How to Actually Understand Your Health Insurance (Before You Choose a Plan This Year)

As a CERTIFIED FINANCIAL PLANNER™ in Dallas, I’ve seen a familiar pattern:

Most people will spend hours researching an investment portfolio—but just minutes picking a health insurance plan.

And I get it. Insurance feels technical, impersonal, and overwhelming. You’d rather focus on building wealth than decoding coverage codes.

But here’s the truth:

Your health insurance decisions are financial planning decisions.

They affect:

- How much you actually keep from your income

- Whether an unexpected diagnosis wipes out your emergency fund

- How confident you feel accessing care when you actually need it

That makes your health coverage more than just an HR form or annual checkbox. It’s a structural part of your financial house — the “roof,” to be exact. And if it’s leaky, everything you’ve built underneath is exposed.

In my Dallas financial planning practice, we don’t treat health insurance as a throwaway conversation. We fold it into the full picture — just like your investments, taxes, estate plans, and savings goals.

Because what’s the point of building long-term wealth if a single medical event could wipe it out?

Before you click “renew” on last year’s plan, let’s walk through how to actually understand your health insurance—and make a confident, informed decision that supports your financial goals.

Why Your Financial Planner Should Know What’s in Your Health Plan

It might feel strange to bring up your health insurance in a meeting about money — but it shouldn’t.

Because the truth is, your healthcare gov coverage isn’t just a line item on your budget. It’s a critical part of how your financial life actually functions — and how your goals get funded (or delayed).

As a Dallas financial planner, I’ve worked with families whose dreams were shaped — and sometimes sidelined — by what their insurance did or didn’t cover.

Here’s why it matters:

- Starting a family? Fertility treatments, OB-GYN care, and neonatal costs can vary wildly depending on your plan — and some offer no fertility coverage at all.

- Switching careers or going self-employed? You need a plan for COBRA, marketplace insurance, or spousal coverage — before you give notice.

- Managing chronic conditions? Out-of-pocket costs, pharmacy tiers, and specialist networks all play a role in how financially (and physically) manageable that condition is.

- Building an emergency fund? Your health plan’s deductible and out-of-pocket max should shape how much you save — because that’s your real risk exposure.

- Thinking about early retirement? You need a strategy for bridging the gap between employer coverage and Medicare — and it’s not as simple as picking a random policy.

In other words: health insurance isn’t just about today’s doctor visits. It’s about building a financial life that supports your future — with fewer unpleasant surprises.

That’s why I ask about your coverage.

Not because I sell insurance (I don’t). But because I know what can happen when you assume you’re covered… and find out too late that you’re not.

Your Health Plan Isn’t Just About Doctors — It’s About Your Dreams.

If starting a family, changing jobs, or retiring early is on your radar, your insurance choices matter more than you think.

Let’s build a financial plan that supports your real life →

Planning Ahead: How Health Coverage Fits Into Long-Term Wealth Strategy

Most people treat health insurance like a now decision — a once-a-year checkbox during open enrollment.

But in reality? Your health coverage ripples into almost every corner of your financial life:

- It impacts your emergency fund strategy (because your deductible is a known financial risk).

- It determines whether your HSA becomes a retirement powerhouse or an underused savings account.

- It shapes how confident you feel accessing care — whether you’re budgeting for braces, prescriptions, fertility treatments, or chronic illness.

That’s why health insurance isn’t a line item — it’s a strategy.

And if you’re building a financial house with clarity and structure, there are a few key things I always recommend keeping in the binder (yes, the actual financial binder we keep updated with your plan):

- A list of current doctors and specialists - This helps us quickly cross-reference with plan networks — and avoid costly out-of-network surprises.

- A list of prescriptions and their tier levels - Because even one specialty drug can dramatically shift your cash flow — and knowing what’s covered can help avoid sticker shock at the pharmacy counter.

- Any ongoing or significant medical conditions in the family - These aren’t just relevant for care — they affect everything from long-term cash flow planning to life insurance 101 underwriting and estate decisions.

And if you’re planning for a major life transition — like having a baby, switching jobs, retiring early, or managing a chronic diagnosis — your insurance needs shift, too.

That’s why your financial planner should always ask about your healthcare.

Not to get nosy.

Not to offer a diagnosis.

