Rewriting Your Financial Story: How to Break Free from Generational Money Myths

As a Dallas-based Certified Financial Planner™ and behavioral finance educator, I've seen how the stories we tell ourselves about money often trace back generations. Many of us are unknowingly living out outdated financial scripts inherited from parents, grandparents, or cultural norms. These beliefs, or "money myths," can quietly sabotage our efforts to grow wealth, even when we’re doing everything else "right."

If you've ever felt like you're stuck in a financial pattern you can't explain, it may be time to rewrite your money story.

What Are Generational Money Myths?

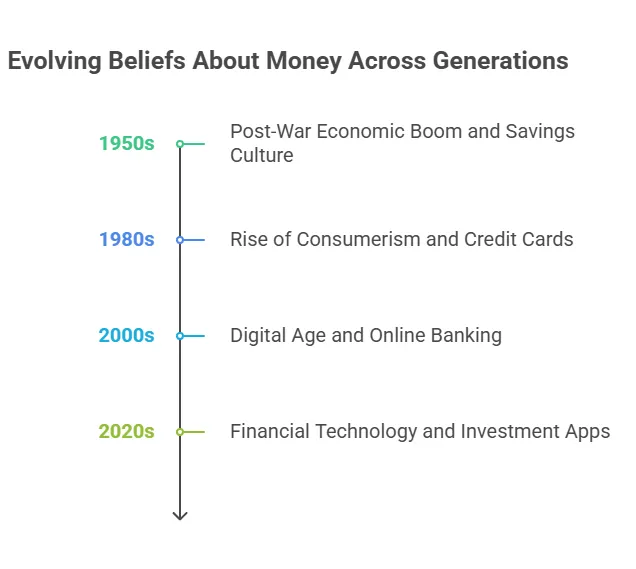

Generational money myths are subconscious beliefs passed down through families and communities. They're not financial facts—they're financial folklore. Common examples include:

- "Money doesn't grow on trees."

- "We don't talk about money."

- "Debt is just a part of life."

- "We aren't rich people."

- "Rich people are greedy."

These myths often come from a place of protection, fear, or survival—but they rarely serve us in building confident, forward-looking wealth strategies.

🧠 Mindset Insight: Studies show children form money beliefs by age 7 (University of Cambridge)

Signs You’re Operating on an Outdated Financial Script

- You avoid talking about money

- You feel guilt or shame around earning more

- You default to overspending or hoarding without clarity

- You fear becoming “like them” (people with money or without it)

- You believe success is tied to sacrifice or struggle

Recognizing the script is the first step in rewriting it.

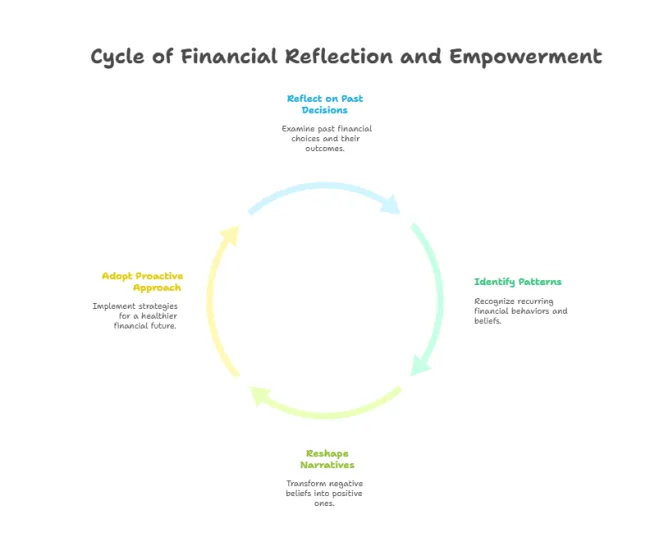

Step 1: Identify Your Money Script

Start by asking yourself:

- What phrases did I hear about money growing up?

- How did my caregivers handle wealth or lack?

- What do I believe about "rich" people? About "struggling" people?

- When I make financial decisions, whose voice is in my head?

📘 Pro Tool: Use this resource to decode your beliefs →

Step 2: Define Your Own Money Values

This isn’t about rejecting your family’s experience—it’s about choosing your own path.

Try these journal prompts:

- What does financial peace look like to me?

- If I weren’t afraid, how would I manage my money?

- What kind of legacy do I want to leave?

🌱 Shift from Survival to Significance: When you plan from your values instead of your fears, you create wealth with meaning.

Step 3: Create a Strategic, Personalized Plan

Once you know your values and mindset blocks, it’s time for action. A strategic financial plan grounded in your truth helps rewire not just your bank account, but your brain.

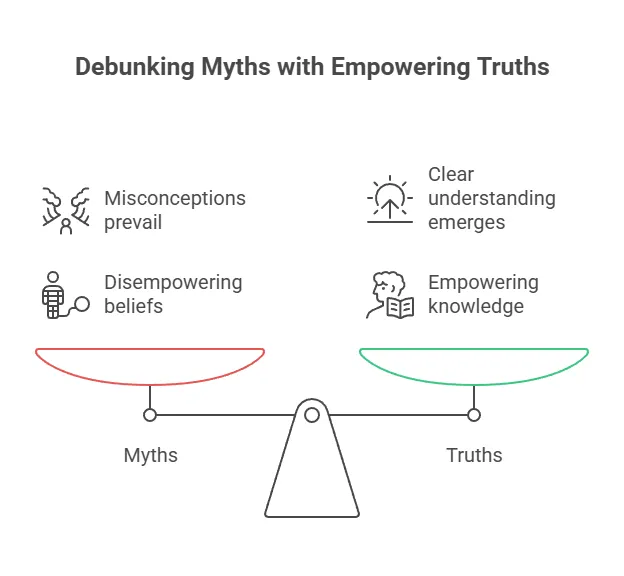

💬 Let’s reframe common myths:

❌ Myth: "I’ll never be good with money."

✅ Truth: Financial literacy is a skill you can learn.

❌ Myth: "We don’t do that kind of investing."

✅ Truth: Your risk tolerance can be honored without staying stuck.

❌ Myth: "I don’t make enough to save."

✅ Truth: Saving $10/month is proof you are a saver.

Ready to Rewrite Your Story?

The first step is awareness. The second is aligned action. And that’s where I come in.

As your planner, I’m not here to judge your past—I’m here to help you build a bold, empowered financial future. Whether you’re navigating inherited debt, first-generation wealth building, or simply ready to do it differently, we’ll create a plan that reflects your mindset, your values, and your future.

📅 Book a discovery call with Melissa Cox, CFP®:

📥 Download your free Emergency Fund Tracker:

FAQs About Generational Money Beliefs

Is it bad to follow my parents' financial example?

Not necessarily—but their approach was built for a different economy. Your financial plan should reflect your goals and opportunities.

Can money beliefs really be changed?

Yes. Like any habit, they take time and intention to shift. Awareness + aligned action = transformation.

How can I teach my kids healthier beliefs?

Start by talking openly about money, modeling values-based spending, and teaching them early with tools like savings jars or budgeting games.