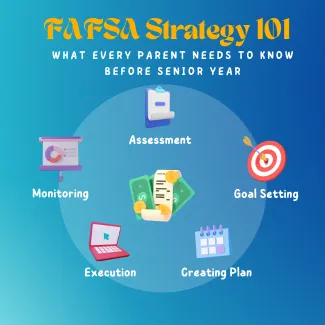

FAFSA Strategy 101: What Every Parent Needs to Know Before Senior Year

Why Parents Work with Me to Get FAFSA Right

As a CERTIFIED FINANCIAL PLANNER™ and College Funding and Student Loan Advisor (CFSLA) based in Dallas, I work with families at every income level who are serious about funding college without breaking their retirement.

And FAFSA? It’s the foundation.

Whether you expect need-based aid or not, completing the Free Application for Federal Student Aid (FAFSA) isn’t optional—it’s essential.

But it’s also misunderstood, misused, and misfiled more often than you think.

Let’s break down what’s changed, what matters most, and how to file smart—not just fast.

What Is FAFSA—and Why It Still Matters (Even for Wealthy Families)

The Free Application for Federal Student Aid (FAFSA) is far more than just a form—it’s the gateway to the entire college financial aid system in the United States.

When filed correctly and on time, FAFSA determines your student’s eligibility for:

- Federal Grants and Scholarships: Including the Pell Grant, FSEOG, and TEACH Grant—many of which never have to be repaid.

- Work-Study Opportunities: Federal and school-based programs that allow students to earn part of their tuition through campus jobs.

- Federal Student Loans: Both subsidized (interest-free while in school) and unsubsidized loans are only available with a FAFSA on file.

- Institutional Aid from Colleges and Universities: Even elite private schools often require a FAFSA to award need-based and merit-based aid.

- Merit Aid and Academic Scholarships: Many competitive awards (including some that are not strictly “need-based”) still require FAFSA submission as a condition of eligibility—even for high-income families.

FAFSA ≠ Just for Low-Income Families

This is where many Dallas families get it wrong.

They assume that if they make too much money to qualify for Pell Grants, the FAFSA doesn’t apply to them.

But here’s the reality: Many schools won’t offer a dime of merit aid or institutional scholarship unless there’s a FAFSA on file. It’s not just about “need”—it’s about access.

If you skip FAFSA, you may be shutting your student out of tens of thousands in awards they’ve earned—even if you don’t qualify for federal need-based grants.

FAFSA Stats That Might Surprise You

- The U.S. Department of Education distributed over $112 billion in financial aid last year through federal programs alone.

- $3.75 billion in Pell Grant aid went unclaimed—largely because eligible families didn’t file FAFSA at all.

- A staggering 40% of students who qualify for aid never submit the form.

In my Dallas practice, I see it constantly: high-achieving students at private schools in Highland Park, Plano, or Frisco miss out on scholarships—not because of grades or test scores—but because their families didn’t file FAFSA due to outdated assumptions.

Sometimes the most financially prepared families are also the most overlooked in aid—simply because they opted out of the system altogether.

Even if You’re Paying Full Price, FAFSA Still Has Purpose

Here’s why affluent families still need to file:

- Unsubsidized Federal Loans are only available if FAFSA is filed—even if you don’t qualify for need-based aid. These loans can help preserve cash flow, protect retirement assets, or provide flexibility during uncertain markets.

- Emergency Federal Aid (like during the COVID-19 pandemic) was only available to families with FAFSA on file.

- Private Colleges and Universities often award merit-based aid using FAFSA data—even if the family doesn’t appear “needy” on paper.

Dallas Planning Tip

I often advise high-net-worth families in North Dallas and Park Cities to file FAFSA regardless of expected aid eligibility. Why? Because many schools use FAFSA as a prerequisite, not a guarantee.

In other words: No FAFSA, no scholarship—even if your student ranks at the top of the class.

College Money Report™: Your FAFSA Starting Point

Want to know how much aid your student might actually get?

