Understanding Bonds: A Complete Guide from a Dallas Financial Advisor

As a Dallas-based Certified Financial Planner™, I’ve reviewed thousands of portfolios—and one thing I’ve seen far too often is investors being pushed into bond-heavy allocations without context, clarity, or purpose.

Sometimes it’s done under the label of “being conservative.”

Other times, it’s just default behavior—relying on outdated 60/40 models or templated portfolio allocations.

But here’s the uncomfortable truth:

If you’re still in your growth phase—especially with less than $1 million in investable assets—bonds might be dragging you down.

Yes, bonds offer income and stability. Yes, they reduce volatility. But if you don’t need income yet… and your biggest goal is still growth… then overweighting bonds might be costing you more than you realize.

So Why Write a Bond Guide at All?

Because bonds still matter—when used strategically.

This isn’t about selling fear or chasing products. It’s about using the right tools for the right job. Bonds can provide:

- Predictable income for retirees

- A buffer during market downturns

- Smart diversification in choppy conditions

- Stability in a plan that isn’t solely built on growth

But they are not a one-size-fits-all solution. And in the wrong hands, they’re often misused.

That’s why I created this guide—

Not to convince you to own bonds, but to help you understand when they do (and don’t) make sense.

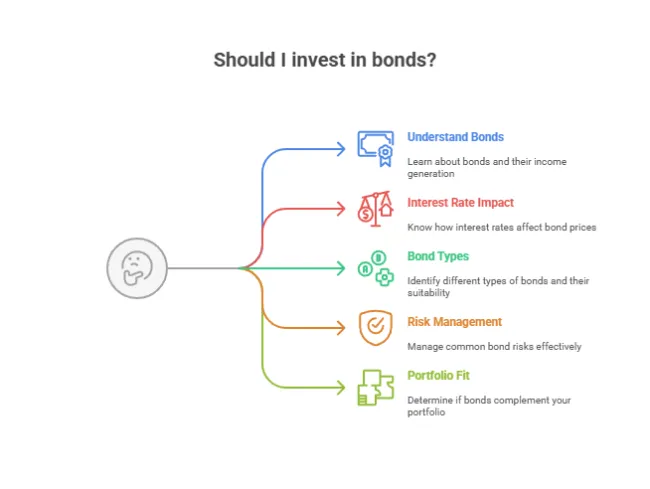

What You'll Learn in This Guide

Whether you’re close to retirement, already drawing income, or just trying to better understand the bond sleeve in your 401(k) or IRA, this article will give you clear, fiduciary-level insights. We’ll cover:

- What bonds are (in plain English)

- How they generate income and react to interest rates

- The different types of bonds—and who they’re actually for

- Why bond prices go down when interest rates go up

- Who should own bonds (and when it’s better to wait)

- The most common bond risks—and how to manage them

- When bonds complement your portfolio—and when they don’t

Let’s dig in—and make sure every dollar in your portfolio is working with purpose.

What Is a Bond?

A bond is essentially a loan. But instead of you borrowing money, you become the lender. You lend your money to a government, municipality, or corporation, and in return, they agree to:

- Pay you interest (called a coupon)

- Return your principal (face value) at a specific maturity date

Simple Breakdown:

You give $1,000 to a company in exchange for a 5% bond.

They pay you $50/year in interest for 10 years.

At year 10, they give your $1,000 back.

Sounds simple, right? It is—but as always in investing, the devil is in the details.

Who Should Own Bonds—And When They Might Not Make Sense

Bonds can play a vital role in managing risk, smoothing returns, and generating income—but they’re not always the right fit for every investor.

Here’s what I tell my Dallas clients when deciding if (and how) bonds belong in their plan:

Bonds Do Make Sense If You…

🔹 Have $1M+ in investable assets and need income

If you’re in or near retirement, bonds help create predictable income and protect against stock market volatility. Larger portfolios can also access more efficient individual bond ladders or municipal bond portfolios.

