Phantom Income: The Hidden Tax Trap Every Smart Investor Needs to Know

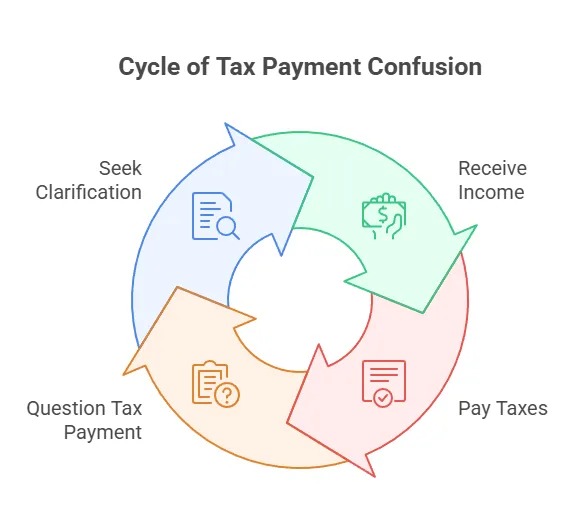

As a Dallas-based Certified Financial Planner™, one of the more frustrating conversations I have with clients involves something called phantom income—because who wants to pay taxes on money they didn’t even receive?

Yet, this happens all the time—especially to high-income professionals, business owners, and investors. If you’ve ever gotten a tax bill that didn’t match your bank balance, phantom income may be the culprit.

Here’s what it is, where it shows up, and how to plan around it so you’re never blindsided again.

What Is Phantom Income?

Phantom income is income you’re taxed on, even though you didn’t actually receive the cash.

The IRS still treats it as real for tax purposes—because it was either earned, accrued, or allocated to you on paper—even if it never hit your bank account.

Common culprits? Pass-through businesses, certain investments, debt forgiveness, and more.

Where Does Phantom Income Show Up?

Here are the most common places I see phantom income wreak havoc:

1. Pass-Through Entities (Partnerships & S Corporations)

If you own part of a business that's structured as a partnership or S Corp, you’re responsible for your share of the profit—even if no money was distributed.

Example: The business earns $200,000. You own 25%. You’re taxed on $50,000… even if the company keeps all the profits in the business.

2. Zero-Coupon Bonds

These bonds are sold at a deep discount and pay nothing until maturity—but the accrued interest is still taxable each year.

You may not see any cash for years, but you’ll pay taxes annually.

3. Mutual Funds or ETFs with Capital Gains

You can get hit with capital gains even if you didn’t sell anything.

If a fund manager sells assets and realizes a gain, it may be passed on to shareholders—and you’ll get a 1099 whether you reinvested the gain or not.

4. Cancellation of Debt (COD)

If a lender forgives your debt—like after a short sale, settlement, or bankruptcy—the IRS may treat the forgiven amount as taxable income.

This is one of the most misunderstood sources of phantom income.

More info:

5. Non-Cash Executive Compensation

Things like restricted stock units (RSUs), deferred compensation, or stock options can trigger taxable income—even before you can sell or use them.

If you’re an executive or startup employee, this is worth reviewing in detail with your planner.

Why Phantom Income Can Be a Problem

It’s not just confusing—it can be costly.

- You owe real taxes on imaginary income

- You may not have liquidity to cover the tax bill

- It can push you into a higher tax bracket

- It can affect your Medicare premiums, Social Security taxation, and more

This is where strategic planning is essential.

How to Manage Phantom Income Like a Pro

1. Use Tax Distribution Clauses in Business Agreements

If you’re a partner in a business, make sure the operating agreement includes a tax distribution clause—so the business distributes enough cash to cover your tax burden each year.

2. Coordinate with Your CPA & CFP®

If you’re only talking to your CPA at tax time, you’re missing opportunities.

With proper tax return analysis (like we do using secure tools), we can catch phantom income before it bites.

3. Optimize Your Investment Location

Don’t hold tax-inefficient mutual funds in taxable accounts if you can avoid it. We help clients:

- Place dividend-heavy or turnover-prone investments in IRAs or Roths

- Keep tax-efficient ETFs or index funds in brokerage accounts

4. Build Tax Liquidity

If phantom income is part of your life, maintain cash reserves or short-term investments that can be accessed easily—so you don’t have to sell something under pressure to pay a tax bill.

Final Thoughts: You Can’t Avoid Phantom Income, But You Can Outsmart It

Phantom income isn’t fair. But it’s real.

And without a planner watching your tax situation year-round, you can wind up paying for income you never received—or triggering a tax chain reaction across your financial plan.

At Future-Focused Wealth, we help clients:

- Identify where phantom income is lurking

- Strategically plan for taxes ahead of time

- Align investments and business income with smarter tax outcomes

- Create liquidity plans so surprises don’t lead to stress

📅 Want to make sure phantom income doesn’t wreck your next return?

Let’s take a look together

FAQs About Phantom Income

Q. Can I avoid phantom income entirely?

Not always—but you can prepare for it and reduce its impact with good planning.

Q. Should I sell investments to cover phantom tax bills?

Only if absolutely necessary. We help clients build liquidity plans to avoid that.

Q. What’s the best way to find out if I have phantom income?

Share your tax return with a financial planner who knows what to look for.