Get a custom College Money Report™ that breaks down:

- Your projected Student Aid Index (SAI)

- College-specific financial aid expectations

- Merit award potential—even for high-income families

- Strategies to close the gap without overborrowing

Get Your Free College Money Report™

FAFSA Has Changed: What Parents Must Know Now

The FAFSA Simplification Act, rolled out in phases between 2023 and 2024, brought the biggest overhaul to the federal aid system in decades. While the new form is shorter and (on the surface) simpler, the strategic impact for parents is anything but.

Here’s what’s changed—and how smart families should adjust their planning:

1. EFC Is Now the SAI (Student Aid Index)

The familiar Expected Family Contribution (EFC) is gone. In its place: the Student Aid Index (SAI)—a recalibrated formula with serious implications for how much colleges think you can afford.

Key changes under SAI:

- No discount for multiple children in college at once - In the past, having two or more kids in college at the same time reduced your EFC. That multiplier is gone under SAI—which could dramatically increase your expected out-of-pocket costs if you have multiple college-bound kids.

- Fewer asset protections - The SAI formula reduces the shielding of parent assets like cash savings and investments. This means more of your net worth may now count against you.

- Small business exclusions removed - Previously, family-owned small businesses with fewer than 100 employees were excluded from aid formulas. Now, under SAI, the value of your business assets may count, especially for entrepreneurial Dallas families and small business owners.

Dallas Planning Note: If you own a dental practice in Plano, a real estate business in Frisco, or run an LLC from home—your business assets could now work against your aid eligibility.

2. The FAFSA Is Shorter—but Strategically More Rigid

Yes, the new FAFSA has fewer questions. But don’t be fooled into thinking that makes it easier. In fact, for high-net-worth or self-employed families, the process is less forgiving and more opaque.

Here’s why:

- Income pulled automatically from the IRS - FAFSA now uses the FA-DDX (Future Act Direct Data Exchange) to pull income and tax data directly from your federal tax return—no uploads, no edits.

- Less room to clarify financial complexity - With less room for explanation, you can’t easily contextualize one-time events (like a large capital gain or sale of a property). This limits your ability to advocate for a more accurate aid assessment.

- Consent is mandatory - All contributors (typically both parents) must consent to the IRS data transfer. Without consent, the FAFSA can’t be processed at all. This has created serious headaches for families with strained relationships, joint custody, or separated finances.

Texas Planning Tip: I work closely with divorced or co-parenting families in Dallas to prepare for this hurdle months before the FAFSA opens. Without coordination, one missing signature could delay—or block—your child’s aid entirely.

3. Divorced Parents: FAFSA Now Follows the Money

Under the old FAFSA rules, the custodial parent (the one the child lived with more than 50% of the time) was the one whose income and assets were reported.

Now? That rule is gone.

Under SAI, the parent who provides the most financial support—regardless of custody—is the one who must file.

This is a game-changer for divorced or separated families and can dramatically impact aid eligibility. It may even make sense to restructure payment responsibilities if aid is on the line.

Dallas Insight: Many of my clients restructure post-divorce college agreements after we model the aid difference based on which parent files. For blended families in Highland Park, this can shift tens of thousands in eligibility.

4. Grandparent 529s No Longer Hurt FAFSA (Game On!)

Under the old system, distributions from a grandparent-owned 529 plan were counted as student income in the following year—dramatically reducing aid eligibility.

That rule is gone.

As of 2024, grandparent-owned 529 withdrawals are no longer reportable income on the FAFSA.

This is a major win for high-net-worth families looking to gift efficiently, fund legacy education, and preserve financial aid at the same time.

Strategic Planning Tip: This change opens powerful opportunities for grandparents to:

- Fund 529s now and spend later—without FAFSA penalties

- Coordinate with their estate or gifting strategy

- Support multiple generations of education, tax-free

At Future-Focused Wealth™, I often help multi-generational Dallas families layer grandparent contributions into a comprehensive strategy that protects aid, maximizes tax advantages, and builds legacy wealth.

