529 Plans vs. Other Education Savings Accounts: What’s Best for You?

College Savings Isn’t One-Size-Fits-All

As a Dallas-based CERTIFIED FINANCIAL PLANNER™ and College Funding and Student Loan Advisor (CFSLA), I often hear parents ask:

“Do I need a 529 plan… or is there something better for my situation?”

The truth? There is no one perfect account. But there is a best-fit strategy for your income level, goals, and financial plan.

Whether you’re saving for private K–12 tuition, undergraduate college, grad school, or even future grandkids, you need to understand how each account type works—before you commit.

Let’s break it down.

529 Plans: The Heavyweight Champion (for Most Families)

If there’s one education savings account that gets the spotlight—and deserves it—it’s the 529 plan. Designed specifically to support education goals, 529s offer one of the most powerful combinations of tax benefits, flexibility, and control available to families planning for college, private school, or even student loan payoff.

At its core, a 529 is a state-sponsored investment account that allows you to grow money tax-deferred and withdraw it completely tax-free, as long as the funds are used for qualified education expenses.

But don’t confuse “state-sponsored” with “limited.” You’re not stuck with your home state’s plan, and you don’t have to attend college in that state, either.

Why 529 Plans Dominate the Education Savings Space

Tax-Free Growth + Tax-Free Use:

Every dollar you contribute to a 529 grows without being taxed, and if you use that money for qualified education expenses—tuition, books, fees, computers, even off-campus housing—it comes out tax-free.

Ultra-High Contribution Limits:

Most 529 plans allow you to contribute $300,000 to $500,000+ per beneficiary, depending on the state. That makes it ideal for families planning ahead for multiple degrees, graduate school, or even legacy gifting.

Parent Control = Built-In Flexibility:

The account owner (usually a parent or grandparent) retains full control—you choose how the funds are invested and when they’re distributed. The child has no legal right to the money, unlike UTMA accounts.

Expansive Qualified Use:

The list of eligible expenses has expanded in recent years to include:

- K–12 private school tuition (up to $10,000/year)

- Trade school and vocational training

- Study-abroad programs

- Student loan repayment (up to $10,000 per beneficiary)

- Even future rollovers into Roth IRAs (up to $35,000) under SECURE Act 2.0, starting in 2024

Multi-Generational Use:

Don’t need the funds after all? You can change the beneficiary to another child, grandchild, or even yourself—without resetting the tax advantages.

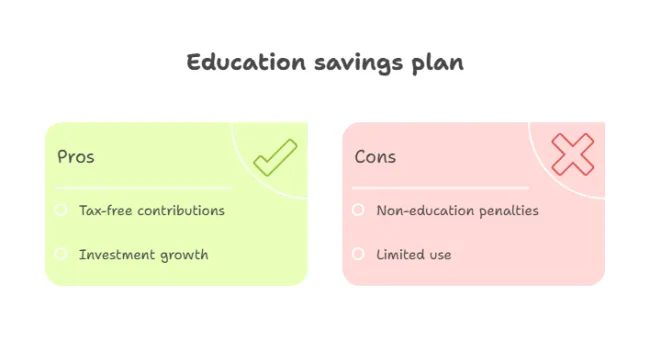

What to Watch Out For (Because Every Tool Has Limits)

Penalties for Non-Qualified Use:

Withdrawals used for non-education expenses face income tax + a 10% penalty on the earnings portion. (You always get your contributions back tax-free.)

Investment Restrictions:

Most plans offer a set of predefined investment portfolios, typically age-based or risk-tiered. While these are sufficient for most families, ultra-high-net-worth clients may prefer broader options through taxable accounts.

Minor FAFSA Impact:

529s owned by a parent count as a parental asset on the FAFSA, assessed at a max of 5.64% of value—which is significantly less than student-owned accounts (assessed at 20%). But when structured poorly (like when a grandparent owns the 529), distributions can count as untaxed income, impacting aid eligibility.

Are There Advantages to Using Your Own State’s 529 Plan?

Sometimes—yes. It depends where you live.

Many states offer state income tax deductions or credits for contributions made to their own 529 plans. In those states, choosing the in-state plan gives you an immediate tax savings, even if the plan itself isn’t the strongest from a fee or performance standpoint.