But because this is part of protecting your wealth — and aligning your resources with the life you’re building.

If your insurance doesn’t reflect your real life, it’s not protection.

It’s paperwork.

Health Insurance Isn’t Just Coverage — It’s a Cash Flow Decision

Most people think health insurance is about protection.

And it is — kind of.

But in practice, health insurance is just as much a cash flow tool as it is a coverage tool.

When I review plans with clients here in Dallas, I don’t just ask, “What’s covered?”

I ask:

- How much will you actually pay before benefits kick in?

- If you had a major medical event, do you know your true out-of-pocket exposure?

- Does this plan make sense for the way you use care — not just the cheapest premium?

Here’s how I break it down with clients:

1. Premiums Are Just the Starting Point

Yes, they matter. But choosing the lowest premium without checking deductibles, copays, and coinsurance is like buying a house based only on the list price — without checking the property taxes, repairs, or HOA fees.

A $300/month premium might look great…

Until you realize you’re on the hook for $8,000 out-of-pocket before anything kicks in.

2. Deductibles Are a Form of Self-Insurance

High-deductible plans can be smart — if you have the cash reserves to back them up.

But if you don’t? That “great rate” can quickly spiral into a debt problem.

As a financial planner, I ask:

“Do you have an emergency fund that aligns with this deductible?”

If not, we either build one — or rethink the plan.

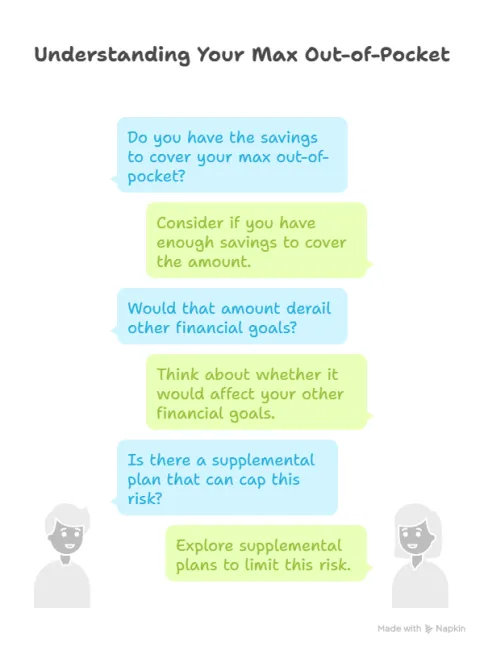

3. Max Out-of-Pocket = Your Worst-Case Budget

This is the number no one looks at… until they get the bill.

If your max out-of-pocket is $9,000, you need to know:

- Do you have the savings to cover that?

- Would that amount derail other financial goals (like your 401(k), college savings, or debt payoff)?

- Is there a supplemental plan that can cap this risk?

Think of it this way: your max out-of-pocket is your “worst-case scenario” budget for the year. And if that number makes you panic? Your plan may not be aligned with your financial reality.

4. Copays and Coinsurance Add Up

Even “good” plans can nickel-and-dime you with copays, specialist fees, or out-of-network surprises.

If you’re in a season of frequent care (chronic illness, pregnancy, young kids, etc.), a plan with higher premiums but lower per-visit costs might actually save you more over time.

What Health Insurance Actually Costs: A Case Study for a Family of Four (2025)

Let’s make this real.

You’re a family of four — two adults and two kids — living in Dallas, trying to choose between two employer-sponsored health plans for 2025. You want to make a smart, financially informed choice… but every plan comparison feels like a spreadsheet in a foreign language.

Here’s what that decision might look like when we translate it into real numbers.

Plan A: Lower Premium, Higher Out-of-Pocket

- Monthly Premium: $600/month

- Annual Deductible: $6,000 family

- Coinsurance: 30% after deductible

- Out-of-Pocket Max: $15,000 family

- Office Visits: $35 copay for PCP / $65 for specialists

- Prescriptions: $15 generic / 40% brand name

This is the “cheaper upfront” plan. You save on monthly premiums — but if you have a bad health year, your out-of-pocket costs can stack up fast.

Best for: Healthy families with strong emergency funds who rarely go to the doctor — and who could absorb a worst-case year without financial strain.