When Should You File the FAFSA?

The FAFSA opens on October 1 each year—and if there’s one piece of advice I give every Dallas-area parent, it’s this:

File as early as possible.

Even if you think you won’t qualify for aid, submitting early keeps your student eligible for:

- First-come, first-served state and institutional grants

- Early-decision or early-action aid packages

- Scholarships that require a completed FAFSA for consideration—even if merit-based

Why Timing Matters

Although the FAFSA Simplification Act caused a rare delay for the 2024–2025 cycle (opening in December), the Department of Education has stated that October 1 will remain the standard opening date moving forward.

That means your planning timeline should look like this:

By Summer Before Senior Year:

- Gather tax returns, W-2s, bank statements, and business asset values

- Discuss income and investment positioning with your financial planner or tax advisor

- Identify who will be listed as a contributor (especially in divorced households)

By October 1:

- Be ready to submit as soon as the portal opens

- Double-check for state and school-specific deadlines (many are well before the federal June cutoff)

- Plan for additional forms like the CSS Profile, if your student is applying to selective private schools

Dallas Planning Tip: Texas residents applying to in-state schools like UT Austin or Texas A&M should file by January 15 to remain eligible for state-based programs like TEXAS Grant—even if the federal deadline is later.

What Year’s Income Counts on the FAFSA?

Here’s where many parents get tripped up: the FAFSA doesn’t look at your current income. It looks back—two years.

This is known as the “prior-prior year” rule.

FAFSA Income Lookback Example:

- FAFSA for College Freshman Year (Fall 2026) = Will use your 2024 income (not 2025)

- That means: Your student’s sophomore year of high school is the tax year that matters most

Why is that important?

Because if you had a one-time capital gain, sold a property, exercised stock options, or took a business windfall that year, your aid eligibility could suffer—even if your income is lower when your student actually enrolls.

FAFSA Strategy Isn’t Just About Paperwork—It’s About Positioning

At Future-Focused Wealth™, I work with families to:

- Time income and distributions well in advance of FAFSA years

- Shift assets where legally possible to reduce aid penalties

- Coordinate tax strategy with college and retirement planning

For Dallas-area business owners, investors, and high-income earners, these tactics can mean the difference between getting zero aid and unlocking tens of thousands in institutional merit dollars.

How the Student Aid Index (SAI) Is Calculated—and Why It Matters

The Student Aid Index (SAI) replaced the Expected Family Contribution (EFC) in 2024. While the new terminology is meant to feel more student-friendly, the underlying message is the same:

It’s the number colleges use to decide how much aid your student gets—and how much you’re expected to pay.

What Is the SAI?

The Student Aid Index (SAI) is a federal formula used to determine your student’s eligibility for need-based financial aid. It’s calculated after submitting the FAFSA, and it appears on your Student Aid Report (SAR).

Think of it this way:

Cost of Attendance (COA)

– Student Aid Index (SAI)

= Eligibility for Need-Based Aid

Key SAI Inputs: What Affects the Number?

The formula behind the SAI is complex, but it boils down to a handful of major factors—and they’re all things you can plan for with enough time:

1. Parent Income

- Most heavily weighted factor—counted at a rate of ~22–47% of discretionary income

- Includes taxable income, untaxed income, and some business income

- Uses prior-prior year tax return (e.g., 2024 income for 2026–27 FAFSA)

Dallas Planning Insight: This is why I work with families during their student’s sophomore year—so we can time Roth conversions, stock sales, or one-time bonuses with aid eligibility in mind.

2. Parent Assets

- Only non-retirement assets are considered (e.g., checking, savings, investment accounts)

- Assessed at 5.64% of total value

- 529 plans owned by parents are included—but far less damaging than student-owned assets

Strategy Tip: Assets in 401(k)s, IRAs, Roth IRAs, and home equity are excluded—so moving excess cash into retirement before FAFSA years can legally improve your aid outcome.

