Credit Cards: Friend or Foe? How They Fit Into Your Financial Plan | Dallas CFP®

For many people, credit cards spark anxiety, shame, or confusion.

For others, they’re a convenience—or even a financial tool.

So which is it?

As a Dallas-based Certified Financial Planner™, I’ve seen credit cards used both wisely and destructively. And the difference isn’t in the card itself—it’s in the strategy and mindset behind it.

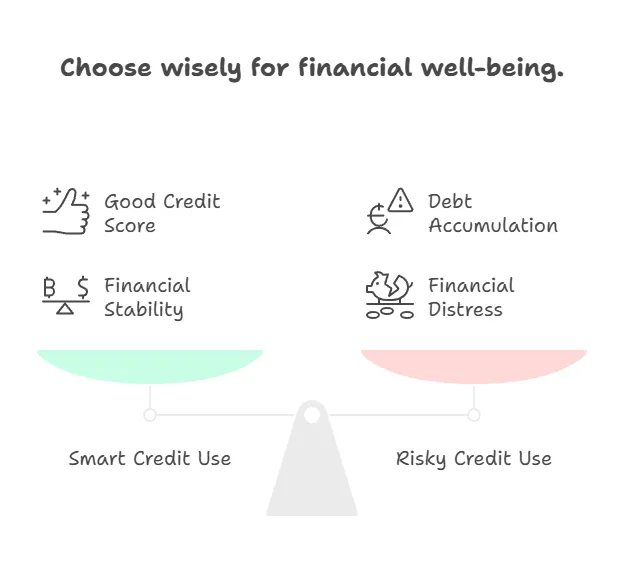

Credit cards are a tool. Not good or bad.

But how you use them can either fuel your plan… or fracture it.

The Problem Isn’t the Card. It’s the Plan (or Lack of One)

Without a plan, credit cards often become:

- A backup for emergencies (that should be an emergency fund)

- A coping mechanism for overspending or stress

- A source of shame when balances spiral out of control

But with a plan, they can become:

- A way to build and boost your credit score

- A vehicle for earning rewards on expenses you’d make anyway

- A training ground for financial discipline

When Credit Cards Help Your Financial Plan

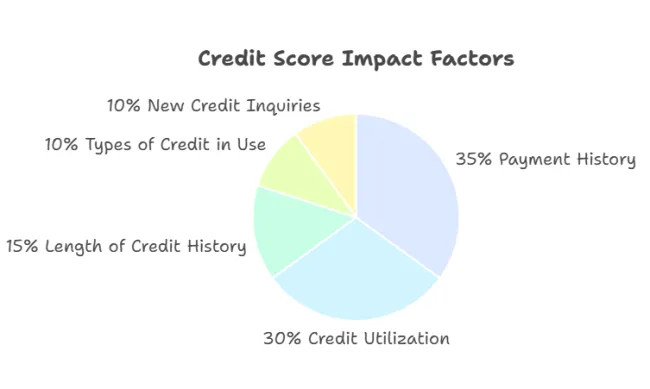

They Build Credit History

Length of credit history and on-time payments = major score boosters.They Offer Protection

Credit cards provide better fraud and purchase protection than debit cards.They Create Leverage

If you need to finance something short-term (and can pay it off), you may earn rewards while building history.They Can Be Automated

Use for fixed expenses (Netflix, insurance) + autopay = no missed payments, no interest.

When Credit Cards Enhance Your Financial Plan

Let’s talk about the upside—because used wisely, credit cards can absolutely elevate your plan.

1. Earned Rewards

Cash back, airline miles, hotel points—if you're already spending on essentials (groceries, gas, bills), responsible card use can give you value back. Think of it like optimizing your spending, not increasing it.

2. Travel Perks

Many cards offer:

- Free checked bags

- Travel insurance

- Lounge access (think Wi-Fi, food, relaxation between flights)

- TSA PreCheck or Global Entry reimbursements

If you're a frequent traveler or planning big family trips, this can offset major costs and stress.

3. Extended Warranties & Purchase Protection

Some cards offer automatic purchase protection, return extensions, or extended warranties on electronics and appliances.

But What About Annual Fees?

Here’s the truth: Some credit card fees are absolutely worth it—if you’re using the perks.

Many premium cards give you:

- Hundreds in travel credits

- Access to airport lounges

- Travel insurance that normally costs extra

So are high-fee cards “bad”? Not if the value you get outweighs the cost. But if you’re not using the benefits—or carrying a balance—it’s not the right fit.

Do I Have a Favorite Card?

Yes… but not just one.

My favorite credit card is whichever one fits your family’s lifestyle, values, and habits best.

Some clients need travel perks. Others need balance transfers. Some want cash-back simplicity.

This is where planning comes in—so your card enhances your goals, not your guilt.

📅 Want help picking the right one?

When Credit Cards Hurt Your Financial Plan

1. They Mask Spending Issues

If you’re “floating” bills, you’re borrowing from tomorrow. That builds debt stress quickly.

2. They Derail Budget Clarity

Multiple cards with different due dates = mental fatigue and missed payments.

3. They Fuel Emotional Spending

We often use cards when we’re bored, stressed, or trying to “feel successful.”

This is where behavioral finance comes in—understanding not just what you do, but why.

Real Example: Coaching Through Credit

A Dallas-area couple came to us with 5 cards, high income—and constant anxiety.

We:

- Consolidated balances

- Set up autopay for minimums

- Added visual debt trackers

- Moved recurring bills to one 0% card

- Rebuilt their emergency fund to stop relying on cards in crisis

Six months later? Lower stress, higher credit scores, and zero late fees.

Credit Planning: Why a Team Helps

Working with a planner and coach can help you:

- Avoid high-interest traps

- Use cards to support your plan

- Repair credit-related stress and anxiety

Work with Melissa Cox, CFP®

Meet Jason Lackey, Financial Coach

Credit Card Habits That Strengthen Your Plan

Use no more than 30% of your credit limit (preferably under 10%)

Set bills to autopay (at least minimums)

Pay statement balance in full monthly

Don’t use cards for emotional spending

Check your credit report 2–3x per year

Final Thoughts: Credit Cards Aren’t Evil. But They Do Need a Plan.

Credit cards aren’t the enemy. But without a strategy, they can quickly undermine the wealth you’re working so hard to build.

At Future-Focused Wealth, we help clients of all ages and stages create realistic plans that make space for credit—without letting it take control. Whether you’re building credit, battling balances, or trying to simplify your finances, we’ll help you take the next smart step—with clarity, not shame.

📅 [Schedule your strategy session now]

FAQs About Credit Cards & Financial Planning

Should I cancel unused credit cards?

Only if they have fees or tempt you to overspend. Older accounts help credit history.

Can I use credit cards while paying off debt?

Yes, if they’re part of a controlled plan. Avoid new charges if you're carrying interest.

Are reward cards worth it?

Only if you pay them off in full each month—otherwise the interest outweighs the perks.