RMD burdens

- Avoid bumping into higher marginal brackets or Medicare cliffs

Without your return, this opportunity could go completely unnoticed.

Investment Alignment & Phantom Income

Your return shows whether:

- Dividends or bond interest are pushing you into higher brackets

- Your accounts are tax-optimized (right assets in the right places)

- You’re experiencing phantom income from non-cash distributions

Armed with this data, we can fine-tune your allocations to lower tax drag and better match your lifestyle.

What the Software Does (Without Taking Over)

We use secure, professional software tools—including solutions like Holistiplan—to:

- Analyze what is your tax return automatically

- Visualize bracket opportunities and AGI impacts

- Model Roth conversions and gifting strategies

- Create clear, readable reports that empower your decision-making

This technology speeds up our insight—but doesn’t replace the strategy. We use it to support your planning, not to hand it over to a robot.

No, I’m Not a CPA—And That’s the Point

We don’t prepare taxes, and we’re not here to replace your accountant.

But most CPAs don’t have the time (or incentive) to coordinate your financial life beyond filing season.

Our role is to:

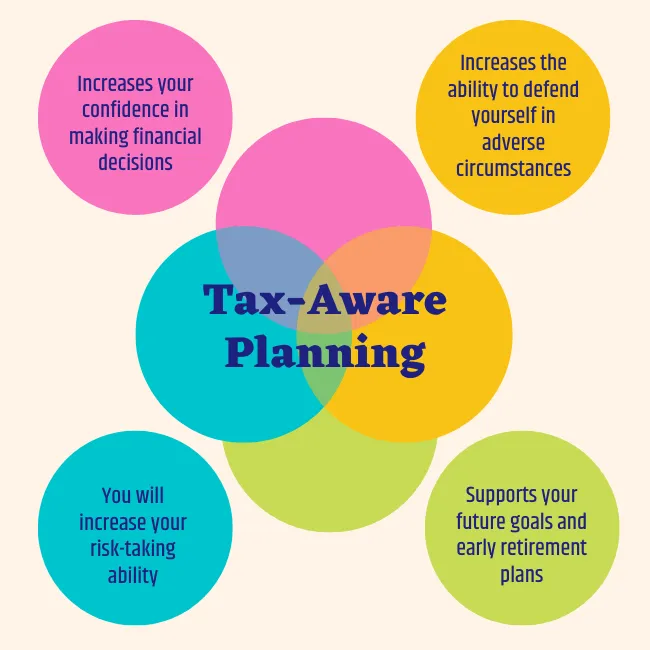

- Bridge the gap between tax prep and tax strategy

- Ensure that your investments, income, and goals align

- Create tax-aware planning that integrates with your CPA—not around them

Real comprehensive planning doesn’t happen in a silo. It happens with teamwork.

Final Thoughts: Your Tax Return Is a Window Into Your Financial Life

You don’t need to be a tax expert to benefit from tax-aware planning.

You just need a planner who knows how to use your return strategically.

When I review your tax return, I’m not looking for mistakes.

I’m looking for:

- Opportunities to reduce lifetime taxes

- Brackets we can optimize

- Roth conversions that make sense now—not five years too late

- Ways to make your financial coaching plan more efficient, more aligned, and more future-focused

📅 Ready to take the guesswork out of tax season—and turn it into real planning power?

Let’s talk. Upload your latest return and book a tax strategy review:

FAQs About Sharing Your Tax Return with a Financial Planner

Q. Do you prepare taxes?

A. No—we’re not tax preparers. But we help plan around taxes, and work with your CPA when needed.

Q. Why would my planner need to see my return?

A. To help identify Roth conversion windows, stealth tax drag, asset inefficiencies, or gifting opportunities.

Q. Is my data secure?

A. Yes. We use encrypted tools for document upload and always treat your return with the highest confidentiality.

Q. Do you only do this for high-net-worth clients?

A. Not at all. Tax-smart planning helps everyone—from early career to retirement.