Staying Invested: Why Dollar Cost Averaging & Tax-Advantaged Accounts Win

Investing with Confidence: A Planner’s Perspective

As a CERTIFIED FINANCIAL PLANNER™, I spend a lot of time helping clients navigate their emotions around investing—especially during times of market uncertainty. Staying invested can feel counterintuitive when the headlines scream panic, but that’s exactly when smart, steady strategies like dollar cost averaging shine. I often remind clients that long-term success isn’t about timing the market—it's about time in the market. In this article, I’ll show you how consistent investing through tax-advantaged accounts and volatile markets can help you build wealth with purpose and confidence, backed by both experience and data.

The Emotional Rollercoaster of Market Volatility

It’s no secret: market volatility can be stressful. Whether you're new to investing or a seasoned pro, watching your portfolio dip can trigger panic. Many investors make the mistake of pulling their money out when markets drop—only to miss the recovery.

But here’s the truth: time in the market beats timing the market—every single time. That’s why strategies like dollar cost averaging (DCA) and leveraging tax-advantaged accounts are so powerful for long-term investors.

What is Dollar Cost Averaging (DCA)?

Dollar Cost Averaging means you invest a fixed amount of money at regular intervals—regardless of whether the market is up or down. By doing so, you buy more shares when prices are low and fewer shares when prices are high. Over time, this helps reduce the average cost per share, lowering risk and smoothing out market volatility.

Let’s say you invest $500 a month into your Roth IRA. If the market drops, your $500 buys more shares. If the market goes up, your investment still continues—but at higher prices. Either way, you're participating consistently, which builds discipline and long-term wealth.

Learn more about Retirement Accounts and Long-Term Investing

Why Investors Panic (and Why It’s a Mistake)

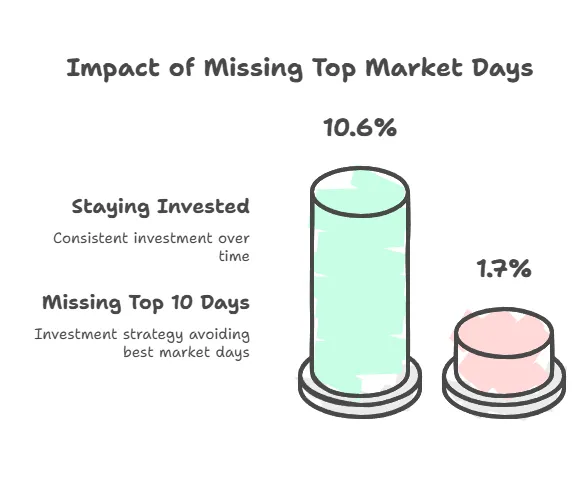

In JP Morgan Guide to Retirement , a powerful chart illustrates how investors who miss just the 10 best days in the market see dramatically reduced returns. And here’s the kicker: the best days often come right after the worst days.

Pulling out of the market during a downturn means locking in losses—and often missing the rebound. For example, between 2003 and 2022, the S&P 500 averaged a 9.8% annual return. But if you missed the best 10 days? Your return dropped to just 5.6%.

Tax-Advantaged Accounts: The Secret Weapon

When combined with dollar cost averaging, tax-advantaged accounts like 401(k)s, Roth IRAs, and HSAs act as rocket fuel for retirement growth.

- Pre-tax accounts (like Traditional 401(k)s) reduce your taxable income now and defer taxes until withdrawal.

- Roth accounts (like Roth IRAs and Roth 401(k)s) grow tax-free after you’ve paid taxes on contributions.

- HSAs (Health Savings Accounts) offer triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified expenses.

Consistent investing inside these vehicles helps grow your wealth while minimizing taxes—a winning combination.

Explore more about Tax-Deferred Investing

Why Staying Invested Wins in the Long Run

Aligning Investments with Goals and Risk Tolerance

Another critical element of staying invested is making sure your investment strategy aligns with your financial goals and risk tolerance. Over time, your life circumstances and financial objectives may shift—and your investments should shift with them. If your portfolio is too aggressive for your risk tolerance, market volatility can lead to sleepless nights and emotional decisions that derail your long-term plan. On the other hand, being too conservative may prevent your money from growing enough to support your future goals.

That’s why it’s so important to regularly review and update your financial goals, investment allocations, and risk tolerance. An outdated plan can create unnecessary stress when the market fluctuates. A current, well-matched strategy gives you confidence to stay the course—because you know your investments are working for you.

Here’s why staying invested works:

- You avoid emotional decisions. Fear leads to poor timing.

- You stay in position for the rebound. Pulling out means you miss the upswing.

- You buy more when prices are low. Think of market dips as "stocks on sale."

Need help staying consistent? Start by Growing Your Savings Rate

And if volatility stresses your budget, first make sure you’re Building an Emergency Fund

Real Life Example: Dollar Cost Averaging in Action

Emma invests $400/month in her Roth 401(k). In a year where the market drops 15%, she continues investing. Her average share cost is lower, and when the market rebounds, her account grows faster than if she had paused contributions. Plus, since it’s a Roth, her gains are tax-free at retirement.

Key Investing Stats & Myths

Stats:

- 66% of Americans fear they won’t have enough saved for retirement.

- The average 401(k) balance dropped nearly 20% in 2022, but rebounded by 2024.

- Long-term investors who stayed invested from 2003–2022 earned nearly double the returns of those who missed just the 10 best market days.

Myths vs. Facts:

- Myth: "Cash is safer during a downturn." Fact: Cash may protect in the short term, but it loses to inflation long term.

- Myth: "I’ll re-enter the market when things feel safer." Fact: Market recoveries are often unpredictable and swift—missing them is costly.

Myth: "I should stop contributing when the market is down." Fact: Market dips are the best time to invest—buy more at lower prices.

Final Thoughts: Ride the Waves, Reap the Rewards

Investing isn’t about getting every decision right. It’s about staying committed to a long-term plan.

By combining dollar cost averaging with tax-advantaged investing, you create a strategy that:

- Smooths out volatility

- Reduces emotional decision-making

- Maximizes compounding

- Minimizes taxes

If you're feeling unsure about your current plan or you're tempted to "wait it out," it might be time for a check-in. As a CERTIFIED FINANCIAL PLANNER™, I help clients stay the course and make data-driven, emotionally neutral investment decisions.

📩 Schedule your free consultation today

Frequently Asked Questions

Q: What if I can’t afford to invest when the market is down?

A: Even small, consistent contributions help. Dollar cost averaging works at any level. If needed, scale back temporarily instead of stopping completely.

Q: How do I know if my risk tolerance is right?

A: It’s important to revisit your risk tolerance annually or after any major life event. If market swings cause anxiety or sleepless nights, your portfolio may be too aggressive.

Q: Is dollar cost averaging better than lump sum investing?

A: Over long periods, lump sum investing can outperform—but DCA helps reduce timing risk and emotional investing. It's especially effective in volatile markets.

Q: What should I do if I panicked and sold my investments?

A: Don’t beat yourself up. Talk with a financial planner about how to re-enter the market gradually and create a plan to avoid panic-driven decisions in the future.

Q: Can I still invest if I’m close to retirement?

A: Yes! Retirement planning doesn’t stop at retirement. A portion of your assets should remain invested to support long-term income needs. It’s about balance and appropriate risk.