Credit vs. Debt: Smart Strategies to Build Credit and Avoid Traps

If I had a dollar for every time someone said, “I’m scared of credit cards,” I’d be writing this blog from a yacht in Lake Lewisville.

As a Dallas-based Certified Financial Planner™, I see it all the time—credit anxiety. A lot of people were never taught the difference between credit and debt, and as a result, they’re often missing out on powerful financial tools or, worse, trapped in cycles of high-interest repayment.

But here’s the thing: credit isn’t the enemy—bad strategy is. In this blog, we’ll break down exactly what credit is, how it differs from debt, how to use it wisely, and how to avoid the most common traps that ensnare Dallas-area families.

Credit vs. Debt: Understanding the Financial Foundation

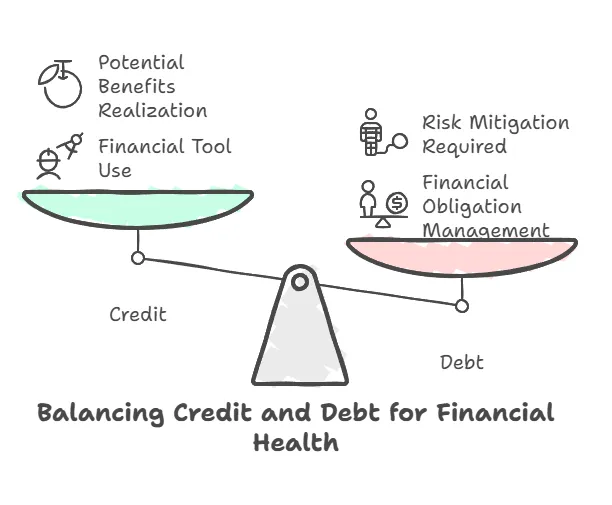

While these terms are often used interchangeably, they serve very different purposes. Credit is a tool. Debt is a consequence.

Credit is the trust a lender extends, giving you the ability to borrow money. If used correctly, it enhances your financial profile, boosts your buying power, and can even help you earn points, cashback, and travel perks.

Debt, on the other hand, is what happens when borrowed money isn’t paid back on time or in full—and it usually comes with interest that compounds the problem. In short: credit is the opportunity, debt is the outcome.

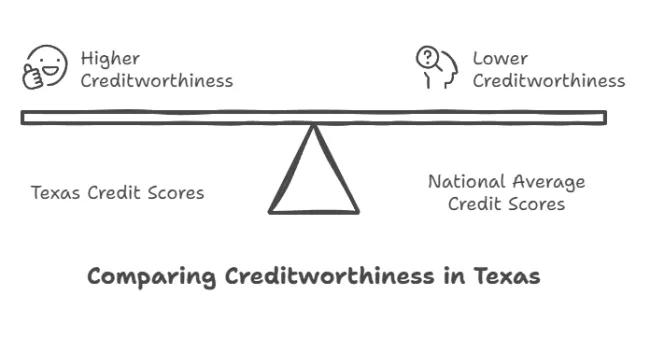

Dallas by the Numbers: The Local Credit Landscape

According to Experian’s 2024 Consumer Credit Review:

- The average credit card debt in Dallas is $8,800.

- The average FICO® Score in Texas is 693—below the national average of 714.

- More than 40% of Texas residents carry a balance month to month.

This data is not meant to scare—it’s meant to empower you. If these stats hit close to home, you’re not alone. And you can change your narrative.

3 Common Credit Myths (And the Truth You Need)

💣 MYTH #1: “Having credit cards will ruin your score.”

TRUTH: Responsible usage of multiple cards can actually increase your score.

💣 MYTH #2: “Carrying a balance improves your credit.”

TRUTH: Interest charges hurt you. Paying in full every month is the best move.

💣 MYTH #3: “Debt is always bad.”

TRUTH: Strategic debt like a mortgage or student loan can actually be a wealth-building tool.