Plan B: Higher Premium, Lower Out-of-Pocket

- Monthly Premium: $1,100/month

- Annual Deductible: $1,500 individual / $3,000 family

- Coinsurance: 10% after deductible

- Out-of-Pocket Max: $6,000 family

- Office Visits: $20 copay for PCP / $40 for specialists

- Prescriptions: $10 generic / $25 brand name

This is the “pay more now, save later” plan. The monthly premiums are higher, but if your child breaks an arm or you have an unexpected surgery, the plan absorbs more of the cost.

Best for: Families with frequent medical needs, young kids in daycare (a.k.a. “germ factories”), or anyone with known conditions that require regular care.

Now let’s run a simple scenario:

Your 6-year-old breaks her wrist on the playground. You go to urgent care, then a specialist, then she needs surgery.

- Under Plan A:

- You pay the full $6,000 deductible, then 30% coinsurance on the rest — up to the $15,000 out-of-pocket max.

- Total potential cost: ~$10,000+ after premiums.

- You pay the full $6,000 deductible, then 30% coinsurance on the rest — up to the $15,000 out-of-pocket max.

- Under Plan B:

- You hit the $3,000 deductible and 10% coinsurance — capped at $6,000 total out-of-pocket.

- Total potential cost: ~$8,000 after premiums — but with more predictability and less risk exposure.

- You hit the $3,000 deductible and 10% coinsurance — capped at $6,000 total out-of-pocket.

The lesson?

Health insurance isn’t just about monthly premiums. It’s about cash flow, risk tolerance, and your ability to weather a financial hit without derailing your plan.

This is why, as your financial planner, I want to help you look beneath the summary sheet — and make a choice that actually supports your financial goals, not just your annual physical.

Confused by Plan Comparisons? You’re Not Alone.

I help Dallas families translate health insurance jargon into real numbers and real decisions.

Book a discovery call and get clarity before open enrollment closes →

What Plan Structure Actually Means (And Why It Matters More Than You Think)

Once you’ve wrapped your head around the numbers — premiums, deductibles, coinsurance — the next layer of decision-making is about how you access care.

Because the fine print doesn’t just say what is covered — it defines how you’re allowed to get it.

That’s where terms like HMO, PPO, and EPO come in.

These plan structures are more than just acronyms. They determine:

- Whether you need referrals to see a specialist,

- Which doctors you can see without paying full price,

- And how much flexibility (or red tape) you’ll encounter when you actually need care.

Let’s break them down so you can confidently choose the structure that fits your family’s needs — and doesn’t sabotage your financial plan with surprise bills or delayed treatment.

HMO, PPO, HDHP… What Do These Letters Actually Mean for Your Wallet?

If you’ve ever stared at your benefits options during open enrollment and thought, “Is this a multiple choice test I forgot to study for?” — you’re not alone.

Most people don’t actually understand what these acronyms mean — or more importantly, how they impact both your care and your financial plan. So let’s demystify the big three:

HMO (Health Maintenance Organization)

Great for: lower premiums and predictable copays.

Watch out for: limited provider networks.

- You’ll need a primary care physician (PCP) who acts as your gatekeeper.

- Referrals are required for specialists.

- If you go out-of-network, you’re usually on your own — financially speaking.

When it works: You’re healthy, live near a large provider network, and want predictable costs.

When it doesn’t: You travel often, have specific specialists you already see, or want more flexibility.

PPO (Preferred Provider Organization)

Great for: flexibility and broader access.

Watch out for: higher premiums and potential surprise bills.

- No referrals required.

- You can see in-network or out-of-network providers (though you’ll pay more for out-of-network).

- Easier to work with if you have ongoing specialist care.

When it works: You want provider choice, you have a complex medical history, or you’re willing to pay more for flexibility.

When it doesn’t: You’re trying to minimize premiums and don’t use much care.

HDHP (High Deductible Health Plan)

Great for: low premiums and HSA eligibility.

Watch out for: big financial hits if you aren’t prepared.

- Often paired with a Health Savings Account (HSA) — one of the best tax tools in the financial planner’s toolbox.

- Preventive care is still covered 100% under ACA rules.

- Everything else? You pay out-of-pocket until you hit your deductible.

When it works: You’re healthy, have a strong emergency fund, and want to build tax-advantaged savings.

When it doesn’t: You have frequent care needs, multiple dependents, or minimal savings.