Examples:

- New York: Deduct up to $10,000 for married couples

- Indiana: Get a 20% state tax credit (up to $1,500 annually)

- Georgia: Deduct up to $8,000 per beneficiary for joint filers

But What About Texans?

Texas has no state income tax, which means:

You don’t get a tax deduction

But you’re free to shop any plan in the country based on features—not geography

Dallas Planning Tip: Even without a state tax incentive, some Texans choose the Texas College Savings Plan for its local familiarity or ease of setup. But I often compare national options to find lower fees, better funds, and more features—especially for higher-contribution families

Who Should Consider a 529 Plan?

Best For:

- Families who want long-term, tax-efficient education savings

- Parents or grandparents who want control over funds (vs. handing money to the child)

- Households seeking flexibility in what type of education they’re saving for (college, grad school, trade, etc.)

- Individuals aiming to gift large amounts tax-efficiently (you can “superfund” a 529—contribute 5 years’ worth of the gift tax exclusion in a single year)

State-Sponsored Prepaid Tuition Plans: A Tool with Trade-Offs

While most families are familiar with 529 savings plans, there’s another lesser-known option worth considering: prepaid tuition plans. These are also state-sponsored programs, but they work very differently.

Instead of investing money in the market and watching it grow, prepaid plans allow you to lock in tuition costs at today’s rates—essentially pre-purchasing college credits for future use.

Sounds great, right? Well, it can be—if the plan aligns with your child’s future and your state’s program is financially stable.

What Is a Prepaid Tuition Plan?

A prepaid tuition plan lets you:

- Pay now (in a lump sum or installments)

- Lock in tuition at participating schools (usually public, in-state universities)

- Avoid future tuition inflation

In short: You’re hedging against rising costs rather than investing to grow funds.

Important: Most prepaid plans only cover tuition and mandatory fees—not room and board, books, or other living expenses. You’ll still need additional savings to cover those costs.

Pros of Prepaid Tuition Plans

- Locks in tuition at today’s rates—no guessing what it’ll cost later

- Avoids market volatility—you’re not investing, so there’s no risk of losses

- State-backed security—some plans are guaranteed by the state (but not all)

- Flexible payment options—monthly contributions or lump-sum payments

Dallas Planning Note: Texas offers the Texas Tuition Promise Fund®, which allows families to purchase units based on current public university rates. It’s particularly attractive if you’re confident your child will attend a Texas public school.

Cons of Prepaid Tuition Plans

- Limited to in-state public schools—most don’t transfer full value to private or out-of-state institutions

- No control over investment growth—your benefit is fixed; there’s no compounding

- May not cover all costs—typically excludes housing, books, and transportation

- Portability varies—if your child goes out-of-state, the benefit may only transfer a fraction of value

- Enrollment windows are limited—some plans only accept new enrollees once per year

Example: If you prepaid tuition at a Texas state school but your child chooses SMU, only a partial value credit may transfer—leaving you to cover the rest out of pocket.

When & How to Enroll

Enrollment Windows:

Most prepaid plans—including Texas’s—have annual open enrollment periods, typically running from September 1 to February 28/29.

Key Tip: If your child is under age one before July 31, they’re eligible for the lowest cost tier. The younger your child, the cheaper the tuition units—because the state assumes more time for growth.

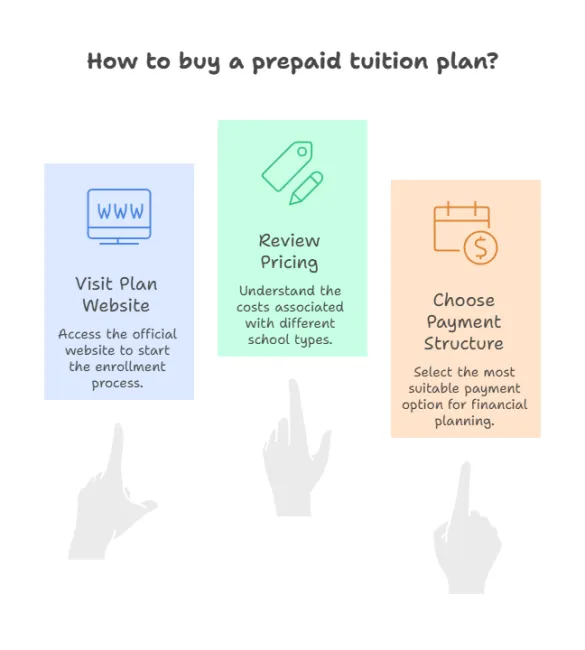

How to Buy a Prepaid Tuition Plan:

- Visit the plan website (for Texas: Texas Tuition Promise Fund®)

- Review current pricing by school type (community college, 4-year university, flagship tier)

- Choose your payment structure:

- Lump sum

- Monthly installment

- Custom payment schedule

- Lump sum

- Purchase units based on how many future semesters or credit hours you want to prepay

- Coordinate with a CFP® or CFSLA to integrate it with your broader college savings strategy

Dallas Planning Tip: Tuition unit prices reset annually on September 1 based on the new academic year’s tuition rates. Buying before that date can often save hundreds—or thousands—long-term.

Who Are Prepaid Plans Best For?

Prepaid tuition plans can be a smart hedge if:

- You’re confident your child will attend a public, in-state university

- You want a guaranteed education benefit without investment risk

- You have limited risk tolerance and value predictability over growth

- You plan to supplement with a 529 savings plan for non-tuition costs

But if your child might choose a private or out-of-state school—or you want more control, growth, and flexibility—a traditional 529 savings plan is often the better choice.

Dallas Insight: I often use a hybrid approach for clients—pairing a prepaid tuition plan with a 529 savings account to cover room and board, or provide backup if their child’s path changes. That flexibility can make all the difference

Coverdell ESAs (Education Savings Accounts): A Niche Tool with Some Hidden Power

Coverdell Education Savings Accounts—formerly known as Education IRAs—offer tax-advantaged education savings, much like 529s. But they come with lower contribution limits and more flexibility in certain areas, especially for K–12 private education expenses.

Because they’re not state-sponsored, they give you broader investment choices and can be a smart supplement to other savings vehicles—if you qualify.

Pros of Coverdell ESAs

- Tax-free growth and withdrawals when used for qualified expenses (just like a 529)

- Can be used for K–12 AND college costs—tuition, books, supplies, even tutoring

- Wider investment options (stocks, mutual funds, ETFs) vs. 529’s limited fund menu

- Control over investments—you can self-direct your account

- Qualified distributions don’t impact federal income tax

Dallas Insight: Some families use ESAs to pay for private school tuition in Dallas-Fort Worth—especially when paired with 529s focused on college.

Cons of Coverdell ESAs

- Annual contribution limit is just $2,000 per child (combined from all sources)

- Income caps apply—to contribute, modified AGI must be:

- < $110,000 (single)

- < $220,000 (joint)

- Must be fully used by age 30, or transferred to another qualifying family member

- More paperwork and tracking required compared to 529s

- No state tax benefits in Texas (but no penalty either)

Pro Tip: Because of the low limits, ESAs work best as a supplement to a broader strategy—not a standalone college plan.

How to Open and Use an ESA

Where to Open:

You can open a Coverdell ESA at most major brokerages, including:

- Fidelity

- Schwab

- TD Ameritrade

Vanguard

How It Works:

- Choose a brokerage and open an ESA in your child’s name

- Fund it with up to $2,000/year (total contributions per child, per year)

- Invest it in mutual funds, ETFs, or other securities

- Withdraw tax-free for qualified expenses—K–12 or college

Important Age Limits:

- Contributions must stop after the beneficiary turns 18 (unless they’re special needs)

- Funds must be used by age 30, or transferred to a qualifying sibling or relative

Best For:

- Families planning for private K–12 tuition, tutoring, or special educational services

- Parents who want full control over investment strategy

- High-planning families with multiple savings tools and a desire to optimize every dollar

- Grandparents who want to help with K–12 expenses without gifting cash

Dallas Strategy Note: I often recommend ESAs to families using private elementary or high school in Highland Park, Plano, or Southlake. These parents often max out their ESA for near-term use and build a 529 for long-term growth.