3. Student Income

- Assessed at a much higher rate—50% of discretionary income

- If your student has a job, side hustle, or trust fund, it could heavily affect eligibility

4. Student Assets

- Counted at 20% of total value

- This is why UTMAs and custodial brokerage accounts can hurt—they’re considered student-owned, even if parents control them.

College Aid Caution: A $10,000 UTMA account could reduce aid eligibility by $2,000. A parent-owned 529 of the same size might reduce aid by just $564.

What the SAI Doesn’t Consider Anymore

Under the FAFSA Simplification Act, some big changes removed aid-friendly adjustments that previously helped families:

- Multiple college students: There’s no longer a discount for having two or more kids in school at once

- Asset protection allowance: Previously shielded some parental assets based on age—now eliminated

- Small business exclusion: Family-owned businesses with under 100 employees must now be reported

These changes raise the effective SAI for many middle- and high-income families—especially business owners.

What’s a “Good” SAI?

There’s no perfect number—but here’s how colleges generally interpret it:

Dallas Planning Note: Some private colleges like SMU, Rice, and Trinity University still offer merit aid even for high-SAI families—but you must complete the FAFSA to be eligible.

Bottom Line: The SAI Isn’t Just a Number—It’s a Strategy

At Future-Focused Wealth™, I help families:

- Estimate their projected SAI early

- Build savings plans that don’t sabotage aid

- Time income, capital gains, and asset shifts around FAFSA lookback years

- Use grandparent 529s, Roth IRAs, and strategic gifting to lower their reported SAI—legally and effectively

📅 Want help understanding where your family stands—and what your next best move is?

Schedule a college funding strategy call

Why High-Income Families Should Still File the FAFSA

You might assume the FAFSA is only for low- or middle-income households.

But skipping it could mean leaving money—and options—on the table.

Even if you don’t qualify for Pell Grants or subsidized loans, the FAFSA opens doors to valuable financial resources that aren’t always income-based.

1. Merit Aid Often Requires a FAFSA on File

Private colleges (and even some public ones) require a completed FAFSA to be considered for non-need-based merit aid—even if the scholarship has nothing to do with your income.

- SMU, Baylor, Rice, TCU, and Trinity University all strongly recommend or require the FAFSA to unlock institutional scholarships.

- Some state schools auto-match FAFSA data with university-specific merit programs—even for high earners.

Dallas Strategy Note: I always advise high-income families to file FAFSA—even if you assume you won’t get anything. It keeps every possible door open for merit aid, honors programs, and tuition discounts.

2. Unsubsidized Federal Loans Are Available Regardless of Need

Every student who files a FAFSA is eligible for Direct Unsubsidized Loans, even if their family’s income is well into the six- or seven-figure range.

- These loans carry lower interest rates than many private loans.

- They can be a liquidity buffer or safety net, allowing you to preserve investments or avoid triggering capital gains.

Example: A Dallas family earning $400K/year may not need a loan—but may choose to use federal unsubsidized loans for cash flow, then pay them off post-graduation when bonus season hits or a large asset vests.

3. Work-Study Eligibility Requires a FAFSA

Some colleges use FAFSA data to offer federal or institutional work-study positions—which can:

- Reduce tuition and housing costs

- Offer flexible, campus-based work

- Add valuable experience to a student’s résumé

Even if you decline the work-study opportunity, filing the FAFSA is still the only way to be considered.

4. You Need It for Grad School Aid Later

If your student plans to pursue a graduate or professional degree, they’ll need a FAFSA to access:

- Federal unsubsidized loans

- PLUS loans

Institutional fellowships or assistantships

Pro Planning Tip: Filing the FAFSA now builds your student’s financial aid history and speeds up the process later—especially if grad school is on the horizon.

5. Some 529 Strategies Require FAFSA Coordination

Grandparent-owned 529 plans used to be a landmine for financial aid—they counted as untaxed income to the student. But as of 2024, that’s no longer the case.

Now, 529 distributions from grandparents don’t affect aid—but you still need to file the FAFSA to claim that aid.

