The Psychology of Budgeting: Why Your Brain Hates Budgets (and How to Fix It)

As a Dallas-based Certified Financial Planner™, I don’t just build budgets—I help people understand why they resist them. Because here’s the truth: budgeting failures rarely come from laziness or lack of tools. They come from how our brains are wired to respond to discipline, delayed gratification, and financial limits.

If you’ve ever made a budget, then broke it by the weekend, this blog is for you.

Why Budgets Trigger Resistance

Budgeting feels restrictive to the human brain. According to behavioral economics, our minds are hardwired to:

- Prioritize short-term rewards (hello, impulse spending!)

- Avoid discomfort (tracking every purchase feels tedious)

- Rebel against perceived control (budgets = rules = stress)

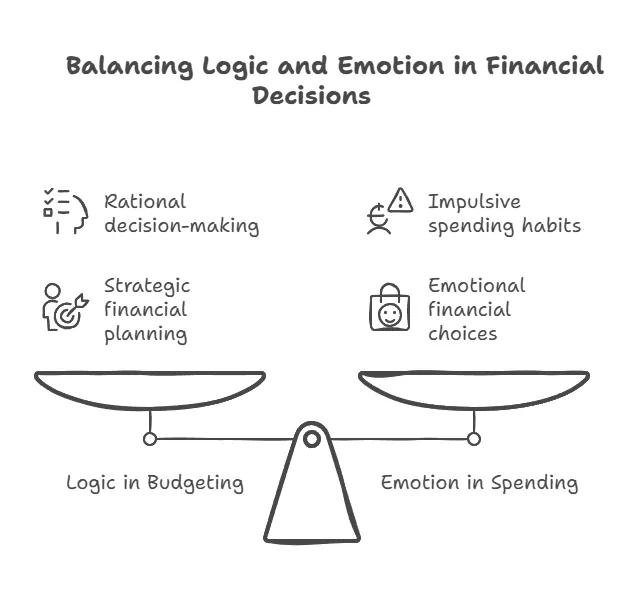

🧠 Fun Fact: The brain's limbic system, which processes emotion, often overrides the prefrontal cortex, which handles logic and planning.

This explains why someone can know they need to stick to a budget—and still swipe the card for that Amazon cart.

Common Budgeting Sabotage Patterns

- All-or-Nothing Thinking

→ One mistake ruins the whole plan, so you give up. - Budget Burnout

→ Overly restrictive plans feel like diets; eventually you rebel. - Invisible Spending

→ Subscriptions, small charges, and autopayments add up silently. - Budgeting Guilt

→ Feeling shame for "bad" spending leads to avoidance, not action.

Understanding these patterns is step one to creating a system that works with your brain, not against it.

Step 1: Reframe the Word “Budget”

Instead of a restrictive "no-fun" spreadsheet, think of your budget as a spending strategy that gives you:

- Permission to spend on what you value

- Confidence to say no to what doesn’t matter

- Control without shame

💡 Try renaming your budget: Spending Blueprint, Wealth Plan, or Cash Flow Map.

Step 2: Align Budgeting with Your Personality

Budgeting isn't one-size-fits-all. If you're a:

- Type A/Planner → Zero-based budgeting might feel satisfying

- Creative/Intuitive → A flexible 3-category approach (Needs, Wants, Goals) could reduce overwhelm

- Avoider/Busy Parent → Automation + weekly reviews may reduce stress

🧭 Key: The best budget is the one you'll actually follow consistently.

Step 3: Use Behavioral Tricks to Stay on Track

- Automate Good Decisions: Schedule savings, automate bills.

- Temptation Bundle: Only review your budget while enjoying a coffee or reward.

- Visual Cues: Use trackers, progress bars, or cash envelopes.

- Budget for Joy: Allocate money for fun or spontaneous spending.

🔗 Behavioral science works best when paired with personalization.

Where Financial Planners and Financial Coaches Unite

This is where collaboration between a financial planner and a financial coach becomes transformational. While financial planners like myself focus on strategy, structure, and long-term goals, coaches like Jason Lackey provide the day-to-day accountability and mindset work that keep those plans in motion.

- Planners guide your portfolio. Coaches guide your patterns.

- Planners design your roadmap. Coaches help you stay on course.

Together, we bridge the gap between what you know and what you consistently do.

Tools That Work with Your Brain

- Emergency Fund Tracker → "Track your emergency fund progress with a visual savings tool."

- Financial Coaching → "Build better budgeting habits with professional support."

- Budgeting Apps Review → "Compare the best budgeting apps based on features and ease-of-use."

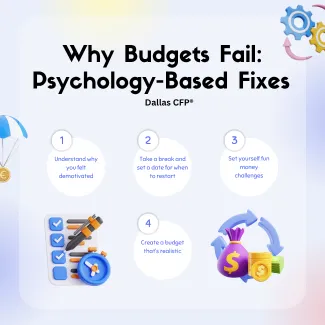

The Real Goal: Financial Confidence, Not Perfection

If you've ever beat yourself up over "failing" at budgeting, take a breath. Budgeting is a skill, not a moral test. And it gets easier when it's aligned with your psychology and values.

As a planner, I help people uncover why their budgets fail, and rebuild systems that feel doable, forgiving, and future-focused. And with the right coach beside you, those new habits stick.

📅 Book a clarity session with Melissa Cox, CFP®:

FAQs About the Psychology of Budgeting

Why do I feel anxious when budgeting?

Because it activates your brain’s emotional centers, especially if you have past money stress. The solution? Start with low-pressure, high-reward steps.

What’s the best budgeting method?

The one you’ll actually use. It should match your lifestyle, energy, and goals.

Can budgeting ever feel fun?

Yes—when it gives you freedom, not just rules. Add rewards, celebrate wins, and keep your goals visible.