How Emotions Shape Your Financial Decisions

Personalized Introduction: Why Emotions Deserve a Seat at the Financial Table

As a CERTIFIED FINANCIAL PLANNER™ and author of Future-Focused Wealth, I’ve spent over 20 years helping people navigate real-life money decisions—retirement, college funding, debt, divorce, job transitions, and more. But no matter how different their financial situation, every client walks in with one thing in common: emotion.

Money is emotional. It’s tied to our childhood, our self-worth, our relationships, our sense of safety, and even our identity.

You can have the “perfect” financial strategy on paper, but if your emotions aren’t aligned with your plan, you’ll struggle to follow through. That’s why understanding how your emotions shape your financial decisions isn’t just helpful—it’s essential for success.

Why Emotions and Money Are Deeply Connected

According to behavioral finance research, we make 90% of financial decisions emotionally and justify them later with logic. From buying a car to skipping an IRA contribution, emotion is often in the driver’s seat.

Common emotional influences:

- Fear causes us to hoard or delay investing.

- Guilt makes us overspend on others or neglect ourselves.

- Shame leads to financial avoidance.

- Excitement results in impulsive investing or overspending.

- Envy triggers lifestyle inflation to “keep up.”

Recognizing these patterns is the first step in taking your power back.

Resource: Emotional Regulation & Financial Behavior – NIH

Emotional Spending: What It Looks Like and How to Stop It

Emotional spending is when you use money to manage your mood, not your goals. It often looks like:

- Shopping after a stressful day

- Clicking “buy now” for instant gratification

- Overspending to match peers on social media

- Justifying purchases with “I deserve this”

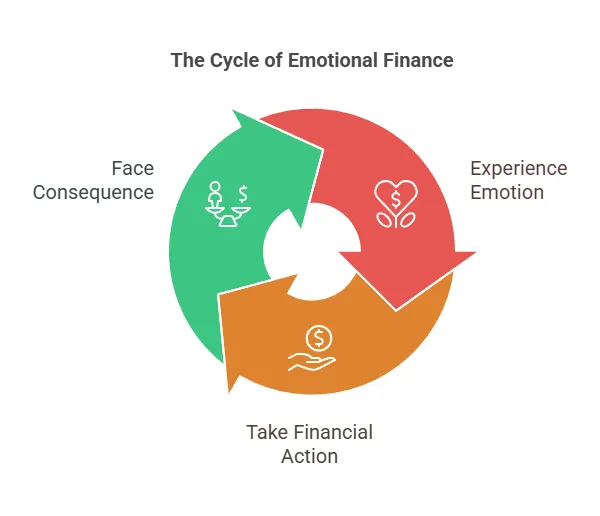

Break the Cycle:

- Pause 24 hours before non-essential purchases

- Ask: “Am I solving an emotional problem with money?”

- Track your triggers in a spending journal

- Build coping strategies that aren’t financial

Learn how to stop social pressure from sabotaging your savings.

🔗 Related Blog: How to Escape Financial FOMO & Avoid Overspending

How Emotions Affect Investing Behavior

Behavioral finance studies show that emotionally driven investors consistently underperform. Fear and greed are the most common culprits:

- Fear = Panic-selling during downturns

- Greed = Chasing returns or taking on too much risk

- Regret = Missing opportunities because of indecision

Better Behaviors:

- Follow a long-term, written investment strategy

- Rebalance intentionally, not emotionally

- Use automation to eliminate second-guessing

- Work with a professional to provide perspective during volatility

🔗 Related Blog: Learn how to adjust your investment strategy without overreacting to market changes.

Financial Shame and Avoidance: A Silent Wealth Killer

Shame shows up when we:

- Avoid checking statements or credit scores

- Delay paying off debt out of fear

- Feel embarrassed to ask for help

- Believe we’ve “failed” financially

Avoidance doesn’t protect you—it paralyzes you.

Heal Financial Shame:

- Forgive past mistakes

- Create a judgment-free review ritual

- Talk to a professional who offers guidance without guilt

- Replace shame with curiosity

🔗 Related Blog: “Learn how to read, fix, and improve your credit report without fear.”

The Future-Focused Financial Mindset

The goal isn’t to eliminate emotion—it’s to channel it wisely.

In Future-Focused Wealth, I teach readers to align their decisions with what matters most. A future-focused mindset is rooted in clarity and purpose.

Future-Focused Habits:

- Align spending with values

- Automate savings and debt payoff

- Build buffers for emotional days (emergency funds!)

- Prioritize consistency over perfection

🔗 Related Blog: How to Shift to a Future-Focused Mindset

The Psychology of Money: What Behavioral Finance Teaches Us

Behavioral finance is the science of why smart people make emotional financial mistakes. It shows us that we are:

- Wired for short-term gratification

- Influenced by group behavior

- Prone to mental shortcuts and biases

- Often irrational under pressure

But with awareness and structure, we can outsmart our own wiring.

Resource: "Explore how behavioral finance influences your investment decisions."

Calm is Your Greatest Financial Asset

If emotions have ever led you to overspend, undersave, avoid your credit report, or second-guess your investments—you are not broken. You’re human.

But here’s the truth: you don’t have to navigate your financial life alone.

As a CERTIFIED FINANCIAL PLANNER™ and author of Future-Focused Wealth, I’ve helped hundreds of people uncover their emotional money patterns and replace them with strategic, empowering habits that actually stick.

Working with a CFP® isn’t about having someone tell you what to do—it’s about having a thinking partner. Someone who can help you:

- Separate emotion from action

- Create a plan rooted in your personal values and goals

- Avoid the pitfalls of emotional investing and reactive decisions

- Build financial systems that reduce stress and increase confidence

- Stay grounded in long-term clarity—even when short-term chaos strikes

Whether you’re just starting out, rebuilding after a setback, or preparing for a major life transition, the right financial plan will help you move from uncertainty to confidence.

Let’s build that plan together.

Let’s create a money mindset—and a future—that’s calm, clear, and completely aligned with your life.

📩 Schedule your free consultation today

FAQs About Emotions and Financial Decisions

1. Why are emotions so tied to money?

Money represents security, freedom, control, and identity. It’s connected to our earliest experiences, relationships, and beliefs—making it emotionally charged.

2. What is emotional spending?

Spending money in response to feelings—like stress, sadness, boredom, or guilt—rather than based on needs or goals.

3. Can emotional investing really hurt my returns?

Yes. Panic-selling or chasing trends often leads to losses. Emotionally reactive investors tend to underperform long-term strategies.

4. How can I reduce financial stress?

Build structure: automate bills and savings, track spending weekly, and meet with a planner to remove guesswork.

5. What if I feel ashamed about my money habits?

Shame is common—but not productive. Replace it with curiosity and support. A CFP® can help without judgment.

6. What’s one easy step to manage emotional spending?

Add a 24-hour rule before any non-urgent purchase and ask yourself: “What am I really feeling right now?”