This makes FAFSA a required tool for multi-generational planning—even for high-net-worth families.

6. It’s a Backstop for Unexpected Financial Changes

Life happens. A layoff, business downturn, medical event, or divorce can dramatically shift your income picture—often mid-year.

If you’ve already filed the FAFSA, you can submit a Professional Judgment Appeal to have your aid reassessed based on current circumstances.

If you never filed? No aid adjustment is possible.

Bottom Line: Filing FAFSA Isn’t About Need—It’s About Options

At Future-Focused Wealth™, I tell high-income Dallas families this:

“You may not need aid—but FAFSA still gives your child access to merit awards, loan flexibility, work-study, and institutional perks. It’s a no-lose move.”

You’ve worked hard to give your student every advantage. Filing FAFSA ensures you don’t miss the ones you’re already entitled to.

Let’s build a FAFSA strategy that keeps every door open

FAFSA Strategies That Actually Work

Get More Aid. Protect More Assets. Stay In Control.

Submitting the FAFSA isn’t just paperwork—it’s an opportunity. And if you plan ahead, you can improve your eligibility, reduce your exposure, and build a smarter path to college funding.

As a CERTIFIED FINANCIAL PLANNER™ and College Funding and Student Loan Advisor (CFSLA), here’s how I guide Dallas families through the strategic FAFSA maze.

1. Understand the FAFSA Timeline and Target Years

The FAFSA uses the “prior-prior year” income to assess your Student Aid Index (SAI).

- Class of 2026 students? FAFSA will use 2024 tax data.

- That makes sophomore year of high school the key year for income planning.

Dallas Strategy Tip: If you’re expecting a high-income year, bonus, RSU vest, or business windfall—time it before freshman year or after sophomore year if possible.

2. Avoid Income Spikes During the FAFSA Window

FAFSA is income-sensitive, especially when it comes to:

- Capital gain

- IRA conversions

- Stock option exercises

- Roth IRA withdrawals

Smart Move: Shift taxable events outside the look-back window (typically sophomore year) to keep SAI lower and aid eligibility higher.

3. Keep Assets in the Right Name

Not all assets are treated equally. FAFSA counts:

- Parent-owned 529s at only 5.64% of value

- Student-owned UTMAs at up to 20%

- Roth IRAs, 401(k)s, and home equity? Not counted at all

Asset Repositioning Strategy: Move cash out of student-owned accounts and into parent-controlled vehicles (like a 529 or custodial Roth) before the FAFSA snapshot date.

4. Don’t Forget Grandparent-Owned 529 Plans

Good news: As of 2024, distributions from grandparent-owned 529s no longer count as student income on the FAFSA.

That makes this an ideal tool for:

- Legacy gifting

- Grandparent involvement without aid penalties

- Strategic late-stage funding

Strategy Insight: Use grandparent 529s to bridge the last two years of college when aid might drop off anyway.

5. Divorced? Coordinate Who Files the FAFSA

New FAFSA rules require the parent who provides more financial support to file—not the one with custody.

That can dramatically change:

- Aid eligibility

- Asset exposure

- Tax-linked strategies

Divorce Planning Tip: The “supporting parent” rule gives you flexibility. I help families shift expenses in advance to optimize which parent’s income gets counted.

6. Prepay Debt or Invest in Non-Countable Assets

If you’re holding cash in checking or savings during FAFSA filing, that money is 100% visible. But you can reposition that cash:

- Pay off high-interest debt

- Fund your Roth IRA or 401(k)

Prepay property taxes or insurance

Cash Flow Strategy: Shift excess liquidity before FAFSA snapshot to reduce countable assets without losing financial flexibility.

7. Document Special Circumstances for Appeals

If you’ve had a financial disruption after the tax year used in FAFSA, you can request a Professional Judgment (PJ) review.

Examples:

- Job loss

- Divorce

- Major medical expense

- Natural disaster

What I Do: I help families prepare and submit strategic appeals backed with documentation to request a lower SAI—and more aid.

