Stocks Explained by a Dallas Financial Advisor | Smart Investing for Growth

As a Dallas-based Certified Financial Planner™, I work with clients every day who own stocks—sometimes through their 401(k), sometimes through a brokerage app—but don’t fully understand what they’re investing in. And that’s okay. The stock market can feel confusing, even intimidating, especially with the nonstop headlines about crashes, bubbles, and bear markets.

But here’s the truth:

📌 Stocks are one of the most powerful tools available to build long-term wealth.

Used wisely, they offer unmatched growth potential, inflation-beating performance, and even passive income through dividends.

In this guide, I’ll walk you through:

- What stocks are (in plain language)

- How the stock market really works

- The different types of stocks and what they mean for your risk level

- Why stock prices move—and how to manage volatility

- How stocks fit into a diversified financial plan

- What Dallas investors need to know before buying their next share

Whether you’re just starting out, preparing for retirement, or looking to clean up an old portfolio, this blog will help you understand stocks with confidence—and use them to support your real-life financial goals.

What Is a Stock? (Plain-English Explanation for Everyday Investors)

A stock represents ownership in a company. When you buy a share of stock, you're purchasing a piece of that business—no matter how big or small. You're not just betting on a ticker symbol; you're becoming a partial owner of the company’s future profits (or losses).

Stocks are also known as equities, because they give you an equity stake in the business.

Key Terms to Know:

- Share: A single unit of ownership in a company

- Stockholder / Shareholder: Someone who owns shares

- Ticker Symbol: A company’s shorthand code on the exchange (e.g., AAPL for Apple)

Example:

If you own 10 shares of Apple, you’re one of millions of part-owners. You don’t get a say in running the business (unless you have voting rights at a shareholder meeting), but you do participate in its financial outcomes—good or bad.

💬 Dallas Insight: Most people own stocks indirectly through retirement accounts or mutual funds—but few realize they’re actually shareholders in hundreds of companies.

What Do You Get from Owning a Stock?

- Capital Appreciation – If the company grows and the stock price rises, your shares become more valuable

- Dividends – Some companies pay out profits to shareholders regularly

- Voting Rights – Depending on the stock class, you may vote on company issues

Types of Stocks and How They Differ

Not all stocks are created equal. Some are stable giants. Some are volatile startups. Understanding the different types of stocks helps you balance risk and return inside your portfolio.

1. Common Stock vs. Preferred Stock

Common Stock is what most investors own—it offers potential growth and voting rights

Preferred Stock is more like a hybrid between a bond and stock—lower risk, steady income

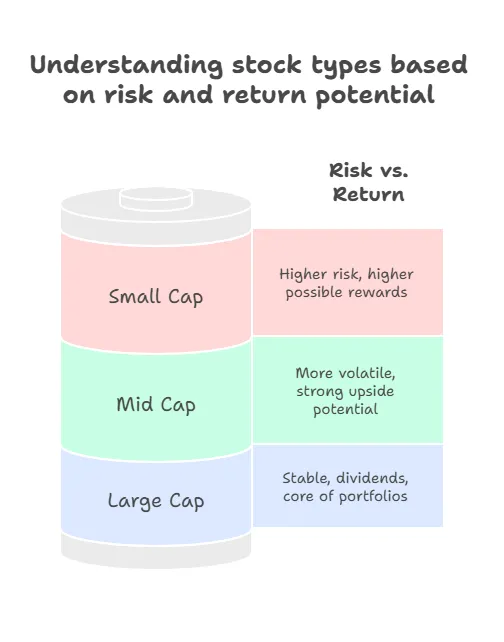

2. Stock Categories by Company Size (Market Cap)

- Large Cap (Over $10 billion): Think Apple, Microsoft – stable, blue-chip firms

- Mid Cap ($2–10 billion): Growing companies with potential for more upside

- Small Cap (Under $2 billion): More volatile, higher growth potential—but more risk

📌 Dallas Strategy Tip: Many portfolios benefit from a blend of large, mid, and small cap stocks depending on risk tolerance and time horizon.

3. Domestic vs. International Stocks

- Domestic Stocks: U.S.-based companies (familiar names and regulatory protection)

- International Stocks: Exposure to global growth (but with more currency and geopolitical risk)

- Emerging Markets: Developing economies with high potential and higher volatility

💡 Fiduciary Insight: Diversifying internationally can smooth returns and reduce reliance on U.S. performance alone.