🔹 Are risk-averse or approaching retirement

Shifting some equity exposure into bonds helps reduce sequence-of-return risk and smooths the ride as you transition into income generation.

🔹 Have specific liability-matching goals

Bonds can be used to “time match” future liabilities like:

- Tuition payments

- Retirement income

- Planned major purchases

Want to offset equity risk in volatile markets

Balanced portfolios (60/40, 70/30) still have their place—especially with today’s higher rates improving bond yields.

Bonds Might Not Make Sense If You…

Have under $1M in total investments

At lower asset levels, prioritizing growth becomes more important. Bonds may dampen returns without providing enough yield to justify the reduced risk. A well-structured portfolio of ETFs, dividend stocks, or target-date funds may provide a more efficient path toward wealth-building.

Are decades from retirement

Younger investors should focus on long-term growth. Bonds often underperform equities over 20+ year periods—so a higher equity allocation is usually more appropriate.

Can’t build a ladder properly

Buying individual bonds requires scale. If you can’t diversify across maturities, sectors, and issuers, you may be better off with ETFs or mutual funds to avoid concentration risk.

Don’t need current income

If you’re reinvesting every dollar, higher-growth investments (like equities) may offer a better return per unit of risk.

Dallas Planning Insight:

I often see investors with $200K–$600K portfolios loading up on bonds because they’ve been told “they’re safe.” But in many cases, this slows their ability to build wealth and doesn’t provide enough income to move the needle.

Instead, I might recommend:

- Growth-oriented ETFs

- Low-cost index funds

- Targeted dividend strategies

Bond ETFs for optional exposure without yield drag

Why Bonds Are Still Relevant in 2025

Despite being labeled "conservative" or "boring," bonds are surging in popularity again—and for good reason.

1. Rising Interest Rates = Higher Yields

For years, bond yields were near zero. But as rates have risen, so have the income opportunities for investors, especially with high-quality, short- and intermediate-term bonds.

2. Retirees Need Predictable Income

In retirement, your focus shifts from growing wealth to drawing from it. Bonds offer consistent, predictable income streams that help support:

- Lifestyle spending

- Healthcare costs

- Travel budgets

- Required Minimum Distributions (RMDs)

3. Volatility Makes Investors Nervous

The stock market has had its share of roller coasters. Bonds can provide a buffer, reducing portfolio drawdowns during market dips.

4. Smart Diversification Matters More Than Ever

As a fiduciary, I never chase returns. I build plans around balance, tax efficiency, and the actual needs of your family. Bonds are a core tool to reduce sequence risk, manage income, and keep your plan on track—even when the headlines don’t.

📍 Dallas Reality Check:

I've seen too many investors loaded up with risk—either through aggressive advisors or default portfolios. Bonds help anchor your investments, especially when things get choppy.

How Do Bonds Work? (Interest, Price, Yield, and Maturity Explained)

Here’s what you need to know to truly understand bonds:

Important Note:

Bond prices and interest rates move in opposite directions. When interest rates rise, existing bond prices fall (and vice versa). This matters—especially if you're selling before maturity or using bond funds.

Types of Bonds: What Dallas Investors Need to Know

Not all bonds are created equal. The type of bond you hold can significantly affect your risk, return, and tax situation. Here’s a breakdown of the most common types:

