5 Ways to Overcome Scarcity Thinking and Start Building Wealth | Future-Focused Wealth

Why Scarcity Thinking Shows Up—and How I Help Clients Break Through

As a CERTIFIED FINANCIAL PLANNER™ and author of Future-Focused Wealth, I’ve sat with countless clients who felt like they were always behind. Not enough income, not enough saved, not enough time to catch up.

Sound familiar?

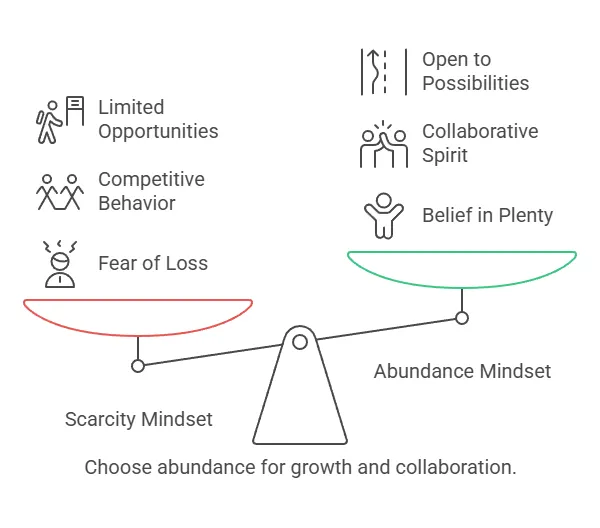

What I’ve learned is this: the biggest barrier to wealth isn’t your paycheck—it’s your perspective. Scarcity thinking convinces us that no matter what we do, we’ll never have enough. It fuels financial anxiety, procrastination, and self-sabotage.

But here’s the truth: wealth is built from abundance thinking—one decision at a time.

This blog will walk you through 5 mindset shifts I use with clients to overcome scarcity and start creating real financial momentum. Let’s rewire how you think about money—so you can finally start building the future you deserve.

1. Identify the Scarcity Scripts Running Your Financial Life

Scarcity thinking often comes from early life experiences or trauma around money. These beliefs become scripts like:

- “I’ll never get ahead.”

- “There’s no point saving—something always comes up.”

- “Money is for other people, not me.”

- “If I spend now, I’ll feel better—even if I regret it later.”

These scripts become self-fulfilling.

Action Step:

Write down your recurring financial thoughts. Are they driven by fear, lack, or limitation? Awareness is the first step to change.

Related Read: Develop a mindset that supports smart financial choices.

2. Focus on What You Can Control, Not What You Can’t

Scarcity thinking often centers around external limitations: inflation, layoffs, market crashes. While these factors matter, they’re not where your power lives.

Instead, shift your focus to:

- Tracking your spending

- Building your savings rate

- Creating systems for consistency

- Increasing your skills or earning potential

Abundance starts when you redirect energy to action.

Related Read:

Learn strategies to increase your savings rate and financial stability.

3. Set Goals That Reflect Possibility, Not Past Struggles

Scarcity-based goals often sound like:

- “Get out of debt.”

- “Stop spending so much.”

- “Survive the month.”

Those are valid—but they’re rooted in avoidance, not ambition.

Flip the script with goal-setting that moves you forward:

- “Save $5,000 for a vacation I’ll actually enjoy.”

- “Invest consistently to retire early.”

- “Earn enough to fund my child’s education.”

Bonus: Use the SMART goal method to make them measurable and achievable.

Related Read:

Learn how to set savings goals you’ll actually reach.

4. Replace Fear-Based Spending With Value-Based Spending

When you believe there’s never enough, you’re more likely to:

- Overspend for quick emotional relief

- Avoid budgeting altogether

- Say yes to purchases to keep up or feel in control

Value-based spending means aligning your money with what matters most—your values, not your fears.

Example:

If “freedom” is your value, you’ll invest in saving and reduce debt—not just buy things to feel temporarily better.

Related Read:

Align your financial decisions with what matters most to you.

5. Get Support From a Planner Who Sees the Whole Picture

Scarcity thinking isolates you. You feel like you have to figure everything out alone. But financial growth accelerates with structure and support.

- Rewrite toxic money stories

- Set realistic, actionable goals

- Create financial systems that reduce stress

- Stay accountable through every life stage

You don’t need more shame. You need a strategy—and a partner.

Related Read:

Scarcity Thinking Doesn’t Build Wealth—Abundance Does

Scarcity isn’t just about dollars. It’s about the story you’ve told yourself about what’s possible.

But here’s what I want you to know: You are not stuck.

You can build wealth, even if you’ve made mistakes. Even if you’re starting late. Even if the past feels heavy.

As a CERTIFIED FINANCIAL PLANNER™ and the author of Future-Focused Wealth, I help people break free from financial fear and build plans rooted in clarity, structure, and confidence.

If you’re ready to shift from “not enough” to “more than possible,” let’s talk. You don’t need a perfect past—you just need the right plan.

Book your consultation now:

Hover text: Schedule time to create your future-focused financial plan.

FAQs About Scarcity Thinking and Building Wealth

1. What is scarcity thinking in personal finance?

It’s the belief that there’s never enough money, time, or opportunity. It often leads to anxiety, impulsive decisions, and avoidance behaviors.

2. Can scarcity thinking affect my ability to build wealth?

Absolutely. When you believe there’s never enough, you may avoid saving, investing, or asking for help—keeping you stuck.

3. How do I shift to an abundance mindset?

Start by identifying limiting beliefs, setting value-aligned goals, and creating daily habits that reinforce possibility and progress.

4. Is this something I can work through alone?

You can start alone, but working with a CFP® or financial coach can fast-track your growth with personalized strategy and support.

5. What’s the first step to breaking out of scarcity?

Track your thoughts and behaviors for one week. Notice patterns. Then take one small, empowering financial action—like automating savings or setting a goal.

6. How does working with a financial planner help?

A planner helps you reframe fear, set goals rooted in your values, and build systems that support consistent, confident action.