Needs vs. Wants: How to Make Smarter Spending Decisions Without Sacrificing Joy

Earlier today, I volunteered at my daughter’s school for career day, and we had a fantastic conversation about money. I asked a group of elementary students to tell me the difference between needs and wants—and they nailed it. Then I threw them a curveball: “Let’s say you’re hungry, standing in front of a McDonald’s with $10 in your pocket. Is buying a hamburger a need or a want? What about a chocolate shake?”

To my surprise, the entire class agreed the hamburger was a need, while the chocolate shake was a want.

It blew me away. These kids instinctively understood what so many adults struggle with: prioritization. But here’s the kicker—as we get older, those lines blur. I’ve had clients confidently tell me both the hamburger and the shake are needs, and honestly? I’ve been there myself. Our values, our emotions, and even our past financial experiences can distort our definitions.

That’s why this conversation is so important. Needs vs. wants is foundational to budgeting, but it’s not always black and white. Let’s explore how to make better financial decisions—without losing the joy in life.

In my 20+ years as a Certified Financial Planner™ in Dallas, I’ve seen this simple distinction trip up people from every walk of life: What’s a need, and what’s a want?

I once had a client tell me their $1,200/month luxury SUV lease was a "need" because they drove clients around. We had to dig deeper. Was it about professionalism—or prestige? It turns out, their clients couldn’t have cared less about the leather seats. That conversation opened the door to a much more empowering way of thinking: spend intentionally, not impulsively.

We’re not here to guilt you out of your morning latte or your dream vacation. This is about making sure your spending reflects your values and your long-term goals. Because when you spend with purpose, you don’t feel deprived. You feel in control.

What Are Needs?

Needs are essentials. They’re the expenses that keep your life running and protect your well-being:

- Housing (mortgage or rent)

- Groceries (not daily Uber Eats)

- Utilities

- Insurance (health, auto, home)

- Transportation to work

- Childcare (for working parents)

When these aren’t covered first, everything else falls apart.

What Are Wants?

Wants enhance your life, but they aren't vital for survival:

- Designer clothing

- Streaming subscriptions

- Luxury upgrades

- Dining out

- New gadgets

- High-end fitness memberships

Here’s a common myth: "Wants are bad." Not true! The key is to identify them clearly and fund them after your essentials.

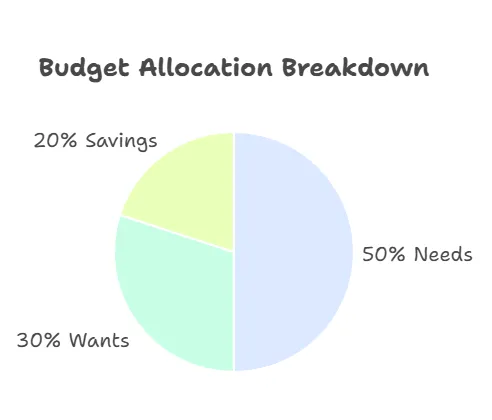

The 50/30/20 Budgeting Lens

Originally coined by Senator Elizabeth Warren, the 50/30/20 rule divides after-tax income into:

- 50% Needs

- 30% Wants

- 20% Savings & Debt Repayment

This framework is a great place to start and adapt based on your financial goals and family structure. Learn more in our Budgeting Method Comparison

The Dallas Angle: Lifestyle Inflation is Real

Now, I’m not here to pick on Dallas—that’s just where I live. But like any big, bustling city, the lines between needs and wants can get seriously blurred. Why? Because comparison is everywhere. We see our neighbors upgrading their kitchens, our coworkers posting luxury vacations, and suddenly that "want" starts to feel like a "need."

FOMO is real, y’all.

And while there’s nothing wrong with enjoying nice things, it's important to check in and ask: Am I doing this because it aligns with my values, or because I’m afraid of missing out?

Dallas is booming. New restaurants, bigger homes, Tesla sightings every block... Keeping up can get expensive fast. But here's the truth: you don't have to look wealthy to be wealthy.

When you confuse wants for needs, your budget starts to balloon. This often leads to:

- Over-leveraging credit cards

- Sacrificing emergency savings

- Missing long-term goals

Use our Credit & Debt Strategies to stay ahead.

Values-Based Budgeting

Ask yourself: Does this expense support my values or just my ego?

If you value quality family time, maybe a weekend getaway is a "need" in your emotional budget. If self-care matters to you, your monthly massage might be a worthy investment.

When we align spending with personal values, we're more likely to stick to a budget without resentment.

Melissa's Tip: When coaching clients, I use a color-coded worksheet to help them bucket expenses. Green = Need, Yellow = Value-Based Want, Red = Impulse. Try it with your next bank statement.

Final Thoughts from Melissa

Understanding needs vs. wants isn’t about cutting joy from your life—it’s about funding your joy with intention.

Every time you redirect money from a want to a goal, you’re saying yes to your future. And when you do splurge, it feels earned, not reckless.

If your spending habits feel murky or your budget never seems to stretch far enough, let’s talk. As a Dallas-based CFP®, I help individuals and families align their money with their values, goals, and real life. No judgment. Just a plan that works.

Schedule a session with Melissa Cox, CFP®

FAQs About Needs vs. Wants

Q: Is it ever okay to treat a want like a need?

A: Absolutely—if it aligns with your values and you've built it into your budget. This is especially true for things that support your mental health, relationships, or purpose.

Q: How do I explain needs vs. wants to my kids?

A: Keep it simple. Needs keep us safe and healthy; wants are the extras. Involve them in budget discussions with visuals or spending jars.

Q: Should I cut out all wants if I'm in debt?

A: Not necessarily. Small, value-aligned wants can keep you motivated during a debt payoff journey. Just keep them reasonable and intentional.