CFP® + CFSLA Perspective: How I Use ESAs in a Smart Strategy

In my Dallas financial planning practice, I rarely recommend Coverdell ESAs as a primary college savings vehicle. But when used strategically, they’re powerful:

- Combine with 529s to split funding by school level (ESA = K–12, 529 = college)

- Use for short-term education needs while 529 funds continue compounding

- Front-load ESA if you expect heavy tutoring or early private school costs

- Coordinate with FAFSA planning—ESA balances count similarly to 529s, but withdrawals don’t hit income calculations the same way if used properly

Bonus Tip: I often help families “burn down” ESA balances before high school graduation to avoid the age-30 deadline and maximize aid positioning.

Summary: ESA at a Glance

UTMA & UGMA Custodial Accounts: Flexible… But with Tradeoffs

If you’re looking for maximum flexibility in how money can be used for a child’s future, custodial accounts under the Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA) might seem attractive. But buyer beware: while these accounts offer few restrictions, they come with tax consequences, financial aid penalties, and an eventual loss of parental control.

Pros of UTMA/UGMA Accounts

- Flexible Use: Funds can be used for any purpose that benefits the child—not just education (think cars, summer programs, weddings, etc.)

- Simple to Open: Available at nearly all brokerages and banks

- No Contribution Limits: Contribute as much as you want (though large gifts may require filing a gift tax return)

- Broad Investment Options: Choose stocks, ETFs, mutual funds, etc.

Dallas Planning Tip: Some families use UTMA accounts for enrichment activities or gap year programs before college.

Cons of UTMA/UGMA Accounts

- Irrevocable Transfers: The money belongs to the child—you can’t take it back

- Loss of Control at 18 or 21: In Texas, ownership typically transfers at age 21 (can vary by state and account type)

- Impacts Financial Aid: Up to 20% of the account value is counted on the FAFSA as a student asset (vs. 5.64% for parent-owned 529s)

- Taxable Earnings: Subject to the “kiddie tax” (unearned income over a threshold may be taxed at parents’ rate)

- No Tax-Free Growth: Investment gains are taxable—no education tax shelter here

Important Legal Note: Once the child takes control, they can use the funds for anything—regardless of your original intent.

Best For:

- Families prioritizing maximum flexibility over tax efficiency

- Grandparents wanting to gift without funding a 529 or ESA

- Smaller balances intended for non-education expenses (like travel, first car, or a business)

Dallas Perspective: I usually don’t recommend UTMAs for long-term education savings—but they can play a role for families who want to teach kids financial responsibility or cover early-life milestones beyond school.

Summary: Custodial Account Snapshot

CFP® + CFSLA Planning Perspective

Custodial accounts are not education-first tools, but they can be layered into a broader financial plan to:

- Handle non-qualified education costs (e.g., transportation, study abroad, off-campus housing)

- Teach teens about investing and budgeting

- Provide early adult financial support without tapping retirement funds or other restricted savings

I always advise clients: never put money into a UTMA you’re not 100% okay losing control over. There are better tools for tax-advantaged education saving

Roth IRAs: Retirement First, But With a Smart Education Twist

Roth IRAs are designed for retirement—but in the hands of a smart planner, they can double as a strategic education savings vehicle. The key is knowing when, how, and why to use them for college expenses—without derailing your future.

Pros of Roth IRAs for Education

- Tax-Free Withdrawals: Contributions can always be withdrawn tax-free; earnings can be withdrawn tax- and penalty-free if used for qualified higher education expenses

- Dual Purpose: Money grows for retirement—but can be tapped for college if needed

- No FAFSA Impact (While Funds Stay In): Assets in a parent-owned Roth IRA do not count against FAFSA (until withdrawn)

- Flexible Investment Options: Unlike 529s or ESAs, ROTHS give you full control over how funds are invested

- No RMDs (during lifetime): Great for long-term planning flexibility

Dallas Strategy Tip: I often recommend Roth IRAs as a “backup plan” for parents who want to stay flexible. If your child gets a scholarship or skips college, the money is still there for retirement.