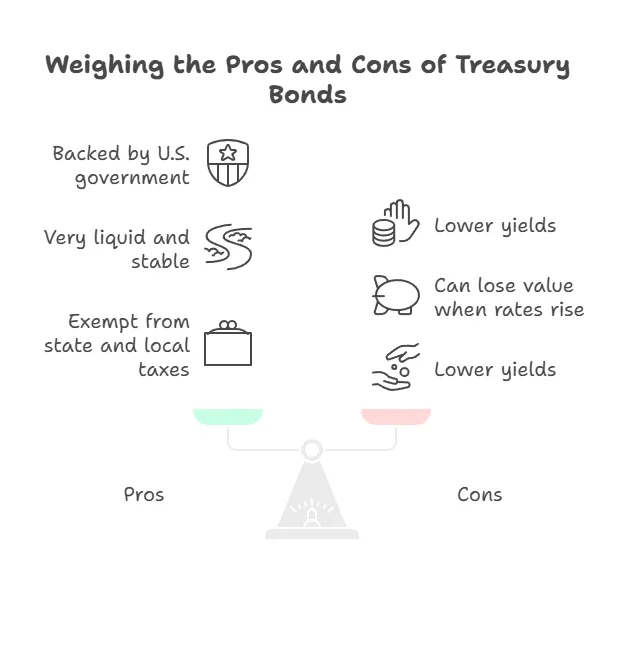

1. U.S. Treasury Bonds

Issued by the federal government, Treasuries are considered the safest bonds in the world.

- Treasury Bills (T-Bills): Short-term (mature in under a year)

- Treasury Notes: Medium-term (2–10 years)

- Treasury Bonds: Long-term (10–30 years)

Pros:

- Backed by the U.S. government

- Very liquid and stable

- Exempt from state and local taxes

Cons:

- Lower yields

- Can lose value when rates rise

2. Municipal Bonds (Munis)

Issued by cities, counties, or states to fund schools, roads, and other projects.

There are two types:

- General Obligation Bonds: Backed by the issuer’s taxing power

- Revenue Bonds: Repaid by income from the funded project (e.g., toll roads)

Pros:

- Interest is often tax-free at the federal level

- May also be state tax-exempt for Texas residents (when issued by TX entities)

Cons:

- Credit risk (not all municipalities are financially strong)

- Lower yields than corporates

Fiduciary Tip: I often use municipal bonds for high-income Dallas investors in taxable accounts to create a stream of federal and state tax-free income.

3. Corporate Bonds

Issued by companies to raise capital.

- Investment Grade: Lower risk (think Apple, Microsoft)

- High-Yield (Junk): Higher returns, but also higher default risk

Pros:

- Higher income potential

- Huge variety of options across industries

Cons:

- Credit risk

- Often fully taxable

📍 Dallas Strategy Insight: Corporate bonds can be smart tools for income planning in tax-advantaged accounts like IRAs—especially when you want higher yields without taking on stock-level risk.

4. International & Emerging Market Bonds

Issued by foreign governments or corporations.

Pros:

- Portfolio diversification

- Potentially higher yields

Cons:

- Currency risk

- Political instability

- Lower liquidity

Planning Caution: These are not ideal for conservative investors. When we do use them, it’s typically in small allocations inside ETF bond blends.

5. Bond Funds and ETFs

Instead of buying individual bonds, you can own baskets of them through:

- Mutual funds

- Bond ETFs

- Target-date funds

Pros:

- Instant diversification

- Low minimums

- Professional management

Cons:

- No guaranteed return of principal

- Price fluctuates daily with interest rates

- Ongoing fees

Fiduciary Perspective: Bond funds are a great tool, but they need to be used with careful risk alignment. Just because a fund says “conservative” doesn’t mean it is.

Why Smaller Portfolios Should Think Twice About Bond Ladders

Bond ladders are a classic fixed-income strategy: you buy individual bonds with staggered maturities (1-year, 2-year, 3-year, etc.) so that a portion of your portfolio comes due—and becomes reinvestable—every year.

In theory, it’s a great way to manage interest rate risk, generate income, and avoid having to time the bond market.

But here’s the thing no one tells smaller investors:

Bond ladders don’t always work well unless you have enough capital to diversify across time, sector, and credit quality.

The Problem with “Mini Ladders”

If you’re trying to build a bond ladder with less than $500K—especially under $250K—you face serious limitations:

💬 Dallas Insight: I’ve had clients come in with a 3-bond “ladder” they were told was diversified. In reality, it was 3 overpriced, low-yield positions from the same issuer—and no flexibility if their needs changed.

What I Recommend Instead

For investors with less than $1M in investable assets—or those early in their wealth-building phase—I typically recommend bond ETFs or mutual funds for the following reasons:

✅ Instant diversification

With one purchase, you gain exposure to hundreds of issuers across sectors and maturities.

