Understanding Mutual Funds: A Straightforward Guide for Dallas Investors

As a Certified Financial Planner™ based in Dallas, I’ve seen firsthand how many investors are placed into mutual funds by default, without ever understanding what they are, how they work, or what they cost.

Mutual funds can be an excellent tool when used appropriately. But they’re not magic—and they’re not always the best fit.

In this article, I’ll walk you through:

- What mutual funds are (in plain English)

- How do they differ from ETFs, Your Financial Plan, and stocks

- What fees to watch out for

- The pros and cons of mutual funds in your financial plan

- How a fiduciary helps you choose the right investments for you—not a sales quota

Let’s dive in.

Why Are Mutual Funds So Popular?

Despite the rise of ETFs, robo-advisors, and custom portfolios, mutual funds remain one of the most widely held investments in the U.S.—especially in retirement accounts and employer-sponsored plans like 401(k)s.

Here’s why they continue to dominate:

1. Ease of Access

Mutual funds are everywhere—from workplace plans to online brokerages. They’re often the default investment for people just starting out, and many 401(k)s use them as core menu options.

💬 Dallas Insight: Most of my clients’ first experience with investing came through a mutual fund in a retirement plan—and many are still in the same funds decades later, unaware of what they cost.

2. Built-In Diversification

With one purchase, you gain exposure to dozens or even hundreds of securities—spreading your risk without the complexity of managing individual positions.

This appeals especially to:

- First-time investors

- Busy professionals

- Retirees looking to reduce portfolio risk

3. Professional Management

Mutual funds are actively or passively managed by licensed professionals. This appeals to people who don’t want to pick individual stocks or bonds and would rather rely on a strategy.

4. Automatic Reinvestment and Rebalancing

Most mutual funds allow:

- Dividends and capital gains to be reinvested automatically

- Optional automatic contribution schedules

- Set-it-and-forget-it rebalancing (especially in target date funds)

These features make them feel "hands-off"—which is exactly what many investors want.

5. Affordability for Beginners

While some funds have minimums, many offer:

- Low entry points (as little as $50/month)

- No trading commissions

- Automatic investment plans to build wealth over time

6. Default in Employer Plans

Let’s be honest: A big reason mutual funds are so popular is because they’re the go-to investment in workplace retirement plans.

Many investors don’t actively choose them—they inherit them by default. And without a fiduciary review, they may stay in high-fee, underperforming funds far longer than they should.

Planner’s Perspective:

Popularity doesn’t always mean suitability. Mutual funds are easy to access—but they shouldn’t be left on autopilot.

If your portfolio is built on mutual funds, it’s worth reviewing:

- How much they’re costing you

- Whether they still align with your goals

- If better, more tax-efficient alternatives exist

📅 Ready to review your mutual fund lineup?

What Is a Mutual Fund?

A mutual fund is a professionally managed investment vehicle that pools money from many investors to buy a diversified portfolio of stocks, bonds, or other assets.

Think of it as a basket of Investment Management Services. You own a share of the basket—not the individual ingredients.

Key Components:

- Fund Manager: Makes decisions about what the fund buys and sells

- Expense Ratio: The annual cost to run the fund

- NAV (Net Asset Value): The price per share, updated daily

- Prospectus: The fund’s official rulebook—yes, it’s long, but it matters

How Do Mutual Funds Work?

When you invest in a mutual fund, you’re buying shares in a portfolio of securities, not directly in the companies themselves.

- Your money is pooled with other investors

- The manager buys a mix of assets

- You receive dividends or capital gains (or reinvest them)

- Shares are bought/sold at the end-of-day NAV, not in real-time

✅ Bonus Insight: Unlike ETFs or stocks, mutual funds don’t trade intraday. This affects how they behave during market volatility.