8. Use a College List Strategy

FAFSA allows you to list up to 20 schools.

- Some colleges are “need-aware” (your financial situation may impact admissions)

- Others are “need-blind” but offer wildly different aid packages

Strategy Play: I guide clients through choosing schools where your SAI stretches farther—often private colleges with generous aid policies or large endowments.

Bottom Line: FAFSA Strategy = Aid Leverage

Families often think FAFSA is all about need.

But for savvy planners, it’s a lever to:

- Preserve wealth

- Improve school choice

- Coordinate 529s, retirement, and taxes

- Access grants, scholarships, and flexible aid—even without “need”

At Future-Focused Wealth™, I help families craft intentional FAFSA strategies that work across income brackets—because financial aid is about planning, not luck.

Schedule a FAFSA Strategy Session

What If You Don’t File the FAFSA?

Skipping the FAFSA might seem like a time-saver—especially if you assume you won’t qualify for aid. But that choice can cost you far more than you realize.

Even high-income families in Dallas should file the FAFSA every year. Here’s why:

1. You Could Miss Out on Merit Aid

Many private colleges and even some public universities require a FAFSA on file to award merit scholarships, even if they’re not need-based.

Example: A student with a 4.0 GPA and stellar SAT might qualify for $10,000/year in merit aid—but not if the FAFSA is missing.

2. You’ll Be Ineligible for Federal Loans

No FAFSA = no access to:

- Subsidized student loans (interest-free while in school)

- Unsubsidized federal loans (better rates than private lenders)

- Parent PLUS loans (which offer fixed interest rates and protections)

Even if you plan to pay out of pocket, loans can offer flexibility—especially in high-cash-flow years or for second children entering college.

3. You Close the Door on Work-Study and Campus Jobs

The Federal Work-Study Program is awarded based on FAFSA. These jobs:

- Are often reserved for FAFSA filers

- Can reduce overall borrowing

- May include campus perks (free meals, housing discounts)

Planning Tip: Work-study doesn’t just provide income—it can reduce student loan reliance without affecting aid eligibility.

4. Your College Can’t Offer Institutional Aid

Many colleges have their own forms of need-based aid, but they rely on FAFSA data to calculate it.

- No FAFSA? No institutional grants.

- Some schools won’t package aid offers at all without the form.

5. You Miss Strategic Planning Opportunities

Filing FAFSA gives you a baseline—and that lets you:

- Run scenarios with your financial planner

- Appeal aid decisions with data

- Coordinate 529 withdrawals and Roth strategies

- Anticipate cash flow across multiple kids in college

Real-Life Example: I helped a Dallas family with $300K+ income save $18,000 by coordinating FAFSA timing with a job loss and using a grandparent 529—none of which would have been possible without submitting the FAFSA.

Don’t Let the FAFSA Scare You—Use It Strategically

Yes, it’s complicated. Yes, the rules change.

But families who skip the FAFSA are voluntarily saying no to aid, flexibility, and smarter planning.

At Future-Focused Wealth™, I help families file early, file correctly, and build intentional FAFSA strategies that work with the rest of their financial lives—not against them.

Book a FAFSA Strategy Call Now

The 4 Biggest FAFSA Mistakes Parents Make (And How to Avoid Them)

Filing the FAFSA isn’t just a box to check—it’s a financial move that can significantly impact your college funding strategy. But too often, even high-income or financially savvy families make costly mistakes that reduce their aid eligibility, complicate tax planning, or block institutional grants altogether.

Here’s how to sidestep the most common FAFSA blunders and file like a pro:

1. Not Filing at All

This is the single biggest mistake—and it’s usually based on a false assumption:

“We make too much to qualify for financial aid.”

But here’s the truth:

- Merit aid at many private colleges requires a FAFSA on file—even if the aid isn’t need-based.

- Federal unsubsidized loans are available to all students who file FAFSA, regardless of income.

- Work-study programs, emergency aid, and state grants may all require FAFSA submission, even for high-income households.