✅ Professional management

Fund managers handle reinvestment, credit research, and market access more efficiently than DIY buyers.

✅ Low minimums

You can invest $100 or $10,000—it’s the same strategy at work, scaled to your level.

✅ Liquidity

Bond ETFs trade like stocks, giving you intraday access to your capital without waiting for maturity dates.

Fiduciary Perspective: Scale Matters

Ladders can be smart—but they work best when you have:

- Enough capital to diversify (ideally $500K+ in bonds)

- A need for predictable income

- A long-term plan for reinvestment and drawdown

If you’re still in your growth phase, or your portfolio is under $1M, it often makes more sense to:

- Use high-quality bond ETFs or mutual funds

- Keep your allocation simple, flexible, and cost-efficient

- Reallocate strategically as your needs evolve

📅 Ready to build a bond strategy that fits your portfolio size—and your real-world goals?

Schedule a portfolio audit now

Micro Bond Ladders vs. Bond Funds: What Dallas Investors Need to Know

When interest rates rise, bond ladders often get promoted as a go-to strategy. And while they can be powerful in the right hands, they aren’t always the best fit—especially for investors building them in small, $1,000–$10,000 increments.

Let’s break down how a micro bond ladder compares to simply using a well-structured bond fund or ETF:

Dallas Planning Insight:

In my practice, I’ve seen many investors attempt to “ladder” with five bonds or fewer—only to:

- End up overexposed to one issuer or sector

- Miss opportunities because cash sits uninvested

- Sell early at a discount due to lack of liquidity

And the worst part? The yield difference often doesn’t justify the effort or risk.

When Funds or ETFs Make More Sense:

- Your bond allocation is under $500,000

- You want diversification without hand-picking maturities

- You’re not spending the income (yet)

- You want daily liquidity and professional oversight

We often use low-cost bond ETFs for clients in accumulation mode or with portfolios under $1M because they offer:

- Automatic reinvestment of interest and capital gains

- Broad sector and credit diversification in a single purchase

- Minimal reinvestment risk—the manager handles the cash flow

- Daily liquidity and transparency

- Potential for capital appreciation if interest rates decline or spreads tighten

Bond funds don’t just generate income—they can increase in value over time, especially in falling rate environments. That’s a major advantage for smaller investors who can’t effectively ladder or diversify on their own.

When portfolios grow, we may layer in custom ladders, municipal strategies, or individual bond sleeves—but the foundation always starts with simplicity, efficiency, and total return potential.

Understanding Bond Risks (and How to Manage Them Like a Pro)

Bonds are often seen as the “safe” part of a portfolio—but that doesn’t mean they’re risk-free. The type of bond, your time horizon, and interest rate conditions all play a role in how much risk you're really taking.

Here’s what Dallas investors need to understand:

1. Interest Rate Risk

When interest rates go up, bond prices go down.

Why? Because your bond’s fixed rate becomes less attractive compared to new bonds with higher rates. This is the single biggest risk for bondholders in a rising rate environment.

Mitigation Strategies:

- Ladder your bonds (stagger maturities)

- Keep duration short to moderate

- Use floating-rate or inflation-linked bonds (TIPS)

💬 Dallas Note: After years of ultra-low rates, many investors held long-term bonds that got crushed as the Fed raised rates. This is why rate-aware bond management is essential—especially for near-retirees.

2. Credit Risk (a.k.a. Default Risk)

When you lend money (buy a bond), there’s always a chance the issuer won’t pay you back.

Higher yields often come with higher default risk—especially in junk bonds or underfunded municipalities.

Portfolio Fix:

- Stick to investment-grade when appropriate

- Use bond ratings (Moody’s, S&P, Fitch)

- Diversify through ETFs or managed funds

📌 Dallas Tip: I help clients weigh yield vs. creditworthiness—not just chase the “best rate.”

3. Duration Risk

The longer the bond’s maturity, the more sensitive it is to interest rate changes. This can create major volatility if rates rise unexpectedly.