Cons of Roth IRAs for Education

- Annual Contribution Limits: Only $7,000/year per person in 2024 (plus $1,000 catch-up if over age 50)

- Income Restrictions: High earners may be ineligible to contribute directly (but can consider a backdoor Roth strategy)

- Withdrawals Count Against FAFSA: Once money is withdrawn—even if qualified—it’s counted as income on FAFSA, potentially reducing aid eligibility

- Reduces Retirement Growth: Tapping ROTHS early means missing out on compounding for retirement

Planning Warning: Just because you can use a Roth for college doesn’t mean you should. For many families, it’s better as a last resort or flexible supplement, not a first-line college savings tool.

Best For:

- Parents who want dual-purpose savings and full investment control

- Families who started late on college savings and need an extra layer of flexibility

- Households who may not qualify for much financial aid and need tax-diversified strategies

CFP®/CFSLA Perspective: I often use ROTHS as a layered tool—especially for families with older kids, large taxable portfolios, or uncertain educational paths. But I always prioritize retirement needs first.

What Counts as a Qualified Education Expense?

To avoid the 10% early withdrawal penalty on Roth IRA earnings, the money must be used for qualified higher education expenses—including:

- Tuition and fees

- Books and required supplies

- Room and board (if enrolled at least half-time)

- Special needs services

Expenses like travel, off-campus meals, or extracurricular fees do not qualify and could trigger taxes and penalties.

Summary: Roth IRA Snapshot

Dallas Planning Scenario:

A high-earning couple in Dallas starts saving late for college. They’ve already maxed 529 contributions and want an additional tax-advantaged layer. We use Roth contributions as a “just-in-case” cushion: if college costs run high, they have access to tax-free dollars. If not? It all rolls toward retirement. No regrets.

Side-by-Side Comparison: Education Savings Accounts

Which Education Account Is Right for You?

Choosing the right college savings account isn’t just about what sounds good on paper—it’s about aligning your financial tools with your income, goals, timeline, and financial aid strategy.

Here’s how I help Dallas families make smarter choices that grow with them—not against them:

If Your Household Income Is Under $100K/year

Your Priorities:

Maximize aid eligibility, save consistently, and avoid accounts that could reduce grant eligibility.

Direct-Sold 529 Plan

- Low-cost, easy to automate, and parent-owned (so it has minimal FAFSA impact).

- Start small—even $25/month grows over time.

- Choose an out-of-state plan if it offers better performance or lower fees.

Coverdell ESA (if eligible)

- Broader use cases (K–12, tutoring, etc.)

- Great for private school savings but capped at $2,000/year and phased out at higher incomes.

- Often underused—but powerful when layered with 529s.

Avoid UTMA/UGMA Accounts

- Student-owned assets hit FAFSA harder (up to 20%)

- Could reduce aid eligibility significantly—even if balances are modest.

Dallas Planning Tip: I help families coordinate 529s with FAFSA-friendly strategies, while preparing for real-life costs like books, laptops, or off-campus housing.

If Your Household Income Is $100K–$250K/year

Your Priorities:

Balance tax benefits, financial aid eligibility, and flexibility across savings tools.

529 Plan as Foundation

- Stick with parent-owned accounts.

- Consider increasing contributions with income increases or bonuses.

- Great for grandparents or relatives who want to contribute via gifting strategies.

Roth IRA as Flexible Backup

- Contributions come out tax- and penalty-free.

- Ideal for families who want dual-purpose savings (education + retirement).

- Helps smooth taxes if your child doesn’t attend college.

Coverdell ESA (if under income limits)

- Useful for private school or education diversity.

- Combine with 529 for full coverage across education years.

UTMA for Non-College Goals Only

- Use only for early-access needs like a first car or summer travel—not core tuition.

- Remember: These are irrevocable and count fully against student aid.

Planning Insight: In this income range, many families fall into the “aid gap”—too much income for need-based aid, not enough to pay full freight. That’s where multi-account strategies shine.

If Your Household Income Is $250K+

Your Priorities:

Aid eligibility is often off the table. The focus shifts to tax strategy, legacy planning, and control.

Advisor-Managed 529 Plan

- Use for multi-child, multi-generational planning.

- Consider “super funding” (5 years of contributions upfront) for estate planning benefits.

- Build in gifting, ownership, and drawdown strategies.

