Why Comparing Yourself to Others Hurts Your Wallet (and How to Stop)

Why I Wrote About Comparison in Future-Focused Wealth

As a CERTIFIED FINANCIAL PLANNER™ and the author of Future-Focused Wealth, I’ve seen comparison sabotage financial confidence more times than I can count.

A client walks into my office feeling like they’ve “fallen behind”—even though they’re earning well, saving steadily, and making progress.

Why? Because someone else seems to be doing better.

But seems is the keyword.

Financial comparison is one of the most deceptive and damaging behaviors I see in my practice—and I dedicated an entire section to it in my book. Because until you stop measuring your success with someone else’s ruler, wealth will always feel out of reach.

This blog is your guide to understanding the financial (and emotional) cost of comparison—and how to stop it with clarity, structure, and a plan that supports your race, your pace.

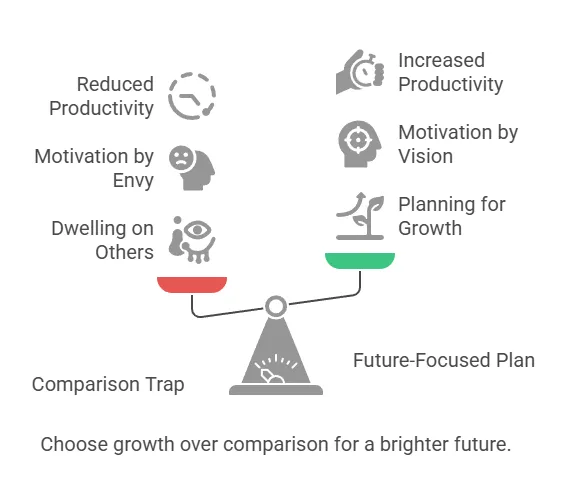

The High Cost of Comparison Culture

We’ve all done it:

- Scrolled past a vacation photo and felt “less than”

- Watched someone buy a home and wondered why you haven’t

- Compared your savings or debt payoff to a friend’s “big win”

Comparison leads to:

- Overspending to keep up

- Avoidance of planning out of shame

- Misaligned decisions based on image, not intention

- A chronic feeling of falling behind—even when you’re not

In Future-Focused Wealth, I write:

“No one ever built a fulfilling life by copying someone else’s numbers. Your goals deserve their own lane.”

Related Read: Learn how to stop social pressure from sabotaging your savings.

Lifestyle Creep and the Comparison Trap

When you compare your lifestyle to others, it often leads to lifestyle inflation—spending more as you earn more just to “keep up.”

This looks like:

- Upgrading your car or house too soon

- Taking trips you can’t comfortably afford

- Matching friends’ spending even when your priorities differ

Result: Your income increases, but your stress and expenses rise with it—and your savings stagnate.

In Future-Focused Wealth, I call this the illusion of wealth—when the outside looks polished but the inside feels stretched thin.

Related Read: Align your financial decisions with what matters most to you.

You Don’t Know the Full Financial Picture

When you compare, you’re doing it with incomplete data. That family who “has it all” might:

- Be in massive debt

- Rely on inheritance or gifts

- Be deeply stressed behind closed doors

You can’t compare someone else’s filtered exterior to your financial reality.

Future-Focused Wealth encourages clients to look inward, not outward, when setting financial benchmarks. Because lasting success only comes from internal alignment—not external validation.

Related Read: Track your spending to free up more money for what really matters.

Money Dysmorphia: The Silent Crisis Fueled by Comparison

Money dysmorphia is when you see your financial life through a distorted lens—no matter how well you’re actually doing.

You might:

- Feel broke even with savings or a solid income

- Minimize your progress (“It’s just a starter home…”)

- Dismiss your financial wins as not good enough

- Constantly chase a moving goalpost of “success”

In Future-Focused Wealth, I describe this as the emotional undercurrent of comparison:

“When you never feel like enough, no amount of money will ever feel safe.”

How to combat money dysmorphia:

- Track real numbers: savings rate, debt payoff, net worth

- Celebrate progress, not just milestones

- Say out loud what you’ve accomplished

- Filter your feed—surround yourself with messages of progress, not perfection

- Work with a CFP® who sees your full picture

Money dysmorphia is real. But it’s also reversible—with mindset, support, and strategy.

Shame Keeps You Stuck Compassion Moves You Forward

Comparison often leads to shame, and shame leads to inaction.

You avoid:

- Budgeting

- Debt conversations

- Long-term planning

- Asking for help

Shame whispers, “You should have figured this out by now.”

Compassion says, “Let’s figure it out now.”

Future-Focused Wealth was written to help you break this cycle. Because shame builds walls—and planning builds peace.

Related Read: Learn how to read, fix, and improve your credit report without fear.

Reclaim Your Race, Your Pace

In my book and with every client, I reinforce one mantra:

“Your race. Your pace.”

Comparison disappears when you focus on:

- Your values

- Your goals

- Your progress

This mindset creates space for joy, ownership, and freedom—the real markers of wealth.

Related Read: Develop a mindset that supports smart financial choices.

Comparison is the Thief of Wealth—But You Can Take It Back

If you’ve ever felt like you’re behind because someone else seems ahead, you are not alone—and you are not behind.

You’re simply on your own path.

Your race. Your pace. Your future.

As a CFP® and the author of Future-Focused Wealth, I help people let go of comparison and step into clarity. Together, we’ll create a plan that’s grounded in what matters most to you—not what looks impressive online.

Ready to build real confidence in your financial life?

Let’s talk.

Book your consultation today: Schedule your one-on-one strategy session with Melissa Cox, CFP®

FAQs About Comparison and Your Financial Life

1. Why is financial comparison so toxic?

It creates stress, leads to overspending, and disconnects you from your own values. It’s based on incomplete information and unrealistic expectations.

2.What is money dysmorphia?

A distorted perception of your financial situation—feeling broke, behind, or inadequate despite evidence to the contrary.

3. How can I break free from comparison thinking?

Track your own progress. Define success on your terms. Limit exposure to unrealistic financial portrayals on social media.

4. How do I know if I’m stuck in lifestyle creep?

If your spending increases with income but your savings don’t, or if your expenses are driven by social pressure—you might be in lifestyle creep.

5. What’s the best way to build financial confidence?

Work with a planner, set clear goals, celebrate progress, and create a plan aligned with your values.

6. How can a financial planner help me stay focused?

A CFP® helps you quiet the noise, get organized, and create a strategy that makes your path feel doable—no matter what others are doing.