4. Growth vs. Value Stocks

- Growth Stocks: Companies reinvesting profits to expand (e.g., Tesla, Nvidia)

- Typically no dividends

- Higher risk, higher return

- Typically no dividends

- Value Stocks: Companies that appear undervalued based on financial metrics (e.g., Johnson & Johnson)

- Often pay dividends

- May be more defensive in bear markets

- Often pay dividends

💬 Many financial planners—including in my Dallas-based practice—use a core blend of growth and value stocks to balance upside with resilience.

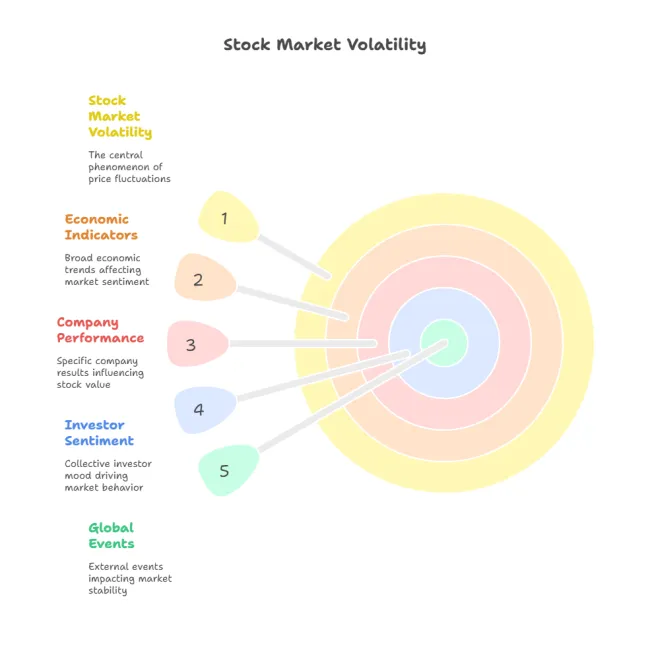

Why Stock Prices Fluctuate (And How to Stay Sane in a Volatile Market)

If you’ve ever checked your portfolio one day and it’s up, then looked the next day and it’s down—welcome to the world of stock market volatility. But what actually causes stock prices to change?

Common Drivers of Stock Price Movement:

- Company Performance

- Earnings reports, revenue growth, or scandals can all shift investor confidence.

- Better-than-expected profits? Stock usually goes up. Poor results? Down it goes.

- Earnings reports, revenue growth, or scandals can all shift investor confidence.

- Economic Indicators

- Inflation, unemployment rates, consumer spending, and interest rate changes all move the broader market.

- For example: rising interest rates often depress stock prices (especially tech and growth stocks).

- Inflation, unemployment rates, consumer spending, and interest rate changes all move the broader market.

- News & Sentiment

- Headlines, tweets from CEOs, or geopolitical events can shift sentiment instantly.

- Even rumors can cause price swings.

- Headlines, tweets from CEOs, or geopolitical events can shift sentiment instantly.

- Supply & Demand

- If more people want to buy than sell, prices go up.

- If more people panic-sell, prices drop—regardless of the company’s fundamentals.

- If more people want to buy than sell, prices go up.

- Market Psychology

- Fear and greed often overpower logic. This is what causes bubbles, crashes, and herd behavior.

- Fear and greed often overpower logic. This is what causes bubbles, crashes, and herd behavior.

💬 Dallas Insight: I often remind clients that volatility is normal, but emotional reactions aren’t. If your stock strategy is built around your plan—not the headlines—there’s no need to panic.

How to Stay Grounded During Volatility:

- Focus on long-term goals, not short-term news cycles

- Avoid checking your accounts daily

- Diversify to manage sector or company-specific risk

- Work with a fiduciary to stick to the strategy (not the emotion)

Remember: volatility is a feature, not a flaw, of investing in stocks. Without it, you wouldn’t get the long-term growth potential.

How Stocks Fit Into Your Financial Plan

Stocks aren’t just something you “buy” because you heard about them on a podcast. In a professionally built financial plan, stocks serve a very specific purpose: long-term growth.

Here’s how I integrate stock investing in my Dallas-based financial planning process:

1. Growth Engine for Long-Term Goals

Whether you’re saving for retirement, education, or financial independence, stocks are your primary tool to outpace inflation and build wealth over decades.

Stocks have historically returned 7–10% annually over long periods—far more than bonds, savings accounts, or CDs.