Pro Tip from a Financial Planner in Dallas:

If your employer contributes to your HSA, that’s free money — don’t overlook it. And if you’re young and healthy, using your HSA as a long-term investment account (not just a medical fund) can be a powerful retirement strategy.

The Right Plan Isn’t Just the Cheapest — It’s the One That Fits Your Life.

If you’re not sure whether your plan matches your care needs, let’s walk through it together.

Start your financial review with an insurance audit →

The Fine Print That Changes Everything

Once you’ve chosen the structure — HMO, PPO, or HDHP — most people feel like they’re done. But here’s where it gets dangerous: even inside the right type of plan, the fine print can turn a good decision into an expensive surprise.

This is where financial planning meets risk management.

Here are a few real-world factors I watch for with clients in Dallas:

- Pharmacy tiers: Your medication might be “covered,” but that doesn’t mean it’s affordable. Brand-name drugs in Tier 3 or 4 can carry co-pays of $150+ per fill — or be excluded altogether.

- Pre-authorization requirements: Need an MRI? A specialist referral? Even if it’s in-network, your plan might require extra hoops. If you miss one, your claim could be denied.

- Balance billing: That “in-network hospital” might still send you a bill from an out-of-network anesthesiologist — and yes, you’re responsible unless state law or your plan protects you.

- Mental health parity: Legally, your plan should cover mental health care like physical care. But the actual reimbursement structure often tells a different story.

These aren’t just policy details. They’re financial realities — and they’re why I encourage every family to treat their insurance review as part of their annual financial planning process.

Because when you understand your plan, you don’t just pick a policy.

You protect your goals, your savings, and your peace of mind.

Why Health Savings Accounts (HSAs) Are a Secret Weapon in Financial Planning

If you’re eligible for a High Deductible Health Plan (HDHP), you’ve likely heard of the Health Savings Account (HSA). What you may not know is that, when used strategically, an HSA is one of the most powerful tax-advantaged tools in your financial planning toolbox.

As a Dallas financial planner, I consider HSAs less like a “spending account” — and more like a triple-tax-advantaged investment account.

Here’s what that means:

- Tax-deductible contributions: Contributions to your HSA reduce your taxable income (just like an IRA or 401(k) contribution).

- Tax-free growth: Funds inside your HSA grow tax-deferred — and if you invest them, that growth is never taxed as long as it’s used for qualified medical expenses.

- Tax-free withdrawals: When used for qualified healthcare expenses, your withdrawals are completely tax-free — no income tax, no penalty.

That’s three layers of tax protection — and no other account offers that combination.

2025 HSA Contribution Limits:

- $4,150 for individuals

- $8,300 for families

- Additional $1,000 catch-up contribution for those 55+

So what does this mean for your financial plan?

HSA Planning Strategies (That Go Beyond the Basics):

- Use your HSA as a stealth retirement account: Unlike FSAs (Flexible Spending Accounts), HSAs are not “use-it-or-lose-it.” That means you can contribute now, invest the balance, and let it grow for years — turning today’s healthcare benefit into tomorrow’s retirement fund.

- Pay current expenses out-of-pocket (if you can): If you can afford to cover current medical expenses from your cash flow, you can let your HSA grow — while still being able to reimburse yourself later (as long as you save the receipts).

- Invest the HSA balance, don’t just save it: Many HSA providers let you invest the funds just like a brokerage account. If you’re healthy and not using the money immediately, put it to work.

One More Dallas Pro Tip:

If your employer contributes to your HSA, that’s free money. Make sure you’re contributing enough to unlock the full match, just like you would with a 401(k).

Don’t Miss the Tax Planning Opportunity Hidden in Your Health Coverage

Here’s something most people — and even some financial advisors — overlook:

Your health insurance decisions can have a direct impact on your tax strategy.

In fact, health-related elections during open enrollment can influence:

- Your taxable income

- Your deduction opportunities

- Your long-term investment strategy

- And even how you fund healthcare in retirement

Let’s break that down.

Health Savings Accounts (HSAs) = Triple Tax Advantage

If you’re enrolled in a High Deductible Health Plan (HDHP), you may be eligible to contribute to an HSA — and if you’re not using it, you could be leaving thousands in tax savings on the table.