Roth IRA Layering

- Keep retirement flexible while building a college cushion.

- Can support advanced tax smoothing, especially when paired with business income, RSUs, or capital gains strategies.

Life Insurance & Trust Strategies

- Indexed universal life (IUL) or whole life with long-term care riders can be used for education & protection.

- Trusts (e.g., education trusts) can help control future distributions and protect assets.

- Great tools for high-net-worth families with legacy or philanthropic goals.

UTMA Caution

- UTMAs often create unexpected tax liability, paperwork issues, and audit exposure.

- If used, keep them under tight limits and with a clear purpose (not for long-term funding).

Dallas Fiduciary Perspective: At this level, coordination with estate attorneys and CPAs is essential. We build layered education funding strategies that optimize taxes, legacy, and long-term family control.

Still Not Sure?

Here’s a simple decision tree I use with clients:

Want to make sure you’re using the right mix?

As a CERTIFIED FINANCIAL PLANNER™ and CFSLA, I’ll help you build the right combination based on your family structure, goals, and long-term strategy—not just product marketing.

Schedule a consultation today and let’s structure your college savings to work for you, not against your financial future

Why Work with a CFP® and CFSLA?

Let’s be honest: opening a 529 is easy—you could Google it and get started today. But if you’re serious about maximizing every dollar, avoiding costly mistakes, and creating a flexible education plan that actually fits your family’s life?

That’s where working with a credentialed expert makes all the difference.

As a CERTIFIED FINANCIAL PLANNER™ (CFP®) and College Funding and Student Loan Advisor (CFSLA), I help Dallas families navigate the real-life complexities of saving for education—not just the theory.

What I Do (That a Basic Savings Account Can’t)

Choose the Right Accounts for Your Situation

There’s no one-size-fits-all option. We’ll compare 529s, ESAs, Roth IRAs, and other tools based on your income, goals, number of children, and legacy preferences.

Time Contributions & Withdrawals Around FAFSA Rules

The FAFSA looks two years back. I’ll help you avoid timing missteps that could reduce aid eligibility or trigger unexpected taxes.

Strategically Coordinate With Retirement, Estate, and Tax Planning

College savings doesn’t happen in a vacuum. I’ll integrate your education funding into your broader financial strategy—so you’re not robbing your retirement or triggering unwanted capital gains.

Protect Financial Aid Eligibility While Still Building Wealth

From ownership structures to asset positioning, I’ll guide you through what really impacts financial aid (and what doesn’t). Yes, even for high earners.

Plan for Multiple Children—Fairly and Flexibly

You don’t need separate strategies for each child. I’ll show you how to build a dynamic, tax-smart approach that adjusts as your family grows.

Structure Legacy Gifts and Grandparent Contributions

Grandparents often want to help—but the wrong approach can wreck aid eligibility. I help families structure gifts, super funding, and legacy strategies the smart way.

Real Talk: Saving for college shouldn’t mean Googling in the dark. I help you turn intentions into strategy—and strategy into results.

Final Thoughts: It’s Not About Picking the “Best”—It’s About Picking the Right Mix

Let’s stop asking, “What’s the best college savings account?”

The better question is:

“What mix of tools will grow my money, protect my student’s aid, and keep our family goals intact?”

At Future-Focused Wealth™, we build customized, coordinated education funding strategies that reflect:

Your income and tax position

Your child’s timeline, goals, and school type

Your family structure (multi-child, legacy, or even grandkids)

Your values and the future you want to fund

Because this isn’t just about saving for school—it’s about funding a future that aligns with everything else you care about.

Ready to build a college savings plan that’s smart, strategic, and stress-free?

Schedule a 1-on-1 Education Strategy Call

FAQs: Education Accounts Explained

Q: Can I have both a 529 and an ESA?

A: Yes! You can contribute to both, though limits apply. Coordination is key.

Q: Is a UTMA better than a 529?

A: Only if you want non-education flexibility. But it hurts financial aid far more.

Q: Can grandparents open a 529?

A: Absolutely—and it can be a powerful gifting tool when structured properly.

Q: Are Roth IRAs really allowed for college expenses?

A: Yes—but only contributions can be withdrawn freely. Earnings require specific rules to avoid penalties.