Actionable Advice:

- Use shorter-duration bonds for income stability

- Keep long-term bonds in retirement accounts where you won’t need the cash soon

4. Inflation Risk

If your bond pays 3% interest but inflation is running at 4%, you’re actually losing purchasing power.

Strategy:

- Use TIPS (Treasury Inflation-Protected Securities)

- Balance fixed income with dividend-paying stocks

- Keep some exposure to assets that grow with inflation

5. Reinvestment Risk

When a bond matures, you may not be able to reinvest at the same rate—especially in falling rate environments.

🛠️ Pro Tip: I often use bond ladders or income-focused ETFs to help clients manage this risk with predictable reinvestment windows.

6. Behavioral Risk

Yes, even with bonds, your biggest risk might be… you.

Investors often sell low during rate spikes or chase yield with inappropriate high-risk bonds.

Planning Insight: My role isn’t just building the portfolio—it’s helping you stay committed to the strategy in all market environments.

Bonds, Inflation, and Interest Rates: Why the Market Looks Different Now

For years, bonds played the quiet, steady role in a portfolio—offering predictable income when stocks got volatile. But if you’ve been watching the news (or your portfolio), you’ve probably noticed: bonds don’t feel so stable lately.

Here’s what’s changed—and why it matters for investors in 2025.

We’re Not in the Zero-Rate World Anymore

For most of the 2010s, interest rates were near zero. That meant:

- Bond yields were extremely low (often under 2%)

- Investors took more risk to find income (chasing junk bonds or high-yield debt)

- Stock-heavy portfolios looked more attractive

But in 2022–2023, everything flipped.

- The Federal Reserve raised rates aggressively to combat inflation.

- Bond prices fell—hard.

- Stock market volatility surged.

Many investors who thought bonds were “safe” were shocked to see losses in their bond funds—a scenario they hadn’t experienced before.

Why Bond Prices Fall When Rates Rise

This is one of the most misunderstood relationships in finance:

When interest rates go up, existing bond prices go down.

Why? Because if new bonds are offering 5%, no one wants your old bond paying 2%. To sell it, you have to discount the price.

This inverse relationship is especially important in bond funds, where you don’t hold to maturity. If you own a long-duration bond fund and rates spike, your account value can drop—even if the fund is labeled “conservative.”

💬 Dallas Insight: I’ve seen portfolios lose 10–15% on “safe” bond funds because they weren’t aligned with today’s rate environment.

Treasuries: From Afterthought to Anchor

For years, U.S. Treasury bonds paid next to nothing—some retirees ignored them entirely. But today?

- 1-year Treasuries are yielding 4.5%–5.2%

- 10-year Treasuries hover around 4%–4.5%

- TIPS (inflation-protected bonds) offer real return above inflation expectations

This is a huge opportunity for risk-conscious investors.

Planning Insight: I’m helping many Dallas clients build short-term Treasury ladders that offer:

- Reliable income

- Near-zero credit risk

- Tax-efficient returns (state and local tax-free)

Especially inside IRAs or Roths, this is a smart alternative to cash or underperforming bond funds.

What Rising Rates Mean for Stocks (and Why Bonds Still Belong)

As interest rates rise, it gets harder for companies to borrow, expand, and justify high valuations. That’s why stock market volatility often follows Fed rate hikes.

Here’s the kicker:

In a rising rate, high-inflation environment, you don’t want all your money in stocks—but you don’t want to blindly load up on long bonds either.

That’s where strategic bond positioning comes in:

- Short- and intermediate-term durations

- High credit quality

- Laddered exposure across multiple maturities

- TIPS or floating-rate bonds where appropriate

What I’m Doing for Clients Right Now

As a Dallas-based fiduciary, I’m actively reviewing every bond sleeve we manage:

- Reducing exposure to long-duration risk

- Rebalancing portfolios to include higher-yielding Treasuries

- Harvesting tax losses from bond funds to improve after-tax returns

- Building bond ladders to match client cash flow and retirement timing

If your bond allocation hasn’t been reviewed since 2021, it’s probably out of sync with today’s economy.