Here’s why HSAs are the unicorn of tax shelters:

- Contributions are pre-tax. (Or deductible if made directly.)

- Growth is tax-free.

- Withdrawals for qualified medical expenses? Also tax-free.

Even better? If you don’t use the money right away, you can invest it — and use it as a healthcare-specific retirement account down the road.

Financial Planner Tip:

Many of my clients in Dallas use their HSA as a stealth IRA, paying current expenses out-of-pocket and letting the account grow. It’s one of the smartest long-term plays most people overlook.

Flexible Spending Accounts (FSAs): Use It or Lose It

If your employer offers a Flexible Spending Account, those contributions lower your taxable income — but there’s a catch:

- Most FSAs have a “use it or lose it” rule.

- That means any unused funds at year-end could vanish.

That’s why, during open enrollment, it’s critical to estimate your healthcare expenses realistically — not optimistically. Otherwise, your tax savings might turn into sunk costs.

Premiums & Deductions for Self-Employed Individuals

If you're self-employed or own a business, your health insurance premiums may be tax deductible — even if you don’t itemize.

But the rules vary based on your business structure, income, and how you pay for coverage. That’s why your CPA and your financial planner should be in sync — because one small tweak could lead to big savings.

Medicare & IRMAA (Yes, Taxes Matter in Retirement Too)

Think taxes stop mattering once you’re 65 and on Medicare? Think again.

Your income in retirement affects how much you pay for Medicare Part B and Part D through IRMAA (Income-Related Monthly Adjustment Amounts). In other words:

- The more you earn → the more you pay.

- And that “extra” cost? It’s not always factored into generic retirement calculators.

That’s why, in my practice, I look at Roth conversions, HSA savings, and strategic income management to help reduce Medicare costs before they hit.

Don’t Leave Tax Savings on the Table.

Whether it’s an HSA, FSA, or Medicare strategy — smart planning now can save you thousands later.

Let’s align your health coverage with your long-term tax plan →

Planning Shifts Around Age 63: Why Your Health Coverage Is About to Get (Even More) Financial

If you’re in your early 60s, your financial plan is likely shifting from “build mode” to “transition mode.” And while retirement income, portfolio withdrawals, and Social Security timing all play a role — there’s one sneaky health-related planning element that catches a lot of people off guard:

Your income at age 63 can impact your Medicare premiums at age 65.

Here's why:

Medicare uses a two-year lookback on your Modified Adjusted Gross Income (MAGI) to calculate whether you’ll owe IRMAA surcharges — basically, premium penalties for higher earners.

So, if you plan to retire at 65 and start Medicare…

But have unusually high income at 63 — from selling a business, converting a Roth IRA, or taking a large distribution?

You might end up paying significantly more for Medicare Parts B and D — even if your income drops later.

What does that mean for planning?

As a financial planner, here’s how we fold that into your strategy:

- We monitor and manage MAGI starting at age 63 (or earlier if we’re anticipating future income events).

- We strategically time Roth conversions, RSU exercises, or asset sales to minimize unnecessary IRMAA penalties.

- We help you understand whether the benefits of today’s tax strategy outweigh the long-term Medicare costs.

This is where your financial plan and health plan collide — because what you earn, what you convert, and what you withdraw doesn’t just affect your taxes. It affects your premiums too.

So, if you’re in that 63+ range — or even in your late 50s planning ahead — this isn’t something to put off. Your financial house should be built with Medicare in mind, long before the first enrollment packet hits your mailbox.

What About Medicare? Health Insurance Planning in Retirement

Health insurance planning doesn’t magically simplify when you turn 65 — if anything, it gets more complex.

As a financial planner, I regularly work with clients in Dallas approaching retirement age, and I can tell you: Medicare is not “free,” and it’s not one-size-fits-all.

Here’s what you need to know:

Original Medicare Isn’t Enough on Its Own

Original Medicare (Parts A and B) covers hospital and medical services, but leaves serious gaps — including:

- No coverage for most prescriptions

- No cap on out-of-pocket costs

- No coverage for dental, vision, or hearing

- No long-term care protection

That’s where Part D (drug coverage), Medicare Supplement (Medigap) policies, or Medicare Advantage (Part C) come in. But each option has trade-offs in cost, flexibility, and network restrictions.

