Understanding ETFs: A Strategic Guide from a Dallas Financial Advisor

As a Certified Financial Planner™ based in Dallas, I often meet clients who’ve heard about ETFs—maybe from a podcast, an online article, or their workplace retirement plan—but still aren’t sure what they are, how they work, or whether they’re better than mutual funds.

ETFs (Exchange-Traded Funds) are one of the most efficient, transparent, and cost-effective investment tools available today—but that doesn’t mean they’re automatically right for every investor. And with the explosion of options (hello, crypto ETFs and AI-themed portfolios), making sense of what’s useful versus what’s hype can feel overwhelming.

In this blog, I’ll break down:

- What ETFs are (in plain English)

- Why they become so popular

- The real difference between ETFs and mutual funds

- How ETFs fit into retirement, tax, and long-term wealth strategies

- Mistakes to avoid—and how a fiduciary can help you choose wisely

If you’re looking for a smarter, more cost-effective way to invest—with less guesswork and more clarity—you’re in the right place.

What Is an ETF?

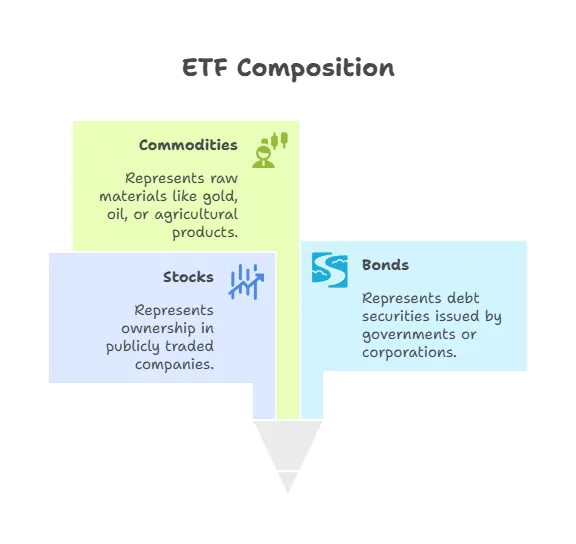

An ETF (Exchange-Traded Fund) is a basket of investments—like stocks, bonds, or commodities—that trades on an exchange just like a stock.

It combines the diversification of a mutual fund with the flexibility of a stock.

ETFs have grown rapidly in popularity due to their:

- Low cost

- Tax efficiency

- Real-time trading

- Transparency

💬 Dallas Insight: In my practice as a fiduciary planner, ETFs are often the core building blocks of portfolios because they help keep costs low and flexibility high, without sacrificing diversification.

How Do ETFs Work?

When you invest in an ETF, you're buying a slice of the entire portfolio it tracks—whether that's the S&P 500, a bond index, or a niche sector.

Key ETF Mechanics:

- Traded on exchanges (like a stock)

- Priced in real-time (unlike mutual funds, which only price once daily)

- Passively or actively managed

- Can be bought and sold at any time during market hours

✅ Bonus Insight: Most ETFs are passive, but active ETFs are growing in popularity, especially in sectors like bonds or alternatives.

ETF vs Mutual Fund: Key Differences

Why ETFs Are So Popular

ETFs are booming—and it’s not just hype. They’ve become a staple for long-term investors, financial advisors, and institutions alike.

Key Reasons for Popularity:

- Low fees: Most ETFs have expense ratios under 0.20%

- Diversification: Broad exposure with one purchase

- Tax-efficient structure: No capital gains distributions

- Transparency: Holdings are updated daily

- Accessibility: No sales loads or commissions in most accounts

Flexibility: Can be used for core or tactical investing

Dallas Note: Many clients are ditching expensive mutual funds or actively managed portfolios in favor of ETF-based strategies built around cost control and flexibility.

