From Fear to Freedom: How Financial Anxiety Impacts Your Money Decisions

Why I See Financial Fear Every Day—and Why It’s Not Your Fault

As a CERTIFIED FINANCIAL PLANNER™ and author of Future-Focused Wealth, I’ve seen financial anxiety take down even the smartest, most capable people. Not because they lack the tools—but because fear keeps them from using them.

- Fear of looking foolish

- Fear of facing the numbers

- Fear of losing what they’ve worked hard to build

- Fear of never catching up

Financial fear is real—and it’s paralyzing.

But here’s what I tell my clients (and what I share in my book):

“Fear is not a financial plan. But it is a signal—and if you follow it with curiosity, it can lead to powerful change.”

This blog is your step-by-step guide to transforming fear into freedom—by learning how anxiety shapes your decisions and how to take control.

What Is Financial Anxiety?

Financial anxiety is the chronic worry, stress, or panic related to money—whether or not your financial situation objectively justifies it.

You may experience:

- Tightness in your chest when checking your bank account

- Avoidance of budgeting, debt, or investments

- Guilt or shame after spending

- Fear of running out of money—even when you’re doing okay

- A constant sense of “it’s not enough”

It’s not about the numbers—it’s about your relationship with them.

Learn: Develop a mindset that supports smart financial choices.

How Fear Hijacks Your Financial Decisions

When fear takes over, your brain moves from logical planning to emotional survival mode. That leads to:

- Overspending to feel in control

- Avoiding finances altogether

- Under-saving due to “what’s the point?” thinking

- Panic-selling investments during market volatility

- Postponing big decisions (like retirement or homebuying)

In Future-Focused Wealth, I call this “emergency-mode money management”—a reactive cycle that keeps you stuck.

Action Step:

Pause and ask: “Is this decision being made from fear or from intention?”

Learn: how to stop social pressure and anxiety from sabotaging your savings.

Why Financial Avoidance Feels Safer (But Costs You More)

Avoiding your finances may feel like relief—but it often makes anxiety worse.

You may avoid:

- Looking at your credit card statement

- Reviewing retirement accounts

- Opening bills or emails

- Talking about money with your partner

This creates uncertainty, which fuels more anxiety.

As I share in my book, the cure isn’t punishment or panic—it’s clarity. When you face your numbers with support, the fear loses power.

Learn: How to read, fix, and improve your credit report without fear.

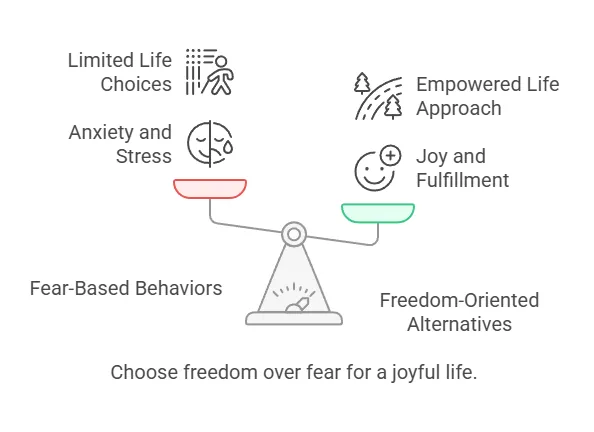

Rewiring Your Financial Mindset: The Path to Peace

Moving from fear to freedom requires mindset shifts and systems. Here’s what I recommend to my clients:

Shift From:

- “I’m bad with money” → “I’m learning to manage money better.”

- “It’s too late” → “I can start from where I am.”

- “This is overwhelming” → “I can take one step today.”

Build Systems That Calm:

- Automate savings and debt payments

- Create a “financial clarity hour” weekly

- Track your net worth or savings rate monthly

Meet with a CFP® for outside perspective

“Fear thrives in uncertainty. Peace grows in structure.”

— Future-Focused Wealth, Melissa Cox

When to Ask for Help: You Don’t Have to Do This Alone

Financial fear often comes with isolation. You feel like:

- You’re the only one who doesn’t “get it”

- Everyone else is doing better

- You’re behind and should be ashamed

Here’s the truth: you’re not behind—you’re just unsupported.

Working with a planner gives you:

- A safe place to talk through your fears

- A strategy rooted in your values and goals

- Clear steps that reduce overwhelm

- Confidence you didn’t know was possible

You can’t logic your way out of financial fear. But you can plan your way through it.

Learn how Melissa Cox helps clients move from fear to freedom in Future-Focused Wealth.

Fear Is Not a Sign of Failure—It’s a Signal for Support

If financial anxiety has kept you stuck, overwhelmed, or spinning in indecision—you are not broken.

You are simply ready for a different approach.

As a CERTIFIED FINANCIAL PLANNER™ and author of Future-Focused Wealth, help people just like you replace panic with peace—and start building wealth from a place of clarity, compassion, and confidence.

Let’s build that plan together. One step at a time.

Book your consultation now: Schedule your one-on-one strategy session with Melissa Cox, CFP®

FAQs About Financial Anxiety

1. What causes financial anxiety?

It can come from childhood money trauma, social pressure, economic uncertainty, or lack of financial education.

2. Is financial anxiety normal?

Yes. Most people experience money stress at some point. It becomes a problem when it prevents action or affects your well-being.

3. How can I stop avoiding my finances?

Start small. Choose one task per week (like reviewing your bank statement) and reward follow-through. Support from a planner helps, too.

4. Can fear impact investment decisions?

Absolutely. Panic-selling, avoiding investing, or chasing trends often come from unmanaged fear—not strategy.

5. What’s one thing I can do today to reduce financial stress?

Automate a small savings deposit or review one account. Action—even small—reduces anxiety over time.

6. How does working with a CFP® help?

A planner gives you tools, perspective, and structure—helping you feel safe and supported while building a long-term financial strategy.