How to Audit Your Insurance Like a Financial Planner

Most People Have a Roof — They Just Don’t Know If It Leaks

You wouldn’t build a home and never check the roof.

You wouldn’t just assume the shingles were intact, or that the flashing was sealed, or that your attic wouldn’t flood during the next storm — especially if you’d invested time, energy, and money building everything underneath it.

But that’s exactly how most people treat their insurance.

They build their careers.

They grow their savings.

They invest in the future.

And then they assume their insurance — the so-called “roof” over the financial house — is quietly doing its job in the background.

Until it doesn’t.

Until something goes wrong, and that protective layer meant to shield their progress from disaster lets water in — or worse, was never nailed down in the first place.

As a financial planner, I’ve sat across from countless clients who thought they were protected. They had homeowners policies, auto policies, life insurance, health coverage, maybe even umbrella insurance layered on top. On paper, they were covered.

But insurance isn’t about what’s written on the front page.

It’s about what’s buried in the exclusions.

It’s about whether the thing you actually need covered… is.

And most people don’t find out their “roof” leaks until it’s too late to patch it.

That’s why this conversation matters. Because you’re not just buying a product — you’re building protection into the architecture of your wealth. And if that structure isn’t reviewed, inspected, and maintained? The entire house becomes vulnerable.

Let’s start there — by climbing onto the roof of your financial house and checking for weak spots. Because you don’t want to wait for a storm to find out what’s missing.

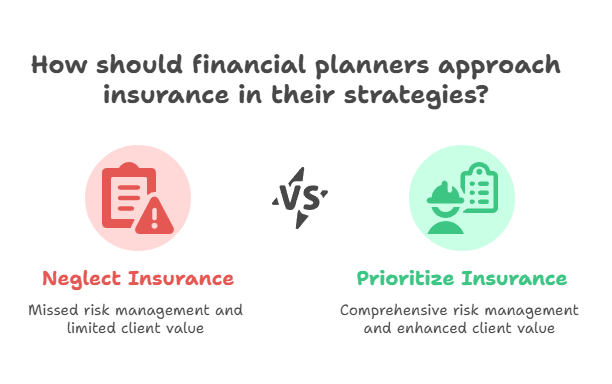

Why Financial Planners Should Obsess Over Insurance (Even If Most Don’t)

Let’s be honest: the average financial planner doesn’t spend much time talking about insurance.

They focus on your portfolio.

Your retirement timeline.

Your investment performance and projected net worth.

And all of that matters — but it’s not the whole picture.

Because here’s the truth: without the right protection in place, even the best-built financial plan can collapse.

That’s why I believe financial planners should obsess over insurance. Not because it’s glamorous — it’s not. Not because it gets the biggest client “wow” factor — it won’t. But because it’s the part of the plan that keeps everything else from falling apart.

I’ve reviewed hundreds of financial plans from other advisors — many with beautiful charts, Monte Carlo simulations, tax projections, and detailed investment allocations.

And yet, when I ask, “Can I see the client’s insurance policies?” — I get blank stares.

It’s treated like a line item.

An afterthought.

A checkbox at best.

But the planner who doesn’t review your insurance isn’t protecting your wealth — they’re simply hoping it won’t get tested.

I don’t hope.

I plan.

Because I’ve seen what happens when people believe they’re covered… until they’re not. I’ve seen policies that looked “comprehensive” fall apart in a single conversation with an adjuster. I’ve seen retirement accounts raided to cover what a $12 rider could have taken care of.

The truth is, most people don’t know what they’re covered for — and sadly, many planners aren’t digging deep enough to find out either.

If your advisor isn’t asking for your declaration pages…

If they’re not reviewing your coverage every year…

If they treat insurance like a nuisance instead of a cornerstone…

You’re not getting a complete plan.

You’re getting a portfolio wrapped in blind spots.

That’s not planning.

That’s luck.

And I don’t build wealth on luck. I build it with purpose — and protection.

What Most People Miss When Reviewing Their Own Policies

Insurance feels simple… until you actually need it.

Most people review their policies the same way they skim through terms and conditions online: glance at the bolded parts, trust the headlines, and move on. They see the word “covered” and assume that means protected.

But here’s the part they don’t see:

Policies aren’t written to inform you — they’re written to protect the carrier.

And the reality is, most denials aren’t based on what your policy says you have.

They’re based on what your policy says you don’t.

I’ve worked with families who thought their flood damage was covered — until they learned it wasn’t considered a “flood” by their insurer.

I’ve seen clients assume their “full coverage” auto policy would provide a rental — only to find out it didn’t include loss-of-use protection.

I’ve seen life insurance claims denied because of technical exclusions related to a job change or overlooked health disclosure.

Why does this happen?

Because most people don’t know what to look for.

