What Makes a Fiduciary Different | Dallas-Based CFP® Financial Planning

As a Dallas-based Certified Financial Planner™ (CFP®), I’m often asked:

“What’s the difference between you and other financial advisors?”

And while the financial world has no shortage of titles—advisor, planner, broker, consultant—the difference that matters most is this:

I’m a fiduciary. Not sometimes—every time. I disclose how I’m paid, why I recommend what I do, and I don’t “sell” plans—I build them around you.

If you’ve ever felt unsure about who your advisor really works for—or wondered why your plan feels more like a pitch—this article is for you.

What Is a Fiduciary Financial Advisor?

In simple terms, a fiduciary is legally and ethically obligated to act in your best interest—at all times.

Not just when it’s convenient. Not just when it’s profitable.

Fiduciaries are required to:

- Avoid conflicts of interest

- Disclose compensation structures transparently

- Recommend only what’s best for you (not what pays them more)

- Uphold loyalty, prudence, and care

CFP® Tip: Every CFP® professional is held to a strict fiduciary standard by the CFP Board. That means if you're working with a CFP®, they are required to act as a fiduciary—at all times, not just when giving financial advice.

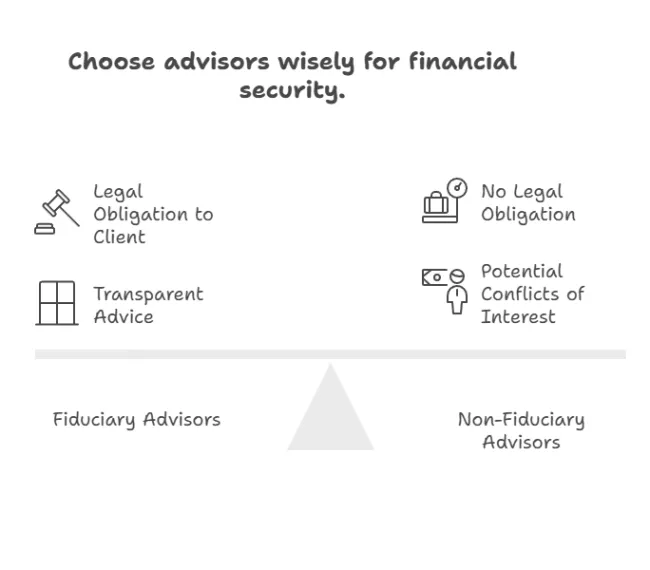

The Difference Between Fiduciary and Non-Fiduciary Advisors

Dallas Insight: If an advisor can sell you a high-commission product that pays them more—even when something better exists—they’re not acting as a fiduciary.

How a Fiduciary CFP® Should Never “Take Off the Hat”

Here’s a truth the industry doesn’t like to talk about:

Some advisors only wear the fiduciary hat when legally required.

Once the “advice” part of the meeting ends, the hat comes off—and the sales role kicks in.

That’s not how I operate.

In my practice, fiduciary duty isn’t something I switch on and off—it’s embedded in every client interaction.

That means:

- I prioritize your best interest—always.

- I may receive commissions for certain products (like insurance), but only when they’re the right strategic fit.

- I don’t “push product” to hit quotas or earn backend bonuses.

- I explain every recommendation, every time—including how I’m compensated.

- I build comprehensive financial plans that start with your goals, not a pitchbook.

Why Fiduciary Standards Matter in Real Life

Let’s look at real-world examples where fiduciary duty truly matters:

1. Retirement Planning:

A non-fiduciary might recommend a high-fee annuity with surrender charges.

A fiduciary would explore low-cost ETFs, tax-aware drawdowns, and Roth conversion strategies.

2. College Planning:

A fiduciary planner uses need-based aid strategies, 529 tax planning, and school-specific net price modeling—not just “save more” advice.

3. Investment Management:

Fiduciaries choose funds with transparent fees and clear goals, not the ones that pay them a backend trail.

Fiduciary = Planning, Not Products

Too many advisors focus on:

- Investment sales

- Insurance commissions

- Pushing you toward “suitable” (not best) options

A true fiduciary focuses on:

- Tax strategy

- Cash flow clarity

- Estate and legacy planning

- Income sustainability

- Holistic wealth building

Dallas Reality Check: Planning-first fiduciary firms like mine aren’t paid to “move money”—we’re paid to move your plan forward.

A True Fiduciary Isn’t a One-Trick Pony

If someone’s entire “plan” revolves around one product, one fund family, or one investment tool—that’s not a plan. That’s a pitch.

As a CFP® and fiduciary, I tailor every strategy to your unique goals, tax picture, risk tolerance, and timeline. That often includes:

- ETFs

- Stocks and bonds

- Insurance (only when appropriate—not as a crutch)

- Tax strategies

- College, estate, or business planning

- And yes—sometimes even saying “you don’t need this at all.”

Cookie-cutter portfolios and product-only plans are the enemy of real progress.

Your plan should be built around your life—not the other way around.

How to Know If Your Advisor Is a Fiduciary (And Not Just Saying So)

Ask these questions:

- Are you always acting as a fiduciary—in all aspects of our relationship?

- Do you receive commissions for product sales?

- Are you affiliated with a broker-dealer or insurance company?

- Are you a CFP® held to the Board’s Code of Ethics and fiduciary duty?

If the answers aren’t clear (or they dodge them), it’s time for a second opinion.