Strategic Tip: Filing the FAFSA creates a baseline. Without it, your student may miss out on thousands in aid—simply because the school has no way to package an award.

2. Misreporting Assets

Incorrect reporting of income and assets is one of the most common errors—and it can drastically inflate your Student Aid Index (SAI), making you look “richer” than you actually are.

Common asset mistakes include:

- Including retirement accounts: FAFSA excludes assets held in 401(k)s, IRAs, Roth IRAs, and pensions. Listing them as available assets can torpedo your eligibility.

- Forgetting about custodial accounts (UTMA/UGMA): These accounts are considered student assets and assessed at 20%—four times higher than parent assets.

- Double-counting 529s: A 529 plan owned by the parent should only be listed once. Listing it under both student and parent can artificially inflate your reportable assets.

Dallas Planning Tip: I perform FAFSA audits for families to ensure reporting is clean, compliant, and strategically positioned—especially when multiple accounts or grandparents are involved.

3. Missing School-Specific Deadlines

While the FAFSA opens every October, each college sets its own priority filing deadline for institutional aid. And that deadline often comes months before final acceptance letters.

What happens if you miss it?

- Your student may still qualify for federal aid—but miss out entirely on the school’s own grants, scholarships, or need-based discounts.

- Some colleges issue aid on a first-come, first-served basis—meaning late filers get whatever’s left… if anything.

Strategy Tip: Build a FAFSA calendar in your student’s junior year. Add every college’s priority deadline and aim to file the FAFSA in October or early November to stay competitive.

4. Not Coordinating FAFSA with Financial Planning

Even families with professional-level income can optimize their aid eligibility—if they plan ahead. But most don’t realize the FAFSA looks two years back at tax returns (the “prior-prior year”), which means:

- That Roth conversion? It may spike your income and reduce aid.

- That big work bonus? It could bump you into an unfavorable aid tier.

- That real estate sale or RSU vest? It may increase your SAI and reduce eligibility—even if it was a one-time event.

Smart Move: Coordinate your FAFSA timeline with your financial planner—ideally starting in your student’s sophomore year of high school. That’s when “FAFSA income” really starts counting.

Real-Life Example: I helped a Dallas family restructure their Roth withdrawals, shift a bonus into a different tax year, and delay an asset sale—all of which dropped their SAI by over $30,000 and unlocked over $15,000 in institutional aid.

Final Takeaway:

The FAFSA isn’t just a form. It’s a financial tool that—when used strategically—can unlock thousands in aid, lower your college costs, and create smarter tax and savings opportunities.

At Future-Focused Wealth™, I specialize in helping Dallas families avoid these mistakes and file FAFSA with intention, accuracy, and maximum benefit.

Schedule a FAFSA Strategy Call Now

FAFSA vs. CSS Profile: Know the Difference

Not all financial aid calculations are created equal. While FAFSA is the federal standard used by nearly every college in the U.S., many elite private institutions also require a separate form: the CSS Profile, administered by the College Board.

This form dives deeper—and handles money very differently.

What Makes the CSS Profile Different?

Unlike FAFSA, which mainly looks at income and a limited set of assets, the CSS Profile digs into a family’s full financial life, including:

- Home equity

- Small business ownership and assets

- Retirement contributions

- Non-custodial parent income

- Trust funds, annuities, and insurance policies

- Medical expenses, elder care costs, and other special circumstances

While FAFSA aims for a standardized aid formula, CSS is more subjective and institutionally tailored—each school can decide how it weighs the information.

Why This Matters for Strategy

Here’s the trap: what helps you on the FAFSA may hurt you on the CSS Profile.

- Example: FAFSA ignores home equity. CSS includes it. A family with high home equity but low income might qualify for aid on FAFSA—but be penalized under CSS.

- Example: Grandparent-owned 529 plans don’t count under FAFSA’s new rules, but can under CSS depending on the school.