📅 Ready to retool your bond portfolio for the current interest rate environment?

Schedule a strategy review

Bond Fees & Taxation: What Dallas Investors Need to Know

Even though bonds are often marketed as “simple” and “safe,” the true cost of owning bonds can be more complex than investors expect—especially when you factor in hidden fees and tax treatment.

How Bonds Are Taxed

Unlike stocks (where you may get lower long-term capital gains treatment), bond income is generally taxed as ordinary income. That means:

Dallas Planning Tip: If you’re in a high tax bracket and own taxable corporate bonds in a brokerage account, you could be paying 30%+ of your interest income in taxes—without realizing it.

What About Bond Funds?

Bond ETFs and mutual funds make things more complex. While convenient, they may come with:

- Ongoing expense ratios (typically 0.05%–0.75%)

- Turnover costs (from managers constantly buying/selling)

- Distributions that trigger taxes, even if you didn’t sell

- No guaranteed return of principal (unlike holding a bond to maturity)

Fiduciary Insight: I frequently review portfolios with bond funds labeled “low risk” that are actually far more volatile—and tax-inefficient—than clients realize. We often restructure these into smarter, lower-cost alternatives that fit your real goals.

Tax-Smart Bond Placement: Asset Location Matters

Where you hold your bonds is just as important as which ones you buy. Smart investors and advisors align bond types with the most tax-efficient account.

Dallas Planning Note: One of the most common (and costly) mistakes I see is clients holding tax-exempt bonds inside IRAs—completely defeating the tax advantage of municipal income.

Other Fees to Watch For

- Bid/Ask Spreads: If you’re buying individual bonds, the spread between what you pay and what the seller receives can cost you 0.5% or more—especially on smaller purchases.

- Transaction Costs: Some custodians or platforms charge markups or flat fees for buying individual bonds.

- Fund Layering: Many target-date or allocation funds include hidden bond exposure—along with fees stacked on top of fees.

Want to see if your bond income is actually helping—or hurting—your financial strategy?

Let’s review your holdings and real return after taxes and fees:

👉 Book a portfolio tax audit with Melissa Cox, CFP®

How Bonds Fit Into a Modern Financial Plan

Bonds aren’t just for retirees or risk-averse investors. When used strategically, they can be a foundational building block for long-term success—if they’re aligned with your actual financial goals.

Here’s how I integrate bonds into client portfolios as a fiduciary planner based in Dallas:

1. Reducing Portfolio Volatility

Stocks may generate growth, but they’re also unpredictable—especially in the short term. Bonds act as a stabilizer. They tend to move differently (and often inversely) from equities, which helps cushion the impact of market downturns.

📉 During market dips, bonds can:

- Provide smoother returns

- Help limit panic selling

- Buy time to make thoughtful financial decisions

Planner Insight: In my client portfolios, I don’t use bonds to eliminate risk—but to manage it. The goal isn’t zero volatility—it’s volatility you can live with.

2. Generating Income (Without Selling Assets)

In retirement or semi-retirement, bonds become income engines—especially if you don’t want to sell stocks to pay bills.

Through:

- Coupon payments (from individual bonds)

- Distributions (from bond funds or ladders)

- Tax-efficient muni interest (in taxable accounts)

You create reliable cash flow without dipping into your principal every time the market hiccups.

Dallas Retirement Tip: We often pair bond ladders with Social Security or pension income to build predictable, “paycheck-like” flows for retirees who want to stop guessing.

3. Strategic Diversification Across Asset Classes

Every solid portfolio includes a blend of risk and return sources. Bonds help balance out:

- Equity market concentration

- Real estate exposure

- Business ownership or concentrated stock positions

Especially for business owners or professionals in Dallas with volatile income, bonds provide emotional and financial buffer zones during uncertain times.

4. Matching Future Liabilities

Want to retire in 5 years? Have college tuition due in 8? Planning a home upgrade in 3?