Medicare Planning IS Financial Planning

Here’s how it ties directly into your wealth strategy:

- Higher income = higher premiums: Medicare Part B and D premiums are based on your income — meaning your tax strategy in retirement (Roth conversions, investment income, RMDs) affects your healthcare costs.

- Supplemental choices impact retirement drawdown: A higher premium plan may reduce variability in future costs, which can help stabilize your spending strategy.

- Timing matters: Missing key deadlines (like your initial enrollment period or Medigap guaranteed issue window) can cost you — literally.

Why I Include Medicare in Every Retirement Plan

Medicare isn’t “set it and forget it.” It requires:

- Annual reviews (especially during open enrollment)

- Strategy alignment with your overall retirement income plan

- Coordination with long-term care planning, especially if you're considering hybrid policies or annuities

And no — I don’t sell Medicare products. But I help you understand what you’re buying, what you’re exposed to, and how to fold healthcare decisions into your long-term financial life.

Because just like any other type of insurance… assumptions can be expensive.

Common Mistakes People Make When Choosing Health Insurance (and How to Avoid Them)

Choosing a health insurance plan shouldn’t feel like a gamble — but for most people, it does. Why? Because the process is full of assumptions, jargon, and hidden trade-offs that don’t show up until you actually need care.

Here are the most common mistakes I see as a financial planner in Dallas — and how to make sure you don’t repeat them this open enrollment season:

Mistake #1: Choosing the Lowest Premium Without Running the Math

It’s easy to gravitate toward the lowest monthly cost — especially when money’s tight or you're feeling healthy. But a low premium doesn’t always mean a low-cost plan.

What to do instead:

Look at the total potential exposure — including your deductible, coinsurance, and out-of-pocket max. Then ask, “Could I handle this financially if something big happened?” If the answer is no, it’s not the right plan.

Mistake #2: Assuming Your Doctor Is In-Network

Every year, I work with families who picked a plan thinking their favorite provider was included — only to find out they weren’t, and every visit cost more than expected.

What to do instead:

Before you enroll, check the current provider directory or call your doctor’s office. Don’t trust last year’s list. Networks change — and surprise billing isn’t something you want to learn about the hard way.

Mistake #3: Ignoring the Out-of-Pocket Maximum

This is the number that caps your annual financial risk. And yet, most people couldn’t tell you what theirs is. That’s a problem — because this is what defines your worst-case scenario.

What to do instead:

Use this number in your emergency fund planning. If your OOP max is $8,000, and your emergency savings is $3,000, you’re exposed. Either increase your cash reserves — or pick a plan that limits that risk.

Mistake #4: Underestimating Prescription Costs

Even with coverage, medications can vary wildly in cost depending on your plan’s drug formulary and tier system.

What to do instead:

Check your current medications against the new plan’s formulary — especially if someone in your family takes a maintenance drug. Brand names can come with sticker shock, even on “good” plans.

Mistake #5: Thinking Your HSA Is Just a Savings Account

If you’re in an HDHP and have access to an HSA, this isn’t just a tax shelter — it’s one of the most powerful investment tools you have. But most people let it sit idle.

What to do instead:

Max it out if you can, and invest the balance (if your HSA provider allows it). Use current savings for smaller expenses and let the HSA grow long-term — even into retirement.

Mistake #6: Not Updating Your Plan to Match Your Season of Life

Maybe your plan made sense five years ago. But what about now? Life changes — and your health insurance should change with it.

What to do instead:

Re-evaluate every year — not just renew. If you’ve changed jobs, started a family, aged into a different care phase, or are preparing to retire early… your needs have shifted. Your plan should reflect that.

Want help navigating these decisions?

Let’s review your current health plan together and make sure it aligns with your financial goals — and your real-life needs.

Schedule your discovery call now →

Should Married Couples Be on the Same Health Insurance Plan?

If you and your spouse both have access to employer-sponsored health insurance, you’ve probably faced this question at least once:

“Should we stay on separate plans, or put the whole family under one?”

It’s one of the most common decisions I help couples navigate — and one that doesn’t have a one-size-fits-all answer. Like every part of financial planning, it depends on the numbers, the benefits… and your goals.

When It Makes Sense to Stay on Separate Plans

- Both employers offer rich individual coverage - Sometimes, each spouse’s company offers low-cost, high-benefit coverage for individual employees — but charges significantly more to add dependents. If you’re both healthy and the math works, this can be cost-effective.

