Growing Your Savings Rate in Your Financial Plan

Introduction: Why Saving More is Essential for Your Financial Future

Many people believe saving money is something they’ll “get around to” when they have extra income. The truth? The sooner you start saving, the more financial stability you create for yourself. Whether you’re planning for an emergency fund, retirement, or a down payment on a house, your savings rate plays a critical role in your overall financial success.

As a financial planner, one of the most common things I hear is, “I’ll save more when I make more.” But after two decades of sitting across the table from families, professionals, and entrepreneurs in every stage of life, I can tell you this: income alone doesn’t grow wealth—your savings rate does.

I’ve seen high earners living paycheck to paycheck and modest-income families quietly build financial empires—because they made saving a habit, not a hope.

Growth doesn’t just happen in your investment portfolio. It happens when you raise the percentage of what you keep from what you earn. Your savings rate is your real financial growth rate—and improving it is one of the most powerful, underrated strategies for long-term success.

In this article, I’ll share the same savings-boosting tactics I give my clients—designed to help you dodge lifestyle inflation, automate your momentum, and make every dollar work harder for your future.

Let’s grow your rate. Let’s build your freedom. Let’s get future-focused.

Yet, one of the biggest challenges is figuring out how to save more when your budget feels tight. The good news? You don’t need to start with 20% right away—small, intentional steps can build massive results over time. This guide will show you practical ways to increase your savings rate, make the most of financial opportunities, and develop a future-focused financial mindset.

🔹 Related Read: Best Budgeting Apps for 2024 – NerdWallet

Fact or Fiction? Common Savings Myths Debunked

🚫 Fiction: “I need a lot of money to start saving.”

✅ Fact: You can start saving with as little as $5 a week—the key is consistency!

🚫 Fiction: “Keeping money in a savings account is pointless because of inflation.”

✅ Fact: While inflation affects cash, having liquid savings for emergencies prevents costly debt.

🚫 Fiction: “Investing is better than saving.”

✅ Fact: You should do both—savings cover emergencies, while investing builds long-term wealth.

🚫 Fiction: “I’ll save more when I make more.”

✅ Fact: If you don’t develop the habit now, higher income won’t change your spending patterns.

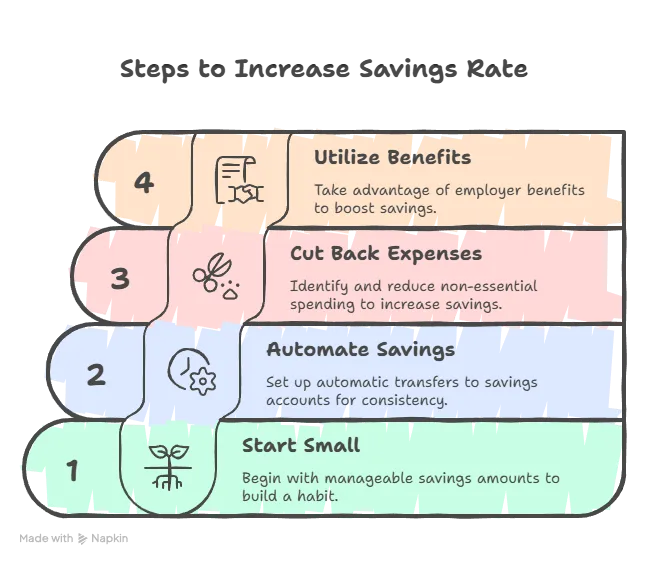

Step 1: Start Small and Build Your Savings Habit

If saving 20% of your income sounds overwhelming, start where you can. Even setting aside $5 per week is a great first step. The key is to get in the habit of saving, no matter the amount.

✅ Open a dedicated savings account separate from your checking account.

✅ Set a realistic savings goal—even if it’s just $20 a month.

✅ As your income grows, increase your savings percentage gradually.

📌 Pro Tip: If you’re new to saving, treat it like a bill. Pay yourself first before spending on anything else!

🔹 Related Read: How to Shift to a Future-Focused Mindset for Financial Success

Step 2: Automate Your Savings for Effortless Growth

One of the easiest ways to increase your savings rate is to automate the process. When savings happen automatically, you don’t have to rely on willpower.

✅ Set up automatic transfers from your checking to your savings account.

✅ Contribute to your 401(k) or IRA automatically from each paycheck.

✅ Use apps like Acorns or Digit to round up spare change and save effortlessly.

📌 Take Action Now: If you're reading this, log into your bank and increase your savings contribution right now! Even a small increase makes a difference.

🔹 Related Read: Expense Tracking for Beginners: Tools and Strategies You’ll Love

Step 3: Identify Areas to Cut Back and Redirect to Savings

Think you don’t have extra money to save? Chances are, small changes can free up more money than you realize.

✅ Review your subscriptions—cancel what you don’t need.

✅ Eat out less and redirect that money to savings.

✅ Limit impulse purchases by waiting 24 hours before buying.

📌 Pro Tip: Even saving just $50/month on unnecessary expenses adds up to $600 a year!

🔹 Related Read: 5 Budgeting Methods Compared: Which One Fits Your Lifestyle?

Step 4: Take Advantage of Employer Benefits

If your employer offers a 401(k) match, use it! It’s essentially free money that helps boost your savings.

✅ Contribute at least enough to get the full employer match.

✅ Consider increasing contributions annually.

✅ Use Health Savings Accounts (HSAs) if available for tax-advantaged savings.

📌 Fact: If your employer matches 50% of contributions up to 6% of your salary, you're getting a 50% return on investment—guaranteed!

🔹 Related Read: The Ultimate Guide to Financial Planning

Final Thoughts: Make Saving a Habit, Not a Challenge

Saving money doesn’t have to be difficult. By starting small, automating contributions, taking advantage of employer benefits, and cutting back on unnecessary expenses, you can steadily increase your savings rate without feeling deprived.

📩 Want to take control of your savings? Schedule a consultation today, and let’s build a financial plan that works for you!

FAQs: Increasing Your Savings Rate

1. How much should I be saving?

Ideally, at least 20% of your income should go toward savings, but if that’s not feasible, start small and increase gradually.

2. How do I save when I’m living paycheck to paycheck?

Start with just $5 per week. Small, consistent savings build over time. Also, track expenses to find spending areas to cut.

3. Is it better to save or pay off debt first?

If you have high-interest debt, prioritize that first while maintaining a small emergency fund. Once debts are under control, shift focus to increasing savings.

4. What’s the easiest way to grow my savings rate?

Automate savings, increase contributions when you get raises, and avoid unnecessary spending.

5. What’s the biggest mistake people make with saving?

Waiting to start! The earlier you save, the more your money grows.