2. Tailored to Risk Tolerance and Time Horizon

A 30-year-old just starting out? Likely 70%–90% in stocks.

A 68-year-old nearing retirement? Maybe 40%–60%, depending on income needs and risk appetite.

💬 Dallas Planning Tip: It’s not just about how much risk you can take—it’s about how much risk you need to take to reach your goals.

3. Diversification Within Stocks

Owning “just a few” stocks (or only U.S. large caps) isn’t enough. We diversify across:

- U.S. and international

- Large cap, mid cap, small cap

- Growth and value

- Individual stocks and ETFs/mutual funds

4. Strategic Placement in Accounts

Depending on tax considerations, we might place stock investments in:

- Roth IRAs (for tax-free growth)

- Brokerage accounts (for tax-loss harvesting)

- 401(k)s and IRAs (for long-term compounding)

This is called asset location, and it’s a key part of optimizing after-tax returns.

5. Behavioral Coaching

As a fiduciary, my role isn't just to “pick stocks”—it’s to help clients:

- Stick to the plan during volatility

- Avoid emotional decisions

- Rebalance portfolios at key times

- Take strategic withdrawals that minimize tax and risk

Types of Stocks: Building Blocks for Every Dallas Investor

When people hear “stocks,” they often picture big names like Apple, Amazon, or Tesla—but there’s much more variety beneath the surface. Understanding the types of stocks helps you make smarter investment decisions, reduce risk, and align your portfolio with your real-life goals.

Whether you're just getting started or looking to refine your strategy, here’s a breakdown of the major stock categories—and what they mean for your long-term financial plan.

1. By Company Size (Market Capitalization)

Stocks are commonly classified by the size of the company, known as market capitalization—which is the total value of all a company’s outstanding shares.

- Large Cap Stocks (Over $10B): Blue-chip companies like Apple or Johnson & Johnson. These stocks tend to be more stable, offer dividends, and are typically the core of retirement portfolios.

- Mid Cap Stocks ($2B–$10B): Growing firms that are more volatile than large caps but offer strong upside potential.

- Small Cap Stocks (Under $2B): Newer or niche companies with higher risk—and higher possible rewards.

💬 Dallas Insight: A diversified portfolio should include a healthy mix of company sizes. Many Dallas-based professionals I work with are overexposed to large caps—missing out on the growth potential of mid- and small-cap sectors.

2. By Geography

- Domestic Stocks: U.S.-based companies traded on NYSE or NASDAQ. These tend to be more familiar and offer stronger legal and regulatory protections.

- International Stocks: Companies based outside the U.S.—helping you tap into global markets like Europe, Japan, or Canada.

- Emerging Markets: Fast-growing economies like Brazil, India, or China. These stocks can offer high returns, but also carry currency and political risk.

🌐 Fiduciary Note: International exposure is one of the most overlooked diversification tools. When U.S. stocks struggle, global equities can help smooth returns.

3. By Style: Growth vs. Value

- Growth Stocks: Companies reinvesting profits to fuel expansion—think Amazon or Tesla. Typically offer higher growth potential but no dividends.

- Value Stocks: Stocks considered undervalued relative to fundamentals—like Procter & Gamble or Berkshire Hathaway. These are more stable and may offer dividends.

💼 Dallas Strategy Tip: In my practice, I often blend growth and value to create a “core and explore” strategy—anchoring in value, while letting growth stocks drive upside.

4. By Stock Type

- Common Stock: What most investors own. It includes voting rights and the potential for capital appreciation.

- Preferred Stock: More like a bond-stock hybrid. Offers fixed dividend income and lower volatility—but usually no voting rights.

📌 Planner Insight: Preferred stock can be useful for income-seeking retirees or conservative investors—but it's often overlooked by DIY investors.

Stock Types Summary Table

Pros and Cons of Stock Investing

Just like any investment vehicle, stocks have benefits and drawbacks. When they’re used thoughtfully within a diversified plan, stocks are a powerful driver of long-term success—but they also come with risk. Let’s break it down:

Pros of Stock Investing:

📈 Long-Term Growth Potential

Historically, stocks outperform bonds, savings accounts, and most other asset classes over time. They’re essential for compounding wealth.

💰 Dividend Income

Many established companies pay dividends—offering a consistent income stream on top of growth.

🔀 Diversification Across Sectors and Countries

You can spread risk across industries (tech, healthcare, energy), geographies (U.S., international, emerging markets), and company sizes (large cap to micro cap).