Fiduciary Planning Means:

- You understand what you own and why

- Every strategy is goal-based, tax-aware, and unbiased

- You get transparency, not jargon

- Your plan changes when your life changes—not when a product goes “on sale”

Why Fiduciary-Only Advisors Are Rare (But Essential)

Most large firms—including brokerage houses and banks—operate under a “suitability” standard, meaning:

They can recommend what’s suitable… even if it’s not the best choice for you.

That’s why many portfolios in Dallas are:

- Overloaded with proprietary funds

- Held hostage by annuity lockups

- Stuffed with layered fees

Planner Perspective: I’ve reviewed hundreds of portfolios where the client thought they had a “plan.” What they really had… was a product bundle.

Want to Experience the Fiduciary Difference?

Whether you’ve worked with an advisor before or you’re just starting your financial journey, this much is true:

You deserve advice that’s about you—not someone else’s incentive plan.

📅 Let’s build a plan grounded in your values, goals, and real-world life:

👉 Schedule a fiduciary financial planning session

Fiduciary in Name Only: A Real-Life Red Flag

The truth is, the financial industry can be extremely seedy. I’ve seen situations where firms publicly present themselves as planning-first and client-focused—using fiduciary language to build trust—while behind closed doors, the emphasis is placed on internal politics, asset gathering, and keeping concerns quiet.

Too often, reps are pressured not to question questionable practices—like trades being placed in client accounts with unclear or undocumented approval. When those concerns are raised, the response is often silence or subtle marginalization, not open discussion.

Here’s the reality: Fiduciary isn’t just a title—it’s a behavior. If what’s said publicly doesn’t match what’s done privately, it’s not a fiduciary environment.

Here’s what we can learned:

- Fiduciary isn’t a title—it’s a behavior. If a firm or advisor can say one thing to the public and do another behind closed doors, that’s not fiduciary.

- If someone benefits from silence or complexity, they’re not working for you.

- And most importantly: When clients come second to firm control, you're not getting advice. You're getting sold.

If you’ve ever wondered whether your advisor is really in your corner, ask them to explain how they get paid, what they recommend, and why. A true fiduciary won’t dodge the question—they’ll welcome it.

Don’t Settle for “Suitable”

You wouldn’t hire a doctor who earns bonuses for prescriptions.

Why accept a financial advisor who earns them for your retirement?

Fiduciary financial planning is not just about ethics—it’s about excellence.

🔍 Ready to see what real financial planning looks like?

👉 Book a strategy session with Melissa Cox, CFP® now

Fiduciary FAQs: What Dallas Clients Ask Me Most

Q: What does “fiduciary” really mean?

A fiduciary is someone who is legally and ethically required to act in your best interest—not theirs. Fiduciaries must put your goals ahead of profits, disclose all conflicts of interest, and never recommend something because it benefits them more than you.

Q: Are all financial advisors fiduciaries?

No. In fact, most financial advisors are not true fiduciaries—especially those who sell products or work under broker-dealer models. Always ask if they act as a fiduciary at all times, and check if they’re a CFP®, which holds them to stricter standards.

Q: What if an advisor only recommends one strategy or product?

That’s a red flag.

A true fiduciary is not a one-trick pony. If your advisor is pushing only annuities… or just mutual funds… or only uses one investment platform—they’re not building a plan around you. They’re selling a system.

Fiduciary Insight:

Real planning is dynamic. Your life evolves. Your plan should too. If someone is pushing just one tool—walk away.

Q: What makes a CFP® different from other advisors?

A CFP® (Certified Financial Planner™) is trained in comprehensive, planning-first strategies and must act as a fiduciary at all times under the CFP Board Code of Ethics. They must pass rigorous exams, meet experience requirements, and maintain ongoing education.

Q: Does being a fiduciary mean you don’t earn commissions?

Correct. As a fiduciary and CFP®, I do not earn commissions on investment products. I may receive regulated commissions on certain insurance solutions—but only when they serve the client’s stated goals and are presented with full transparency. My compensation is fee-based, flat-fee, or project-based—depending on your plan. That means your success is my only incentive.

Q: What’s the difference between fiduciary and suitability standards?

“Suitability” means the product only has to be “good enough.”

“Fiduciary” means the strategy must be what’s best for you—even if it pays the advisor less. That’s a massive difference in trust, transparency, and long-term outcomes.

Q: Can an advisor be a fiduciary sometimes and not others?

Yes—and that’s the problem. Many advisors wear a fiduciary “hat” during the planning phase but switch to a sales role when recommending products. That’s why working with a fiduciary-only CFP® is critical—no hat-switching, no hidden agenda.

Q: How do I know if my advisor is really acting as a fiduciary?

Ask them directly:

- Do you act as a fiduciary at all times?

- Are you affiliated with any product companies?

- Do you earn commissions or revenue-sharing from investments?

If they hesitate or dodge, you already have your answer.

Q: Do banks and big brokerage firms follow fiduciary rules?

Generally, no. Most large institutions operate under the suitability standard, which means they may offer proprietary funds, annuities, or products that benefit the firm more than you.

Q: Why should I work with a fiduciary in Dallas?

Because your life, your family, and your money deserve unbiased, client-first advice—especially in a fast-growing, high-income city like Dallas. A fiduciary CFP® helps you cut through the noise, clarify your goals, and make decisions with confidence.