Planning Insight:

If your student is applying to both FAFSA-only and CSS Profile schools, your savings, gift strategy, and account ownership structures must be multifaceted. There’s no one-size-fits-all tactic—you need a layered plan.

Dallas College Planning Tip: Many high-profile Texas families applying to out-of-state private colleges (like Vanderbilt, NYU, or Tulane) need coordinated FAFSA + CSS Profile strategies to protect eligibility and reduce tuition exposure.

The OBBB Act: The New Cap on Parent Loans (and Why It Matters Now)

Passed in response to the growing crisis of family debt tied to college funding, the One Borrower, One Loan, Better Budgeting (OBBB) Act introduced sweeping changes to Parent PLUS loans.

The big shift? Parents can no longer borrow unlimited amounts.

What Changed?

Previously, parents could borrow up to the full cost of attendance, no matter their income or ability to repay. That meant many families unknowingly took on six-figure debt just to fill the gap between savings and tuition.

The OBBB changed that:

- PLUS Loans are now capped at the cost of attendance minus other aid received

- No more “lifestyle borrowing” or taking out PLUS loans for non-education purposes

- Schools must certify that the borrowing aligns with real educational costs

Why It Matters for Families

This is a good protection in theory—but it also creates new pressure.

With less borrowing flexibility:

- Families must be more proactive in FAFSA filing, early saving, and applying for merit aid

- You can’t rely on last-minute loans to “make up the difference”

- Grandparent help, Roth IRA backup strategies, and even cash flow planning become essential

CFP® + CFSLA Planning Perspective:

I often work with families who could borrow large amounts—but shouldn’t. With the OBBB’s new limits, the days of “we’ll figure it out later” are over. Now, smart families are figuring it out earlier, layering aid strategies, and keeping student debt realistic.

Dallas Insight: Many local families at SMU, Baylor, or TCU used to rely on PLUS loans to plug big aid gaps. Now, I help them pre-build savings, reposition assets, and time gifts to avoid overborrowing in the first place.

Get Your Free College Money Report™

Final Thoughts: FAFSA Is the First Step—Not a One-Time Task

Filing the FAFSA isn’t just a checkbox—it’s the gateway to every other college funding opportunity.

It determines:

- Your student’s eligibility for grants, scholarships, and loans

- Access to institutional and merit aid (even at elite private schools)

- How your savings, income, and legacy planning will affect financial aid

But here’s the truth: Getting it wrong—or skipping it altogether—can cost your family thousands.

Every year, families with solid income still qualify for:

- Unsubsidized loans at lower rates than private banks

- Merit aid that requires a FAFSA on file

- Emergency grants or school-specific awards

And with major changes from the FAFSA Simplification Act and new borrowing caps under the OBBB Act, the form is more strategic than ever.

Filing isn’t the end of your financial aid journey. It’s the beginning of a multi-year strategy that evolves as your child progresses through high school, applies to colleges, and evaluates offers.

Your Next Move? Planning, Not Guessing

At Future-Focused Wealth™, I help Dallas families turn FAFSA from a frustrating process into a proactive strategy.

That means:

- Timing income and asset shifts ahead of the two-year look-back window

- Aligning grandparent 529 gifts, Roth withdrawals, and trust assets to minimize aid impact

- Reviewing merit-based opportunities and school-specific rules (FAFSA vs. CSS)

Building plans for multi-child families and multi-year affordability—not just freshman year

Let’s build your FAFSA strategy before it’s too late.

Schedule a College Aid Planning Session

FAQs: FAFSA for Real Life

Q: We make over $250K—do we still need to file?

A: Yes. Many private schools require it to award merit aid. And it unlocks unsubsidized loans for your student.

Q: Do I include my home equity?

A: Not on FAFSA—but you do on the CSS Profile. That’s why the dual-form strategy matters.

Q: We’re divorced. Who fills out FAFSA now?

A: The parent who provides the most financial support—not the one with legal custody.

Q: Should I file early?

A: Always. The earlier you file after FAFSA opens, the more aid you may receive.