🧠 Ownership Mentality

Owning stocks gives you a stake in the economy and innovation—creating engagement in your investments.

🛠️ Liquidity

Publicly traded stocks are easy to buy and sell, giving you flexibility and access to cash when needed.

Cons of Stock Investing:

📉 Volatility

Prices can swing dramatically in the short term. This emotional rollercoaster is hard for some investors to stomach.

⏳ No Guaranteed Returns

Unlike CDs or bonds, there are no promised interest payments. Losses are possible—especially short-term.

💼 Company-Specific Risk

Even a great company can experience scandal, disruption, or declining sales that impact its stock price.

⚖️ Emotional Decision-Making

It’s tempting to buy high and sell low if you aren’t guided by a plan. Behavioral mistakes are one of the top reasons individual investors underperform the market.

💵 Taxes on Gains

If you sell for a profit, you’ll owe capital gains tax (unless it’s in a tax-deferred or Roth account).

💬 Dallas Insight: I often help clients balance the power of stocks with other tools—like bonds, annuities, or cash reserves—to create an all-weather portfolio that can grow through good markets and stay resilient in bad ones.

Common Stock Investing Mistakes (and How I Help You Avoid Them)

Even smart investors can fall into traps when investing in stocks. Here are the most common ones I see—and how working with a fiduciary can help prevent them:

1. Chasing “Hot” Stocks or Headlines

Jumping into trending companies (think meme stocks or crypto-adjacent plays) without a plan often leads to disappointment.

🛑 Strategy fix: I help clients focus on long-term fundamentals—not hype

2. Lack of Diversification

Having all your money in tech stocks, one mutual fund, or your employer’s stock is risky—even if it’s performed well.

🔄 Strategy fix: We spread risk across sectors, market caps, and geographies.

3. Selling in a Panic

Market drops can be scary. But selling at the bottom locks in losses and derails your plan.

🧠 Strategy fix: I act as your behavioral coach, helping you stay calm and stick to your goals during volatility.

4. Ignoring Fees and Tax Impact

DIY platforms and stock pickers often overlook expense ratios, trading costs, or capital gains tax from selling.

💼 Strategy fix: We structure your stock portfolio with cost, tax, and goal alignment in mind.

5. Not Rebalancing

Left alone, your stock allocation can get out of whack—taking on more risk than you intended.

🔧 Strategy fix: I regularly rebalance portfolios to match your target allocation.

Fiduciary Perspective: You don’t need to beat the market. You need to meet your goals—with a stock strategy that’s disciplined, intentional, and personal.

Where (and How) to Buy Stocks: A Practical Guide for Beginners and DIY Investors

Once you understand what stocks are and how they fit into your financial plan, the next question is: “Where do I actually buy them?”

Good news: Today, buying stocks is easier than ever—but that doesn’t mean every platform or method is equal. Here’s what Dallas investors need to know.

Through a Financial Advisor

If you're investing as part of a long-term plan, working with a fiduciary financial advisor like myself means:

You get a personalized strategy

We place trades for you (often using ETFs, mutual funds, and institutional tools)

Your investments are aligned with tax strategy, retirement goals, and cash flow needs

Fiduciary Perspective: I don’t sell stocks to make commissions. I help clients build evidence-based portfolios that align with your goals—not Wall Street’s.

Workplace Retirement Plans (401(k), 403(b), etc.)

Many people buy stocks through their employer-sponsored retirement plan:

- 401(k) plans often offer mutual funds or stock-index funds, not individual stocks

- Some offer a brokerage window, allowing you to pick specific stocks

🔎 Dallas Insight: These accounts are tax-advantaged—but that doesn’t mean all the investment options are good ones. Reviewing your 401(k) lineup is a smart planning move.

Online Brokerages (DIY Platforms)

These are the most common way to buy individual stocks:

- Fidelity

- Charles Schwab

- Vanguard

- TD Ameritrade (now merged with Schwab)

- E*TRADE

- Merrill Edge

✅ Pros:

- Low or no trading commissions

- Wide access to individual stocks, ETFs, and mutual funds

- Research tools, retirement calculators, and more

❌ Cons:

- You’re on your own—no personal advice

- Easy to make emotional or impulsive trades

💬 Fiduciary Tip: Many Dallas clients come to me after getting overwhelmed on DIY platforms. If you want guidance, not just tools, a fiduciary can help you build the right strategy before you buy.