Bonds let you time-align your money with your goals, so you’re not forced to sell stocks in a down market.

Example: I help clients use a bond ladder to match future spending—where each bond matures when they need cash. No guessing. No forced selling.

5. Tuning Your Portfolio to Your Risk Tolerance

This isn’t about “aggressive vs. conservative.” It’s about how much risk you need to take to reach your goals—and how much you’re comfortable living with.

A typical mix might include:

- 70% stocks / 30% bonds (for pre-retirees)

- 50% stocks / 50% bonds (for income-focused retirees)

- 80% stocks / 20% bonds (for long-term accumulators with strong stomachs)

Dallas Planning Insight: Too many advisors default to 60/40 portfolios—without asking whether that balance is based on your plan or just their model. I build the allocation around your needs, not a template.

6. Offsetting Sequence-of-Return Risk

Retiring during a market downturn is one of the biggest risks to your portfolio longevity. Bonds help reduce that danger by letting you withdraw income without selling depressed stocks.

This is especially critical in the first 5–10 years of retirement, where early losses can compound long-term shortfalls.

📅 I structure portfolios so clients have 3–5 years of income safely allocated—using bonds—to avoid the “panic sell” trap.

Final Word: Bonds aren’t flashy. They don’t go viral on Reddit. But when used wisely, they protect your plan, stabilize your strategy, and give you the flexibility to invest—and spend—with confidence.

👉 Want to find out how bonds should fit into your plan—not just your portfolio?

Common Bond Investing Mistakes (and How I Help You Avoid Them)

Bonds are often seen as the “safe” side of the portfolio, but used incorrectly, they can drag down performance, inflate costs, or create hidden risks. As a fiduciary financial planner, I see the same missteps over and over—especially in Dallas portfolios built by sales-driven advisors or automated platforms.

Let’s walk through the most common ones—and how to sidestep them with smart, personalized strategy.

1. Using Bonds When You Don’t Need Income

Many investors under age 55 are pushed into bond-heavy portfolios under the guise of “being conservative.” But if you're still in growth mode, bonds may:

- Limit your upside

- Add unnecessary complexity

- Fail to move the needle on return

Strategy Fix: I align your allocation with your goals. If income isn’t a current need, we optimize for growth and tax efficiency instead.

2. Owning Bond Funds Without Understanding the Risk

Just because something says “bond” doesn’t mean it’s low risk.

Bond mutual funds and ETFs can:

- Drop in value if rates rise

- Lack a maturity date (you don’t get your principal back automatically)

- Contain high-yield or long-duration holdings that increase volatility

Portfolio Fix: I help you decode what’s really inside your funds—and whether it’s helping or hurting your plan.

3. Overconcentrating in One Bond Type

Too much in:

- Long-duration Treasuries? Sensitive to rising rates

- Junk corporates? High default risk

- Munis? Great for income… but what if you’re not in a high tax bracket?

Strategy Fix: We blend bond types to match your timeline, tax bracket, and income needs—without overexposing you to a single risk factor.

4. Chasing Yield Without Understanding the Tradeoffs

High-yield = high risk. There’s no such thing as a “safe” 8% bond. If the coupon seems too good to be true, the issuer may be in shaky financial territory.

I’ve seen portfolios full of junk bonds that looked great… until the market turned and the income dried up.

Portfolio Fix: We evaluate return per unit of risk—not just raw yield.

5. Ignoring Tax Implications

Many investors hold taxable bond funds in brokerage accounts—generating:

- Ordinary income taxes on interest

- Unnecessary capital gains from fund turnover

Dallas Tax Planning Tip: I structure bond placement by account:

- Munis in taxable accounts (for tax-free interest)

- Corporates in IRAs (to defer tax on high yield)

- Treasuries in Roths (for stable, tax-free income)

6. Forgetting to Rebalance

If your bonds perform well (or your stocks drop), your portfolio can tilt too far toward fixed income—dulling growth and changing your risk profile.