Types of Mutual Funds: Choose with Clarity

There are hundreds of fund styles, but here are the core categories Dallas investors need to understand:

1. Stock (Equity) Funds

- Focused on growth

- Can be large-cap, small-cap, sector-specific, or global

2. Bond (Fixed Income) Funds

- Focused on income and capital preservation

- May include municipal, government, or corporate bonds

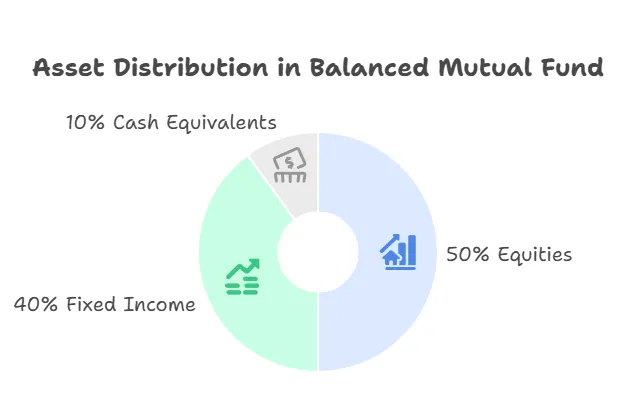

3. Balanced (Asset Allocation) Funds

- Mix of stocks and bonds

- Often used for hands-off investors

4. Index Funds

- Passively track a benchmark (like the S&P 500)

- Low cost, long-term efficiency

5. Target Date Funds

- Designed for retirement

- Automatically rebalance based on your age or time horizon

⚠️ Planner’s Note: Not all target date funds are created equal—look at fees, glidepath, and diversification.

What Are Mutual Fund Share Classes—and Why Do They Matter?

When people talk about “mutual fund fees,” what they often don’t realize is that the share class you’re in plays a huge role in what you pay—and how.

🎯 Translation? Two people could own the same fund, but one is paying way more in fees just because of their share class.

Let’s break it down.

What Is a Share Class?

A share class refers to different versions of the same mutual fund.

Each class invests in the same portfolio, but charges fees in different ways—typically to pay brokers or advisors.

Common Share Classes Explained:

Understanding Fees in Mutual Funds

Fees matter more than most investors realize. Just a 1% difference can reduce your retirement savings by six figures over time.

Common Costs in Mutual Funds:

- Expense Ratio: Ongoing annual fee (avg. 0.10%–1.50%)

- Front-End Load: Sales charge when you buy (up to 5.75%)

- Back-End Load: Fee if you sell early

- 12b-1 Fees: Hidden marketing/distribution charges

🎯 Fiduciary Tip: Many “advisor-sold” mutual funds exist solely to pay commissions. As a fiduciary, I guide clients away from those products and toward clean, cost-effective options.

Fiduciary Insight:

Commission-based advisors often use A, B, or C shares—because that’s how they get paid.

But as a fee-only fiduciary, I generally use F or I shares, which:

- Eliminate embedded commissions

- Reduce conflicts of interest

- Let you see exactly what you're paying for advice

⚠️ Tip: If your advisor hasn’t explained what share class you’re in, you may be paying unnecessary fees.

Dallas Reality Check:

I frequently see Dallas investors stuck in Class A or C shares they purchased years ago—still paying 1%–2% annually in embedded commissions and trail fees, often without even realizing it.

Switching to Institutional (I) or Advisor (F) share classes can eliminate those hidden fees and provide access to lower-cost fund options—but there is a tradeoff:

These share classes are typically only available through a fee-based advisory relationship, where the advisor charges a transparent, flat percentage for ongoing guidance and portfolio management.

The key difference?

- In Class A/C shares, the fees go to compensate the product seller, whether you get advice or not.

- In Institutional/Advisor shares, the fee compensates your fiduciary planner—someone who is required to act in your best interest and build a plan around your goals.

In my practice, I believe clear fees and unbiased advice always beat buried commissions and sales quotas.

What You Should Do:

- Find out your share class (check your account statement or fund prospectus)

- Calculate your total cost, including front/back loads and expense ratios

- Ask your advisor why you’re in that share class—and what your options are

📅 Not sure where to start?