- They trust the summary.

- They assume the declarations page tells the whole story.

- They believe their agent explained everything that matters.

- They file their policies in a drawer and forget about them.

And when you combine trust, complexity, and overwhelm, you get financial exposure hidden in plain sight.

The most common pain points?

- Exclusions you didn’t know were there.

- Coverage limits that haven’t changed in 10 years.

- Deductibles that are wildly out of sync with your cash flow.

- Life insurance that quietly expired or doesn’t follow you when you leave a job.

- Health policies with pre-authorization hoops that make actual care feel inaccessible.

They don’t notice until it’s too late.

Until they’re calling the insurance company from the side of the road…

…or the emergency room…

…or their waterlogged living room.

And here’s the hardest truth:

Even well-meaning people — smart people, organized people, financially responsible people — fall into this trap.

Because insurance doesn’t feel urgent until it’s everything.

That’s why a planner’s role isn’t just to ask if you have coverage.

It’s to dig in and ask the real question:

Does this coverage actually do what you think it does?

It’s also why I started taking insurance reviews so seriously.

Not because I read it in a textbook… but because I lived it.

If you haven’t read what happened when our lake house turned into a waterlogged disaster zone — and how I found out the hard way what our policy didn’t cover — let me offer you a not-so-gentle reminder to take your own audit seriously:

We Thought We Were Covered: What Our Water Leak Taught Us About Insurance — It’s not just a story. It’s the reason I don’t skip this step anymore.

The Dangerous Illusion of “Full Coverage”

If I had a dollar for every time someone said, “We’re good — we have full coverage,” I could fund a whole new emergency fund just off misplaced confidence.

It’s one of the most dangerous phrases in personal finance.

Because “full coverage” isn’t a promise. It’s a feeling.

It’s the kind of phrase we say when we’ve ticked the box, set up auto-pay, and trust that whatever happens next, the policy will step in and take care of it.

But here’s what most people don’t realize:

“Full coverage” isn’t real.

Not legally. Not practically. And definitely not in the fine print.

I’ve had clients swear they were fully insured — only to call me from the ER after discovering their ambulance ride wasn’t in-network. Others assumed their auto policy included rental reimbursement — until the adjuster told them it was an optional rider they never added. And many more have leaned on employer-provided life insurance, thinking it was permanent protection, not realizing it ends when the job does.

In our case, we assumed our homeowners policy would step in after a pipe burst in the upstairs shower of our lake house. It didn’t. Because somewhere deep in the policy, it defined that type of damage as “gradual,” not “sudden and accidental.” And that tiny shift in language cost us tens of thousands of dollars.

The declarations page made us feel safe.

The exclusions told a different story.

And the adjuster? He delivered the news with a smile that felt almost rehearsed.

But here’s the hard truth:

Most insurance policies are written and sold in isolation.

An agent might do their best to guide you through what you need — but if they’ve never seen your net worth, your income sources, your liabilities, or your long-term goals, how could they possibly know what’s at stake?

Especially in a call center environment — where quotas are king and conversations are brief — agents aren’t incentivized to dive deep into your financial picture.

They’re trained to sell coverage. Not to build context.

And it’s not about blame.

Most of these agents are doing their best with the tools and training they have.

But that’s exactly the problem.

Insurance without planning is like installing locks on random doors in a house you’ve never seen.

You might get lucky.

Or you might leave something critical wide open.

That’s the illusion — the dangerous kind.

The belief that paying premiums equals protection.

That coverage means covered.

That a few bold words on a summary page tell you everything you need to know.

They don’t.

And the longer you live under that illusion, the more at risk you actually are

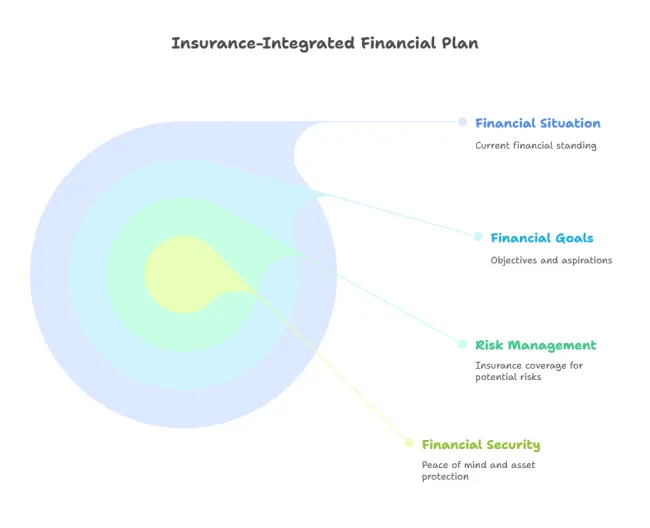

What an Insurance-Integrated Financial Plan Actually Looks Like

For most people, insurance lives in a different mental drawer than financial planning.