- One spouse needs ongoing or specialized care - If one of you has a chronic condition and access to a plan with better specialist coverage, it might make sense to keep that plan just for that person — while the other partner selects a lower-cost option.

- One employer offers better HSA compatibility - If one plan is HSA-eligible (and the other isn’t), and you want to leverage tax planning strategies, staying separate might maximize savings and flexibility.

When It Makes Sense to Join One Family Plan

- You have kids - In most cases, it’s more efficient to have dependents on one plan. If you split coverage (e.g. one child on each parent’s plan), things like coordination of benefits, deductibles, and out-of-pocket tracking get more complicated — and more expensive.

- The cost difference is negligible — but coverage isn’t - Sometimes, one plan offers stronger networks, better mental health or maternity coverage, or lower copays. In that case, it may be worth consolidating for ease of care and simplicity.

- You’re trying to reach one deductible or OOP max - Having everyone on the same plan means all medical spending goes toward a shared deductible and out-of-pocket maximum. That can protect your cash flow in a high-need year.

Financial Planner Tip for Married Couples:

Run the numbers both ways. Don’t just compare premiums — model out:

- Total expected costs (including worst-case OOP)

- Prescription coverage

- Employer HSA contributions

- Network access for your current doctors and providers

And remember: your health insurance decision affects your emergency fund, your HSA or FSA usage, and even your tax deductions if you’re self-employed.

This isn’t just a paperwork decision. It’s a financial planning strategy.

Should Married Couples Choose Separate or Joint Health Insurance?

Planner’s Perspective:

Run your numbers both ways — including worst-case out-of-pocket scenarios — before enrolling. And make sure your financial planner and CPA are aware of your choice, especially if you’re leveraging tax-advantaged accounts like HSAs or FSAs. A small shift in plan design can mean a big difference in long-term outcomes.

Wrapping It All Together: Health Insurance as a Financial Planning Decision

When most people think about health insurance, they see paperwork. Premiums. Deductibles. A confusing benefits portal they’d rather ignore. But as a financial planner, I see something else entirely: a structural layer of your financial house — one that determines whether a medical event is a brief inconvenience or a major financial setback.

The truth is, your health insurance doesn’t sit off to the side of your wealth-building strategy. It shapes your cash flow. Your savings goals. Your retirement timeline. Your tax plan. That’s why, in my Dallas financial planning practice, we include health coverage in every comprehensive review — not as a side note, but as a core part of protecting the life you’re working hard to build.

If you’re not sure your coverage supports your goals, let’s take a look together. Because the best time to understand your plan… is before you need it.

Health Insurance Myths That Could Cost You (and Your Financial Plan)

Even smart, financially responsible families fall for health insurance myths — often because the system is complicated, full of jargon, and designed to push quick decisions during open enrollment. Let’s clear up the most common misconceptions that can cost you money, coverage, or peace of mind.

Myth #1: “The cheapest premium is always the best choice.”

Truth: Low premiums can hide high deductibles, coinsurance, and out-of-pocket maximums. If you end up in the hospital or need ongoing care, a “cheap” plan can be the most expensive decision you make.

Myth #2: “I’m young and healthy — I don’t need much coverage.”

Truth: Accidents don’t check your calendar. A broken bone, appendectomy, or unexpected illness can easily cost tens of thousands. Having the right coverage isn’t about what’s likely — it’s about protecting against what’s possible.

Myth #3: “All doctors in a network are covered equally.”

Truth: Networks are tricky. You might choose an in-network hospital but still get billed by an out-of-network anesthesiologist or specialist. Always confirm provider participation — and watch out for balance billing.

Myth #4: “HSAs are just savings accounts for medical expenses.”

Truth: A Health Savings Account is one of the most powerful investment tools available — triple tax-advantaged and designed to grow long-term. Treat it like a stealth retirement account, not just a checking account for copays.

Myth #5: “Medicare will cover everything once I turn 65.”

Truth: Original Medicare leaves gaps — no prescription drug coverage, no dental, vision, or hearing, and no cap on out-of-pocket costs. Without supplemental coverage, retirees can face major unexpected bills.

Myth #6: “I’ll just renew the same plan every year.”

