Can You Really Afford That? A Smart Framework for Big Financial Decisions in Dallas

Over the past 20 years as a Certified Financial Planner™ I’ve had countless conversations with clients who came into my office feeling stuck or second-guessing a big purchase they already made. It almost always starts with a gut feeling: "Something doesn’t feel right about this mortgage..." or "We bought the car, but now I can’t sleep at night."

Here’s the truth: money decisions aren’t just math—they’re emotional. And in a city like Dallas where new developments, luxury cars, and high-stakes upgrades are the norm, it can feel like you're falling behind if you don't keep up. But as someone who’s helped families from Preston Hollow to Plano, I can promise you this:

Comparison is not a financial strategy.

There’s a myth floating around that "If you can make the monthly payment, you can afford it." That mindset is how people end up house-poor, car-broke, or wiping out their emergency savings on avoidable repairs. This blog will walk you through a framework I use with clients every day to help them slow down, get clear, and make smart, intentional financial decisions.

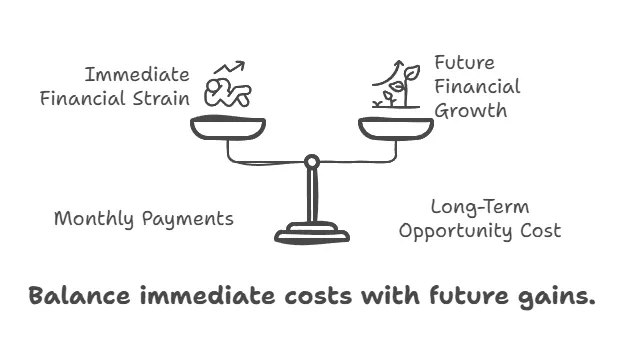

Understand the True Cost

A $60,000 SUV isn't just a $60,000 decision. Factor in taxes, interest, insurance, maintenance, and lost investment potential. For instance, that down payment could have grown significantly in a diversified investment account.

Dallas Tip: Property tax in Texas can add a hefty chunk to your monthly home budget. Always use local calculators like SmartAsset’s Texas Property Tax Tool

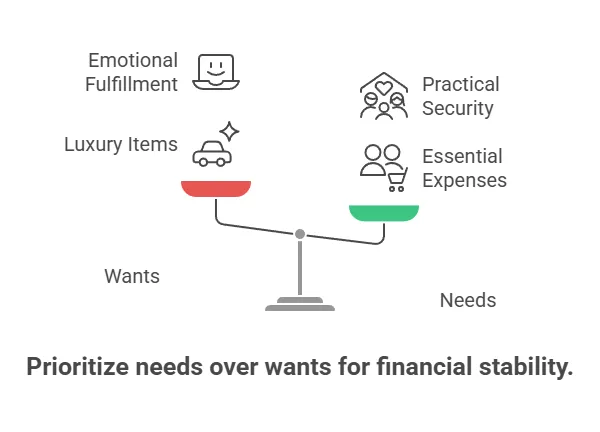

Distinguish Between Wants and Needs

This is where values-based budgeting shines. Do you need a new kitchen, or do you want one because Pinterest said so?

Read our guide on Needs vs Wants

Run the "5-Year Regret Test"

Ask yourself: "Will I regret NOT buying this five years from now?" If the answer is emotional rather than logical, take a step back.

Big purchases should align with your long-term goals, not momentary gratification.

Budget Stress Test

What if your income dropped by 20%? Could you still make this purchase without dipping into savings or taking on high-interest debt?

Use our Budgeting Method Comparison to see how resilient your finances really are.

Assess Impact on Other Goals

Will this purchase delay your retirement? Your kid's college fund? A dream to start a business?

Balance the NOW with the LATER. That’s what future-focused financial planning is all about.

Pro Insight: Melissa Cox, CFP®, recommends using her signature Financial Binder method to visualize how big purchases affect your financial ecosystem.

Run the Numbers (Literally)

Use tools like:

These tools give you clarity beyond sticker price.

Talk to a CFP® in Dallas

Before making a move, get advice from someone who can look at your whole picture. A Certified Financial Planner can help you:

- Align the purchase with your values

- Stress-test your decision against goals

- Plan for hidden costs and future risks

Ready to talk? Schedule a consultation with Melissa Cox, CFP®.

Final Thoughts from Melissa

Big purchases can be exciting and emotionally satisfying—but they should never come at the expense of your future self. I work with Dallas-area families every day to help them find this balance: enjoying life now without sacrificing the long-term freedom they crave.

I believe your financial decisions should reflect your values, not your stress levels. If you're unsure about a purchase or need a second set of eyes on your budget, let's sit down together. Whether you're navigating a new home, a big investment, or just want a clearer roadmap, I’m here to make the process feel empowering, not overwhelming. Contact Melissa Cox CFP®.

FAQs About Can You Really Afford That?

Q: How do I know if I can afford a new car in Dallas?

A: Use the 15/20/10 rule: 15% of your monthly income toward a car payment, 20% down, and loan length no more than 10% of your monthly take-home. Use local calculators for taxes and insurance costs.

Q: Should I pay cash or finance big purchases?

A: It depends. Paying cash avoids interest, but if you’re depleting emergency savings or sacrificing investment growth, it may not be wise.

Q: What if I regret not making the purchase?

A: Use the "5-Year Regret Test." If it's an emotional decision, wait. Logic and alignment with long-term goals should drive big spending.