Investing Apps (Fintech & Mobile Platforms)

Examples include:

- Robinhood

- SoFi

- Public

- Acorns (round-up investing)

These offer modern interfaces and low barriers to entry.

✅ Pros:

- Great for beginners

- Easy-to-use apps

- Fractional shares allow investing with small amounts

❌ Cons:

- Limited research tools

- Some platforms gamify investing (which can backfire)

- Lack of personalized support

Dallas Caution: Day Trading Is Not a Shortcut to Wealth

Just because it’s trendy doesn’t mean it’s safe.

I've seen too many Dallas investors—especially younger ones—buy stocks based on app alerts, Reddit threads, or TikTok hype without fully understanding what they’re investing in.

And even more concerning: many are lured into day trading believing it’s a fast path to wealth.

Fiduciary Insight:

As a financial planner, I help clients build sustainable wealth—not chase short-term wins. Day trading might look exciting, but it’s not a financial strategy. It's often gambling in disguise.

Why Day Trading Rarely Works — and What to Do Instead

With the rise of investing apps, Reddit threads, and TikTok “financial influencers,” day trading has exploded in popularity—especially among younger investors looking for a fast track to wealth.

But here’s the truth that doesn’t get enough attention:

Day trading is not investing. It’s gambling with a financial costume on.

The Reality Behind the Trend

Most Day Traders Lose Money

Studies consistently show that over 90% of day traders lose money. And worse, only 1% make profits consistently over time.

It’s Mentally Exhausting

Day trading requires intense focus, constant monitoring, and snap decisions under pressure. That stress can easily lead to emotional mistakes—and big losses.

Taxes Can Wipe You Out

Every trade is a taxable event. If you’re holding stocks for less than a year, those profits are taxed as ordinary income, not long-term capital gains. That means you could be paying up to 37% in federal taxes alone.

It’s Not Really “Free”

Even if your platform charges no commission, you’re still paying through:

- Wide bid/ask spreads

- Slippage on execution

- Margin interest if you borrow to trade

💬 Dallas Insight: I’ve seen local investors make five-figure mistakes chasing hype trades or trying to “beat the market” in their lunch break.

What to Do Instead: A Smarter, More Sustainable Approach

If you’re interested in growing your wealth, here’s what works:

- Long-term investing with a strategy

- Diversification across asset classes and sectors

- Tax-aware placement of your investments

- Working with a fiduciary to avoid emotional missteps

You don’t need to trade every day to be successful.

You need a portfolio aligned with your goals—and the discipline to let it work for you.

Bonus Tip: Know Your Account Type

Where you buy stocks also determines how they’re taxed and how flexible your investments are:

📅 Want help reviewing where your investments live—and if they belong there?

Schedule a strategy session

Fees and Taxation: What You Really Pay to Own Stocks

Buying a stock may seem straightforward—but the true cost of ownership can include hidden fees and tax surprises that eat away at your return if you’re not careful. Let’s break it down so you can invest with clarity and confidence.

Common Stock Ownership Costs

Even in today’s “no commission” world, there are still fees you need to watch for:

1. Trading Commissions

Most major brokerages have eliminated commissions on U.S. stock trades—but this doesn’t always apply to:

- International stocks

- Broker-assisted trades

- Specialized accounts (like trusts or solo 401(k)s)

✅ Fiduciary Tip: Always check your platform’s fee schedule—even “free” trades can come with caveats.

2. Bid/Ask Spread

The difference between what a buyer is willing to pay and what a seller is asking. On highly liquid stocks, this is tiny. On smaller or volatile stocks, this can cost you 0.5% or more per trade.

💬 Dallas Insight: On large trades or illiquid stocks, I’ve seen clients lose money simply due to poor execution timing.

3. Custodial or Platform Fees

Some custodians charge annual maintenance or account fees—especially in IRAs or small accounts. These can range from $25–$100+ per year.

4. Advisory Fees (if using an advisor)

If you work with a fiduciary financial planner like me, you’ll typically pay a transparent, flat percentage of assets under management (e.g., 1.00% or less)—in exchange for planning, advice, and proactive portfolio management.

🛑 Warning: Commission-based advisors may sell you products like loaded mutual funds or annuities instead of stocks, often resulting in higher embedded fees and sales incentives.

Taxation of Stocks: What to Expect When You Sell

Understanding how stocks are taxed helps you make smarter decisions about what to sell, when, and from which account.

1. Capital Gains Tax

When you sell a stock for more than you paid, you’ll owe capital gains tax on the profit.