Let’s review your mutual fund fees and share classes together:

Active vs. Passive Management: Why Some Mutual Funds Charge More

One of the most important distinctions in mutual fund investing—and one of the biggest drivers of fees—is whether the fund is actively managed or passively managed.

What’s the Difference?

Actively Managed Funds

These funds have professional portfolio managers who try to beat the market by selecting individual stocks or bonds they believe will outperform.

✅ Pros:

- May offer better downside protection in volatile markets

- Can exploit market inefficiencies in niche sectors

- Great for specialized strategies (small-cap, global equity, etc.)

❌ Cons:

- Higher expense ratios (typically 0.75%–1.5% or more)

- Not all managers outperform their benchmarks

- Greater tax inefficiency due to frequent trading

Passively Managed Funds (Index Funds)

These funds track a market index like the S&P 500 or Total Market Index. There’s no stock-picking—just a rules-based replication of the index.

✅ Pros:

- Low cost (expense ratios as low as 0.03%)

- Consistent performance that mirrors the market

- Tax-efficient and simple to understand

- Ideal for long-term investors focused on steady growth

❌ Cons:

- No potential to “beat” the market

- May include companies you don’t want to own (ex: ESG preferences)

Planner Perspective:

In my Dallas-based financial planning practice, I often use low-cost passive funds as a foundation, and carefully incorporate active management in areas where it adds value—like international markets, alternatives, or certain bond strategies.

The real key is this:

Are you paying for performance—or just for packaging?

Cost Comparison Snapshot:

Fiduciary Insight:

The right mix of active and passive depends on your goals, tax bracket, and timeline.

As a fiduciary, I’m not tied to one fund family or style—I build portfolios based on your needs, not someone’s sales quota.

📅 Want a second opinion on whether your funds are worth their cost?

Pros and Cons of Mutual Funds

✔️ Pros:

- Diversified

- Professionally managed

- Simple to access

- Automatic reinvestment available

❌ Cons:

- Higher fees than ETFs

- Tax inefficiency (capital gains passed to all shareholders)

- Lack of intraday trading

- Some require minimum investments

How Mutual Funds Fit into a Financial Plan

For many clients, mutual funds work well as:

- Core long-term holdings (especially index funds)

- A way to gain exposure to markets without picking individual stocks

- Part of retirement accounts like IRAs or 401(k)s

But they should always be selected based on:

- Your risk tolerance

- Your time horizon

- Your overall portfolio allocation

As a fiduciary, my job is to ensure every fund—if used—fits the broader strategy, not just the product shelf.

Mutual Fund Red Flags to Watch For

- Hidden sales loads or commissions

- High expense ratios with underperformance

- “Closet index funds” (charging active fees, performing like an index)

- Overlap: multiple funds owning the same stocks

📌 Dallas Note: Some local investors get mutual funds through workplace plans or banks—but they rarely know what they’re paying for. That’s where an independent review helps.

How Are Mutual Funds Taxed? (And Why It Matters in Dallas)

Many investors focus on performance and fees—but overlook the impact of taxes, especially when mutual funds are held in taxable accounts (like individual or joint brokerage accounts).

Here’s what you need to know:

1. Capital Gains Distributions (Even If You Don’t Sell)

Unlike stocks or ETFs, mutual funds pass capital gains to shareholders when the manager buys or sells securities inside the fund.

That means:

- You could owe taxes even if you didn’t sell anything

- The gains are taxed in the year they’re distributed

- High turnover = higher tax drag

🔍 Dallas Insight: I’ve had clients surprised by unexpected tax bills—just because their actively managed mutual fund had a big year. That’s why asset location matters.

2. Dividend and Interest Income

If your mutual fund owns dividend-paying stocks or interest-bearing bonds:

- Those payments are passed to you

- They’re usually taxed as ordinary income (unless they qualify for long-term capital gains treatment)

Even funds marketed as “tax-efficient” may trigger income you didn’t plan for—especially dangerous for retirees trying to avoid IRMAA surcharges on Medicare.