Truth: Coverage, networks, and prescription formularies change annually. What worked last year might cost you thousands more this year. Treat open enrollment as a fresh review — not a rubber stamp.

Bottom line:

Health insurance isn’t just paperwork — it’s one of the biggest financial planning tools you’ll ever use. Avoiding these myths can mean the difference between steady progress and financial setbacks.

Your Health Insurance Is Too Important to Wing It.

I don’t sell insurance — but I do help families make smart, informed choices that protect their wealth.

Schedule your free discovery call with a Dallas financial planner today

Frequently Asked Questions About Health Insurance and Financial Planning

Q: How do I figure out which health insurance plan is best for my family?

A: Start with your family’s actual medical usage. List your doctors, specialists, prescriptions, and expected care (like pregnancy or chronic conditions). Then, compare:

- Premiums (monthly costs)

- Deductible (what you pay before insurance kicks in)

- Out-of-pocket maximum (your worst-case scenario)

- Networks (do your providers participate?)

The right plan isn’t always the cheapest. It’s the one that fits your family’s needs and your financial plan.

Q: What’s the difference between an HMO, PPO, and HDHP?

A:

- HMO (Health Maintenance Organization): Lower premiums, limited network, referrals required. Good for predictable, routine care.

- PPO (Preferred Provider Organization): Higher premiums, more flexibility, no referrals. Better if you have ongoing specialist needs.

- HDHP (High Deductible Health Plan): Lower premiums, higher risk exposure, but comes with HSA eligibility — making it a strong tax planning tool if you have savings to back it up.

Each structure has trade-offs, and the “best” depends on how you use care and your cash flow strategy.

Q: How much should I keep in my emergency fund based on my health insurance plan?

A: At a minimum, your emergency fund should equal your plan’s deductible + one month of expenses. Ideally, you want coverage for your out-of-pocket maximum — that’s the real worst-case exposure. For families, this can mean $6,000–$15,000 depending on your plan.

Q: Is a Health Savings Account (HSA) really worth it?

A: Absolutely — when used correctly. An HSA is:

- Tax-deductible going in (reduces taxable income).

- Tax-free while growing (investment earnings compound tax-deferred).

- Tax-free coming out (for qualified medical expenses).

That’s a triple-tax advantage no other account offers. If you can, cover small medical bills out of pocket and let your HSA grow long-term — it can double as a stealth retirement account.

Q: What’s the difference between an HSA and an FSA?

A:

- HSA: Only available with a High Deductible Health Plan. Money rolls over year to year, can be invested, and stays with you if you change jobs.

- FSA (Flexible Spending Account): Available with many traditional plans. Contributions reduce taxable income, but funds are “use it or lose it” each year (with a small rollover allowance in some plans).

If you qualify for an HSA, it’s generally the better long-term tool.

Q: Should married couples join the same health plan or keep separate ones?

A: It depends. Staying separate may save money if both employers heavily subsidize individual coverage. But joining one plan often simplifies cash flow, deductibles, and out-of-pocket tracking — especially if you have children. The right decision usually comes down to modeling both options side by side.

Q: How do I avoid surprise medical bills?

A:

- Confirm your providers are in-network every year during open enrollment.

- Ask about out-of-network specialists even at in-network hospitals (like anesthesiologists).

- Review pre-authorization requirements for major procedures.

- Check your plan’s pharmacy formulary for drug coverage and tier levels.

This extra step saves families thousands in unplanned costs.

Q: How does Medicare fit into financial planning?

A: Medicare is not free — and it doesn’t cover everything. At 65, you’ll need to decide between Original Medicare + supplements or Medicare Advantage. Your income also affects premiums through IRMAA surcharges. This means Roth conversions, investment income, and withdrawals in your 60s can directly impact healthcare costs later. It’s a tax and retirement planning conversation as much as a medical one.

Q: How often should I review my health insurance plan?

A: Every year during open enrollment — plus anytime you face a life change like:

- Marriage or divorce

- New child or dependent

- Career change or self-employment

- Retirement planning

- Major health diagnosis

Your health plan should evolve with your life. What worked last year may not be the right fit today.

Bottom line: Health insurance isn’t just coverage. It’s a financial planning decision that touches your budget, emergency fund, taxes, and retirement. The best plan is the one aligned with both your health needs and your financial goals.