Credit Score Anatomy: Why It Matters More Than You Think

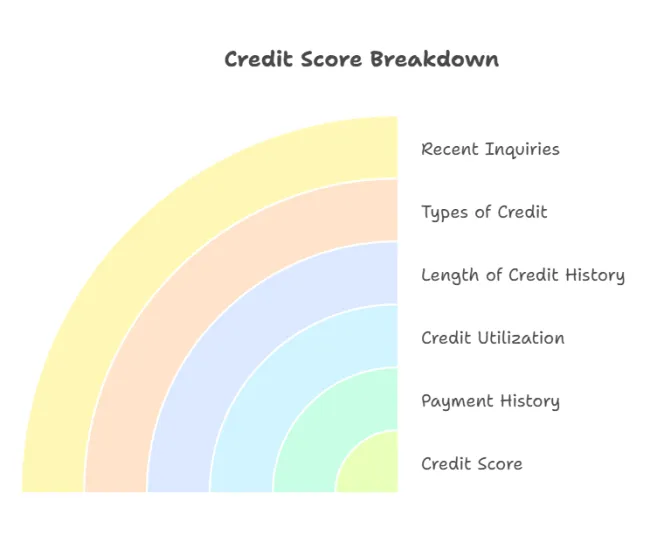

Every major lender—from mortgage companies to car dealers to landlords—looks at your credit score. Here’s the breakdown:

- 35% Payment History (Did you pay on time?)

- 30% Utilization Ratio (Are you using too much of your limit?)

- 15% Credit History Length (How long have you been using credit?)

- 10% Credit Mix (Do you have a healthy variety of credit types?)

10% New Inquiries (Have you opened too many accounts recently?)

💡 Pro Tip: Set credit utilization goals below 30% of available credit—ideally under 10% for optimal scoring.

Using Credit Strategically (Without Drowning in Debt)

If you want to leverage credit to your advantage, follow these proven strategies:

✔ Pay in Full, Always: Never carry a balance unless absolutely necessary.

✔ Earn While You Spend: Use rewards credit cards aligned to your habits—travel miles, cash back, or points.

✔ Autopay Is Your Best Friend: Missed payments = massive score drops.

✔ Set Custom Alerts: Keep spending top-of-mind and catch fraud early.

✔ Monitor Like a Pro: Use free tools like AnnualCreditReport.com or Credit Karma

Debt Reduction: From Stress Spiral to Strategy

Debt becomes toxic when it goes unmanaged. Here are your best options:

- Avalanche Method: Target the highest interest rate first.

- Snowball Method: Pay the smallest balance first for psychological wins.

- Balance Transfer Offers: Great if you can pay off within promo periods.

- Negotiate With Lenders: You’d be surprised how many will lower your APR if asked.

Emergency Fund Backup: Prevent future debt by cushioning against surprise expenses. See our Budgeting Method Comparison

📊 STAT: Americans pay over $120 billion in credit card interest annually. That’s more than the entire GDP of some countries.

Final Thoughts from Melissa

Look, I’m not here to tell you credit is evil. I’m here to help you master it.

When clients come to me feeling overwhelmed by credit or buried under debt, I tell them what I’m telling you: you’re not behind—you’re just ready for a better strategy.

Let’s take control together.

Schedule a session with Melissa Cox, CFP®

FAQs About Credit vs. Debt

Q: Can using credit actually make me money?

A: Yes! With the right rewards card, you can earn cash back, travel points, or even airport lounge access for purchases you were going to make anyway.

Q: Should I close old credit cards I don’t use?

A: No. It reduces your available credit and can hurt your score. Better to leave them open and unused.

Q: What’s the fastest way to raise my credit score?

A: Pay down balances to reduce utilization and make every payment on time. Avoid opening too many accounts at once.

Q: Will checking my credit hurt my score?

A: No. Personal checks are soft inquiries. Only lenders performing hard pulls can affect your score.

Q: How much credit card debt is too much?

A: If your monthly payments exceed 10% of your income or you’re only making minimums, it's time for a strategy reset.