Planner Tip: In Dallas, I often help clients sell strategically to:

- Stay under capital gains thresholds

- Offset gains with tax-loss harvesting

- Time Roth conversions and income

2. Dividends

If your stock pays a dividend, it’s taxable—even if you reinvest it.

- Qualified dividends (from most U.S. stocks) are taxed at 0%, 15%, or 20%

- Ordinary (non-qualified) dividends are taxed at your regular income rate

💬 Dallas Note: Many retirees are surprised that their reinvested dividends still create a 1099-DIV each year. A tax-aware withdrawal plan matters.

3. Wash Sale Rule

If you sell a stock for a loss, then buy it back within 30 days, the IRS disallows your loss for tax purposes.

I help clients avoid this by coordinating tax-loss harvesting and rebalancing efforts across multiple accounts.

4. Tax-Aware Account Placement

Where you hold your stocks affects how (and when) you’re taxed:

📍 Dallas Planning Insight: I often place high-growth or dividend-paying stocks inside Roth IRAs to maximize long-term tax-free compounding.

Want to review the true cost and tax efficiency of your stock holdings?

Let’s do a detailed portfolio audit and tax alignment strategy:

Final Thoughts from Melissa Cox, CFP®: Stocks Aren’t Just for Wall Street — They’re for Your Life

Stocks aren’t just a buzzword or a Wall Street game—they’re the foundation of long-term financial growth for everyday investors. But the real power of stocks comes from how you use them within a plan, not just how you pick them. Whether you're building wealth, preparing for retirement, or seeking financial independence, understanding the different types of stocks—and how they fit your goals—is critical.

As a Dallas-based Certified Financial Planner™, I don’t just help clients pick investments—I help them build strategies that are tax-efficient, risk-aware, and completely personalized. That means no hype, no hot stock tips, and no commission-driven advice. Just smart, disciplined investing designed for your real life.

📅 If you're unsure whether your stock portfolio is truly working in your favor—or just reacting to market noise—let’s talk:

👉 Schedule a no-pressure strategy session:

You don’t need to predict the next big winner.

You just need a clear plan—and the right guide to help you follow it.

Stock Investing FAQs: What Dallas Investors Ask Me Most

Q: Are stocks safe for retirement investing?

Stocks are considered growth assets, which makes them ideal for long-term retirement goals. While they can be volatile short-term, over time they tend to outperform other asset classes like bonds or cash. The key is matching your stock exposure to your risk tolerance and time horizon.

Q: What’s the difference between stocks and ETFs?

A stock represents ownership in a single company. An ETF (Exchange-Traded Fund) holds a basket of stocks, providing instant diversification.

📌 Related blog: Understanding ETFs

Q: Can I lose all my money in stocks?

While total loss is rare in diversified portfolios, individual stocks can go to zero. That’s why diversification is critical. Owning a variety of companies across sectors and countries helps reduce single-company risk.

Q: Should I invest in stocks or mutual funds?

It depends on your goals. Stocks offer control and potential upside, but mutual funds (or ETFs) offer instant diversification and professional management.

📌 Related blog: Understanding Mutual Funds

Q: What is a dividend, and do all stocks pay them?

A dividend is a portion of a company’s profits paid to shareholders. Not all companies pay them—many growth stocks reinvest profits instead. Dividend-paying stocks are often used in retirement income strategies.

Q: When should I sell a stock?

You might sell when:

- Your goals change

- The stock no longer fits your plan

- You need to rebalance

- It’s time to harvest a gain or loss for tax purposes

As a fiduciary, I help clients make tax-efficient selling decisions tied to their goals.

Q: What’s the capital gains tax rate on stocks?

- Held less than 1 year: Taxed as ordinary income (10%–37%)

- Held over 1 year: Taxed at long-term capital gains rates (0%, 15%, or 20%)

Q: How much of my portfolio should be in stocks?

It depends on your age, income needs, and risk tolerance. Younger investors might be 80–90% stocks; retirees may lean 40–60%. There’s no one-size-fits-all. I tailor every allocation to the individual.

Q: Can I invest in stocks with a small amount of money?

Yes! Thanks to fractional shares and commission-free platforms, you can start investing with as little as $5–$50. Roth IRAs and workplace plans are great ways to start building stock exposure early.

Q: Do I need a financial advisor to invest in stocks?

No—but working with a fiduciary advisor helps you avoid emotional pitfalls, choose the right account types, and integrate your investments into a larger tax and retirement plan.