It’s a separate login.

A different advisor.

A line item on a budget — not a strategy built to protect what you’re building.

But in my practice, insurance isn’t separate. It’s structural.

Because when a pipe bursts, when someone files a lawsuit, or when a health crisis knocks on your door, the consequences don’t stay neatly confined to one category. They spill across your income, your savings, your debt plan, your retirement trajectory — even your emotional energy and decision-making.

That’s why, when I create a financial plan, the insurance review isn’t a bolt-on service or a side conversation.

It’s integrated into the foundation, the walls, and the roof of your financial house.

Not because I sell insurance (I don’t).

Not because I earn a commission (I never do).

But because I’ve lived through what happens when you think you’re protected — and learn you’re not.

And once you’ve watched your family stand ankle-deep in water, wondering what to do next, you stop treating coverage like a line item.

You start treating it like a non-negotiable.

So when I say this review is included as part of your comprehensive plan, I mean it. There’s no extra fee. No upsell. No awkward product pitch waiting at the end of the conversation.

Just a clear-eyed look at whether your protection matches the life you’ve built — and the one you’re still building.

Because you can’t build a lasting financial house if you ignore the structural weak points.

You can’t light the fire of wealth growth and hope the roof holds.

And you definitely can’t plan for a future that isn’t protected.

And let’s be honest — the infamous Farmers Insurance commercials, with their runaway shopping carts and exploding toilets, didn’t come out of nowhere. Those stories were real. So are the warning labels on your household appliances. Someone tried it. Someone filed the claim. Someone got burned.

That’s why I don’t build financial plans that assume nothing will go wrong.

I build plans that ask, “What if it does?”

And then answer it — in writing, with clarity, and with confidence.

That’s what a real financial plan looks like.

Not just investments and projections, but protection where it matters most.

How a Financial Planner Actually Audits Insurance (No Checklists Required)

If you’ve ever tried to “do the responsible thing” and pull out your insurance policies, chances are it ended one of two ways:

- You glanced at the coverage amounts, felt reassured, and closed the folder.

- You got overwhelmed by the legal language, put it off, and told yourself you’d deal with it later.

Neither one is an audit.

When I audit a client’s insurance during a financial planning engagement, I’m not just verifying that a policy exists. I’m evaluating whether that policy plays the role it should inside the larger structure of their financial house.

I want to know:

- Does this policy align with the risks this family faces today — not five years ago?

- Are there any hidden landmines in the exclusions or limitations?

- If something catastrophic happened tomorrow, would this policy keep them on track — or knock them completely off course?

I don’t separate insurance from the rest of financial planning.

Because you can’t talk about protecting wealth without knowing what’s at risk.

So when I audit a policy, I read like a detective.

Not for reassurance — but for surprises.

I don’t start with the declarations page.

I start with the exclusions.

Because that’s where the damage lives.

That’s where the “Oh no, we don’t cover that” clauses hide.

And once I’ve found the weak spots, I bring them into the financial plan.

If a client is self-insuring a $15,000 risk without knowing it?

We plan for that.

If their disability policy won’t pay for 90 days, and their emergency fund covers 30?

We plan for that.

A real audit doesn’t just check boxes.

It reveals gaps.

It translates legal jargon into human outcomes.

And it asks the most important question a financial planner can ask:

What’s the cost of assuming you’re covered when you’re not?

How a Financial Planner Actually Audits Insurance (No Checklists Required)

If you’ve ever tried to “do the responsible thing” and pull out your insurance policies, chances are it ended one of two ways:

You either glanced at the coverage amounts, felt vaguely reassured, and closed the folder.

Or you got overwhelmed by the fine print, mumbled something about getting to it later, and quietly slid it back into the drawer.

Let’s be clear — neither of those are audits. They’re emotional coping mechanisms dressed up as adulting.

When I audit a client’s insurance as part of their financial plan, I’m not just making sure the policy exists. I’m asking whether that policy is actually doing its job inside the structure of their financial house.

Does this coverage reflect the life they’re living now — or is it stuck protecting a version of them from five years ago?

Are the exclusions silently undercutting what looks like protection?

And the big one:

If something catastrophic happened tomorrow, would this policy keep their financial plan on track… or blow it straight off the rails?

Because I don’t treat insurance like a side conversation.

You can’t talk about protecting wealth if you don’t understand what’s at risk.

So when I sit down with a policy, I read it like a detective.

Not for comfort — but for surprises.

I don’t start with the declarations page.

I start with the exclusions.

Because that’s where the pain is hiding. That’s where the “Oh, we don’t cover that” clauses live.