3. Tax-Efficient vs. Tax-Inefficient Funds

💬 Planner’s Tip: If you’re holding active mutual funds in a taxable account, you may be paying more in taxes than necessary—without better performance.

Where You Hold Funds Matters: The Power of Asset Location

As a fiduciary planner, I look at where you hold mutual funds—not just what you hold.

Smart Tax Pairings:

- Hold actively managed mutual funds in IRAs or Roths (to shelter distributions)

- Use tax-efficient index funds or municipal bond funds in taxable accounts

- Consider Roth conversions if your income is temporarily low

Why Your Planner Needs Your Tax Return

Final Word on Taxes & Mutual Funds:

Your mutual fund’s after-tax return matters more than its stated return.

If you’re not sure what your funds are costing you in taxes—or how to rebalance for tax efficiency—let’s take a look together.

📅 Schedule your mutual fund tax review here:

Final Thoughts from Melissa Cox, CFP®: Make Your Mutual Funds Work Smarter

Mutual funds can be a valuable tool in your investment toolbox—if they’re used wisely.

But they’re not “set it and forget it.” They come with costs, complexity, and planning trade-offs that deserve attention.

As a Dallas-based fiduciary financial planner, my goal is to help you understand what you own, why you own it, and how it fits your plan.

If you’re unsure whether your mutual funds are aligned with your goals—or just paying someone else’s commission—let’s talk.

📅 Schedule a portfolio review and strategy session today:

Mutual Fund FAQs: What Clients Ask Me Most

Q: Are mutual funds a safe investment?

Mutual funds offer built-in diversification, which can reduce overall portfolio risk. However, they are still subject to market risk depending on the assets inside the fund (stocks, bonds, etc.). No investment is guaranteed—your safety depends on the fund’s holdings and your goals.

Q: What’s a “good” expense ratio for a mutual fund?

For index mutual funds, a good expense ratio is typically under 0.10%. Actively managed funds may range from 0.50% to 1.50%. Anything above 1% deserves scrutiny—especially if the fund isn’t consistently outperforming its benchmark.

Q: Should I choose mutual funds or ETFs?

It depends on your goals and tax situation. ETFs often have lower costs and better tax efficiency, while mutual funds can offer automatic reinvestment and professional management. In many cases, a mix of both is appropriate.

📌 Internal Link: ETFs and Your Financial Plan

Q: Can mutual funds lose money?

Yes. While diversified, mutual funds are still market-based investments. Stock funds can lose value during downturns, and bond funds are sensitive to interest rate changes. That’s why fund selection must match your time horizon and risk tolerance.

Q: How do mutual funds pay me income?

You can receive:

- Dividends (from stocks or interest)

- Capital gains distributions

- NAV growth (when the price of fund shares increases)

These can be reinvested or paid out—depending on your preferences.

Q: What happens to my mutual funds when I retire?

They don’t disappear—but your strategy may need to shift. We may:

- Reallocate to reduce risk

- Use funds for structured income

- Adjust for Required Minimum Distributions (RMDs)

- Move to more tax-efficient holdings

Q: Can I move mutual funds between accounts without paying taxes?

Only if you're transferring between retirement accounts (like IRA to IRA). Moving funds between taxable accounts usually triggers a capital gains event if there's a profit.

Q: Do mutual funds work for short-term goals?

Generally, no. If you need the money in less than 3–5 years, mutual funds—especially those with equity exposure—may carry too much volatility. For short-term needs, consider high-yield savings, CDs, or short-duration bond funds.

Q: Are mutual funds actively or passively managed?

Both!

- Actively managed funds have human managers trying to outperform the market

- Passively managed funds (like index funds) track a benchmark like the S&P 500

Each has pros and cons—cost, risk, performance—and should align with your overall plan.

Q: What’s a mutual fund “prospectus”—and do I really need to read it?

The prospectus is the fund’s legal document outlining:

- Objectives

- Strategy

- Fees

Risks

While it’s lengthy, reviewing it (or having your fiduciary planner review it) ensures you're not investing blindly or being surprised by fees.