Strategy Fix: We monitor and rebalance annually—or opportunistically during rate shifts—to keep your allocation on target.

7. Treating Bonds as “Set and Forget”

Bonds are dynamic. Rates move, yields shift, and the right mix changes as you age.

I’ve seen clients holding the same 15-year-old bond fund their bank sold them—still thinking it’s “safe,” even though the duration, yield, and holdings no longer fit their life.

Fiduciary Role: My job is to regularly review your bond strategy, recheck duration and credit exposure, and align the portfolio to where you are now—not where you were 10 years ago.

Dallas Perspective:

Bonds are not a “check the box” investment. They’re a precision tool. Used correctly, they can create strength, income, and confidence in your plan. Used incorrectly, they can become silent portfolio drag.

📅 Want to stress-test your bond allocation—and find out if it’s helping or hurting you?

👉 Schedule a strategy session with Melissa Cox, CFP®

Bonds Aren’t Boring—They’re Strategic (When Used Right)

Bonds may not dominate headlines like tech stocks or crypto, but they do play a critical role in building a resilient, income-producing financial plan—when they’re used intentionally. In my Dallas-based practice, I don’t treat bonds as a default solution. I treat them as a strategic tool to manage volatility, support retirement income, and diversify your portfolio with purpose.

Whether you're approaching retirement, rethinking your risk tolerance, or just wondering if your bond allocation is helping or hurting you—let’s have that conversation.

📅 Schedule a 1-on-1 strategy session and let’s review your bond holdings together:

Bond FAQs: What Dallas Investors Ask Me Most

Q: Are bonds always safer than stocks?

Not necessarily. Bonds generally have lower volatility than stocks, but they come with their own risks—like interest rate risk, credit risk, and inflation erosion. “Safer” depends on your time horizon, income needs, and risk tolerance.

Q: How are bonds taxed?

It depends on the type:

- Treasuries: Exempt from state and local taxes

- Municipals: Often tax-free at the federal (and sometimes state) level

- Corporates: Fully taxable as ordinary income

💡 Fiduciary tip: Where you hold the bond (taxable vs. tax-deferred account) matters just as much as what kind you own.

Q: Should I buy individual bonds or bond funds?

If you have $1M+ to properly build a bond ladder, individual bonds may give more control. But for most investors, bond ETFs or mutual funds offer instant diversification and easier management—just make sure the fund matches your risk and duration needs.

Q: What’s a bond ladder—and why would I use one?

A bond ladder staggers maturity dates so you have bonds coming due at regular intervals (e.g., every 1–2 years). This strategy:

- Reduces reinvestment risk

- Smooths interest rate exposure

- Creates predictable income

I often build ladders for retirement income, tuition planning, or liability matching.

Q: Do bonds lose value when interest rates rise?

Yes. When rates go up, the value of existing bonds (with lower yields) typically goes down. This matters most if you’re using bond funds or selling before maturity.

Q: Can I lose money in a bond?

Absolutely. If you sell a bond at a loss, hold a bond fund during rate spikes, or invest in junk bonds that default, losses are possible. Bonds are often less volatile—but not risk-free.

Q: Are bond funds “safe” for conservative investors?

Some are. Others… not so much. Bond funds vary widely in duration, credit quality, and interest rate sensitivity. Just because a fund says “conservative” doesn’t mean it’s appropriate for your risk profile.

Q: What kind of return should I expect from bonds?

In today’s market (2025), high-quality bonds may yield 3–5%. Junk bonds and international bonds can offer more—but with more risk. Bonds are designed more for income and stability than high growth.

Q: Should young investors even own bonds?

In most cases—not yet. If you’re under 40 and focused on growth, equities usually provide better long-term results. That said, a small bond allocation may make sense if you’re extremely risk-averse or need liquidity.

Q: What’s better: municipal or corporate bonds?

It depends on your tax bracket.

- High-income investors in Dallas may benefit from Texas-based municipal bonds (often triple tax-free).

- Tax-deferred accounts (like IRAs) are better for corporate bonds, since the income is taxable either way.