Types of ETFs

ETFs come in many styles and flavors. Here's a breakdown of the most common types you might see in a fiduciary-advised portfolio:

1. Index ETFs

- Track a market index (e.g., S&P 500, Total Stock Market)

- Ultra-low cost and highly diversified

- Ideal for core long-term holdings

2. Bond ETFs

- Invest in U.S. Treasuries, corporates, municipals, or global debt

- Useful for income, risk reduction, and liquidity

3. Sector or Thematic ETFs

- Target industries (tech, healthcare) or trends (clean energy, AI)

- Often used for tactical allocations

4. International/Global ETFs

- Provide exposure to foreign markets or specific countries

- Help diversify U.S.-heavy portfolios

5. Dividend or Income ETFs

- Focus on companies with strong dividend yields

- Often used in retirement income strategies

6. ESG ETFs

- Align with environmental, social, and governance principles

- Popular among values-based investors

ETF Fees & Expenses

ETFs are celebrated for their low costs, but not all are created equal.

What to Watch:

- Expense ratio (generally <0.10% for index funds, higher for active)

- Bid/ask spread (how much you lose when buying/selling)

- Trading commissions (usually $0 in modern platforms, but check!)

- Underlying index quality (not all “S&P 500 ETFs” are equal)

Fiduciary Tip: In my Dallas-based planning practice, we often reduce total investment costs by swapping out expensive mutual funds for ETFs—without changing asset exposure.

Active vs Passive ETFs

Passive ETFs:

- Track a benchmark

- Low turnover

- Extremely cost-efficient

- Great for long-term investors

Active ETFs:

- Managed by a team (like mutual funds)

- Can adapt quickly to market conditions

- Often more expensive (0.35%–0.90%)

- May offer alpha in niche strategies

As with mutual funds, the goal is to ensure you’re paying for performance, not marketing.

How ETFs Fit Into a Financial Plan

As a fiduciary, I don’t push products—I build strategies. And ETFs play an important role when we’re looking to:

- Lower total portfolio costs

- Improve tax efficiency

- Maintain broad diversification

- Add flexibility for cash needs or rebalancing

- Customize strategies (like ESG, income generation, or tactical tilts)

Whether we’re managing an IRA, Roth, brokerage account, or 401(k) rollover, ETFs offer flexible and smart building blocks for goal-based portfolios.

Common ETF Mistakes to Avoid

- Chasing trends: Don’t buy the latest shiny object (crypto ETFs, meme-sector funds) without a plan

- Ignoring the index: Know what the fund actually tracks

- Over-diversifying: Too many overlapping ETFs can dilute performance

Forgetting tax impact of selling: While ETFs are tax-efficient, selling them still creates capital gains

ETFs in Volatile Markets: What Investors Need to Know

While ETFs offer liquidity and transparency, they aren't completely immune to the stress of a fast-moving market. In fact, some of the very features that make ETFs appealing can also introduce risk when the market turns choppy.

Here are a few considerations every investor should understand:

1. Intraday Trading Can Invite Emotional Decisions

Because ETFs trade like stocks, you can buy or sell at any time during market hours. This is great for flexibility—but it also means emotional trading is easier.

When markets drop, investors often panic-sell ETFs intraday—locking in losses that a traditional mutual fund (which prices only once daily) might help avoid.

2. Flash Crashes & Liquidity Gaps

In rare cases of extreme market volatility (like the 2010 "Flash Crash"), ETFs have briefly traded far below their fair value due to:

- Lack of buyers/sellers in certain ETF niches

- Pricing disconnect between the ETF and its underlying assets

- Thin volume in sector or international ETFs

🧠 Dallas Planning Tip: Always use limit orders when trading ETFs to avoid paying more—or getting less—than you intended.

How I Use ETFs in Client Portfolios (Without Product Bias)

As a Dallas-based fiduciary, I’m not tied to any particular fund family or sales quota. I use ETFs as building blocks for customized, goal-driven strategies, and here's how:

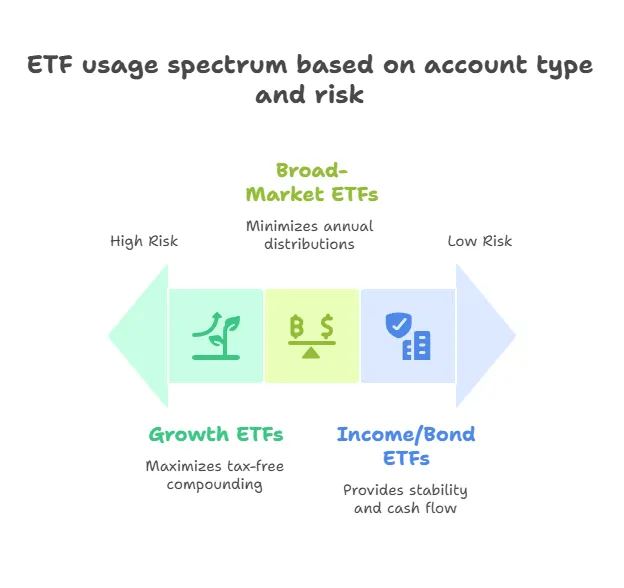

✅ In Roth IRAs

- I use growth-focused ETFs with low turnover to maximize tax-free compounding over decades.

✅ In Taxable Brokerage Accounts

- I select tax-efficient, broad-market ETFs that minimize annual distributions

- I integrate tax-loss harvesting to offset capital gains elsewhere

✅ In Traditional IRAs & 401(k) Rollovers

- I use income-producing or bond ETFs to provide stability and cover cash flow needs

- I match the allocation to the RMD strategy and timeline

✅ Across All Accounts

- I rebalance portfolios using ETF models based on each client’s risk tolerance, retirement age, and financial goals

- I don’t use proprietary models or lock you into “pre-packaged” portfolios

🔍 Most importantly: I help you understand what you own and why it fits your bigger picture—no confusing fund names or “just trust us” advice.

When ETFs Might Not Be the Right Fit

Even though I’m a strong advocate for ETFs, I’ll be the first to say: they’re not perfect for every situation.

Here’s when I might recommend an alternative strategy:

❌ 1. You Need Short-Term Liquidity

If you’re planning to use your funds in under 12–18 months, individual CDs, money market funds, or high-yield savings accounts may make more sense—especially in a high-interest environment.

❌ 2. You’re Taking Frequent Withdrawals

In retirement, if you're making monthly withdrawals from a taxable ETF portfolio, each sale can generate capital gains. A laddered bond portfolio or income annuity (when appropriate) might reduce complexity.

❌ 3. You Prefer Active Stock Selection

Some investors want direct control over their holdings—maybe for ESG filtering, tax-loss harvesting, or legacy stocks. In these cases, building a custom portfolio of individual stocks might be more appropriate.

❌ 4. You Need Illiquid, High-Income Alternatives

For certain clients, private real estate, business investments, or alternatives can play a role that ETFs can’t replicate, though they come with tradeoffs and risk.

💡 Fiduciary Perspective: A good investment isn't the one with the best marketing—it’s the one that matches your plan, timeline, and lifestyle.

How Are ETFs Taxed? (And Why They’re More Efficient Than Mutual Funds)

One of the biggest reasons ETFs have exploded in popularity is their tax efficiency—but most investors don’t understand why. If you’ve ever compared a mutual fund to an ETF and wondered why the ETF generates less taxable income, here’s what’s going on behind the scenes.

1. ETFs Rarely Trigger Capital Gains Distributions

Unlike mutual funds, which often pass capital gains to shareholders at the end of each year, ETFs use something called the "in-kind redemption process."

📘 Translation: When large investors redeem shares of an ETF, the fund can swap securities without triggering a taxable event for remaining shareholders.

This structure allows ETFs to:

- Avoid forced sales that would generate capital gains

- Minimize taxable distributions, even in volatile years

- Provide greater after-tax performance, especially in taxable accounts

💬 Dallas Insight: Many of my clients were surprised to learn that their mutual funds were creating tax bills—even when they didn’t sell a thing. Swapping those positions into ETFs helped reduce those surprises.

2. You Still Pay Taxes When You Sell

ETFs are not tax-free. When you sell ETF shares at a gain:

- You’ll owe capital gains tax

- Long-term gains (held >1 year) are taxed at favorable rates (0%, 15%, or 20%)

- Short-term gains are taxed as ordinary income

That’s why tax-aware selling strategies (like tax-loss harvesting or waiting until long-term treatment applies) are critical in taxable accounts.