And once I’ve found the blind spots, I don’t just hand them back to the client with a polite warning. I fold them into the plan.

If they’re unknowingly self-insuring a $15,000 plumbing disaster?

We plan for that.

If their disability policy has a 90-day elimination period but they’ve only got 30 days of savings?

We plan for that.

Real insurance audits don’t check boxes — they expose risk.

They strip away the comfortable language and translate policy-speak into actual life consequences.

And they always come back to one essential question:

What’s the cost of assuming you’re covered… when you’re not?

What an Insurance-Integrated Financial Plan Actually Looks Like

Most people don’t think of insurance as part of financial planning.

They think of it as a side conversation.

A separate folder.

A “speak to your agent” moment.

But if you’ve ever worked with me — or even read this far — you know that’s not how I operate.

I don’t believe in separating protection from planning.

Because when a pipe bursts, a lawsuit hits, or a medical emergency knocks on your door — it doesn’t show up in isolation.

It ripples through your income, your savings, your investments, your retirement timeline, your emotional energy… all of it.

So when I build a financial plan for someone, the insurance review isn’t optional.

It’s included.

Not as a sales pitch. Not as a commission-driven conversation.

And not because I have a product to push. I don’t.

It’s included because I’ve lived through the nightmare of thinking we were covered… and learning we weren’t.

I include it because I’ve seen what happens when families get blindsided — and how fast something “small” can snowball into something life-altering.

And maybe that’s the greatest myth of all — that insurance only matters when things go horribly wrong.

The truth is, it matters before that.

It matters when you’re building. When you’re protecting. When you’re creating a life that actually works — and doesn’t fall apart at the first sign of trouble.

That’s why, as part of every comprehensive plan I deliver, the insurance audit comes standard.

There’s no extra charge.

No hidden agenda.

No upsell waiting at the end.

Just a straightforward, experienced perspective from someone who knows what could happen — and is committed to making sure it doesn’t wreck your life when it does.

And yes… the funny Farmers Insurance commercials? The ones with exploding kitchen sinks and trampolines crashing through neighbors’ windows?

They exist because someone actually filed a claim for that.

Just like the warning label on your hair dryer that says “Do not use in the bathtub”…

Someone tried it.

Disasters don’t just happen in commercials. They happen in real life.

And too many financial plans ignore that until it’s too late.

But not this one.

Not on my watch

Ready for the Real Audit? Let’s Look Under the Hood Together

You can’t control every curveball life throws at you.

But you can choose whether you’re caught off guard — or fully prepared.

For most people, insurance feels like background noise. A checkbox on a to-do list.

You know it’s there.

You assume it works.

Until the day you find out it doesn’t.

I’ve lived that moment — the one where everything you thought was “covered” suddenly isn’t.

Where an adjuster smiles, a policy falls short, and you’re left wondering how things went so wrong.

That’s why I don’t build plans that guess.

I build plans that know.

Plans that integrate your insurance into the heart of your financial structure.

Plans that treat protection as the foundation — not the footnote.

So here’s what I’m offering:

If you’ve ever said, “I think I’m covered,” let’s test that.

If you’ve ever wondered, “Would my plan survive a hit?” — let’s find out.

No pressure. No sales pitch. Just a conversation rooted in clarity, strategy, and purpose.

Because the next pipe that bursts, lawsuit that strikes, or health diagnosis that changes everything — it won’t wait for you to “get around to it.”

Let’s make sure your plan holds up when it matters most.

Schedule Your Discovery Call — and let’s audit your financial protection like your future depends on it.

Because it just might.

FAQs About Auditing Insurance Like a Financial Planner

Do I really need to read my entire policy?

Not necessarily — but someone should. If you’re working with a financial planner, they should read it deeply (especially the exclusions). At minimum, you need to go beyond the declarations page and understand where your policy draws the line between “covered” and “denied.”

What’s the difference between being insured and being protected?

Being “insured” means you have a policy.

Being protected means that policy actually covers the financial impact of a real-world event — without blowing up your retirement, draining your emergency fund, or turning a crisis into a catastrophe.

Isn’t this what my insurance agent is for?

Sometimes. But not always. Many agents work from a limited menu of products or have sales quotas to meet — especially in call centers. And very few know your entire financial picture. That’s why I integrate insurance into the planning process — not as a transaction, but as a critical part of your overall strategy.

What’s the worst that could happen if I don’t review my policies?

Best-case scenario? You overpay for coverage you don’t need.

Worst-case? You find out — too late — that the one thing you thought was covered… isn’t. And by then, the financial damage has already been done.

What’s the cost to review my insurance through you?

It’s included as part of your comprehensive financial plan.

There’s no upsell, no product pitch, and no extra fee.

Just the real audit your future deserves — done by someone who’s been through the fire and is committed to helping you avoid it