3. Dividends from ETFs Are Taxable

If your ETF owns dividend-paying stocks or bonds:

- Those dividends are passed through to you

- You’ll receive a 1099-DIV form at tax time

Dividends may be qualified or non-qualified, affecting your tax rate

🧠 Planner Tip: In retirement planning, I often help clients structure their ETF income to align with their tax bracket, Medicare IRMAA thresholds, or Roth conversion windows.

4. Tax Efficiency by Account Type

Not all accounts are created equal when it comes to ETF taxation:

💬 Dallas Planning Insight: I often pair ETFs with Roth accounts or taxable brokerage portfolios to help maximize growth with minimal tax drag.

Bottom Line: Tax Efficiency Is a Feature, Not a Guarantee

ETFs can be incredibly tax-smart—but only if:

- You understand when and how gains are triggered

- You hold them in the right type of account

You have a plan for income, withdrawals, and rebalancing

📅 Want to audit the tax drag of your current portfolio or learn how ETFs could improve your after-tax returns?

Book a tax-smart portfolio review with Melissa Cox, CFP®.

Final Thoughts from Melissa Cox, CFP®: Are ETFs Right for You?

ETFs are one of the most efficient, flexible investment tools available today. But they’re not one-size-fits-all.

As a Dallas-based Certified Financial Planner™, I use ETFs to lower costs, improve tax outcomes, and bring clarity to investing, without product bias or sales pressure.

If you’ve been unsure whether your portfolio is working as hard as it could… or you’re still stuck in high-fee mutual funds from 10 years ago, now’s the time for a fresh look.

📅 Let’s build a smarter ETF-based strategy that fits your life, your values, and your goals:

ETF FAQs: What Dallas Investors Ask Me Most

Q: Are ETFs safer than stocks?

Not necessarily. ETFs contain many stocks (or bonds), so they’re diversified by design—which often reduces risk compared to buying individual stocks. But their safety still depends on what the ETF holds, and no ETF is completely risk-free.

Q: Are ETFs better than mutual funds?

Depends on your goals, time horizon, and account type.

📌 Related blog: Understanding Mutual Funds

Q: Can I lose money in ETFs?

Yes. ETFs are market-based investments, which means they can fluctuate with the value of the underlying assets. While they’re diversified, that doesn’t mean they’re guaranteed to grow—especially in short time frames.

Q: Are ETFs good for beginners?

Absolutely. In fact, many beginner-friendly portfolios use ETFs because they:

- Offer instant diversification

- Are low-cost

- Require no stock picking

- Can be customized to risk tolerance

ETFs are also ideal for automated investing platforms and Roth IRAs.

Q: Do ETFs pay dividends?

Yes—if the underlying investments (stocks or bonds) pay dividends, those payments are passed through to you. You can choose to:

- Reinvest the dividends automatically

- Take them as cash for income

You’ll still receive a 1099-DIV at tax time, even if you reinvest them.

Q: Are ETFs good for retirement accounts?

Yes. ETFs work very well in:

- Traditional IRAs and 401(k)s (tax-deferred growth)

- Roth IRAs (tax-free growth)

- Brokerage accounts (tax-aware harvesting potential)

They can be used for both growth and income strategies.

Q: What’s the difference between an index fund and an ETF?

They’re often similar in what they invest in (like the S&P 500), but:

- ETFs trade throughout the day like stocks

- Index mutual funds trade at day’s end

- ETFs are typically more tax-efficient

ETFs may have lower fees

Q: Are ETFs actively managed or passive?

Most ETFs are passive—tracking an index. But a growing number of actively managed ETFs exist, especially in bond, dividend, or specialty strategies. These tend to cost more, but may offer flexibility in volatile markets.

Q: Can ETFs be used for income?

Yes! Some ETFs are designed to generate reliable dividends, and others include bond exposure for monthly or quarterly income. In retirement, ETFs can be used to build a flexible, tax-efficient income strategy.

Q: Do I need to rebalance ETFs?

Yes—especially if you own multiple ETFs in different asset classes (stocks, bonds, international, etc.). Periodic rebalancing keeps your risk aligned with your plan. Many modern platforms automate this, or we handle it for clients inside managed portfolios.